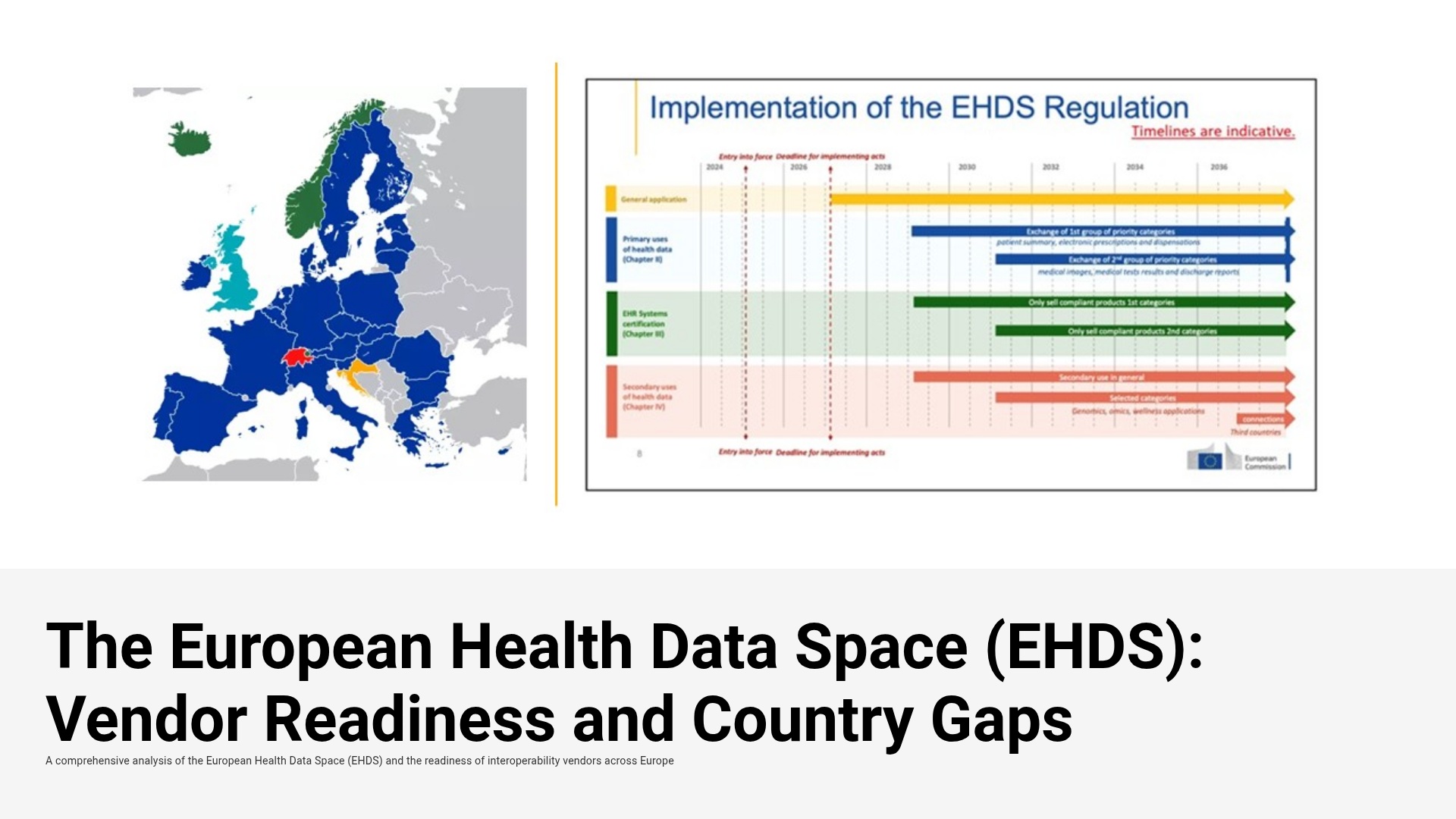

Independent Benchmarking Across 13 EU Countries and the UK Reveals Vendor Readiness and Country Gaps Ahead of EHDS Enforcement

LONDON, GB / ACCESS Newswire / August 28, 2025 / Black Book™, the independent global healthcare technology research firm, today announced the release of the first pan-European report on interoperability and middleware vendors in the era of the European Health Data Space (EHDS).

The study, Interoperability and the EHDS: Vendor Landscape and Country Readiness in Europe, is the first continent-wide benchmarking of EHDS readiness, vendor performance, and middleware adoption across 13 EU member states and the UK. It arrives at a critical moment as the EHDS framework becomes enforceable in 2026, requiring hospitals and health systems to modernize digital infrastructure for both primary care continuity and secondary data use in research, AI, and policymaking.

"This is the first independent analysis of Europe's interoperability market, and it shows a sector in rapid transition," said Doug Brown, Founder of Black Book Research. "EHDS compliance is no longer theoretical; procurement decisions are happening now. Black Book research reveals which vendors are positioned to serve the EHDS client market, where hospitals are underprepared, and how digital budgets are shifting."

Why This Research Was Needed

Until now, European interoperability research has been fragmented: national adoption studies or vendor-commissioned whitepapers. What was missing was a neutral, vendor-agnostic, unbiased comparative view of:

Which vendors are enabling EHDS compliance by country.

How CIOs and CMIOs are budgeting and replacing middleware.

Where the biggest gaps stand in cross-border exchange.

Black Book's survey of 684 hospital and IT executives and panel sessions with CIOs in thirteen EU countries and the UK fills this gap with a vendor-agnostic lens and measurable KPIs.

"The EHDS is a continent-wide mandate that will shape every hospital's IT roadmap," Brown added. "This research was urgently needed to give policymakers, vendors, and health systems a credible baseline of where Europe stands today and where the gaps remain."

Support Stats: The EHDS Readiness Gap

Readiness & Adoption, Q3 2025

Only 31% of European hospitals report their middleware is EHDS-compliant today.

National spine adoption varies widely: Finland leads at 97% connected institutions, while Germany trails at 43%; EU average is 58%.

Budget Shifts

61% of CIOs plan to replace or upgrade their integration platform before 2027.

Average 14% of IT budgets in 2025-27 are earmarked for EHDS projects-triple the share in 2022.

Vendor Performance (Scorecard: 0-100 scale; 100 = strongest EHDS readiness based on Black Book's proprietary European Interoperability key performance indicator scoring by survey participants directly)

Rank |

Vendor |

HQ/Primary Market |

Score |

|---|---|---|---|

1 |

Dedalus |

Italy/France |

92 |

2 |

InterSystems |

EU |

90 |

3 |

Better |

Slovenia/UK |

88 |

4 |

Marand |

Slovenia |

86 |

5 |

Enovacom (Orange) |

France |

84 |

6 |

CompuGroup Medical (CGM) |

Germany |

81 |

7 |

Philips HealthSuite |

Netherlands |

78 |

8 |

Siemens Healthineers |

Germany |

77 |

9 |

Orion Health |

UK |

74 |

10 |

Cambio |

Sweden |

72 |

11 |

CSAM Health |

Nordics |

70 |

12 |

Agfa HealthCare |

Belgium |

67 |

13 |

Vitagroup |

Germany |

65 |

14 |

NTT Data |

Italy |

64 |

15 |

Ehiway |

Spain |

62 |

16 |

Medispring |

Belgium |

61 |

17 |

Tiani Spirit |

Austria |

59 |

18 |

Epic Systems (EU projects) |

EU |

57 |

19 |

OpenApp |

Ireland |

55 |

20 |

Ripple Foundation |

UK |

54 |

Cross-Border & Secondary Use Gaps

Only 18% of providers are currently engaged in EHDS pilots (rare disease registries, cancer cohorts).

Just 17% can provide anonymized EHDS-ready datasets for research and AI training.

To measure vendor readiness, Black Book applied a 10-point KPI framework now emerging as the baseline for EHDS adoption and middleware performance across Europe.

10 KPIs Defining EHDS Middleware Readiness

Black Book's benchmarking applied ten qualitative key performance indicators to evaluate vendor positioning for EHDS adoption and middleware performance across Europe:

EHDS Compliance Maturity - Alignment with EHDS technical and governance rules.

Cross-Border Data Exchange Enablement - Secure, GDPR-compliant sharing across EU member states.

Secondary Use Readiness - Capability to generate anonymized, research-ready datasets.

Vendor Trust & Market Credibility - Confidence from CIOs and CMIOs in vendor roadmaps and delivery.

API Openness & Modularity - API-first, openEHR-ready platforms enabling flexible integration.

National Spine Integration - Compatibility with national EHR backbones and readiness for EHDS extension.

Implementation Agility - Speed and reliability of upgrades or replacements under deadline pressure.

Governance & Consent Automation - Automation of consent, audit trails, and access management.

Innovation in Middleware Functions - New EHDS-driven capabilities (e.g., IoT-to-spine, rare disease registries).

Sustainability of EHDS Investment - Long-term vendor commitment to EHDS features post-2027.

Groundbreaking Vendor Insights

The report identifies first movers and national champions already shaping EHDS adoption:

Dedalus (Italy/France): The first large vendor to re-architect middleware specifically for EHDS, with Dedalus X-Interop already deployed in multiple national tenders.

Better (Slovenia/UK): Emerging as the leading openEHR-native platform; survey panels cite Better as "first to service" EHDS-ready API projects in Nordics and UK pilots.

Marand (Slovenia): Powering Slovenia's national projects and UK/Nordic EHDS pilots with Think!EHR middleware.

Enovacom (France, part of Orange): Leading France's EHDS pilot work, including oncology dataset exchange across borders.

InterSystems (EU): IRIS for Health and HealthShare widely adopted in NHS and Ireland, positioning it as a trusted EHDS partner.

CompuGroup Medical (Germany): Aligning middleware products with gematik ePA standards, extending toward EHDS compliance.

Philips HealthSuite & Siemens Healthineers: First IoT-to-national spine integrations preparing EHDS-compliant RPM/IoT flows.

"API-first vendors like Better, Marand, and Ripple Foundation are punching above their weight against legacy incumbents," Brown added. "This is a rare moment where new entrants can win national business because EHDS compliance resets the market."

Country-Level Vendor Highlights

France: Enovacom (Orange) and Dedalus dominate; GDPR consent automation central to EHDS pilots.

Germany: CGM, Siemens, Vitagroup, and Agfa compete in sovereignty-driven tenders; hospitals face steepest readiness gap.

UK: InterSystems, Orion Health, and Ripple Foundation leading NHS "Spine 2" EHDS API pilots.

Nordics: Finland's Kanta (national EHR spine) sets the global standard; CSAM, Cambio, Better, and Marand strong across Sweden and Norway.

Italy: Dedalus continues to dominate regional interoperability; NTT Data entering EHDS contracts.

Spain: Ehiway gaining ground in regional EHDS pilots.

Eastern Europe: Slovenia (Better, Marand) and Baltics emerging as openEHR-native EHDS adopters.

Why It's Newsworthy

Policy urgency: EHDS becomes law in 2026, forcing immediate procurement.

Market disruption: Smaller API-first vendors (Better, Marand) are competing with incumbents (Dedalus, InterSystems, CGM).

Economic scale: EHDS-related middleware projected to be a €7 billion market by 2027.

Black Book expansion: This marks Black Book's sixth year of dedicated European benchmarking, part of a global research program now spanning 110 countries, with Europe as a central focus of its health IT performance studies.

About Black Book Research

Black Book™ is the leading source of healthcare technology user satisfaction insights and vendor performance benchmarking. Since 2011, over 3.3 million healthcare IT users worldwide have contributed to Black Book's independent surveys.

Now in its eighteenth year of dedicated European benchmarking, Black Book's global research program spans 110 countries, with Europe a central focus of its health IT performance studies. Black Book has also been a champion of U.S. data interoperability improvements and FHIR implementation, while serving as a strong supporter of openEHR initiatives worldwide.

These efforts qualify Black Book as a global leader in HIT user polling, healthcare IT services expertise, and comparative vendor performance analysis-conducted free of vendor influence, performance improvement plans, payments, or evaluation subscriptions. Widely regarded for its independence and transparency, Black Book has become a trusted resource for global healthcare organizations, policymakers, and investors seeking credible vendor benchmarks.

For more information contact research@blackbookmarketresearch.com and access free global healthcare IT reports at www.blackbookmarketresearch.com

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

View the original press release on ACCESS Newswire