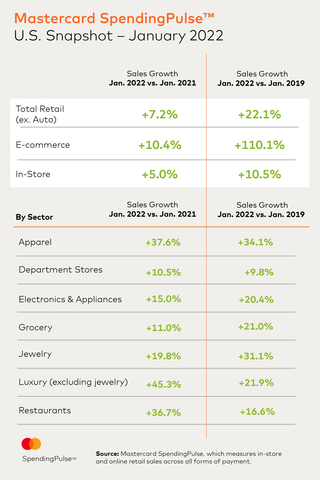

2022 kicked off with gains across nearly all retail sectors, according to Mastercard SpendingPulseTM, which measures in-store and online retail sales across all forms of payment. This January, U.S. retail sales excluding auto increased 7.2% year-over-year (YOY), with online sales growing 10.4% compared to January 2021. Despite the shadow of Omicron and elevated inflation, consumer spending was buoyed by pent-up savings, wage growth and the continued re-opening of the “experience economy.” Beneficiaries included Department Stores, Apparel and Luxury, which all saw double-digit growth.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220210005277/en/

Mastercard SpendingPulse - U.S. Snapshot, January 2022 (Graphic: Business Wire)

Key retail trends were a continuation from the strong holiday season, including:

- The shift back to services: The pandemic arrested a decades-long trend of more spending on services vs goods. Since the middle of last year, this tide has begun to shift back to services – or experiences – as consumers resume in-person activities. According to Mastercard SpendingPulse, Restaurant sales grew 36.7% YOY and 16.6% compared to pre-pandemic levels.

- Digital demand: E-commerce sales growth shows no signs of stopping, with double-digit increases in January even compared to the strong base in 2021. Compared to pre-pandemic levels, e-commerce sales were up 110.1%, underscoring the sustained and significant nature of the shift to digital.

- New year, new looks: Apparel sales were up 37.6% in January YOY, the strongest growth rate for January in SpendingPulse history. The Apparel sector has experienced positive growth for 11 consecutive months as consumers refresh wardrobes and dress to impress for gatherings and events taking place in 2022. Department Stores have similarly gained from resurgent spending, with January sales up 10.5% YOY and 9.8% vs. pre-pandemic levels.

- Luxe for loved ones: Luxury (+45.3% YOY) and Jewelry (+19.8% YOY) sales continued to outperform in January ahead of Valentine’s Day.

“Coming on the heels of the holidays, January typically marks a month of returns and exchanges. However, the strong growth across sectors reflects the optimism and eagerness for the year ahead,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “With nearly all sectors up, we see consumers returning to their shopping habits with a continued emphasis on digital.”

*Excluding automotive sales

About Mastercard SpendingPulse:

Mastercard SpendingPulse reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check.

Mastercard SpendingPulse defines “U.S. retail sales” as sales at retailers and food services merchants of all sizes. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included.

About Mastercard (NYSE: MA)

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220210005277/en/

Contacts

Julia Monti | 914-249-6135 | Julia.monti@mastercard.com

Alexandria Brown | 914-260-1020 | Alexandria.brown@mastercard.com