Meta Platforms (META) — the parent company to massively popular social media platforms like Instagram, WhatsApp, and Facebook — was not supposed to be here now. After perceptions started to build that Meta was not doing much in the realm of artificial intelligence (AI) and risked falling behind names like OpenAI, Alphabet (GOOGL), and Anthropic, the company focused on assembling an AI dream team to build something called “Superintelligence." That was preceded by a mammoth $14.3 billion investment in Alexandr Wang's data labelling company, Scale AI. Wang was also entrusted with leading Meta's AI operations.

As these developments come close to completing a year, though, META stock shareholders have been rewarded with an unwelcome 7% decline in the share price since mid-June. Moreover, shares of the $1.6 trillion company are down 10% over the past 52 weeks. Now, another recent development may add a few more worry lines to the brows of shareholders.

Renaissance Bids Meta Adieu

In a recent 13F filing, popular Jim Simons-founded hedge fund Renaissance Technologies revealed that it has completely exited from Meta. Selling all of its 482,499 shares of META stock, the fund is estimated to have pocketed about $354.3 million from the transaction.

Entering META just about a year after the company's intial public offering (IPO), Renaissance has stayed true to its philosophy and made several buy and sell transactions in shares of the social media giant over the years. Overall, since 2013, the hedge fund has conducted 24 purchases and 25 sales of META stock.

This begs the question: Is this most recent sale really a damning indictment of Meta Platforms? Or is it just a routine transaction for a hedge fund primarily focused on data, algorithms, and price patterns? More importantly, is Meta stock a buy or a sell now? Let's take a closer look.

A Blowout Q4

Shares of Meta Platforms have been under pressure of late, but the firm's latest quarterly results led to a 10% pop in the share price after the numbers handily beat Street expectations. Revenue grew by an impressive 24% from the previous year to $59.9 billion, powered by a 6% year-over-year (YOY) increase in average price per ad in Q4 2025. Earnings were also up, rising by 11% in the same period to $8.88 per share, outpacing the consensus estimate of $8.21 per share.

Although gross margins fell by 700 basis points to 41% from 48% in the year-ago period, the company remarkably continues to expand its base with daily active people at 3.58 billion on average in December 2025. This means close to half of the world is on Meta's platforms — a testament to its scale, acceptability, and reliance.

The growth was complemented by solid cash flow generation. Net cash from operating activities increased 29% YOY to $36.2 billion, as the company closed the quarter with a cash pile of $35.9 billion. This was much higher than its short-term debt levels of $2.2 billion.

Coming to capital expenditures — a metric that is increasingly being monitored among hyperscalers like Meta — Meta expects capex to be in the range of $115 billion to $135 billion in 2026. The midpoint of that figure would denote a growth rate of 73% from 2025. This may be a bit concerning, as stakeholders across the board are skeptical about the huge capex spend by companies like Meta in terms of ROI. For Meta in particular, while AI initiatives are showing positive signs, the rise in capex spend is growing at a much faster pace, (although Meta's 2026 projections are on the lower side when compared to other tech titans).

With that said, Meta Platforms expects revenue to be between $53.5 billion and $56.5 billion in Q1 2026, implying 30% YOY growth at the midpoint. Meanwhile, META stock continues to trade at elevated levels. Meta's forward price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) ratios stand at 21.15 times, 8 times, and 17 times, all much higher than their respective sector medians.

Meta Platforms May Be a Silent AI Winner

Among the "Magnificent Seven," Meta may not be in that much of a spotlight currently. However, it is building in stealth, and positive signs are emanating, although they may not be as clear yet. The latest endorsement for Meta came from billionaire investor Bill Ackman.

In that sense, Meta's substantial capex appears well justified, as the majority of these outlays are directed toward building out AI infrastructure, encompassing data-center construction, expanded cloud capacity, and AI chip procurement. These investments are essential to drive the ambitious roadmap of Meta Superintelligence. In particular, the company's 2026 spending priorities are shifting toward enhancing user-facing applications with AI that more deeply understands individual preferences and delivers agentic shopping experiences. Such capabilities should further boost user engagement and create greater value for advertisers.

Meta has also made serious progress in refining its recommendation algorithms. Previously, these systems relied primarily on surface-level signals such as watch time, likes, and shares to determine feed content. The company is now incorporating large language models capable of comprehending content at a more nuanced level, enabling significantly more personalized and relevant recommendations that drive higher user interaction.

A further enhancement is the introduction of an incremental attribution model that more accurately identifies which users make purchases specifically because of exposure to an advertisement. Traditional models often over-attribute conversions by crediting ads for sales that would have occurred anyway. Meta reports that its latest model has delivered a 24% uplift in incremental conversions compared with the prior generation, a meaningful improvement that has contributed to a roughly 6% YOY increase in average price per ad during Q4 2025.

Video generation tools represent another rapidly expanding area, reaching a $10 billion annual run rate in the most recent quarter and growing at nearly three times the pace of overall revenue. These solutions provide advertisers with valuable functionality, such as reformatting TV-oriented videos for mobile viewing. The potential applications appear extensive, and this segment remains in the relatively early stages of commercialization.

Meta is also advancing in agentic shopping tools, enabling users to input complex prompts describing desired products or services. These systems can reason through options and identify optimal solutions, offering a more sophisticated and customized shopping experience than traditional search or recommendation methods.

Taken together, Meta's investments are not merely capital deployed for its own sake. The company's targeted improvements in AI-driven personalization, attribution accuracy, creative tools, and agentic capabilities are designed to increase time spent on its platforms and enhance advertiser outcomes, which in turn should support sustained revenue growth and margin improvement.

Lastly, Meta is currently engaged in a massive global expansion of its data-center infrastructure, with several high-profile projects breaking ground or nearing completion in early 2026. The most significant of these is a $10 billion “gigawatt-scale” campus in Lebanon, Indiana, which officially broke ground in February 2026. Spanning 4 million square feet, this facility is designed specifically to handle the immense power requirements of next-generation AI models. Additionally, Meta is nearing the completion of an $800 million, 715,000-square-foot data center in Cheyenne, Wyoming, which is expected to go online in 2027. This site is particularly notable because Meta recently signed a landmark agreement with TerraPower to potentially host advanced nuclear reactors nearby, ensuring the facility has a dedicated, carbon-free energy source to sustain its AI workloads.

What Do Analysts Think About Meta?

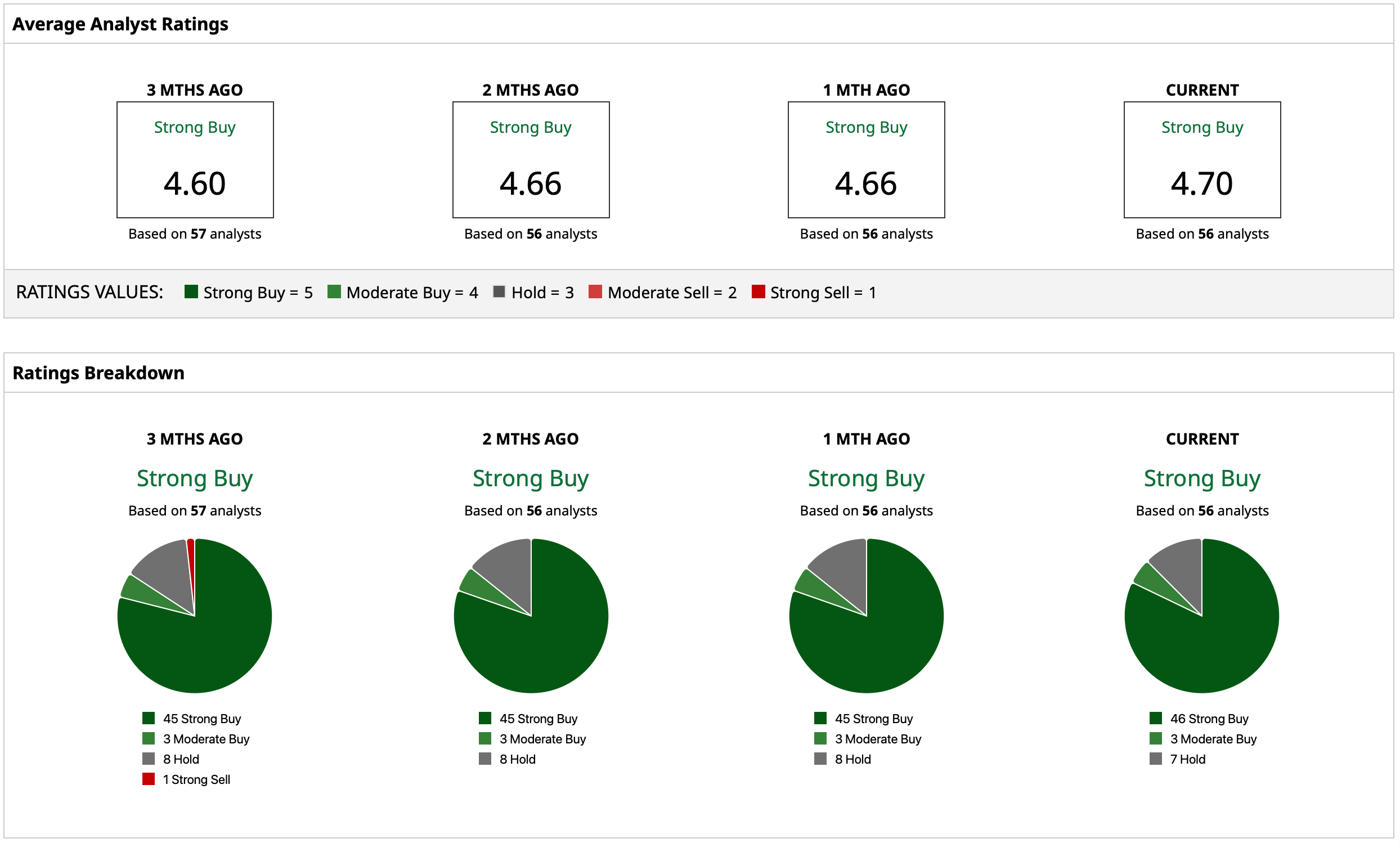

Analysts continue to remain bullish about META stock, attributing shares with a consensus rating of “Strong Buy” as well as a mean target price of $864.02. This denotes potential upside of about 34% from current levels. Out of 56 analysts covering Meta Platforms, 46 have a “Strong Buy” rating, three have a “Moderate Buy” rating, and seven have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart