The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Wyndham (NYSE: WH) and the rest of the travel and vacation providers stocks fared in Q3.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 16 travel and vacation providers stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.9% below.

Luckily, travel and vacation providers stocks have performed well with share prices up 15.1% on average since the latest earnings results.

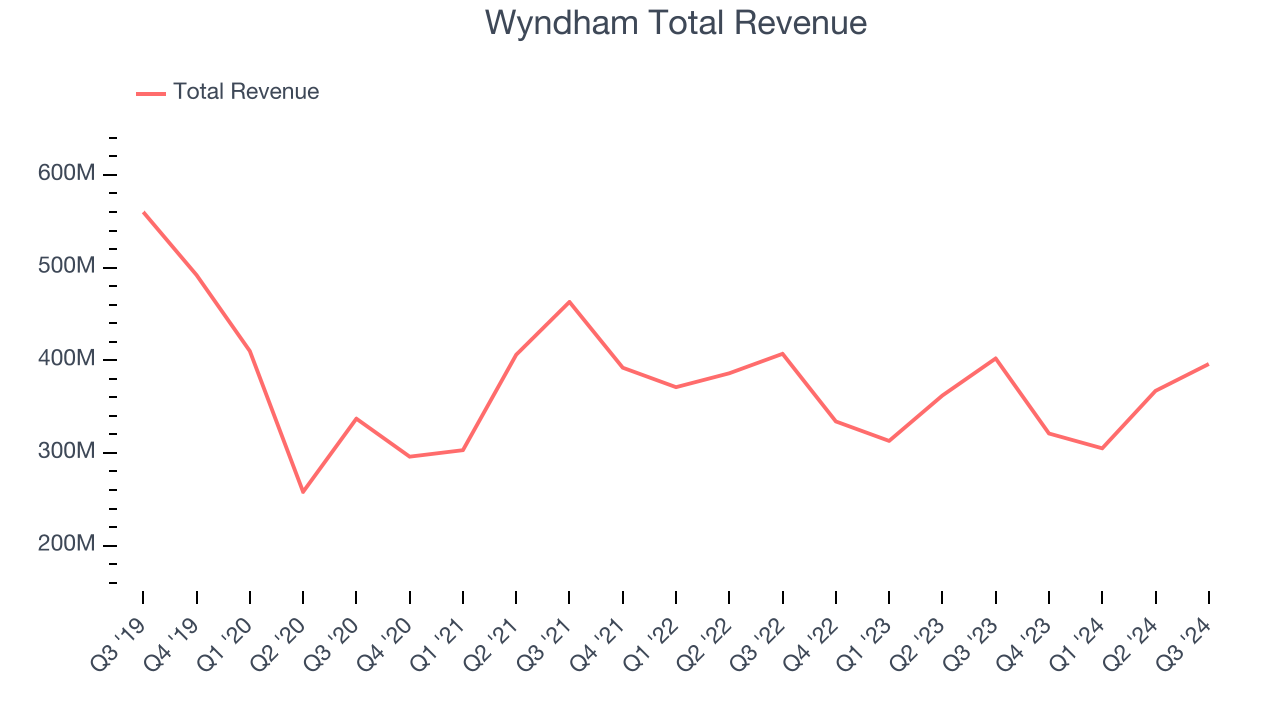

Wyndham (NYSE: WH)

Established in 1981, Wyndham (NYSE: WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Wyndham reported revenues of $396 million, down 1.5% year on year. This print fell short of analysts’ expectations by 3%. Overall, it was a slower quarter for the company with a miss of analysts’ adjusted operating income estimates.

"Our teams around the world once again delivered exceptional results, executing our long-term growth strategy and achieving 7% growth in comparable adjusted EBITDA fueled by continued system expansion, higher royalty rates and growth in our ancillary revenues," said Geoff Ballotti, president and chief executive officer.

Wyndham delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 20.5% since reporting and currently trades at $98.04.

Read our full report on Wyndham here, it’s free.

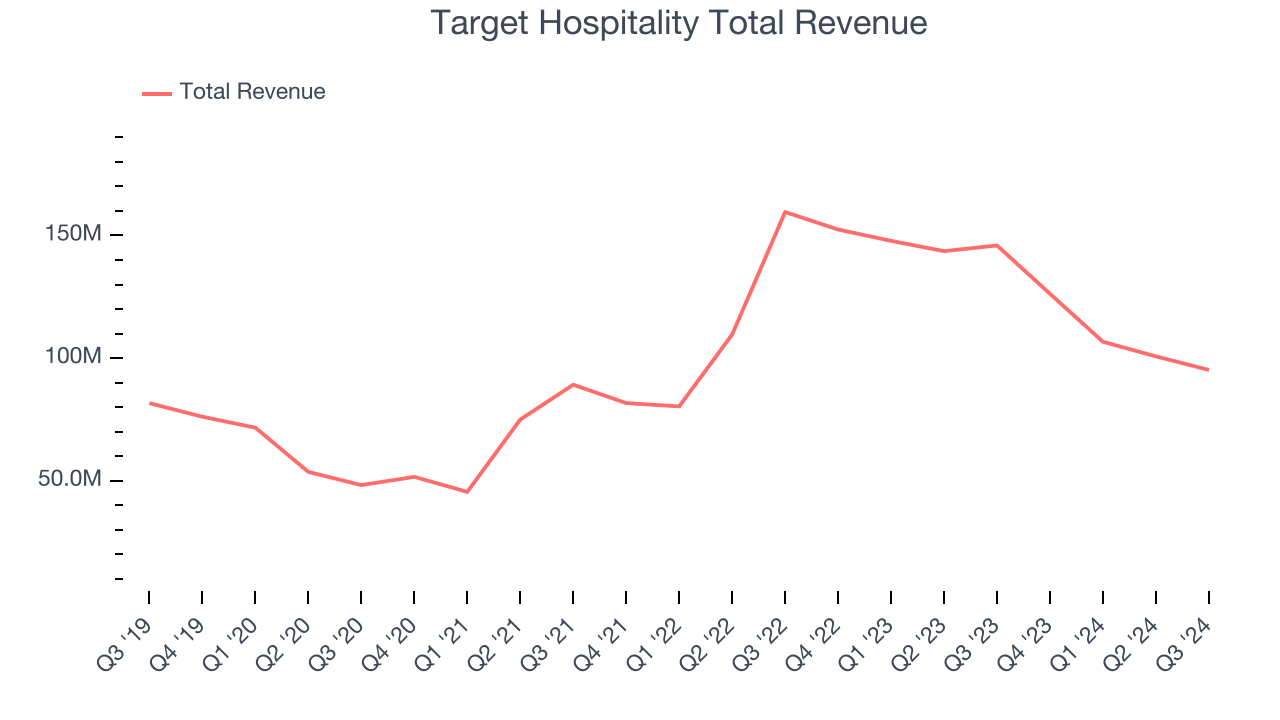

Best Q3: Target Hospitality (NASDAQ: TH)

Essentially a builder of mini communities, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Target Hospitality reported revenues of $95.19 million, down 34.8% year on year, outperforming analysts’ expectations by 8.3%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Target Hospitality achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 10.7% since reporting. It currently trades at $8.22.

Is now the time to buy Target Hospitality? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sabre (NASDAQ: SABR)

Originally a division of American Airlines, Sabre (NASDAQ: SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $764.7 million, up 3.3% year on year, falling short of analysts’ expectations by 1.4%. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Sabre delivered the weakest full-year guidance update in the group. As expected, the stock is down 5.6% since the results and currently trades at $3.89.

Read our full analysis of Sabre’s results here.

Choice Hotels (NYSE: CHH)

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE: CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Choice Hotels reported revenues of $428 million, flat year on year. This print lagged analysts' expectations by 0.9%. Zooming out, it was actually a strong quarter as it produced an impressive beat of analysts’ EPS estimates and a decent beat of analysts’ adjusted operating income estimates.

The stock is up 9% since reporting and currently trades at $151.20.

Read our full, actionable report on Choice Hotels here, it’s free.

Delta Air Lines (NYSE: DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Delta Air Lines reported revenues of $15.68 billion, up 7.7% year on year. This print topped analysts’ expectations by 2.5%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but a miss of analysts’ EBITDA estimates.

The stock is up 24.5% since reporting and currently trades at $63.50.

Read our full, actionable report on Delta Air Lines here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.