MicroStrategy (MSTR) is doubling down on its Bitcoin strategy despite mounting pressure from a stock price that has collapsed more than 50% over the past six months. The company added 10,624 Bitcoin (BTCUSD) last week for $962.7 million at an average price of $90,615 per coin, bringing total holdings to 660,624 Bitcoin acquired for $49.35 billion.

The purchase marks a return to aggressive buying after several weeks of smaller acquisitions constrained by worsening market conditions. The acquisition was funded primarily through the sale of $928.1 million in common stock, with an additional $34.9 million raised through preferred stock sales.

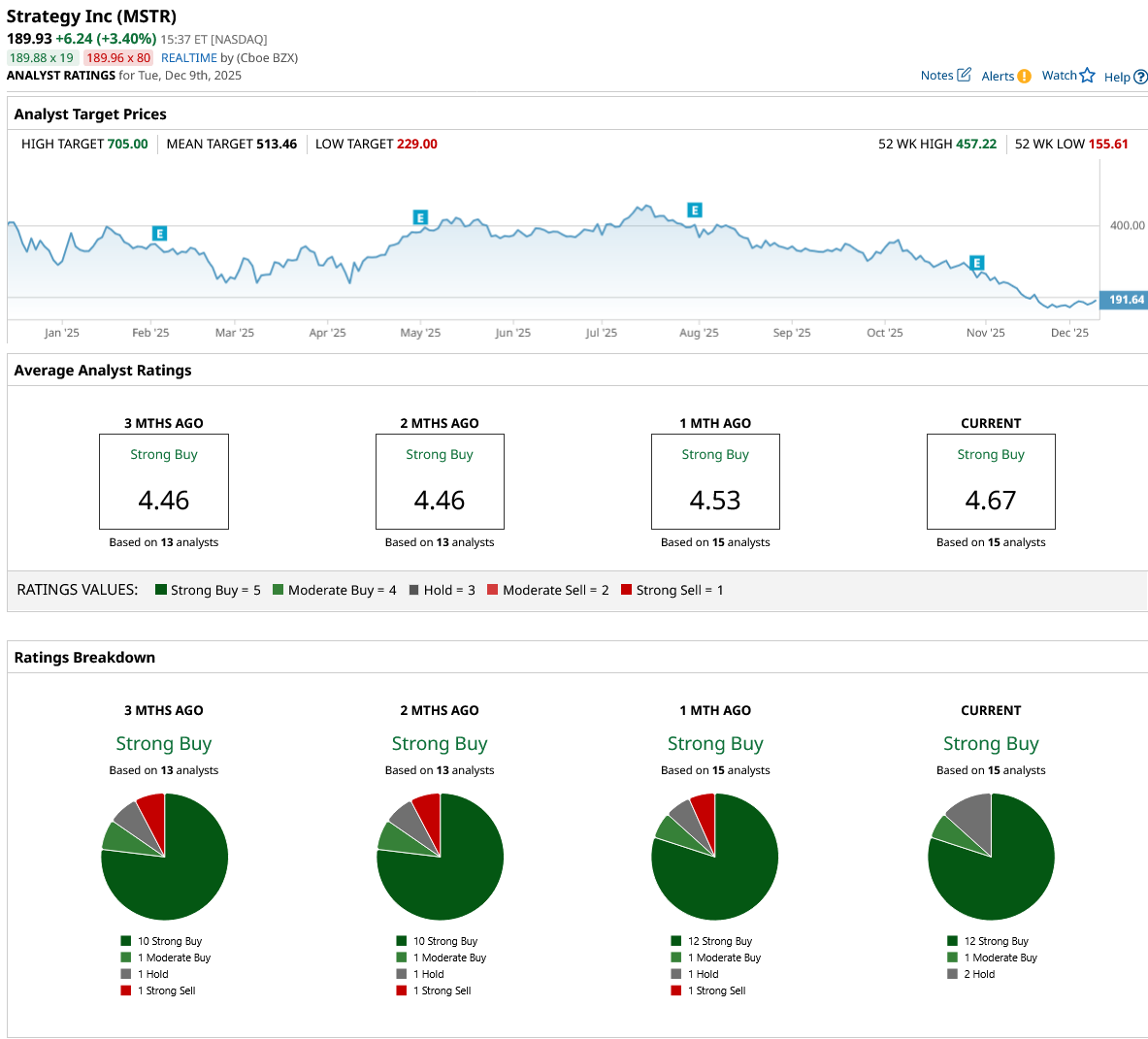

MSTR stock hit a 52-week low of around $155 on Dec. 1 during a crypto market selloff but has since recovered to $190, which is still well below recent highs.

Executive Chairman Michael Saylor continues his evangelism for Bitcoin, currently meeting with sovereign wealth funds and institutional investors in Abu Dhabi.

The company recently established a $1.44 billion cash reserve to cover dividend payments on preferred stock and interest on debt, a significant shift that acknowledges the challenges of relying solely on equity sales to fund operations.

Is MicroStrategy Stock a Good Buy Right Now?

MicroStrategy now holds approximately 3.1% of the 21 million Bitcoin that will ever exist, making any misstep potentially catastrophic for shareholders who have effectively bought into a leveraged Bitcoin fund with a software company attached. Most concerning for investors is CEO Phong Le's recent acknowledgment that the company could be forced to sell Bitcoin under specific crisis conditions.

This marks a dramatic departure from Saylor's longstanding never-sell philosophy. The trigger would come if the stock trades below the value of its Bitcoin holdings and the company cannot raise new capital through equity or debt.

With the metric known as mNAV hovering near 0.95 and approaching the critical 0.9 danger zone, that scenario no longer seems far-fetched.

MicroStrategy has issued four preferred securities in 2025, raising $6.7 billion, with STRC being the largest U.S. IPO of the year. The preferred instruments offer tax-deferred dividends as return of capital, which management expects to continue for at least 10 years, given the company's negative taxable earnings profile from its buy-and-hold Bitcoin strategy.

The company faces $750 million to $800 million in annual preferred dividend payments, and with the stock down over 60% from its highs, the traditional funding mechanism through equity sales is becoming increasingly complex.

Year-to-date (YTD), MicroStrategy has raised more than $20 billion in capital to fund its Bitcoin purchases, with the capital structure shifting dramatically toward preferred stock offerings rather than traditional convertible debt. The company achieved a 26% Bitcoin yield YTD against its revised full-year target of 30%, adding 116,555 Bitcoin through disciplined capital deployment.

All Bitcoin holdings remain fully unencumbered with no collateral obligations. MicroStrategy's balance sheet has transformed dramatically, with digital assets growing from under $7 billion in Q3 of 2024 to over $73 billion in Q3 of 2025, driven by both additional acquisitions and the adoption of fair value accounting.

The company received its first credit rating from S&P at B-minus, opening doors to an estimated $9 trillion high-yield credit market compared to the $2.8 trillion unrated market previously available.

What Is the MSTR Stock Price Target?

During the last earnings call, management reaffirmed full-year 2025 guidance, assuming Bitcoin reaches $150,000 by year-end, targeting operating income of $34 billion and earnings per share of $80. The company now qualifies for S&P 500 ($SPX) inclusion based on market capitalization and profitability metrics.

Out of the 15 analysts covering MSTR stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average MSTR stock price target is $513.46, above the current price of $190.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart