Let’s dig into the relative performance of MarketAxess (NASDAQ: MKTX) and its peers as we unravel the now-completed Q2 financial exchanges & data earnings season.

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 10 financial exchanges & data stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 13% since the latest earnings results.

MarketAxess (NASDAQ: MKTX)

Pioneering the shift from phone-based to electronic bond trading since 2000, MarketAxess (NASDAQ: MKTX) operates electronic trading platforms that enable institutional investors and broker-dealers to efficiently trade fixed-income securities like corporate and government bonds.

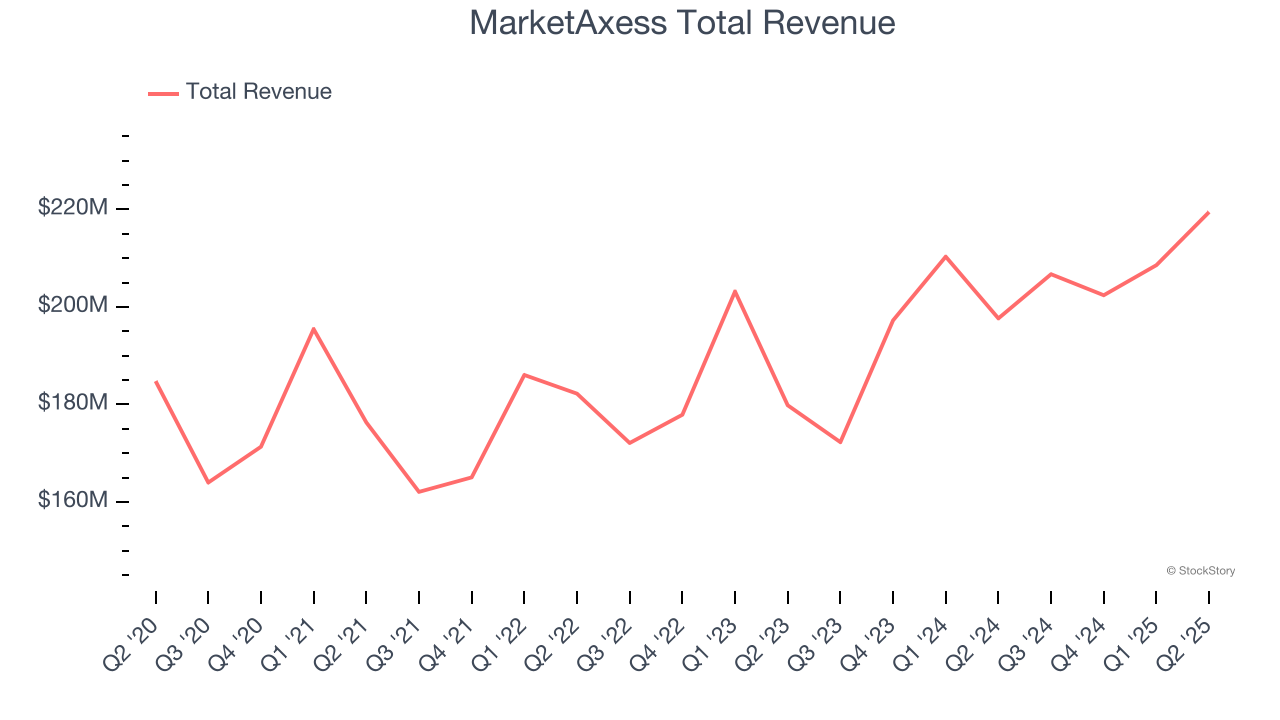

MarketAxess reported revenues of $219.5 million, up 11% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a miss of analysts’ EBITDA estimates.

MarketAxess delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 17.7% since reporting and currently trades at $171.07.

Is now the time to buy MarketAxess? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Moody's (NYSE: MCO)

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE: MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

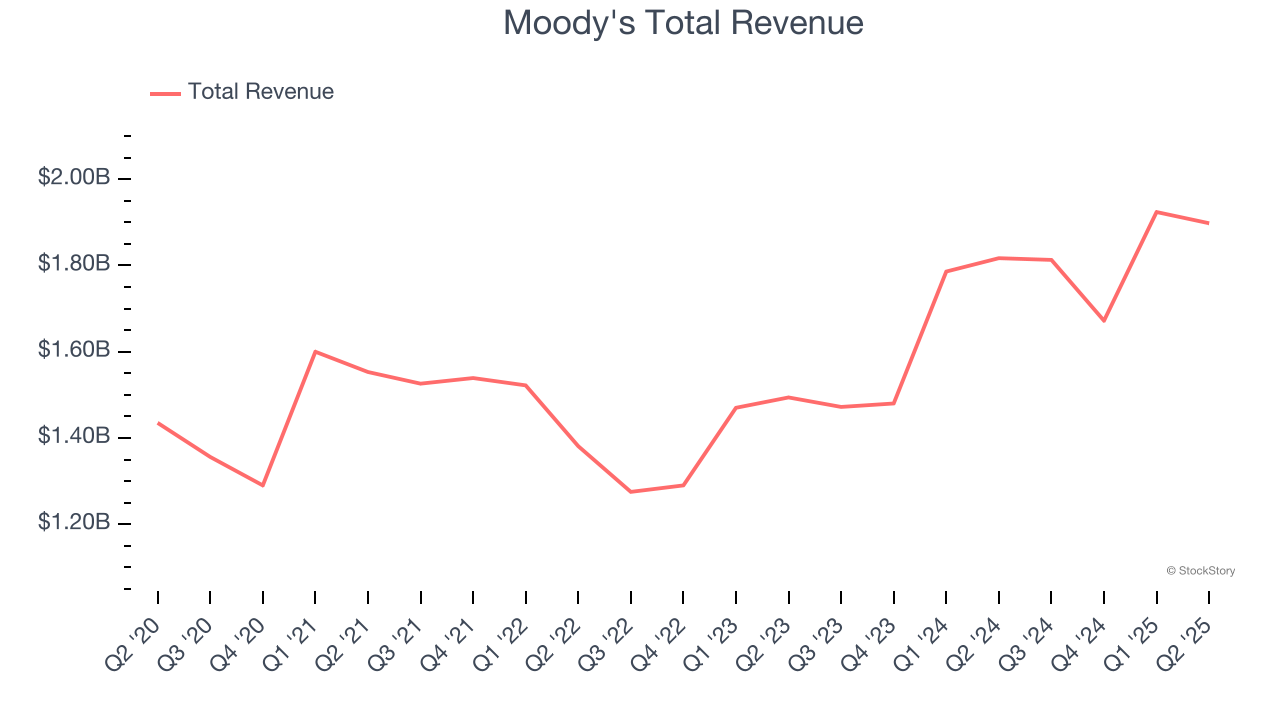

Moody's reported revenues of $1.90 billion, up 4.5% year on year, outperforming analysts’ expectations by 2.9%. The business had a strong quarter with an impressive beat of analysts’ Investor Services segment estimates and a solid beat of analysts’ EBITDA estimates.

Moody's achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.6% since reporting. It currently trades at $465.88.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Tradeweb Markets (NASDAQ: TW)

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ: TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb Markets reported revenues of $513 million, up 26.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

As expected, the stock is down 23% since the results and currently trades at $106.41.

Read our full analysis of Tradeweb Markets’s results here.

CME Group (NASDAQ: CME)

Born from the Chicago Mercantile Exchange founded in 1898 as a butter and egg trading venue, CME Group (NASDAQ: CME) operates the world's largest derivatives marketplace where traders can buy and sell futures and options contracts across interest rates, equities, currencies, commodities, and more.

CME Group reported revenues of $1.69 billion, up 10.5% year on year. This number met analysts’ expectations. More broadly, it was a mixed quarter as it failed to impress in some other areas of the business.

The stock is down 2.8% since reporting and currently trades at $267.

Read our full, actionable report on CME Group here, it’s free for active Edge members.

Nasdaq (NASDAQ: NDAQ)

Originally founded in 1971 as the world's first electronic stock market, Nasdaq (NASDAQ: NDAQ) operates global exchanges and provides technology, data, and corporate services that help companies, investors, and financial institutions navigate capital markets.

Nasdaq reported revenues of $1.31 billion, up 12.7% year on year. This result surpassed analysts’ expectations by 2.1%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ Capital Markets Technology segment estimates and an impressive beat of analysts’ Trading Services segment estimates.

The stock is flat since reporting and currently trades at $87.98.

Read our full, actionable report on Nasdaq here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.