With a market cap of $91.6 billion, Marsh & McLennan Companies, Inc. (MMC) is a global professional services firm that provides advisory services and insurance solutions focused on risk, strategy, and people. Headquartered in New York, the company operates through its Risk and Insurance Services and Consulting segments, serving clients worldwide across multiple industries.

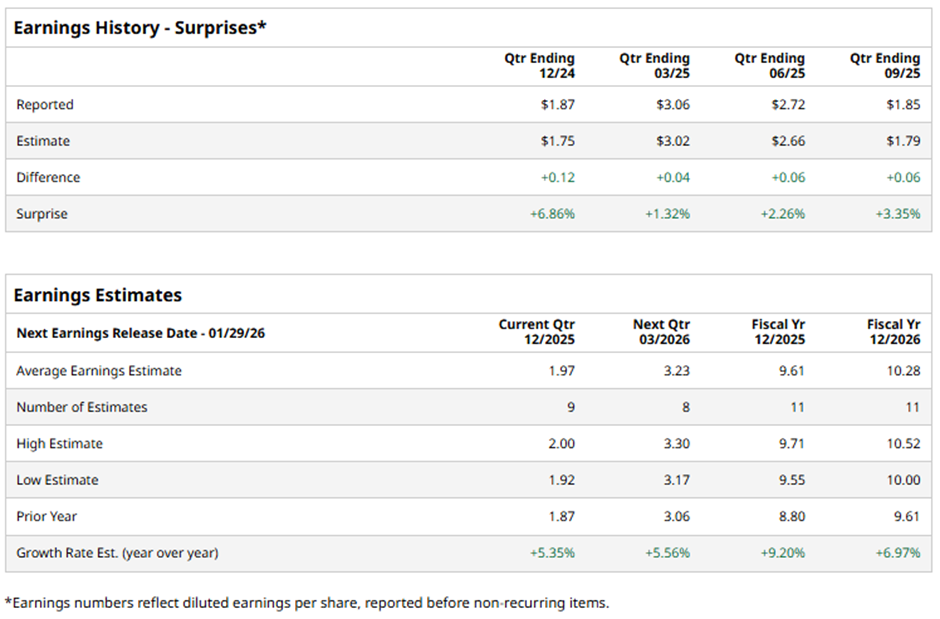

Marsh & McLennan is set to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast MMC to report an adjusted EPS of $1.97, a rise of 5.4% from $1.87 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the insurance broker to post an adjusted EPS of $9.61, up 9.2% from $8.80 in fiscal 2024.

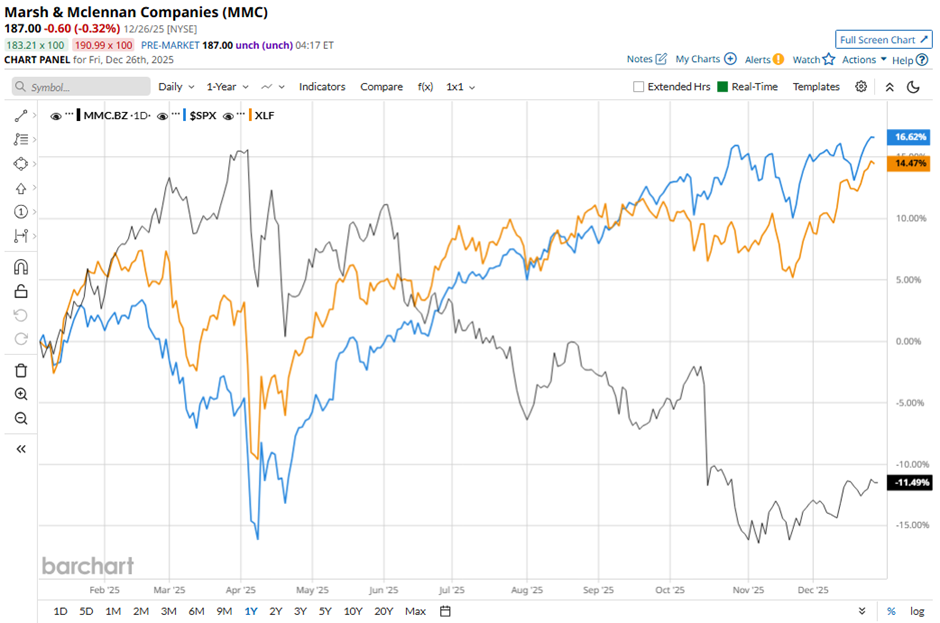

Shares of Marsh & McLennan have declined 12.7% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.8% increase and the State Street Financial Select Sector SPDR ETF's (XLF) 13.3% return over the same period.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $1.85 and revenue of $6.35 billion, shares of MMC tumbled 8.5% on Oct. 16. Adjusted operating margin in the key risk and insurance segment was flat year-over-year at 24.7% and missed estimates, while underlying growth in that segment slowed to 3% from 4% in Q2, even though reported revenue rose 13% to $3.9 billion. Management and analysts also pointed to rate softening, macroeconomic uncertainty, and slowing demand from large clients as headwinds that could pressure growth into 2026.

Analysts' consensus view on MMC stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, seven recommend "Strong Buy," one has a "Moderate Buy," 16 "Holds," and one suggests "Moderate Sell." The average analyst price target for Marsh & McLennan is $211.28, suggesting a potential upside of nearly 13% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart