Options trading volumes have surged in recent years, and zero-days-to-expiration (0DTE) options have emerged as a popular tool for active traders. These contracts only last for a single session, offering concentrated exposure that makes them especially appealing during high-leverage events.

One use case? Earnings. When a company reports results the same day its weekly options expire, that creates an intriguing 0DTE setup. In this scenario, everything hinges on a single trading session — the earnings release is the catalyst, and the outcome defines the entire return profile of the trade. It’s a pure directional bet, where the cost of the options incorporates the expected move associated with the event, but not the same degree of time risk (e.g. extrinsic value) associated with longer-dated options.

That said, 0DTE isn’t the only way to trade earnings or other near-term events. Monthly and weekly options offer flexibility across a range of shorter timeframes. For example, a monthly contract with 10 days left becomes a 10DTE trade. A weekly contract with five days remaining offers a 5DTE setup.

These durations can still deliver event-driven exposure but with a bit more time for price action and volatility to play out. That added flexibility gives traders more room to adjust, especially when they want to position immediately ahead of an earnings release, Federal Reserve decision, or other high-impact catalyst.

When a company reports on a Thursday or Friday, traders may turn to weekly options with one or two days until expiration to capture the market’s post-earnings reaction. These contracts can deliver strong returns when the move aligns with the trader’s directional outlook, but that risk-reward profile cuts both ways. With so little time until expiration, even a small miscalculation can lead to a total loss of premium.

It’s important to note that most ultra-short-term options setups rely on long options or defined-risk positions. That’s largely because of their straightforward risk profile, where the maximum potential loss is limited to the premium paid. For traders looking to express a directional view without taking on unlimited risk, these structures offer a clear and manageable approach.

In contrast, selling short-term options, especially naked positions in single stocks around earnings, carries a very different risk profile. These trades require substantial margin and can result in significant losses if the stock moves sharply in an unexpected direction. With binary outcomes and large price swings in play, undefined-risk positions can unravel quickly. The same can be said for long options positions if the stock doesn’t make a big enough move in the right direction.

Understanding how a 0DTE earnings trade works is easier with a real-world example. The following scenario is for illustrative purposes only, and outlines how a 0DTE options setup can unfold when earnings and expiration fall on the same trading day.

A Real-World Look at a 0DTE Earnings Setup

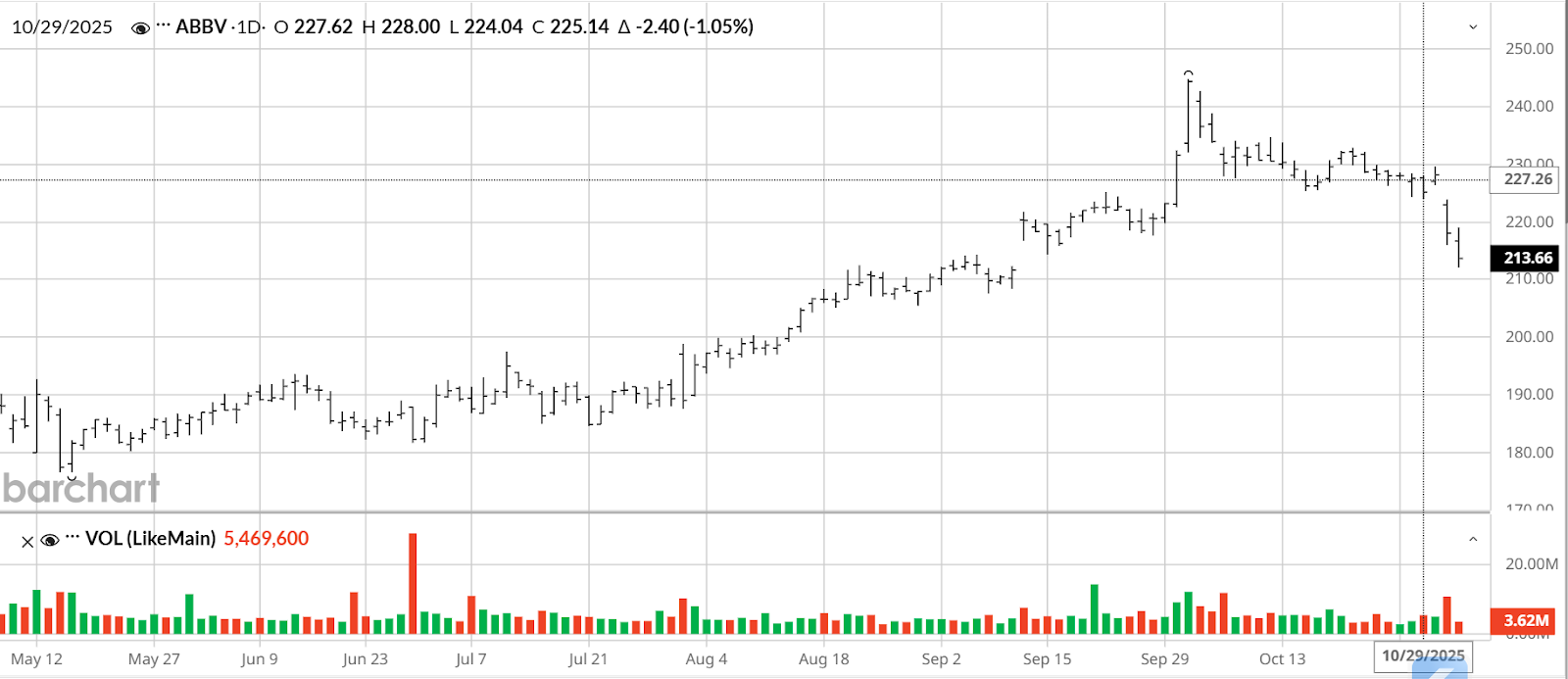

On Friday, Oct. 31, AbbVie (ABBV) released its Q3 earnings report before the market opened. That same day also marked the expiration of AbbVie’s weekly options, meaning those contracts effectively became zero-days-to-expiration (0DTE) options after the market closed on Oct. 30.

When the market closed on Oct. 30, AbbVie shares were priced at $228.20, and the $230-strike call expiring the next day was trading around $3.65 (the midpoint of the bid-ask). That implied an upside breakeven level near $233.65 per share for the upcoming earnings event. On the downside, the $227.50-strike put traded for about $4.20, implying a breakeven of $223.30 per share.

Based on those prices, the options market was expecting a move of roughly 2.4% higher for the call, and 2.1% lower for the put. For context, AbbVie rallied nearly 3% during the trading session following its previous earnings release on July 31, suggesting that a similar reaction on Oct. 31 could have pushed one of those directional trades into profitable territory.

As it turned out, the stock broke sharply to the downside after the earnings results were released. On Oct. 31, AbbVie shares fell about 4.5%, sliding from roughly $228 per share to $218 by market close. That outcome rendered the upside calls worthless, but the downside puts delivered a solid payoff.

The $227.50-strike puts, which traded for $4.20 at Thursday’s close, settled at $9.35 by the end of trading on Oct. 31. For traders who bought those puts ahead of the report, that move translated into a gain of about $5.15 per contract. That represents a return of roughly 122% in less than 24 hours.

Balancing Opportunity and Risk in Short-Term Options Trading

As the AbbVie example illustrates, short-term options can be especially powerful during earnings season. These events are often binary in nature, with stocks prone to sharp moves in either direction, typically within a single trading session. That potential for a sudden gap is what attracts traders seeking concentrated exposure with clearly defined risk.

From that perspective, 2DTE, 1DTE, and 0DTE options offer a straightforward, high-leverage way to express a directional market view. The potential reward, as demonstrated by the ABBV downside put, can be significant. But the same structure that amplifies gains also magnifies losses.

With little time remaining until expiration, the option carries minimal time value, which means there is almost no room for recovery if the trade moves against you. For example, a bullish trader who bought the ABBV $230 call, for example, would have lost the entire premium in a single session. One can also lose if the stock doesn’t make a big enough move in the right direction. In the case of ABBV, had the stock remained above the downside breakeven ($223.30), the trader still would have lost the premium paid to enter the position. Because the stock’s move wouldn’t have been large enough to overcome the cost of the option.

In most options strategies, implied volatility plays a central role in both pricing and decision-making. In ultra-short-term setups, however, the impact is much smaller. With so little time remaining, these contracts trade almost entirely on intrinsic value, which reflects the option’s worth based on the stock’s current price. As a result, 0DTE trades are less about predicting volatility and more about capturing short-term directional momentum.

For many traders, that’s exactly the appeal. Zero-days-to-expiration options compress an entire opportunity into a narrow window. It’s a test of timing, discipline, and conviction, all within a defined-risk framework that rewards precision. But it’s also unforgiving. If the market doesn’t move fast enough, even a well-placed idea can expire worthless.

Some professionals do sell short-term options, but this approach is more common in index products than in single stocks. It’s important to recognize that selling unhedged, near-expiration contracts involves a high level of risk. Within large institutional portfolios, backed by deep capital reserves, this type of exposure can sometimes be managed effectively. For most retail traders, however, being short these options is neither practical nor recommended.

Ultimately, ultra-short-term options setups like 0DTE capture are high-risk, high-reward propositions. And in that regard, they are probably best suited for those that have extremely high conviction in the outcome of an event — whether it's earnings-related or otherwise. They combine precision, timing, and conviction in a compact, high-stakes format that rewards decisiveness. But as stated previously, the risks are also high.

Some traders do find short-term options appealing because they don’t tie up capital for long periods. These trades are typically opened and closed within a day or two, and sometimes hours. But that speed comes with a cost. The same mechanics that make 0DTE trading exciting also make it challenging, requiring a clear plan, disciplined execution, and a comprehensive understanding of risk.

For those new to short-term options, it’s prudent to start with mock trading — paper trading your ideas before committing real capital. Mock trading gives you a chance to observe how these contracts behave in real time, and how quickly market conditions can change. That experience can be extremely valuable as you refine your approach, and build a strategy that fits your outlook and risk tolerance.

The same mindset is useful with any new product or strategy, because hands-on practice offers insights you can't get from theory alone. The goal isn’t just to identify winning trades, but to understand what makes them work, and how to navigate the ones that don’t.

On the date of publication, Andrew Prochnow did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?