If Wednesday’s reports from banking giants like Bank of America (BAC) and Citi (C) are the appetizers, Thursday, Jan. 15, is the main course for understanding the actual health of the American consumer and the regional lending landscape. While the big headlines often follow the investment banks, Thursday brings us Morgan Stanley (MS), Goldman Sachs (GS), PNC Financial (PNC), and U.S. Bancorp (USB).

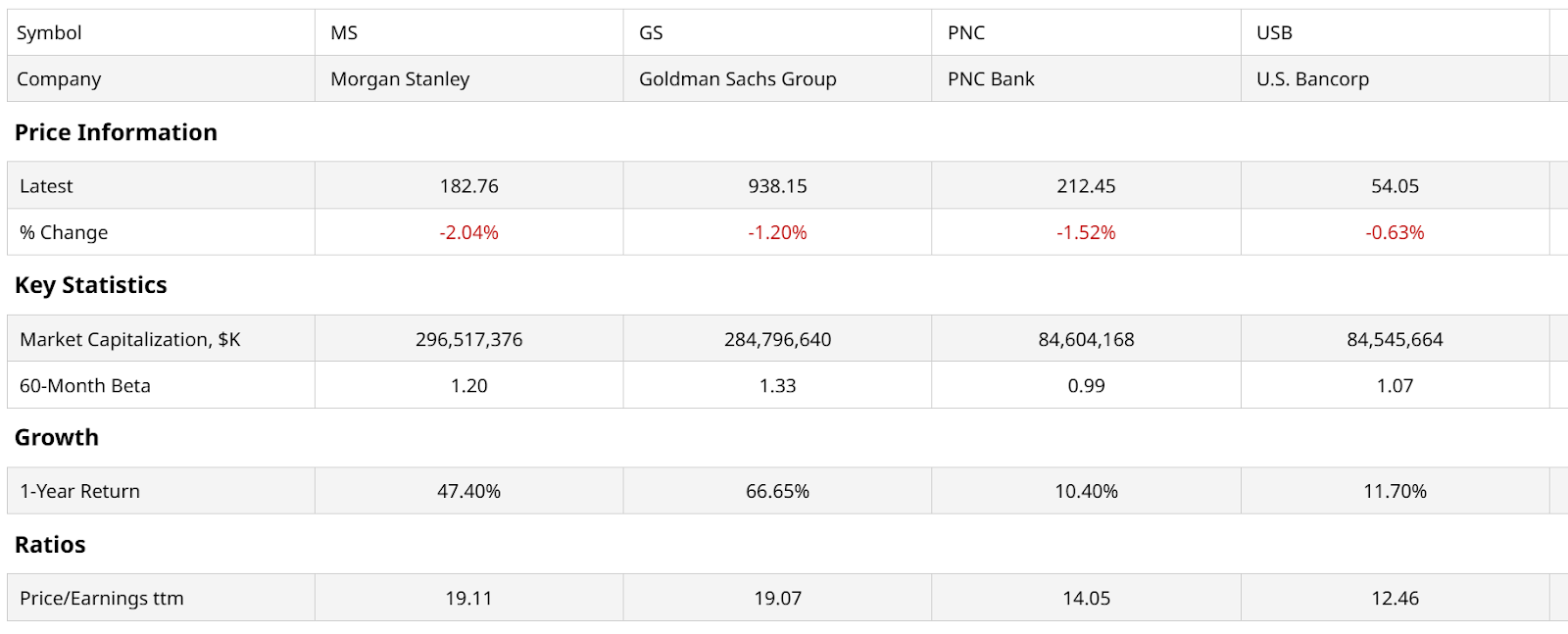

The exchange-traded fund (ETF) geek in me can’t help but think of them as two pairs rather than four of a kind. MS and GS are much larger, and thus play a more prominent role in the S&P 500 Index ($SPX), as well as many financial sector ETFs. The other two are leading regional players — still quite big but on a different plane.

The market will be looking to this foursome to post solid net interest income (NII) trajectories. But perhaps more nerve-wracking for those exposed to the sector will be updates on credit loss provisions. If the banks are tucking away more cash for rainy days, it tells you exactly what they think of the "soft landing" narrative.

The Capital Market Kings: Morgan Stanley (MS) & Goldman Sachs (GS)

For Morgan Stanley and Goldman, the story in 2026 is the long-awaited "thaw" in the deal-making environment. We’ve had years of pent-up demand for mergers and acquisitions (M&A) and initial public offerings (IPOs).

Morgan Stanley has a top-level wealth management arm. It’s the stabilizer that has made MS a much smoother ride than GS over the last decade. Goldman Sachs is currently the Dow’s ($DOWI) largest member, at more than 11% of the entire index.

MS is not in that index and never has been. So both stocks could move similarly, but if you see the Dow Industrials move wildly on Thursday morning, there’s a good chance it's GS driving it.

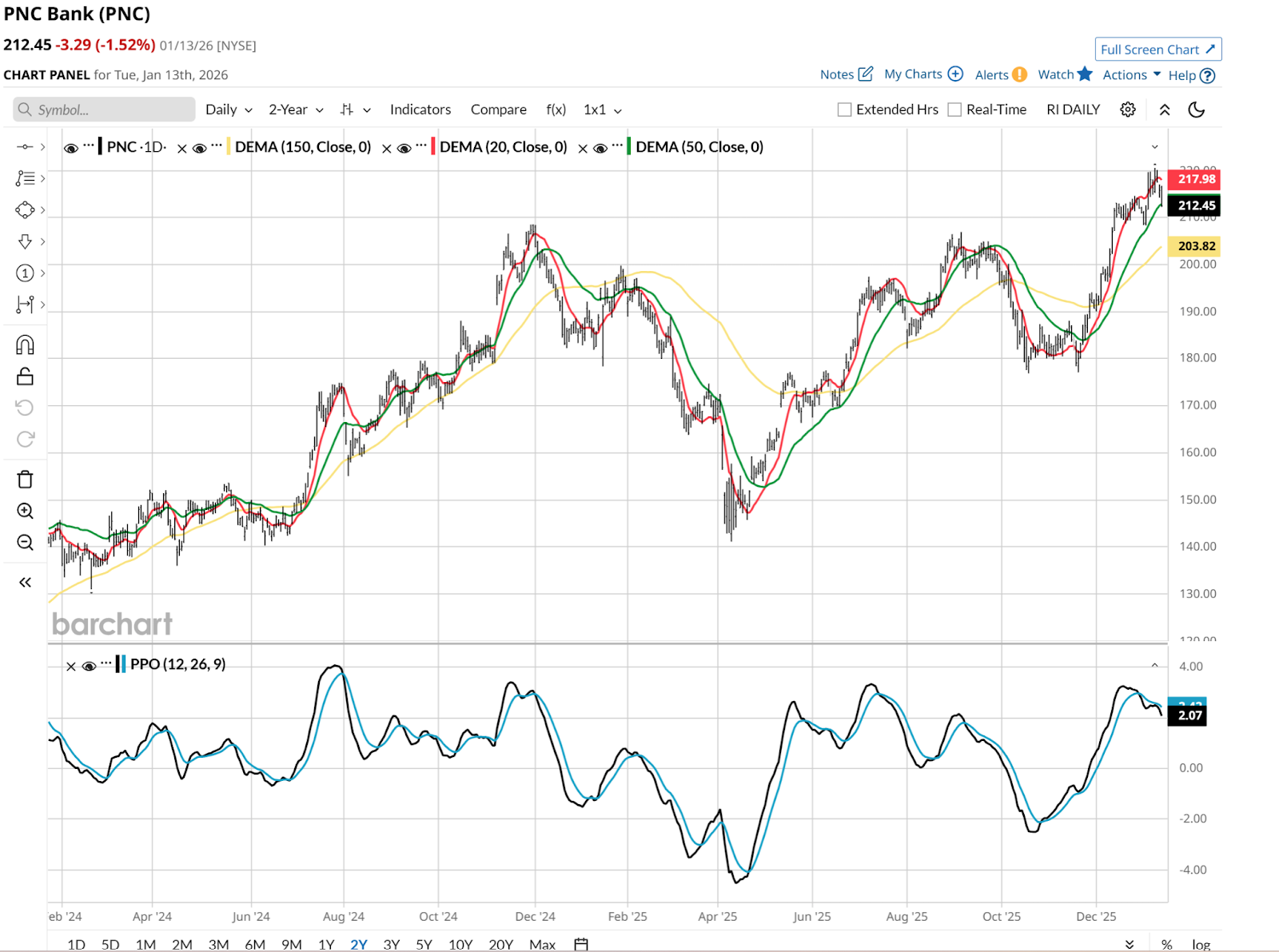

I see PNC and USB as the regional reality check. This is where the rubber meets the road. These regional heavyweights aren't focused on high-flying M&A; they are focused on mortgages, auto loans, and small business lines of credit.

The Charts Show Who’s Best-Positioned Going Into Earnings

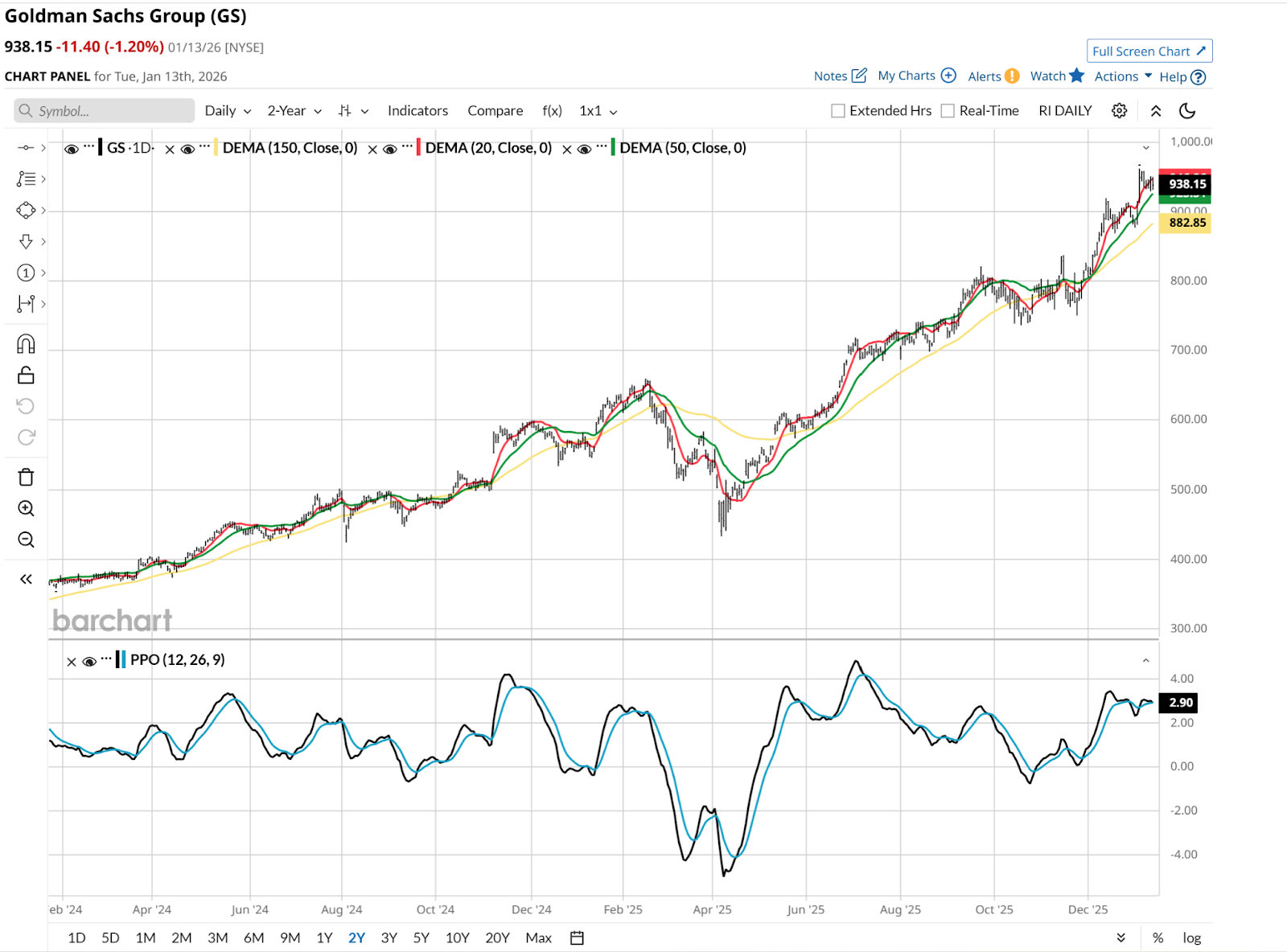

At a glance, GS looks like the broad market to me. Stretched, overvalued, but it only matters when the market decides it does. Maybe that will be this week — or maybe it will vault higher still. There’s no clear path here.

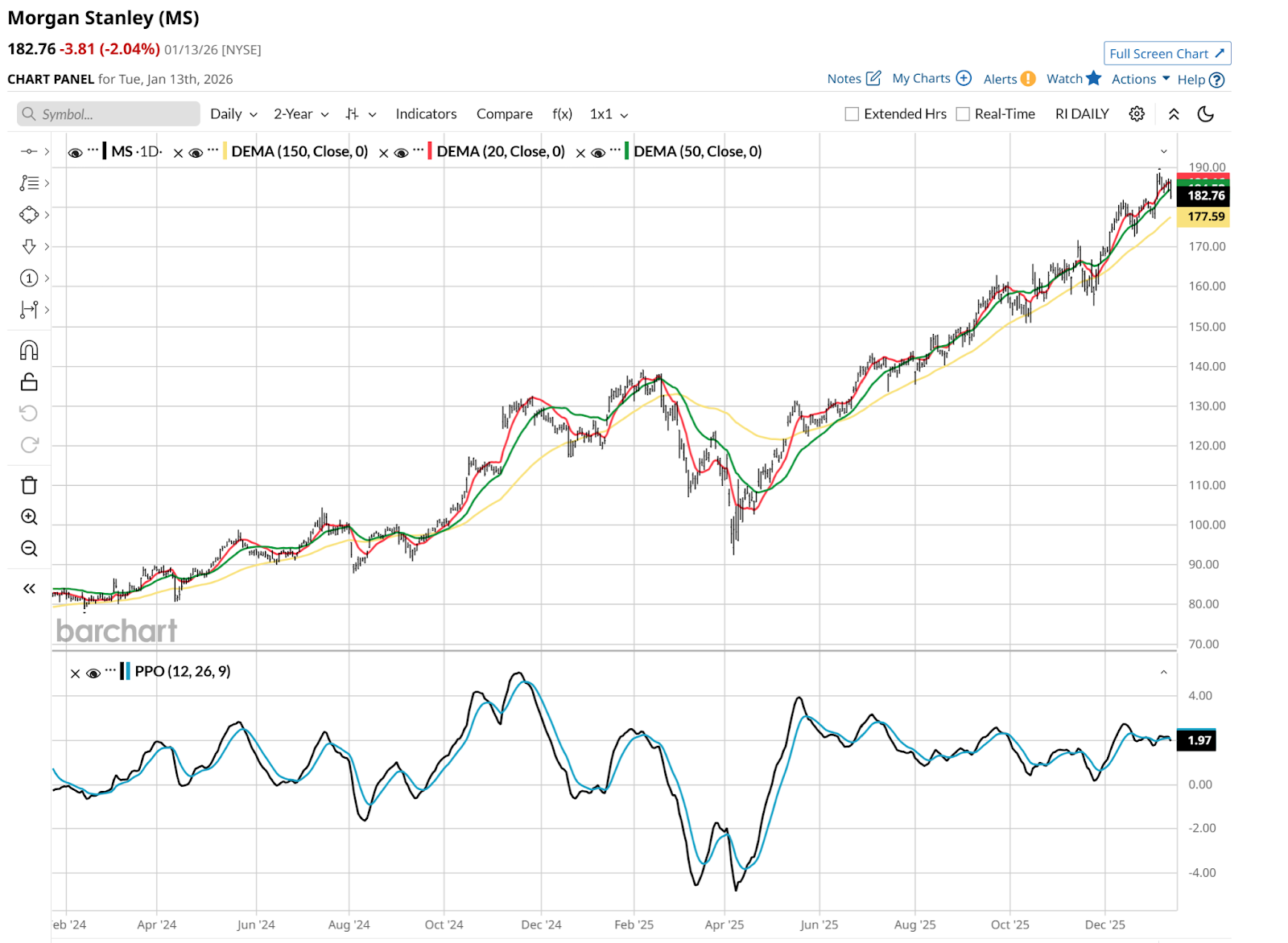

Notice how MS’s chart is almost a carbon copy. Only on earnings days does it tend to divert severely. Other than that, this is another example of “correlation nation,” as I call it.

The good news here is that PNC’s chart doesn’t look like the others. The bad news is that it looks worse! That PPO is already tipping over, so Thursday could be the beginning of the end of a monster run. Or not. I gave up the crystal ball stuff a long time ago. Not with a market that has this much staying power, and the monster flows into index ETFs that keep it elevated.

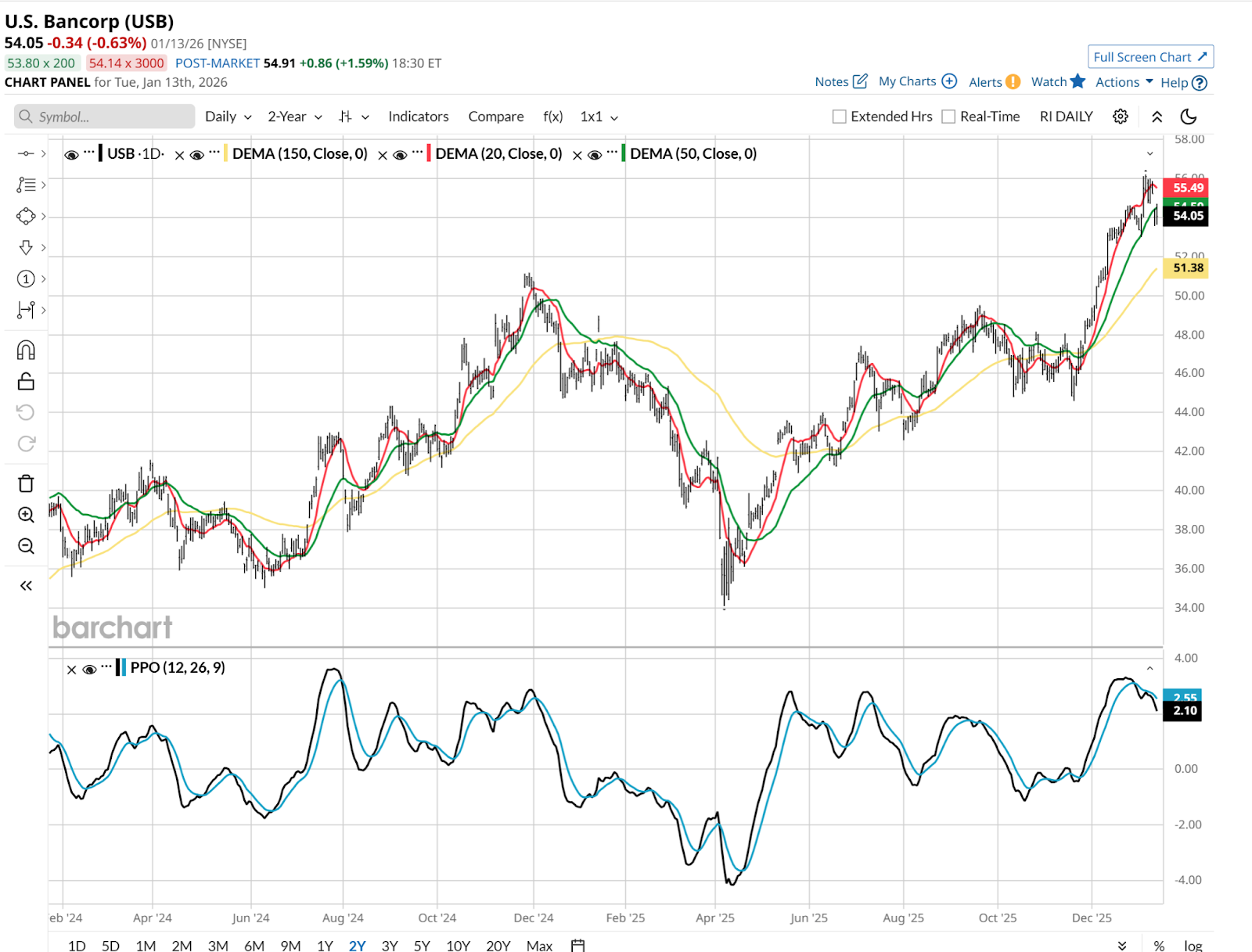

And wouldn't you know it? USB is very similar to PNC, chart-wise anyway.

The One To Watch

I’ve seen too many investors get whipsawed by trying to play individual bank earnings. The 10-minute reaction to a headline is often the opposite of where the stock ends the day. I wouldn’t bank on any of these stocks.

But if they are to lead the market in one direction or the other, as is the case with so many sectors now, Goldman Sachs, the one with the very sharpest hand on the pulse of Wall Street’s big money movements, will likely point the way.

Rob Isbitts is a semi-retired fund manager and advisor. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Casts Doubt on the Netflix-Warner Bros. Discovery Deal, How Should You Play NFLX Stock?

- Broadcom CEO Hock Tan Just Sold $24 Million Worth of AVGO Stock. Should You Dump Shares Too?

- HSBC Says These 2 AI Stocks Are Likely to Be Earnings Winners. Should You Buy Them Now?

- Behind Berkshire’s Curtain: Is Greg Abel Preparing to Cut Davita Loose?