Semiconductor stocks have been among the most closely watched groups as the market has entered 2026, and a note from Morgan Stanley briefly raised concerns. Citing data from the Semiconductor Industry Association (SIA), Morgan Stanley said that while the growth in worldwide chip sales in November came in weaker than expected on a month-over-month basis, overall trends are improving.

Reportedly, sales in November grew 7.1% month-over-month, below Morgan Stanley’s forecast of 10.4% growth. However, growth was still considerably stronger than the 10-year average of 2.5%. More significantly, growth over the past three months also came close to 30% year-over-year (YOY), while growth over one month was close to the same rate, indicating that an overall recovery is on track.

For those investing in artificial intelligence (AI) bellwethers like Nvidia (NVDA), it's important to consider whether this “bumpiness” is a sign of a true slowdown, or if it's just a matter of timing within what is otherwise a very strong cycle. Let's take a closer look.

About Nvidia Stock

Nvidia (NVDA) is a global leader in designing graphics processing units (GPUs) and accelerators with exposure to data centers, AI, high-performance computing, and advanced networking. Based in Santa Clara, California, Nvidia currently has a market capitalization of approximately $4.45 trillion, ranking it among the most valuable corporations in the world.

NVDA stock has had an exemplary year with sharp growth as hyperscalers, corporations, and governments compete to develop AI infrastructure. Currently, the stock is trading near $185 with a 52-week price range of $87 at the low end and $212 at the high end. Although NVDA has experienced some correction in recent periods, it continues to be ahead of the market with sharp growth in Nvidia's earnings capacity.

In terms of valuation, Nvidia is richly priced. Its forward price-to-earnings (P/E) multiple is over 40, while its price-to-sales (P/S) multiple is over 30. This is a sign of continued execution and strong demand visibility, although this is increasingly driven by the data center/AI side of the business as opposed to the semiconductor side.

Nvidia Posts Another Blowout Quarter

Nvidia's latest earnings statement again confirmed why investors have been ignoring short-term industry fluctuations, continuing to focus on long-term growth opportunities. In the third quarter ended Oct. 26, Nvidia posted record revenue of $57 billion, an increase of 22% sequentially and a 62% year-over-year (YOY) improvement. EPS came in at $1.30, while gross margins were comfortably above 73%. The company cited "unprecedented" demand for its cloud-based GPUS, which it said were effectively sold out, as well as growth in AI workloads for training and inference.

Moving ahead into the fourth quarter, Nvidia forecast revenue of around $65 billion with gross margins of roughly 75%. This forecast indicates that, despite the decline of some semiconductor markets, Nvidia’s key markets are still faced with supply shortages as opposed to demand shortages.

This sector break down at Morgan Stanley goes a long way in explaining why Nvidia is apparently unaffected by softer data in November. The areas that were weak were in the discretes, analog, and microcontrollers, which have a closer tie-in to automotive, industrials, and consumer electronics. Memory was a mixed bag, with NAND beating expectations and DRAM very strong in October.

Importantly, the company highlighted amid its results that related demand for AI was still robust. Morgan Stanley also reiterated that direct beneficiaries of AI, such as Nvidia, continue to see strong order flow, adding that it’s possible for AI strength and economic recovery to coexist. Put another way, November did not show signs of slowing AI investment, but rather signs of the semiconductor market being split, with traditional segments remaining mixed while data center and AI infrastructure showed extraordinary growth.

What Do Analysts Expect for Nvidia Stock?

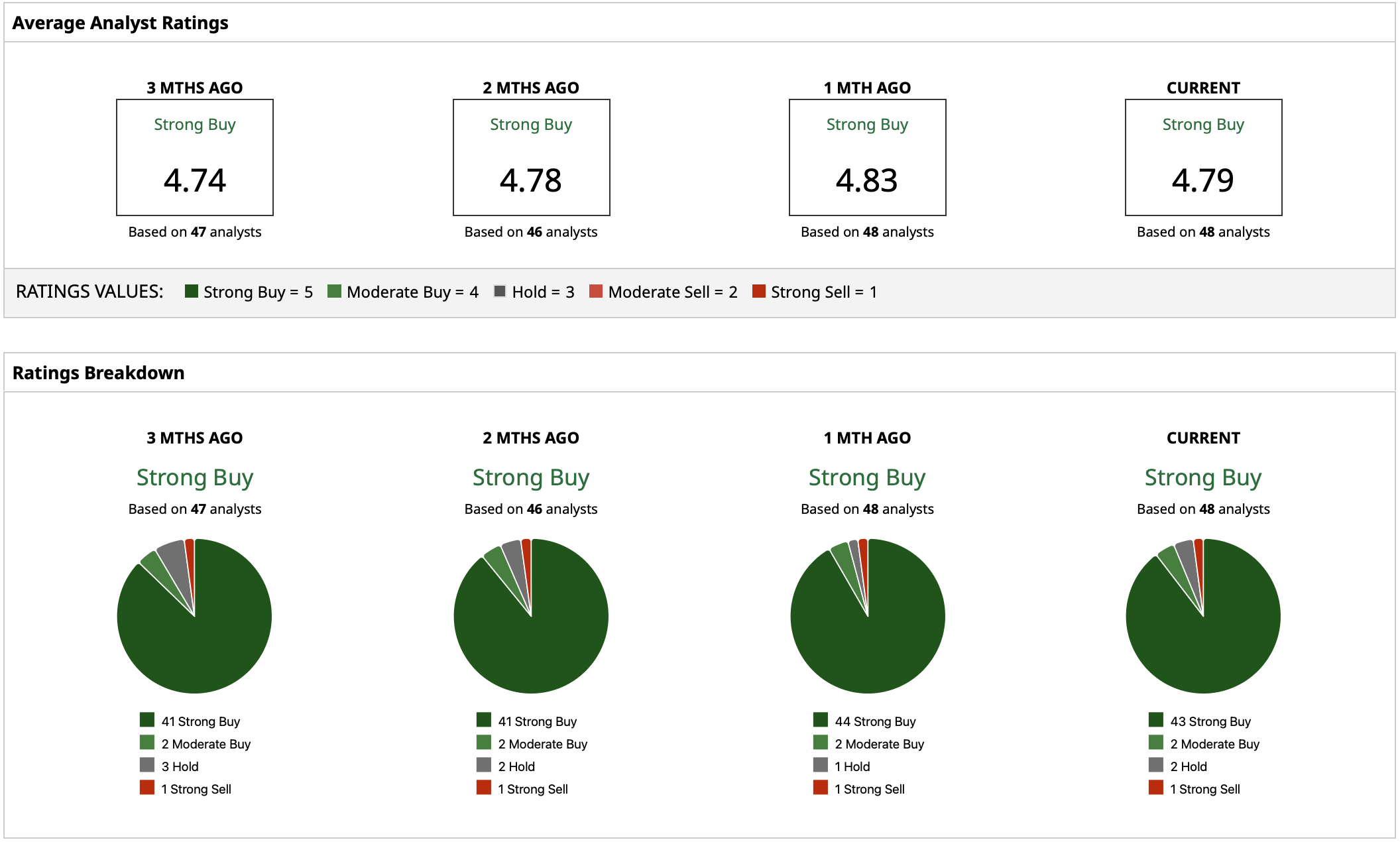

Wall Street remains generally positive about the outlook for Nvidia with a “Strong Buy” consensus rating. Analysts note the company’s continued revenue growth, strong margins, and visibility into the spending patterns of hyperscalers. The current mean price target for NVDA stock is $255.07, implying about 36% potential upside from the current market price.

Although the risk associated with Nvidia's valuation is significant — especially with a possible cooling-off period regarding expected AI expenditures — there is a consensus among analysts that the firm has a strong competitive stance as well as a record of execution that justifies a premium multiple. With more than $62 billion left on its share repurchase program, Nvidia has strong financial flexibility as well.

On the date of publication, Yiannis Zourmpanos had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Is Back From the Brink, But It Only Gets Tougher From Here. How Should You Play INTC in 2026?

- Cathie Wood Is Trimming Her Palantir Stake Again. How Should You Play PLTR in January 2026?

- As Trump Unveils His ‘Great Healthcare Plan,’ How Should You Play UnitedHealth Stock?

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’