Dividend stocks are the best option for investors looking for consistent passive income. These are companies with stable cash flows, healthy balance sheets, and a long history of rewarding shareholders with steady dividends. Here are two solid dividend stocks that stand out for providing consistent income and long-term stability, even in volatile markets.

Dividend Stock #1: Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is a global healthcare company that makes prescription drugs that treat serious and chronic diseases and also makes medical devices and technologies used in hospitals. JNJ’s diversified business generates stable, resilient revenue and strong cash flow, allowing it to pay recurring dividends. JNJ has been paying and increasing dividends for over six decades now, earning it the title of a Dividend King. Its forward yield of 2.5% is higher than the healthcare average of 1.6%. Its forward payout ratio of 42% is also reasonable.

In the third quarter, Johnson & Johnson reported sales of $24 billion globally, representing 5.4% year-over-year (YoY) growth, despite a significant headwind from the loss of exclusivity of STELARA. Adjusted net earnings grew to $6.8 billion, with adjusted diluted EPS of $2.80, a 15.7% increase YoY. Free cash flow generation remained strong, hitting $14 billion in the first nine months of the year, enabling the company to fund innovation while maintaining shareholder returns.

JNJ also announced intentions to spin off its Orthopaedics business, forming a more concentrated healthcare innovation company centered on six key growth areas: oncology, immunology, neuroscience, cardiovascular, surgery, and vision. Management stressed that the separation is expected to boost MedTech growth and margins while having no impact on the company's dividend. The company ended the quarter with $19 billion in cash and marketable securities and reiterated its commitment to disciplined capital allocation. Despite significant investments in R&D and strategic growth efforts, management has stated clearly that the Johnson & Johnson dividend will not be affected.

Looking ahead, management expects revenue to grow by more than 5% in 2026, with profitability potentially increasing due to new product launches and margin improvement. Johnson & Johnson remains an outstanding dividend stock for investors looking for consistent passive income supported by strong fundamentals.

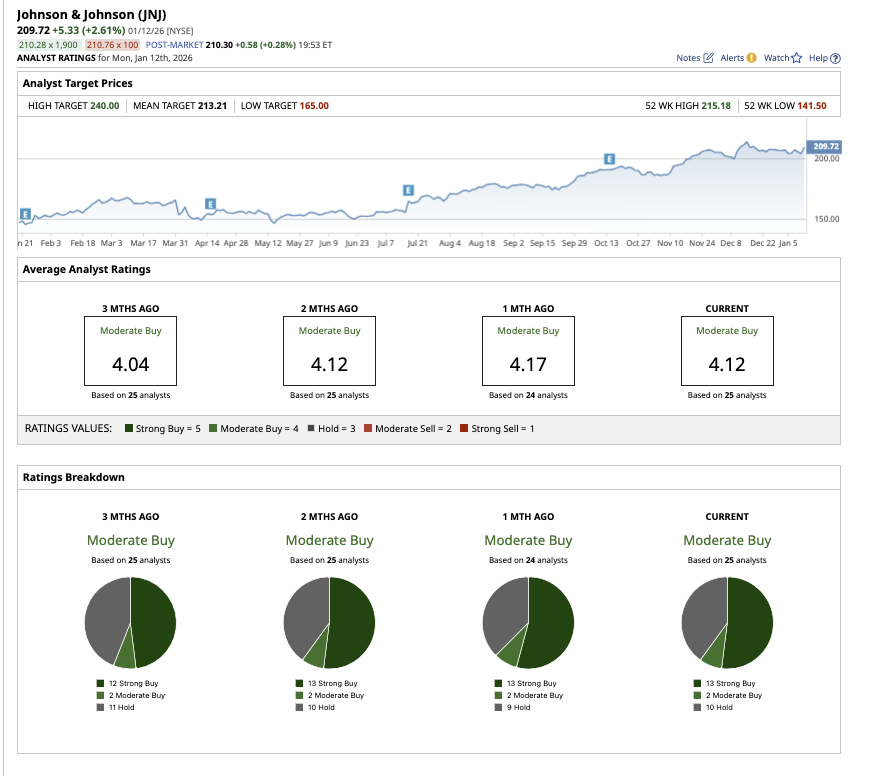

Overall, Wall Street rates JNJ stock a consensus “Moderate Buy.” Out of the 25 analysts covering the stock, 13 rate it a “Strong Buy,” two rate it a “Moderate Buy,” and 10 rate it a “Hold.” The mean target price on the stock is $213.21, which is 1.6% above current levels. Meanwhile, its high target price of $240 implies a potential upside of 14.4% in the next 12 months.

Dividend Stock #2: Procter & Gamble (PG)

Procter & Gamble (PG) is a global consumer goods company that makes everyday products people use at home, often daily, such as household and cleaning products, personal care and grooming, and baby, feminine, and family care. P&G owns some of the world's most trusted brands, which are sold in more than 180 countries. Consumers frequently stick with these brands for several years, resulting in great pricing power and brand loyalty. This business model has generated steady cash flows and reliable earnings, allowing it to pay and increase dividends for the past 69 years in a row.

It also pays a higher yield of 2.9% compared to the consumer staples sector average of 1.89%. Its forward payout ratio of 57.5% is reasonable and sustainable for a mature consumer staples company like P&G. It allows the company to reinvest in the business, fund innovation and marketing, pay down debt, and ensure consistent dividend growth over time.

In the first quarter of fiscal 2026, P&G's earnings rose 21% to $1.95 per share. In the quarter, an adjusted free cash flow productivity of 102% showed that the company is converting earnings into cash very efficiently, which strengthens dividend safety and the company's ability to pay cash to shareholders without strain.

Notably, it paid out $2.55 billion in dividends and $1.25 billion in share repurchases to shareholders. Because P&G makes everyday products that households rely on, leading to steady long-term profits, it is considered one of the safest and most defensive stocks in the market.

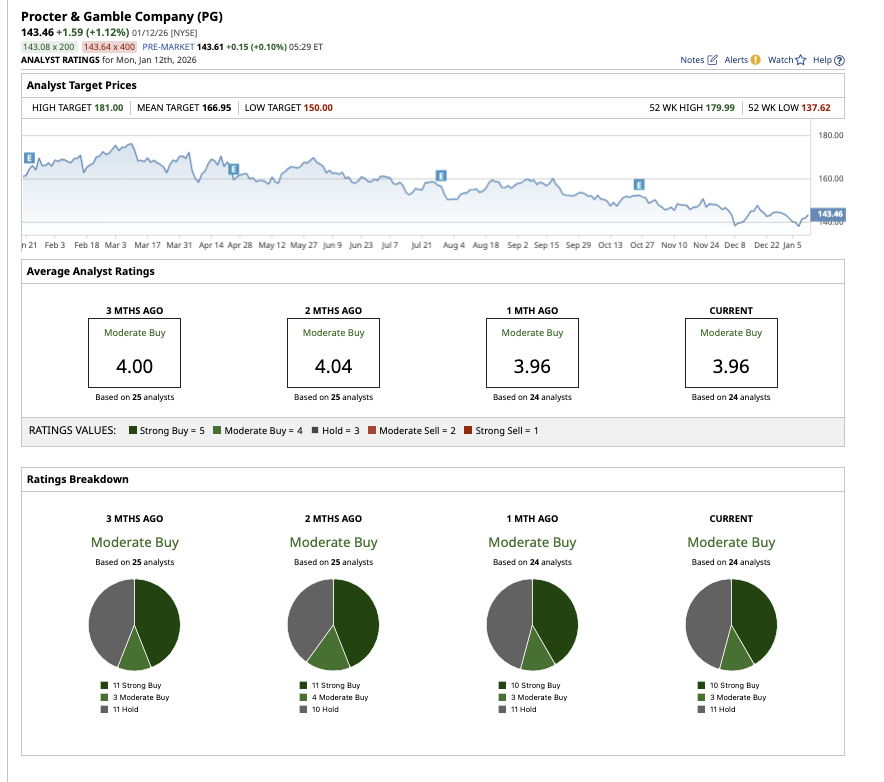

Currently, PG stock holds a “Moderate Buy” rating on Wall Street. Of the 24 analysts who cover PG, 10 have a “Strong Buy” rating, three say it is a “Moderate Buy,” and 11 rate it a “Hold.” Based on the mean target price of $166.95, PG stock has upside potential of 16.3% from current levels. Plus, its high target price of $181 implies an upside potential of 26.1% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 Rock-Solid Dividend Stocks to Buy for Steady Passive Income

- UnitedHealth Just Got a Checkup, and UNH Stock Has Some Big Problems to Treat in 2026. The Bull and Bear Cases Now.

- Should You Buy Dividend-Paying Gold Stocks as Trump Makes Them ‘Great Again’?

- 2 High-Yield Dividend Aristocrats to Consider in 2026