December 31, 2020 - TheNewswire - Vancouver, B.C. Canada - Belmont Resources Ltd. (“Belmont”), (or the “Company”), (TSXV:BEA) (FSE:L3L2) announces that it has applied to the TSX Venture Exchange for approval to close the first tranche of the private placement announced on December 15, 2020 for aggregate gross proceeds of up to $87,500 (the “NFT Financing”). The NFT Financing will consist of 1,250,000 Units – (the “NFT Units”) of the Company at a price of $0.07 per Share.

NFT Units:

Subject to approval, the Company will issue 1,250,000 Units. Each NFT Unit consists of one common share of the Company (a “Common Share”) and one transferable share purchase warrant (a “Warrant”). Each Warrant entitles the holder to purchase one Common Share at a price of $0.10 for a period of two years from the initial closing date of the financing.

The use of proceeds of the financing will be used for general corporate and working capital purposes.

Acceleration Clause on Warrants:

The Warrants are subject to an accelerated expiry date, which comes into effect when the trading price on the TSX Venture Exchange of the Company’s common shares closes at or above $0.15 per share for 10 consecutive trading day commencing four months plus one day after the closing. (date of share/warrant issuance). In such event, the Company may accelerate the expiry date of the Warrants by disseminating a press release, providing the Warrant holders with an acceleration notice (the “Notice”) and in such case the Warrants will expire on the 30th day after the date on which such press release is disseminated.

All securities issued under this private placement, and the shares that may be issuable on the exercise of the warrants, are subject to a statutory hold period expiring four-months and one day from issuance and to customary closing conditions including, but not limited to, receipt of applicable regulatory approvals, including approval of the TSX-V.

Drill Program Planned for A-J Gold Project

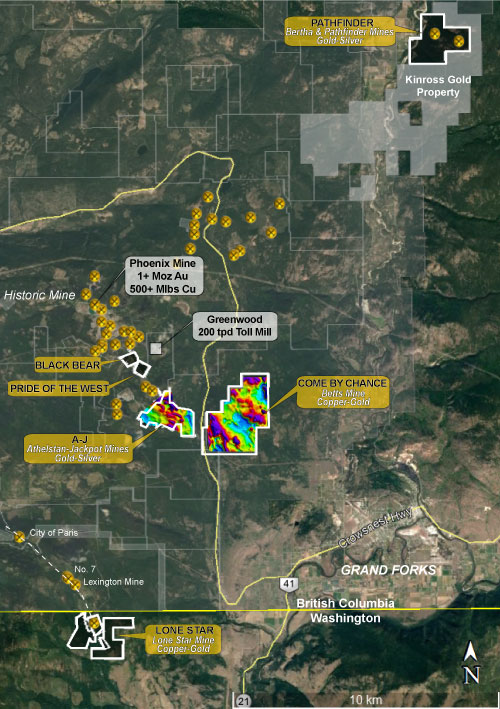

The Company is planning a 2,000m drill program on their Athlestan-Jackpot (A-J) gold project. The A-J property has two past producing gold mines which collectively produced 7,600 ozs Au & 9,000 ozs Ag (Minfile 082ESE047). The A-J Group was one of the most productive gold mines in the Greenwood mining district of southern British Columbia.

The primary target of the planned drill program is a coincident strong resistivity-chargeability anomaly identified only 130 meters below the two former gold mines. This large IP anomaly is identified as a possible causative source of gold mineralization at surface including the two mines.

The Company is currently reviewing bids for the drilling program and anticipates drilling to commence in January 2021.

The Company’s project portfolio includes:

- Athelstan & Jackpot Gold mines (Athelstan-Jackpot property - 100%)

- Bertha & Pathfinder Gold-Silver mines (Pathfinder property - 100%).

- Betts Copper-Gold mine (Come By Chance property - 100%)

- Lone Star Copper-Gold mine (Lone Star Property - LOI)

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This Press Release may contain forward-looking statements that may involve a number of risks and uncertainties, based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control. Actual events or results could differ materially from the Companies forward-looking statements and expectations. These risks and uncertainties include, among other things, that we may not be able to obtain regulatory approval; that we may not be able to raise funds required, that conditions to closing may not be fulfilled and we may not be able to organize and carry out an exploration program in 2020, and other risks associated with being a mineral exploration and development company. These forward-looking statements are made as of the date of this news release and, except as required by applicable laws, the Company assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements.

Copyright (c) 2020 TheNewswire - All rights reserved.