Global car rental company Hertz (NASDAQ: HTZ) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 4.7% year on year to $2.58 billion. Its non-GAAP loss of $0.68 per share was also 43.8% below analysts’ consensus estimates.

Is now the time to buy Hertz? Find out by accessing our full research report, it’s free.

Hertz (HTZ) Q3 CY2024 Highlights:

- Revenue: $2.58 billion vs analyst estimates of $2.68 billion (3.8% miss)

- Adjusted EPS: -$0.68 vs analyst estimates of -$0.47

- EBITDA: -$157 million vs analyst estimates of -$20.76 million (656% miss due to a $1.0 billion asset impairment charge due to the decline in fleet residual values)

- Gross Margin (GAAP): 6.6%, down from 26.3% in the same quarter last year

- Operating Margin: -0.8%, down from 17.1% in the same quarter last year due to a $1.0 billion asset impairment charge due to the decline in fleet residual values

- Free Cash Flow was -$1.36 billion, down from $313 million in the same quarter last year

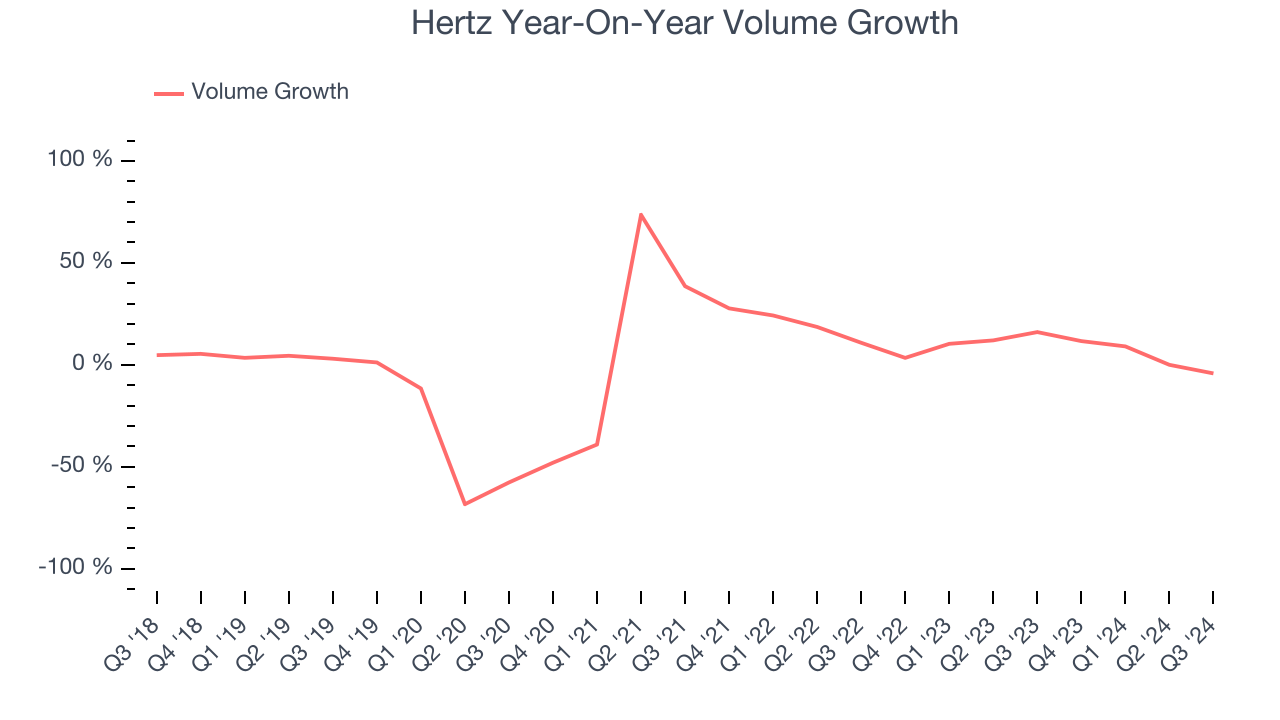

- Sales Volumes fell 4.2% year on year (16.1% in the same quarter last year)

- Market Capitalization: $1.03 billion

"In the third quarter, we continued executing on our efforts to implement our transformation, focusing on our back-to-basics strategy to deliver sustainable, long-term returns for shareholders," said Gil West, Hertz CEO.

Company Overview

Started with a dozen Model T Fords, Hertz (NASDAQ: HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

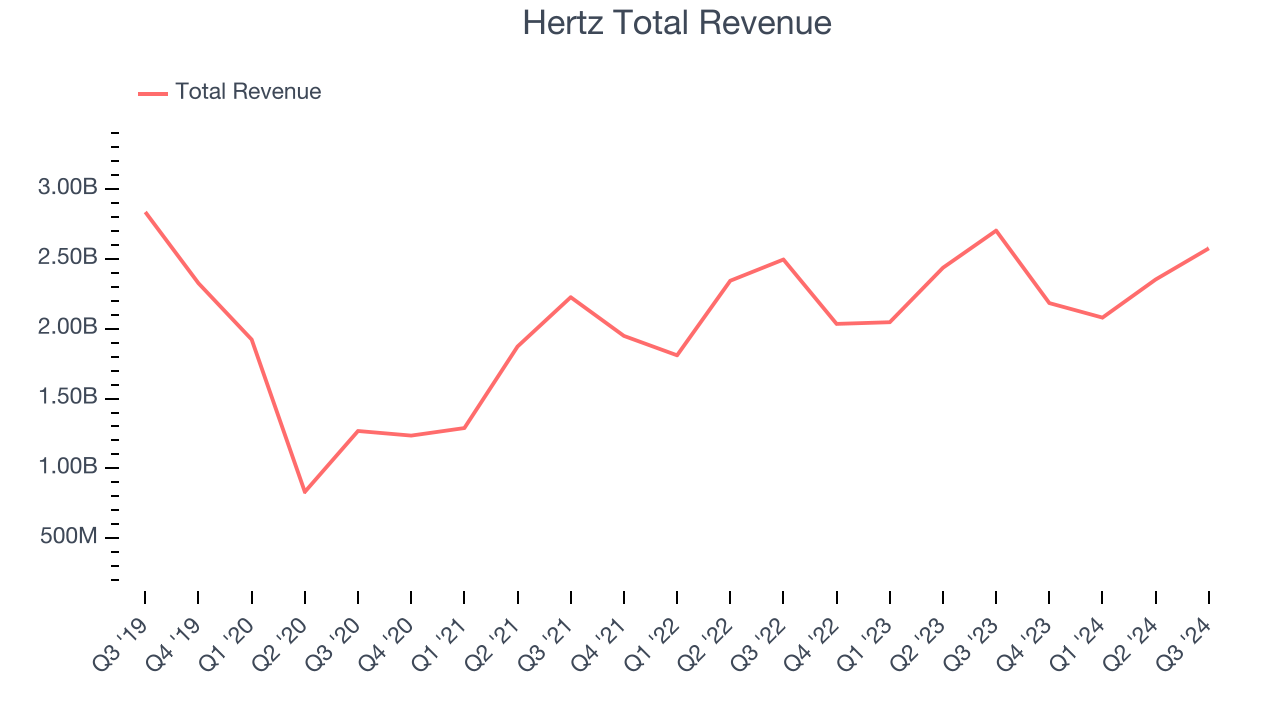

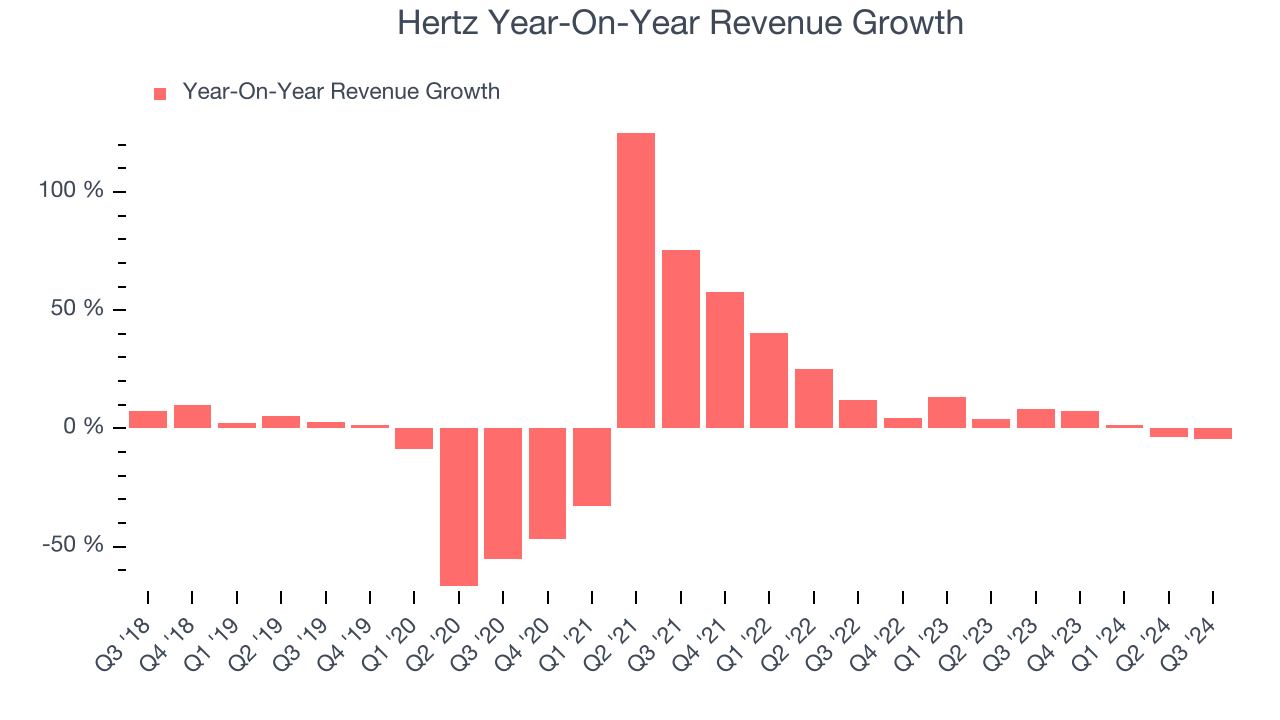

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Hertz struggled to generate demand over the last five years as its sales dropped by 1.2% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hertz’s annualized revenue growth of 3.4% over the last two years is above its five-year trend, but we were still disappointed by the results. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Hertz grew slower than we’d like, it did perform better than its peers.

Hertz also reports its sales volumes, which reached 41.3 million in the latest quarter. Over the last two years, Hertz’s sales volumes averaged 7.3% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Hertz missed Wall Street’s estimates and reported a rather uninspiring 4.7% year-on-year revenue decline, generating $2.58 billion of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

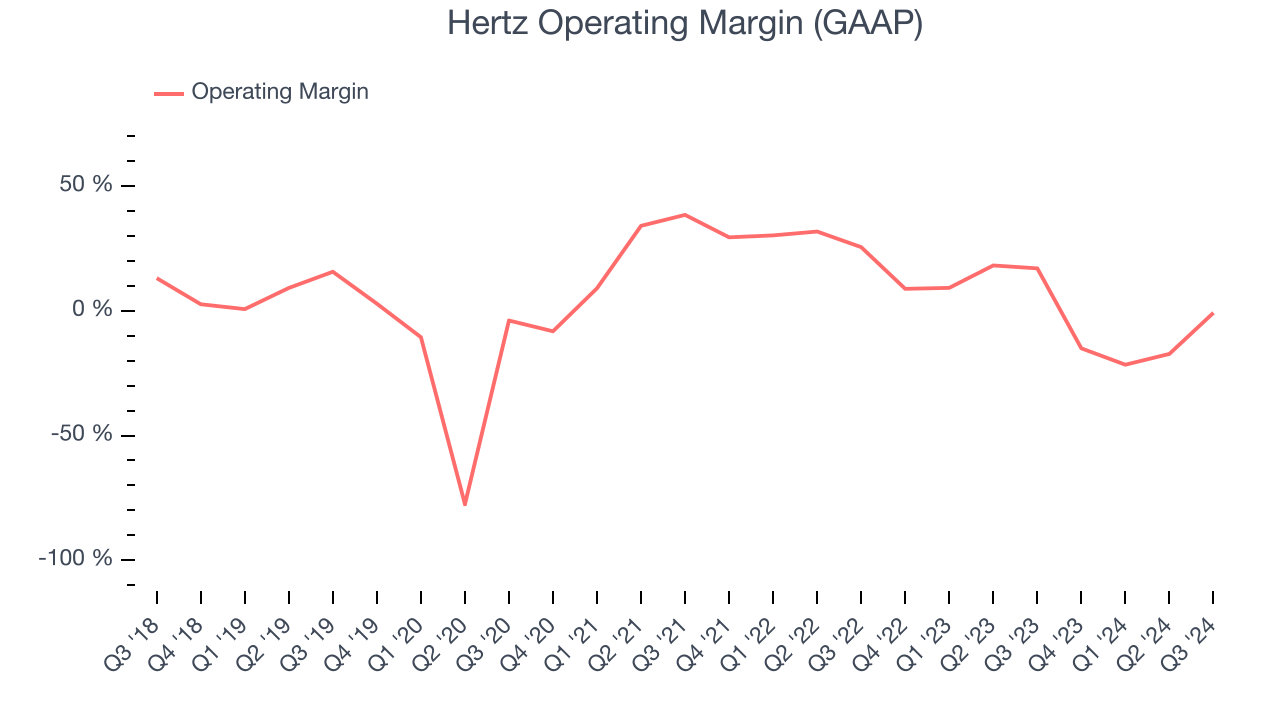

Hertz has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.2%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Hertz’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years. Shareholders will want to see Hertz grow its margin in the future.

In Q3, Hertz’s breakeven margin was down 17.8 percentage points year on year. Since Hertz’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

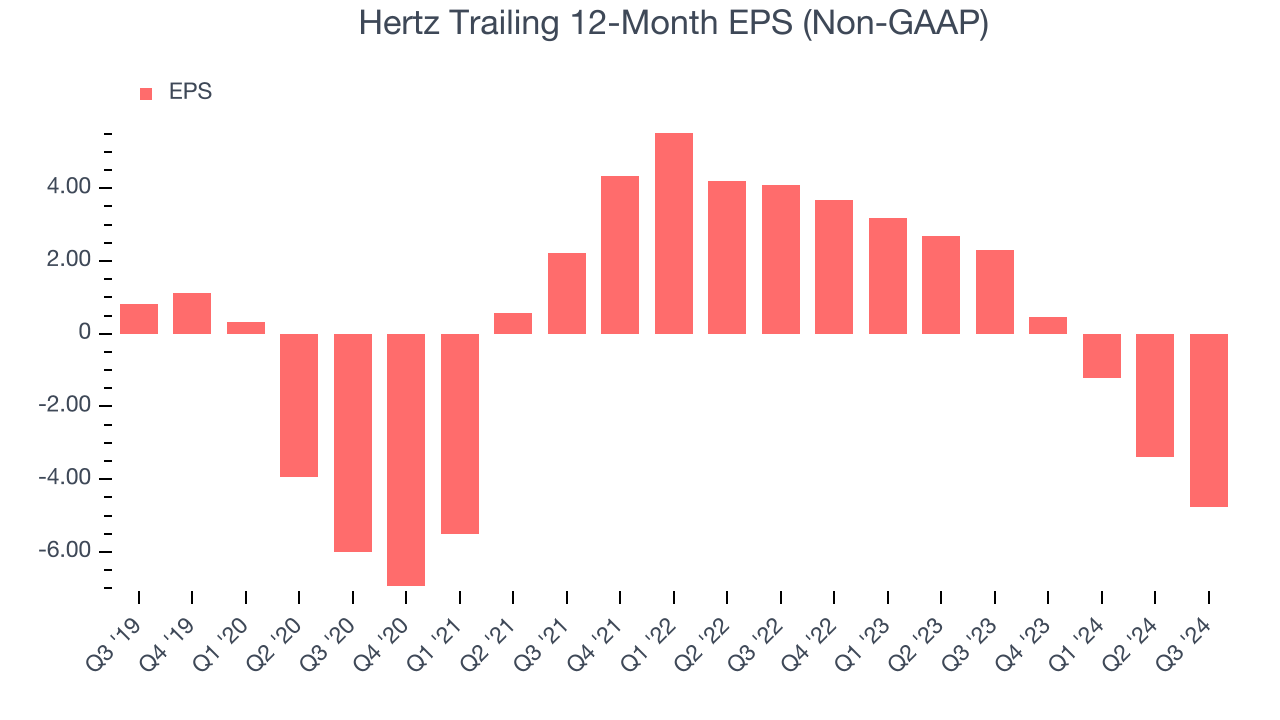

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Hertz, its EPS declined by more than its revenue over the last five years, dropping 51.3% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

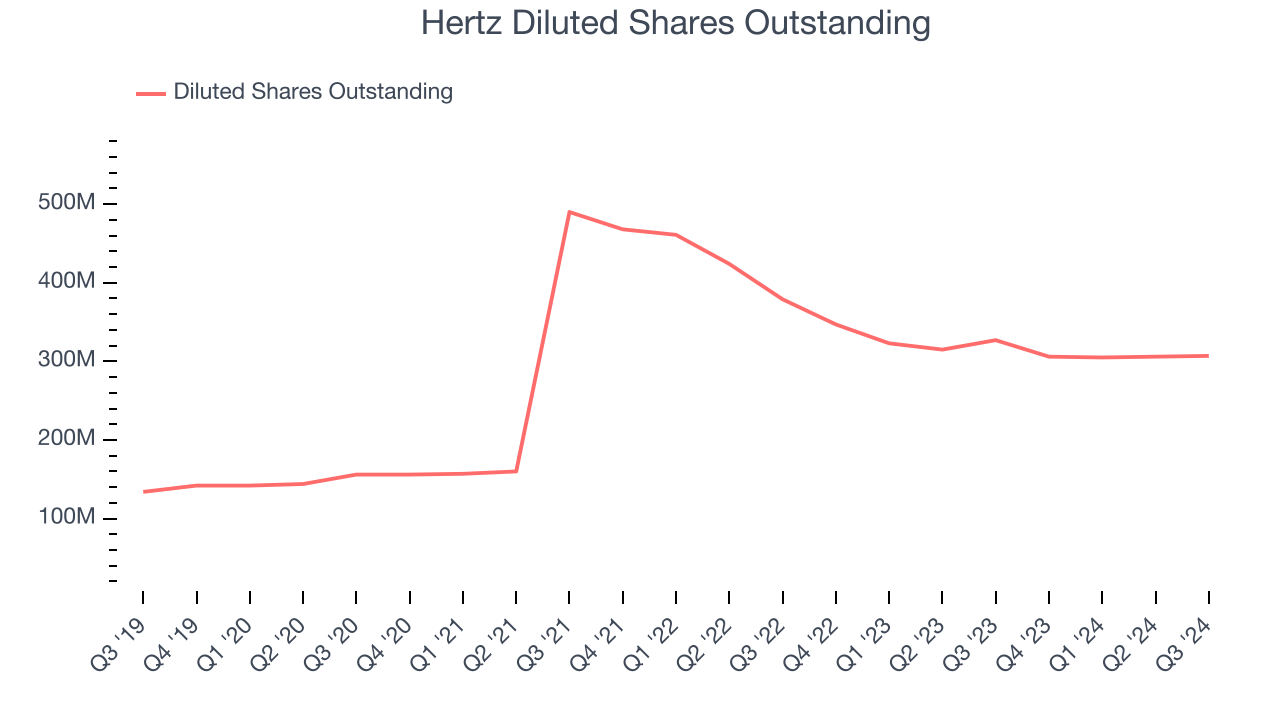

Diving into the nuances of Hertz’s earnings can give us a better understanding of its performance. Hertz recently raised equity capital, and in the process, grew its share count by 129% over the last five years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Hertz, its two-year annual EPS declines of 78% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Hertz reported EPS at negative $0.68, down from $0.70 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hertz to improve its earnings losses. Analysts forecast its full-year EPS of negative $4.76 will advance to negative $1.71.

Key Takeaways from Hertz’s Q3 Results

We struggled to find many resounding positives in these results. Its revenue missed on weaker-than-expected volumes and its EBITDA fell short of Wall Street’s estimates as well. Overall, this quarter could have been better. The stock traded down 10.4% to $3.01 immediately after reporting.

The latest quarter from Hertz’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.