Freddie Mac (FMCC) shares rallied as much as 10% this morning after Big Short investor Michael Burry said he’s bullish on the government-sponsored mortgage giant.

The hedge fund manager confirmed he has a “personal” stake in the housing finance enterprise, which was established in 1970 to expand the secondary market for U.S. mortgages.

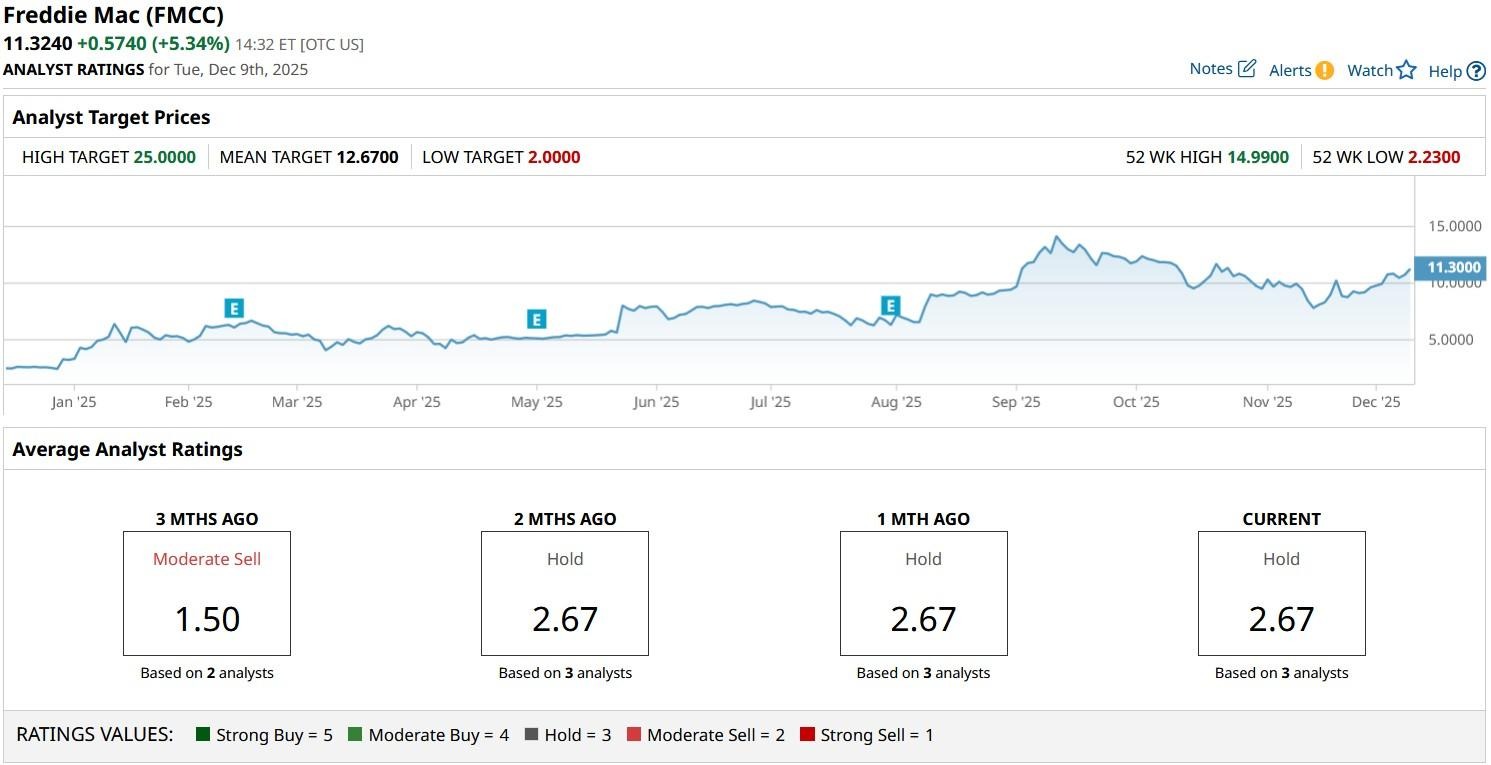

Note that Freddie Mac stock is currently traded over the counter. At the time of writing, it’s down about 20% versus its year-to-date high in September.

Burry’s View on Freddie Mac Stock

In his newsletter, Michael Burry said FMCC is on the cusp of a difficult but transformative journey.

He dubbed the company’s path to an initial public offering (IPO) a “steep, windy, and rocky climb,” underscoring the challenges that remain for the Federal Home Loan Mortgage Corporation.

Still, Burry argued that investors who approach the stock with a deep understanding of its history will be better positioned to benefit.

He even suggested that legendary investor Warren Buffett’s conglomerate holding firm, Berkshire Hathaway (BRK.A) (BRK.B), could acquire a large portion of the offering, signaling confidence that Freddie Mac’s relaunch could attract heavyweight institutional support.

Why Burry’s Call Is Bullish for FMCC Shares

Burry’s constructive view is largely positive for Freddie Mac stock as it brings credibility, visibility and investor confidence to a company that has long struggled under government conservatorship.

Having accurately predicted the housing market crash in 2008, his view carries significant weight with both retail and institutional investors.

Burry’s willingness to take a personal stake signals conviction that FMCC stock has a favorable risk-reward profile.

This may encourage more investors to consider Freddie Mac as a viable long-term play despite its current volatility and OTC trading status.

From a technical perspective, FMCC is currently trading decisively above its key moving averages (50-day, 100-day, 200-day) – indicating it’s currently in a long-term bullish trend.

What’ the Consensus Rating on Freddie Mac?

Wall Street analysts also forecast further upside in Freddie Mac shares for 2026.

While the consensus rating on FMCC shares currently sits at “Hold” only, the mean target of about $12.67 indicates potential upside of well over 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?

- Apple Stock Marks a Solid Comeback. Is AAPL a Buy, Sell, or Hold for 2026?