Taiwan Semiconductor (TSM) shares are extending gains on Jan. 15 after the semiconductor giant posted better-than-expected financials for its fourth quarter.

On Thursday, the company said its revenue came in at a record NT$1.046 trillion in Q4, driving the quarterly profit up by 35% on a year-over-year basis.

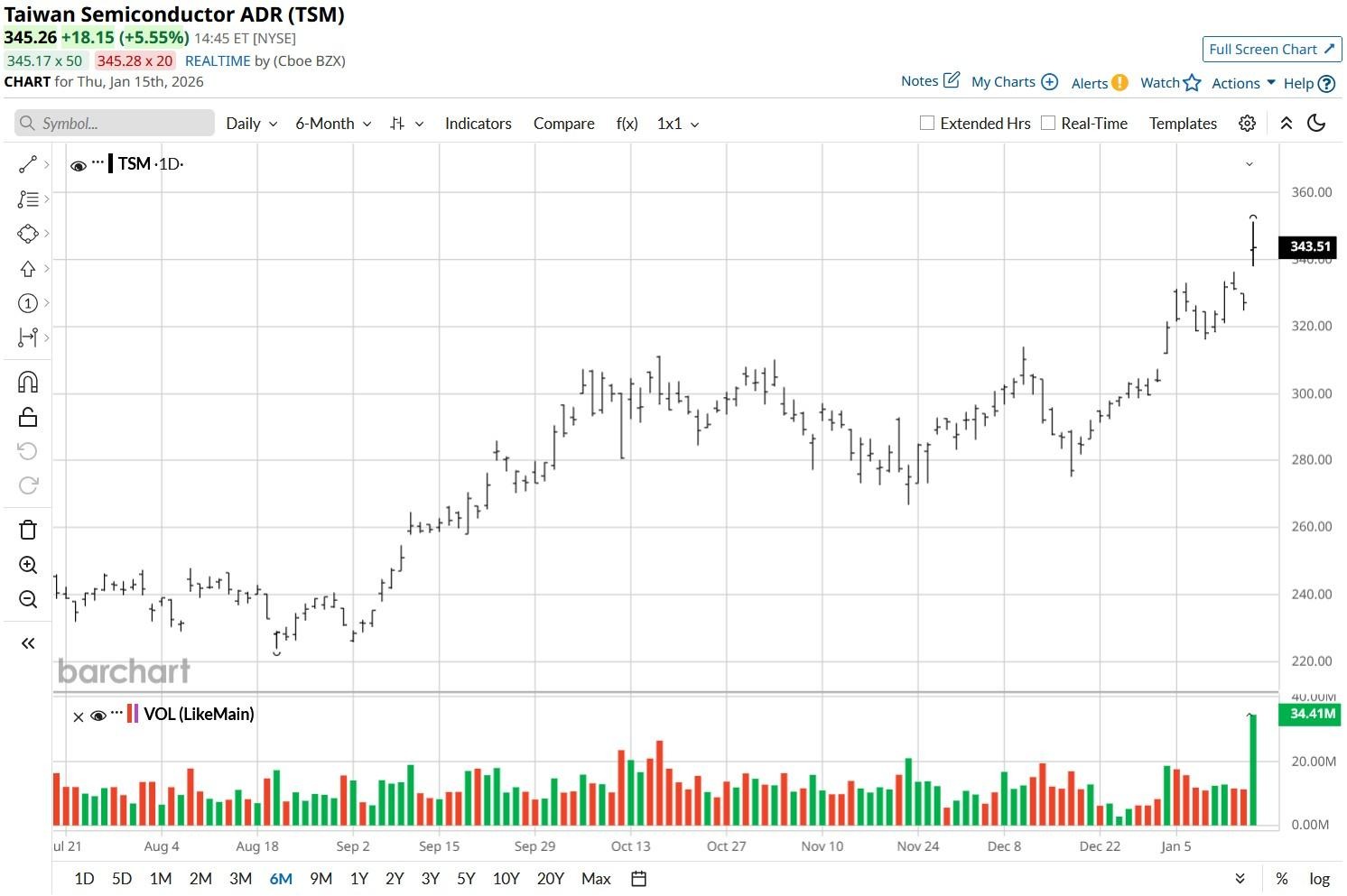

Following the post-earnings rally, TSMC stock is up more than 140% versus its 52-week low.

Is TSMC Stock Overvalued Currently?

According to the NYSE-listed behemoth, its artificial intelligence (AI) customers continue to signal robust demand that will drive its revenue up by another 40% in the current quarter.

TSMC remains worth owning also because it’s a key enabler of artificial intelligence, with names like Nvidia (NVDA) and Broadcom (AVGO) heavily dependent on its manufacturing capacity for their cutting-edge AI chips.

This, in itself, is a strong enough reason to stick with Taiwan Semiconductor for the long term.

Counterpoint Remains Bullish on TSM Shares

Counterpoint Research’s senior analyst Jake Lai recommends keeping exposure to TSMC shares despite a stretched valuation (trailing price-earnings ratio at 34x) mostly because 2026 will likely be another “breakout year” for AI demand.

According to him, the firm’s “2nm capacity expansion, new production contributing to sales, and continuous expansion of advanced packaging” will drive this semiconductor stock up further this year.

TSMC’s plans of investing up to $100 billion in the U.S. keep it insulated from tariffs and broader geopolitical headwinds as well.

Moreover, Taiwan Semiconductor remains decisively above its key moving averages (MAs). Although its 14-day relative strength index (RSI) has crossed into overbought territory, its longer-term RSI remains at 62.

A 1.1% dividend yield makes TSM stock even more attractive to own in 2026.

What’s the Consensus Rating on Taiwan Semiconductor?

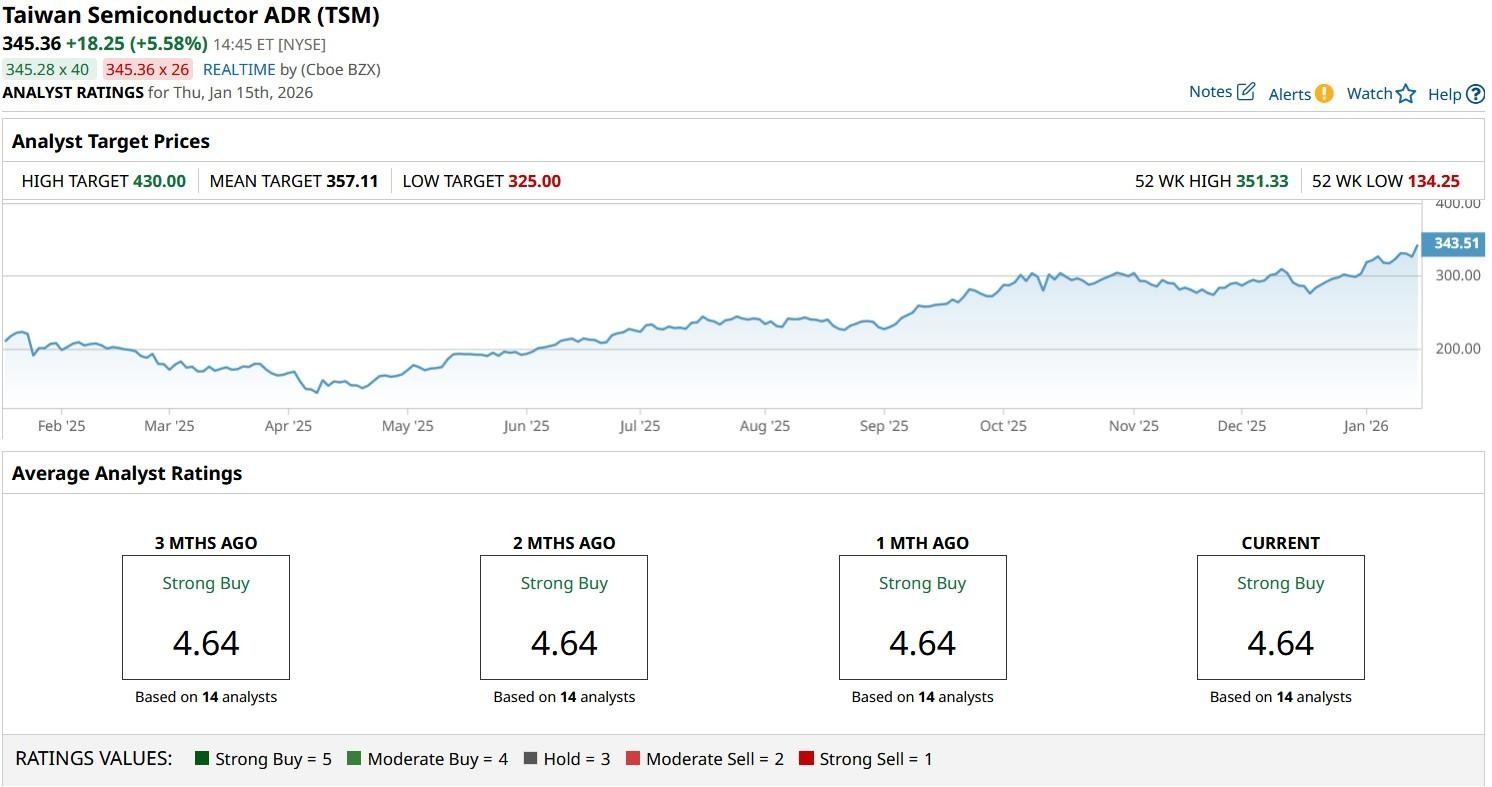

What’s also worth mentioning is that Wall Street analysts remain bullish as ever on TSMC stock for the next 12 months.

The consensus rating on TSM shares remains at “Strong Buy” with price targets going as high as $430 indicating potential upside of nearly 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Is Back From the Brink, But It Only Gets Tougher From Here. How Should You Play INTC in 2026?

- Cathie Wood Is Trimming Her Palantir Stake Again. How Should You Play PLTR in January 2026?

- As Trump Unveils His ‘Great Healthcare Plan,’ How Should You Play UnitedHealth Stock?

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’