With a market cap of $25.9 billion, CenterPoint Energy, Inc. (CNP) operates electric transmission, distribution, and generation assets, as well as natural gas sales, transportation, and distribution services across multiple states. It serves over 2.8 million metered customers and owns extensive electric and natural gas infrastructure.

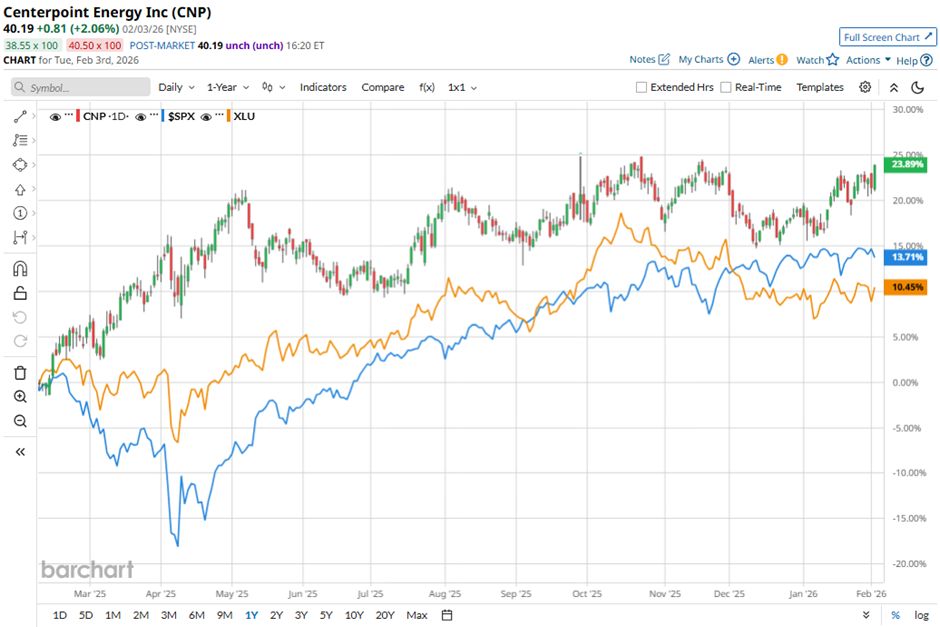

Shares of the Houston, Texas-based company have outperformed the broader market over the past 52 weeks. CNP stock has returned 23.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. Moreover, shares of the company are up 4.8% on a YTD basis, compared to SPX's 1.1% rise.

Looking closer, shares of the energy delivery company have also outpaced the State Street Utilities Select Sector SPDR ETF's (XLU) 10.5% return over the past 52 weeks.

CenterPoint Energy reported strong Q3 2025 results on Oct. 23, posting adjusted EPS of $0.50, representing more than a 60% increase compared to Q3 2024. The company also reiterated its raised 2025 adjusted EPS guidance of $1.75 - $1.77 and its 2026 adjusted EPS outlook of $1.89 - $1.91. In addition, CenterPoint reported net income of $293 million for the quarter and highlighted strong demand growth, with Houston Electric industrial throughput up more than 17% year over year. However, the stock fell marginally on that day.

For the fiscal year that ended in December 2025, analysts expect CNP's adjusted EPS to grow 8.6% year-over-year to $1.76. The company's earnings surprise history is mixed. It beat or met the consensus estimates in two of the last four quarters while missing on two other occasions.

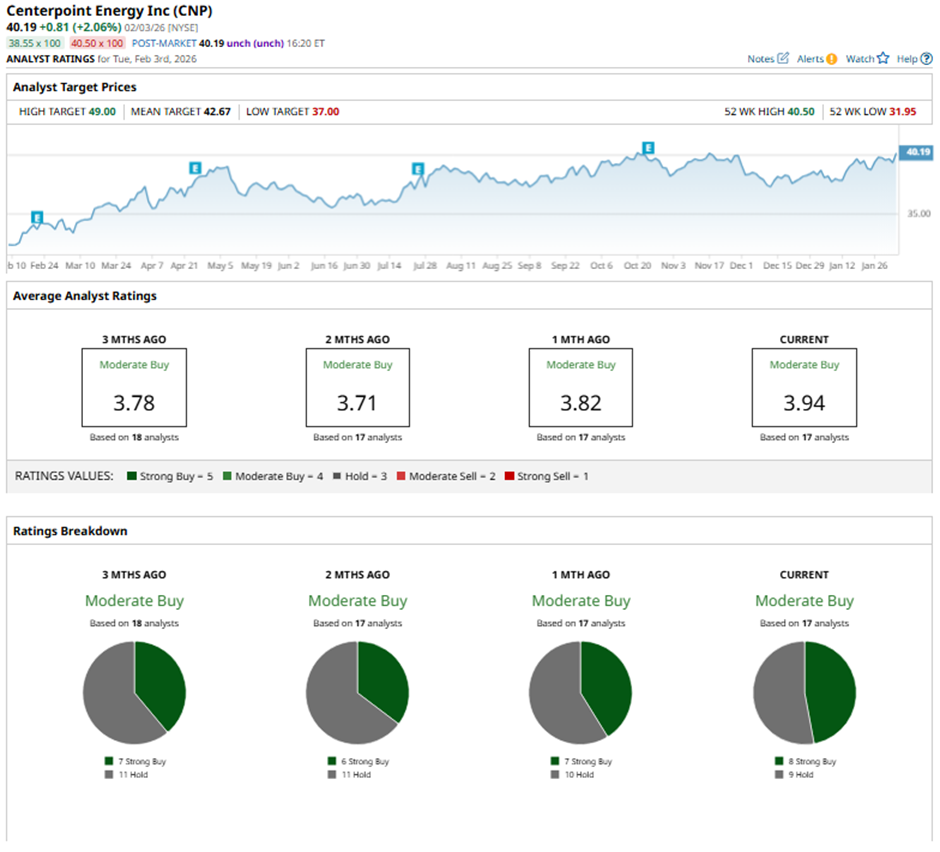

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings and nine “Holds.”

On Jan. 21, Morgan Stanley raised its price target on CenterPoint Energy to $37 and maintained an “Equal Weight” rating.

The mean price target of $42.67 represents a premium of 6.2% to CNP's current price. The Street-high price target of $49 suggests a 21.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart