Intel (INTC) will release its Q4 financials on Thursday, Jan. 22. Despite competitive pressures and its slower start in the artificial intelligence (AI) space compared to peers, Intel stock has surged more than 100% over the past six months.

What’s Behind Intel’s Rally?

Intel has taken several steps to stabilize its finances and restore strategic flexibility, which boosted its share price. Funding support from the U.S. government and strategic investments from Nvidia (NVDA) and SoftBank Group (SFTBY) have strengthened the company’s balance sheet. At the same time, Intel has unlocked value by monetizing parts of its Altera and Mobileye businesses, providing additional capital to fund its long-term growth initiatives. Also, it paid off $4.3 billion of debt in Q3 and continues to deleverage its balance sheet.

These actions have helped reposition Intel at a time when demand for AI-driven computing is reshaping the industry. The rapid adoption of AI is not only boosting AI-specific workloads but also driving renewed growth in traditional compute markets.

Intel’s recent collaboration with Nvidia positions it well to capitalize on the AI-driven momentum. Under the partnership, Intel and Nvidia plan to codevelop multiple generations of custom data center and PC products designed to accelerate AI applications.

Operationally, Intel’s fundamentals are also showing signs of improvement. The company delivered a solid third quarter, with top line, gross margin, and earnings all exceeding management’s guidance. Notably, Q3 marked the fourth consecutive quarter of improved execution, reflecting stabilization in Intel’s core markets and steady progress in its broader turnaround efforts.

With the stock already pricing in much of this optimism, any softness in Intel’s Q4 performance and outlook could keep the stock volatile.

For INTC stock, the options market is expecting a post-earnings move of approximately 7.5% in either direction for contracts expiring Jan. 23, which is higher than the stock’s average earnings-related move of 5.4% over the past four quarters. Note that INTC stock increased 3.4% following the previous earnings announcement.

Intel's Q4 Expectations

Intel enters the fourth quarter with momentum from a stronger-than-expected third-quarter performance, though near-term results are likely to reflect a company still balancing recovery with structural challenges. In the third quarter, Intel reported revenue of $13.7 billion, up 6% sequentially. That upside has helped stabilize investor expectations after several volatile quarters.

Looking ahead, management is guiding fourth-quarter revenue to a range of $12.8 billion to $13.8 billion. At the midpoint of this range, and after adjusting for the deconsolidation of Altera, revenue is expected to be roughly flat compared to the prior quarter. Intel anticipates modest sequential growth in product revenue, but this growth is likely to remain capped due to supply constraints.

Within Intel’s product segments, the Client Computing Group is expected to decline modestly sequentially, reflecting continued pressure on traditional PC demand. In contrast, PC AI-related products are projected to grow strongly quarter over quarter. This mix shift is largely driven by Intel’s strategic decision to prioritize wafer capacity for higher-margin server shipments rather than entry-level client parts. On the foundry side, Intel Foundry revenue is expected to increase sequentially, supported by rising Intel 18A revenue.

Profitability, however, remains under pressure. Intel is forecasting a gross margin of approximately 36.5%, down sequentially. The decline is attributed to an unfavorable product mix, higher costs associated with the initial shipments of Core Ultra 3, and the impact of removing Altera from consolidated results. Adjusted earnings per share (EPS) is expected to come in at $0.08.

This outlook stands in contrast to analysts’ expectations. Analysts are forecasting an average loss of $0.02 per share for the quarter. Intel’s recent track record suggests the company could exceed expectations, as it has beaten consensus EPS estimates in three of the last four quarters. Most notably, during the last reported quarter, Intel exceeded analyst expectations by a wide margin, delivering earnings that were 200% above estimates.

Is INTC Stock a Buy?

Intel’s upcoming fourth-quarter results are best viewed as part of a transition rather than a clear turning point. While revenue growth is expected to remain modest and margins are still under pressure, the company’s operational execution has been improving.

The company’s financial footing has also strengthened. Improved liquidity, a more resilient balance sheet, and a growing list of strategic partnerships provide Intel with greater flexibility as it navigates a highly competitive semiconductor landscape. Further, the rapid expansion of AI-driven data center infrastructure is supporting demand for server CPUs, offering a meaningful growth opportunity for Intel’s data center business.

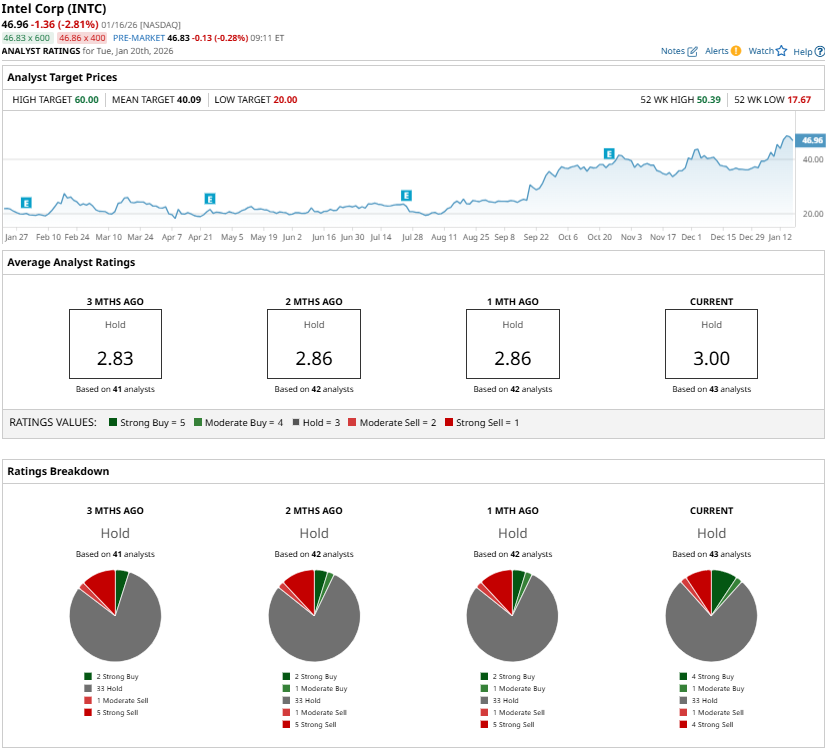

That said, competition from rivals remains intense and continues to cap near-term upside. Wall Street analysts currently maintain a “Hold” consensus rating on INTC shares ahead of the fourth-quarter earnings release.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Amazon Too Cheap Ahead of Earnings? Put Yields are High, Implying AMZN Stock Could Rally

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?