GE Vernova Inc. (GEV), headquartered in Cambridge, Massachusetts, is an energy company that provides products and services for generating, transmitting, orchestrating, converting, and storing electricity. Valued at $180 billion by market cap, the company manufactures and services key infrastructure, including wind turbines, gas turbines, hydroelectric systems, and grid and electrification solutions. The energy equipment manufacturing and services company is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

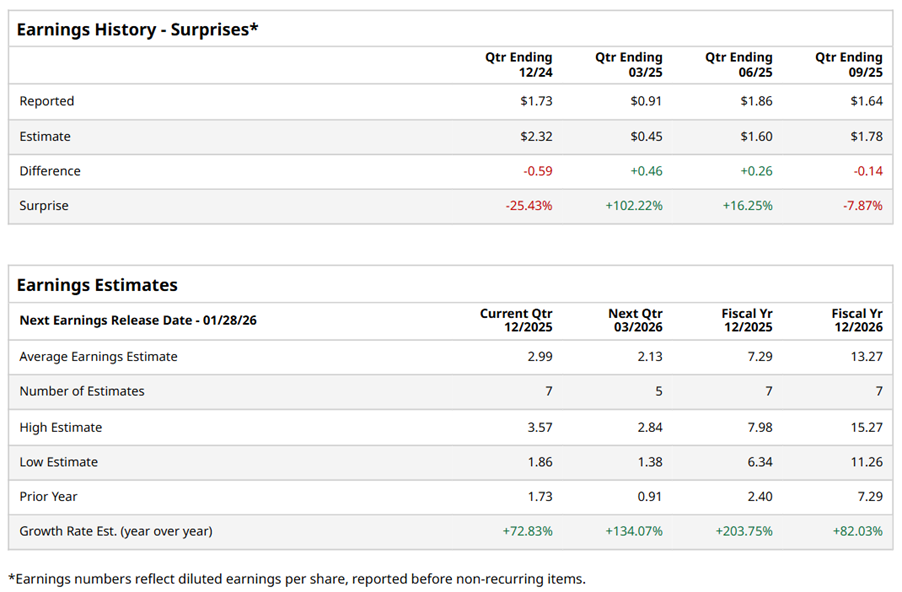

Ahead of the event, analysts expect GEV to report a profit of $2.99 per share on a diluted basis, up 72.8% from $1.73 per share in the year-ago quarter. The company exceeded consensus estimates in two of the last four quarters, while missing the forecast on two other occasions.

For the full year, analysts expect GEV to report EPS of $7.29, up 203.8% from $2.40 in fiscal 2024. Its EPS is expected to rise 82% year over year to $13.27 in fiscal 2026.

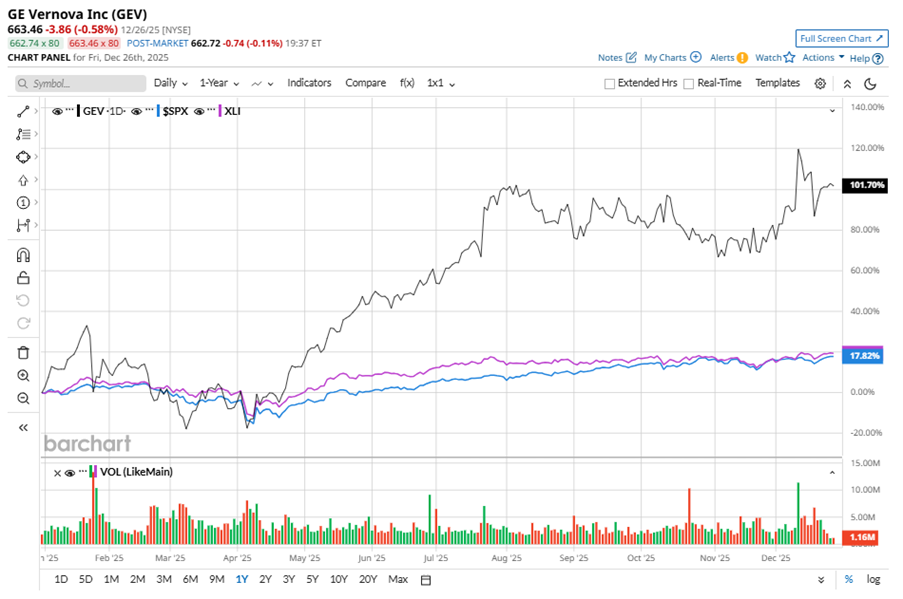

GEV stock has considerably outperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares up 93.4% during this period. Similarly, it significantly outperformed the Industrial Select Sector SPDR Fund’s (XLI) 17.1% gains over the same time frame.

GEV’s strong performance is driven by growing demand for AI-related power, electrification, and decarbonization. Its portfolio of power generation, grid, and energy storage solutions positions it well for growth, with rising electricity demand from AI and data centers, favorable pricing, and an expanding backlog boosting margins. With wins like the Taiwan Power Company contract and a growing presence in grid modernization, GEV is poised for sustained growth in 2026 and beyond.

On Oct. 22, GEV shares closed down by 1.6% after reporting its Q3 results. Its EPS of $1.64 fell short of Wall Street expectations of $1.78. The company’s revenue was $10 billion, exceeding Wall Street forecasts of $9.2 billion. GEV expects full-year revenue in the range of $36 billion to $37 billion.

Analysts’ consensus opinion on GEV stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 29 analysts covering the stock, 20 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” six give a “Hold,” and one recommends a “Strong Sell.” GEV’s average analyst price target is $767.67, indicating a potential upside of 15.7% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart