The global focus on COVID-19 over the past year has caused people to evaluate aspects of financial security that they may have previously put off — most importantly, creating a will and an estate plan. But the Q4 Wells Fargo/Gallup Investor and Retirement Optimism Index shows that while some progress has been made in this area, many investors have more work to do. Close to half of investors in the new survey (45%) report they have neither a will nor an estate plan. About a third say they do have a written will (34%), 4% have written estate plans, and 17% have both.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201228005004/en/

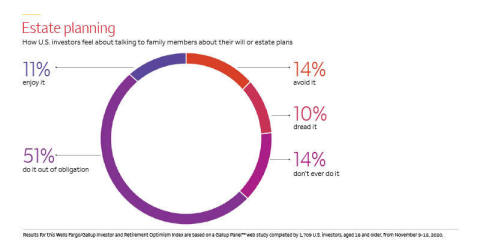

A graphic showing how U.S. investors feel about talking to family members about their will or estate plan. (Graphic: Wells Fargo)

“The pandemic has put in sharp relief the need to plan for the future, including having good end-of-life plans in place,” said Michael Liersch, head of Advice and Planning for Wells Fargo’s Wealth & Investment Management division. “The availability of the vaccine is great news, but it should not stop people from preparing estate plans.”

Higher-income investors are no more prepared than investors as a whole, but the percentage with either a will, estate plans or both does increase with age. The percentage with no preparations declines from 70% of investors under age 50 to 17% of those 65 and older.

Which of the following do you currently have? | ||||||||

A written will (%) | Written estate plans (%) | Both (%) | Neither (%) | |||||

All investors | 34 | 4 | 17 | 45 | ||||

High-income investors | 19 | 6 | 30 | 45 | ||||

Aged 18 to 49 | 19 | 1 | 11 | 70 | ||||

Aged 50 to 64 | 36 | 4 | 17 | 43 | ||||

Aged 65 and older | 50 | 9 | 24 | 17 | ||||

Investors’ assignment in 2021: Close the family communication gap in estate planning

Even those who have a will or estate plan in place may need to be more open about them with family or other heirs, to ensure their final wishes are understood and carried out.

Nearly two-thirds (65%) report they have only spoken a little or not at all to family members about their will or estate plans, and 57% believe they need to do more when it comes to communicating these plans. Again, this changes with age, but even 45% of retired investors say they need to do more.

Talking to family members about wills and estate plans is not something most investors enjoy. The slight majority (51%) say they do it out of obligation, while most of the remaining respondents either avoid it (14%), dread it (10%) or don’t ever do it (14%). Just more than one in 10 surveyed (11%) say they enjoy it. At the same time, the idea of including a “letter of wishes” in their will detailing matters from funeral arrangements to how they want heirs to use their money or other assets, appeals to 56% of investors — possibly because it sidesteps direct conversations. Higher-income investors are not markedly different in most respects from all investors in their estate preparation or preferences. However, those high-income investors surveyed are much more likely to want to leave a letter of wishes (70% vs. 56%).

While most investors (62%) say they want to leave it up to their heirs to do as they choose with the money and assets they leave them, 35% want to determine the specific impact their estate has through directions they leave behind. “Having a specific impact after you are gone is difficult to do without discussing your goals with family members while you are able to,” said Liersch.

One reason investors may avoid conversations about their will or estate is that most surveyed say they are confident their family members understand and support their estate plan goals: 35% are “highly confident” and 38% “somewhat confident.” Just 13% are “not too confident” or “not at all confident,” while 14% say they have not set these goals.

“The perception that family members are in sync with their wishes may be true for some investors, but for others, that may need to be confirmed,” said Liersch. “Even if investors want to provide their heirs broad latitude in using their assets, communicating that sentiment now is important to give their heirs peace of mind — and the financial tools and knowledge — in making these decisions when the time comes.”

Investments and Insurance Products: NOT FDIC Insured • NO Bank Guarantee

About the Wells Fargo/Gallup Investor and Retirement Optimism Index

Results for this Wells Fargo/Gallup Investor and Retirement Optimism Index are based on a Gallup Panel™ web study completed by 1,709 U.S. investors, aged 18 and older, from Nov. 9 – 15, 2020. This quarter’s poll includes an oversample of higher-income investors, defined as having $240,000 or more in household income, resulting in a total of 603 higher-income investors included in this survey.

The Gallup Panel is a probability-based, longitudinal panel of U.S. adults who Gallup selects using random-digit-dial phone interviews that cover landline and cellphones. Gallup also uses address-based sampling methods to recruit Panel members. The Gallup Panel is not an opt-in panel. The sample for this study was weighted to be demographically representative of the U.S. investor population, using demographic targets determined from investor samples within prior Gallup national adult surveys. For results based on this sample, one can say that the maximum margin of sampling error is ±5 percentage points at the 95% confidence level. Margins of error are higher for subsamples.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error and bias into the findings of public opinion polls.

For this study, the American investor is defined as an adult in a household with stocks, bonds or mutual funds of $10,000 or more, either in an investment account or in a self-directed IRA or 401(k) retirement account. About two in five U.S. households have at least $10,000 in such investments. The sample consists of 62% nonretirees and 38% retirees. Of total respondents, 25% reported annual incomes of less than $90,000; 65% reported $90,000 or more. The median age of the nonretired investor is 51 and the retiree is 69. The Wells Fargo/Gallup Investor and Retirement Index is an enhanced version of Gallup’s Index of Investor Optimism, which provides the historical trend data.

The Investor and Retirement Optimism Index has an adjusted baseline score of 100 from when it was established in October 1996. It peaked at +152 in January 2000, at the height of the dot-com boom, and hit a low of -81 in February 2009.

About Wells Fargo Wealth & Investment Management

Wells Fargo Wealth & Investment Management (WIM) is a division within Wells Fargo & Company. WIM provides financial products and services through various bank and brokerage affiliates of Wells Fargo & Company and is one of the largest wealth managers in the U.S., with nearly $1.9 trillion in client assets. WIM serves clients through the following businesses: Wells Fargo Private Bank serves high-net-worth individuals and families; Abbot Downing serves ultra-high-net-worth individuals and families; Wells Fargo Advisors provides investment advice and guidance to clients through nearly 13,000 full-service financial advisors and referrals from more than 5,300 licensed bankers; and Wells Fargo Asset Management brings together a strategic balance of investment capabilities to serve the investment needs of institutions, financial advisors, and individuals worldwide. Through Wells Fargo Private Bank and Abbot Downing, WIM is also a leading provider of trust, investment, and fiduciary services, including personal trust services and a number of specialized wealth services designed to meet the diverse needs of high-net-worth clients.

Abbot Downing, a Wells Fargo business, and Wells Fargo Private Bank offer products and services through Wells Fargo Bank, N.A. and its various affiliates and subsidiaries. Wells Fargo Bank, N.A. is a bank affiliate of Wells Fargo & Company.

Brokerage services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Wells Fargo Asset Management (WFAM) is the trade name for certain investment advisory/management firms owned by Wells Fargo & Company. These firms include but are not limited to Wells Capital Management Incorporated and Wells Fargo Funds Management, LLC. Certain products managed by WFAM entities are distributed by Wells Fargo Funds Distributor, LLC (a broker-dealer and Member FINRA).

Wells Fargo Bank, N.A., offers various advisory and fiduciary products and services including discretionary portfolio management. Wells Fargo affiliates, including financial advisors of Wells Fargo Advisors, a separate non-bank affiliate, may be paid an ongoing or one-time referral fee in relation to clients referred to the bank. The bank is responsible for the day-to-day management of the account and for providing investment advice, investment management services, and wealth management services to clients. The role of the financial advisor with respect to bank products and services is limited to referral and relationship management services.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.92 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment and mortgage products and services, as well as consumer and commercial finance, through 7,200 locations, more than 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 31 countries and territories to support customers who conduct business in the global economy. Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.

News Release Category: WF-ERS

View source version on businesswire.com: https://www.businesswire.com/news/home/20201228005004/en/

Contacts:

Vince Scanlon, 336.430.9786

Vince.Scanlon@wellsfargo.com