Online new and used car marketplace Cars.com (NYSE: CARS) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 3.1% year on year to $179.7 million. Its GAAP profit of $0.28 per share was 352% above analysts’ consensus estimates.

Is now the time to buy Cars.com? Find out by accessing our full research report, it’s free.

Cars.com (CARS) Q3 CY2024 Highlights:

- Revenue: $179.7 million vs analyst estimates of $179.9 million (in line)

- EPS: $0.28 vs analyst estimates of $0.06 ($0.22 beat)

- EBITDA: $51.13 million vs analyst estimates of $49.13 million (4.1% beat)

- Gross Margin (GAAP): 66.1%, down from 67.7% in the same quarter last year

- Operating Margin: 6.4%, down from 8.2% in the same quarter last year

- EBITDA Margin: 28.5%, in line with the same quarter last year

- Free Cash Flow Margin: 26.3%, up from 16.2% in the previous quarter

- Dealer Customers: 19,255, up 540 year on year

- Market Capitalization: $1.11 billion

"We demonstrated steady and consistent execution against our platform strategy as we drove profitable growth across the Cars Commerce product suite during the third quarter. Increased subscription growth, particularly in AccuTrade, reflected growing dealer affinity for our unique data insights and differentiated technology. Now, we are focused on finishing the year strong with further revenue and margin growth, and continued product innovation that enables automotive commerce in this strong demand environment, " said Alex Vetter, Chief Executive Officer of Cars Commerce.

Company Overview

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE: CARS) is a digital marketplace that connects new and used car buyers and sellers.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

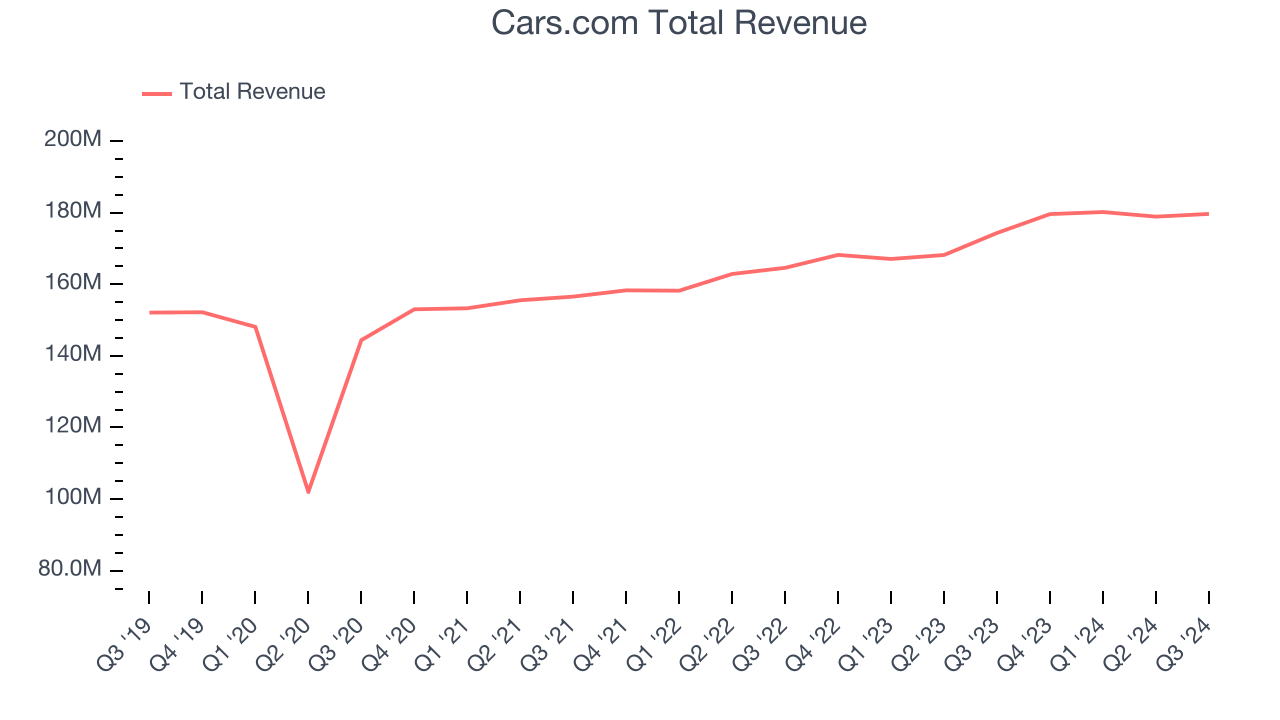

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Cars.com grew its sales at a sluggish 5.1% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Cars.com grew its revenue by 3.1% year on year, and its $179.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates the market thinks its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

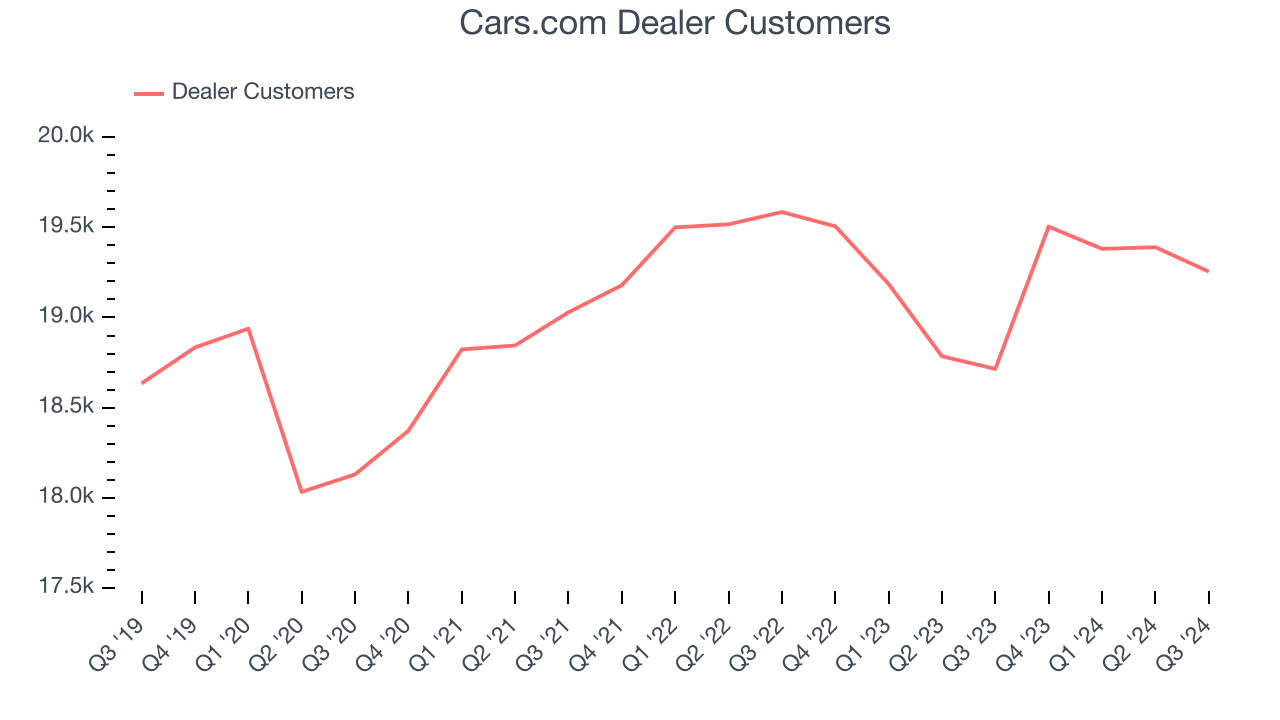

Dealer Customers

As an online marketplace, Cars.com generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Cars.com struggled to engage its dealer customers over the last two years as they have been flat at 19,255. This performance isn't ideal because internet usage is secular. If Cars.com wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

Luckily, Cars.com added 540 dealer customers in Q3, leading to 2.9% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating buyer growth.

Key Takeaways from Cars.com’s Q3 Results

We enjoyed seeing Cars.com exceed analysts’ EPS and EBITDA expectations this quarter. On the other hand, its buyers fell short of Wall Street’s estimates. Overall, this was still a good quarter. The stock traded up 7.1% to $18 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.