MarketWatch published an article on Monday with the heading This ETF from a 106-year-old firm has crushed rivals while avoiding ‘Magnificent Seven stocks.’ The ETF is the Tweedy, Browne Insider + Value ETF (COPY), launched in late 2024.

The actively managed ETF seeks three things: undervalued stocks, insider buying, and opportunistic share repurchases.

“For the COPY ETF, the Tweedy, Browne team selects stocks of companies whose insiders (officers, directors or controlling shareholders) have been buying shares with their own money. They will also select stocks of companies that are repurchasing their shares at attractive prices, based on Tweedy, Browne’s valuation analysis,” MarketWatch contributor Philip van Doorn wrote.

As Van Doorn says, the fund uses over “30 different investment characteristics,” to determine if a stock is undervalued, trading below its intrinsic value.

For years, I’ve said that most American companies do a terrible job of repurchasing their shares; either they put the purchases on autopilot to meet the dollar amount of their share repurchase program, or they buy willy-nilly without any thought of the stock’s intrinsic value, often buying at the top, rather than near the bottom.

As Warren Buffett says, you can’t pin down the precise intrinsic value for a stock. Still, good capital allocators know when their share price is dear—insiders are selling—or undervalued—insiders are buying by the boatload.

COPY currently has 180 stocks, with weightings ranging from 1.97% to 0.11%. Of these 180, 12 had unusual options activity yesterday.

Of those 12, I’ve selected two worth considering for your portfolio.

Devon Energy (DVN)

While many investors are focusing on oil and gas companies that will do much of the heavy lifting to revitalize Venezuela’s broken energy infrastructure, Devon Energy will continue to benefit from drilling exclusively in the U.S.

Over the past 12 months, DVN has flatlined, up less than 1%. That compares to a 4.6% gain for Chevron (CVX), the only U.S. producer currently operating in Venezuela.

Analysts like Devon’s stock. Of the 30 analysts covering it, 24 rate it a Buy (4.53 out of 5), with a 12-month target price of $45.86, 30% higher than its current share price.

Despite a $57 price for a barrel of West Texas Intermediate, Devon’s expected to earn $4.04 a share in 2025. Its shares trade at 8.7 times this estimate. While not quite as low a multiple to what it was in 2023, around 6x earnings, it’s still historically low.

The last insider purchase I can see for Devon was CEO Richard Muncrief’s purchase of 15,000 shares in March 2024 at an average price of $44.42. It doesn’t appear that Muncrief made any purchases in 2025. That’s not a big commitment.

However, it makes a significant move in share repurchases. In its Q3 2025 10-Q, it notes that from the beginning of 2021 through Sept. 30, 2025, it repurchased 92.68 million shares at an average price of $44.70.

It accelerated share repurchases in 2024 and through the first three quarters of 2025. In fact, in 2025, it repurchased 23.695 million shares of its stock, only 249,000 less than for all of 2024, for about $200 million less. That’s some buying.

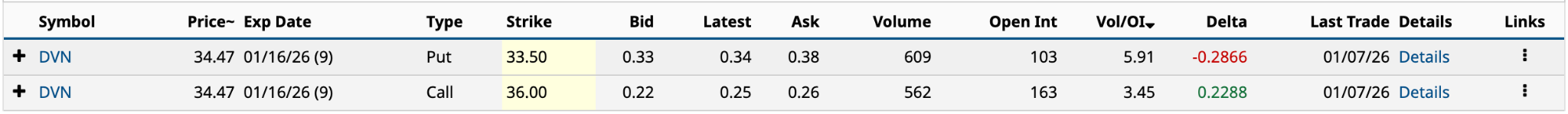

Here are the unusually active options from yesterday that I’d consider.

These two options are for the Long Strangle's ingredients. Here are the prices as I write this late on Thursday morning.

So, in a long strangle, you buy a call and a lower-priced put, both with the same expiration date, in this case, a week tomorrow. The cost of the long strangle is $67 or less than 2% of its current share price. You make money if the share price is above $36.67 or below $32.83 at expiration. Your maximum loss is the $67 net debit.

So, in a long strangle, you buy a call and a lower-priced put, both with the same expiration date, in this case, a week tomorrow. The cost of the long strangle is $67 or less than 2% of its current share price. You make money if the share price is above $36.67 or below $32.83 at expiration. Your maximum loss is the $67 net debit.

ConocoPhillips (COP)

ConocoPhillips (COP) is one of the firms that will likely be meeting with President Trump tomorrow to discuss Venezuela’s oil. The company has $12 billion in expropriation claims against Venezuela for assets seized two decades ago.

None of America’s big oil companies, including COP, will be attracted to making significant investments when oil prices are already too low for their liking. Add in a political situation that is far from sorted, and you’ve got the makings of a very tense meeting.

I’m no fan of Exxon Mobil (XOM) and its peers, including ConocoPhillips, but they must be frustrated that the president committed their funds to the cause before laying out a clear plan. This has all the makings of what the military calls a clusterfudge. Shareholders and prospective shareholders should be concerned about what might transpire in the years ahead.

Over the past 12 months, COP stock has performed marginally better than Devon, up nearly 3%, but it remains well below the S&P 500 and 28% below its three-year high of $135.18 in April 2024.

Like Devon, analysts like COP stock. Of the 28 analysts covering it, 21 rate it a Buy (4.36 out of 5), with a 12-month target price of $111.78, 15% higher than its current share price.

In 2025, ConocoPhillips is expected to earn $6.56 a share. That’s 14.9 times this estimate. While not quite as low a multiple as Devon, it’s still reasonably attractive, especially if the company’s CEO can get assurances that its $12 billion in expropriation claims will be paid out of the near-term oil production in Venezuela. If. If. If.

As far as I can tell, CEO Ryan Lance has never made an open-market purchase of COP stock since becoming chief executive in 2012. That’s not great to see.

The company initiated its current share repurchase program in 2016. In October 2024, it increased its authorization by up to $65 billion. Since 2016, it has repurchased 474.8 million shares through Q3 2025, with an outlay of $38.3 billion and an average price per share of $80.67 per share. Given its share price hasn’t traded below this average since November 2021, the return on its share repurchases is good, if not great.

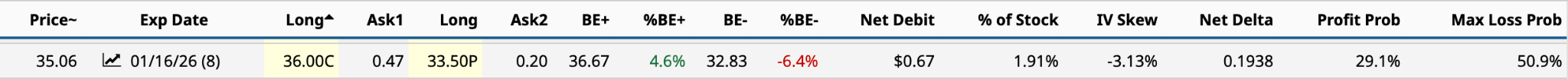

Here are the unusually active options from yesterday.

Both of these puts are deep ITM (in the money). Therefore, you wouldn’t be selling them for income, but rather to get a good entry point to own the shares. The break-even prices for the $120 and $130 strikes are both $96.20.

Neither would usually be something I would consider. However, with more details about the White House’s plan for Venezuela's oil to be released tomorrow and next week, the 3.08% expected move is likely too low. COP stock is up nearly 5% today as investors bet that the news for ConocoPhillips will be good.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Follow the Smart Money: 2 Undervalued Stocks With Aggressive Share Buybacks and Unusual Options Activity

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.

- Here’s How You Can Intercept IONQ Stock’s Play-Action Pass for a 127% Payout

- How To Find Options Trades This Earnings Season