Intel's (INTC) CFO just put his money where his mouth is. Now investors are asking if they should follow his lead. David Zinsner purchased 5,882 shares of Intel at $42.50 each on Jan. 26, just days after the chipmaker's earnings report sent the stock tumbling.

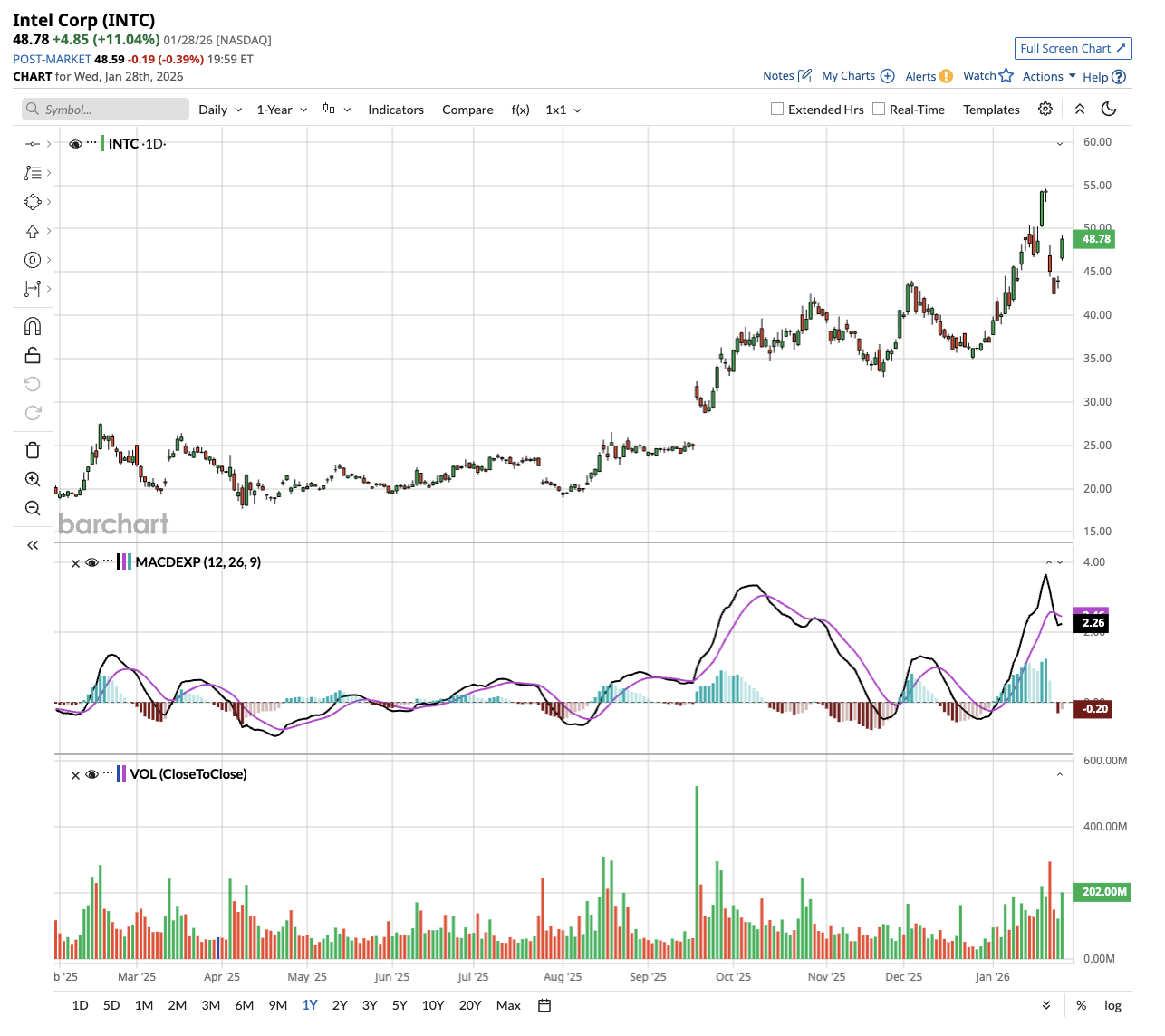

The timing is notable. INTC stock had cratered 17% on Friday following weak guidance and warnings about supply constraints that spooked Wall Street. For a CFO to step in with his own cash right after such a selloff sends a message. But is it the right message for investors?

The Case Zinsner Is Making

Zinsner's buy came following fourth-quarter results that told two different stories. On one hand, Intel beat expectations with adjusted earnings of $0.15 per share versus the $0.08 analysts expected. Revenue of $13.7 billion also topped the $13.4 billion consensus.

On the other hand, the guidance was ugly:

- Intel expects first-quarter revenue between $11.7 billion and $12.7 billion with breakeven earnings.

- Analysts had penciled in earnings of $0.05 per share and sales of $12.51 billion.

That's a miss on both counts.

The culprit? Supply constraints. CEO Lip-Bu Tan admitted during the earnings call that the company can't meet full demand for its products. Production yields are running below his targets, and Intel is scrambling to squeeze more output from its existing factories.

"We are on a multiyear journey," Tan said. "It will take time and resolve."

INTC stock got hammered, erasing gains built on hopes of a turnaround for the embattled American chipmaker.

But Zinsner sees something different. His purchase suggests he believes the selloff overshot and that Intel's longer-term story remains intact.

What Intel Is Building Toward

The excitement around Intel centers on its foundry business, which makes chips for other companies. The chipmaker is betting billions that it can compete with Taiwan Semiconductor (TSM) and win back market share it's been bleeding for years.

Intel's 18A manufacturing technology is the linchpin. Tan said earlier this month that 18A "over-delivered" in 2025, suggesting it's mature enough for volume production. Intel is already using 18A to make its own Core Ultra Series 3 processors and is hunting for external customers.

On the earnings call, Zinsner told analysts that customers for Intel's next-generation 14A technology should appear in the second half of this year. Once those customers commit, Intel will start pouring capital into 14A capacity.

"Once we get them, we're gonna need to start really spending capital on the 14A front, and that's how you'll know," Zinsner said.

There's also a potentially massive wildcard in play. Reports from Digitimes suggest Nvidia (NVDA) may use Intel's foundry for some of its 2028 production needs. According to supply chain sources, Nvidia could tap Intel for portions of its Feynman architecture platform, targeting low-volume, non-core production.

The plan, as described, would keep Nvidia's main GPU die with Taiwan Semiconductor but shift portions of the Input/Output die to Intel's 18A process. Advanced packaging could use Intel's EMIB technology, with Intel handling roughly 25% of final packaging while TSMC does the rest.

The Risks of Investing in Intel Stock

Zinsner's optimism doesn't erase the challenges Intel faces. The company posted a net loss of $600 million in the fourth quarter, or $0.12 per diluted share. That's worse than the year-ago loss of $100 million.

Analysts at RBC Capital Markets warned that meaningful revenue from 14A customers may not show up until late 2028. That's a long time to wait for validation, especially when competitors like TSMC are already dominating the foundry space and profiting massively from the AI boom. Jefferies was even blunter, writing that they "still don't see a clear path forward given further share loss, no AI strategy and unclear fab/packaging opportunities."

- Intel's Data Center and AI segment posted $4.7 billion in revenue during the quarter, up 9% year-over-year (YoY).

- That's a positive sign, driven by increased spending on AI infrastructure.

- But Client Computing Group sales fell 7% to $8.2 billion, suggesting not all business lines are firing on all cylinders.

The supply constraints are also a real problem. Zinsner told CNBC that the soft first-quarter guidance stems partly from Intel not having the supply it needs to meet seasonal demand. He expects improvement in the second quarter, but that's a promise investors have heard before.

Should You Buy INTC Stock Now?

Insider buying is generally a bullish signal. CFOs have access to information that retail investors don't, and when they buy stock with their own money, it usually means they believe the market has mispriced the company. But it's not a guarantee. Intel is on a multiyear turnaround that will require flawless execution, massive capital investment, and customer wins that haven't materialized yet.

Zinsner's purchase suggests he thinks the worst-case scenario is overblown and that Intel's foundry ambitions will eventually pay off. For investors willing to stomach volatility and wait years for the payoff, that bet might make sense.

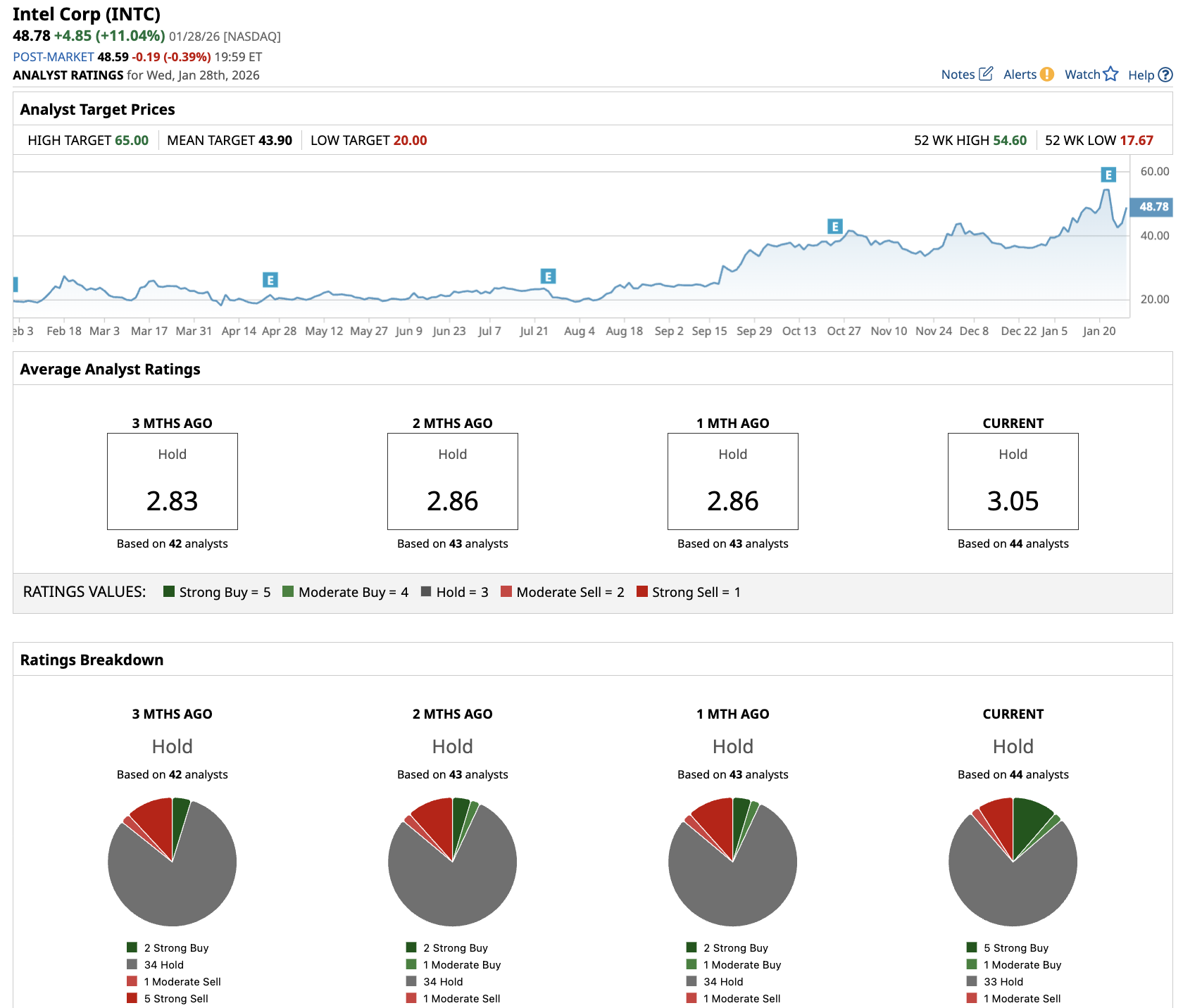

Out of the 44 analysts covering INTC stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” 33 recommend “Hold,” one recommends “Moderate Sell,” and four recommend “Strong Sell.”

The average INTC stock price target is $43.90, below the current price of $49.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Tesla Transforms Into an AI Company, How Should You Play TSLA Stock Now?

- Palantir Stock Has Struggled Recently — Can Q4 Earnings Spark a Comeback In PLTR?

- This Energy Stock Is Up 700%, But I Wouldn’t Touch It with a 10-Foot Pole

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.