The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how gig economy stocks fared in Q2, starting with Upwork (NASDAQ: UPWK).

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 6 gig economy stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Luckily, gig economy stocks have performed well with share prices up 16.1% on average since the latest earnings results.

Upwork (NASDAQ: UPWK)

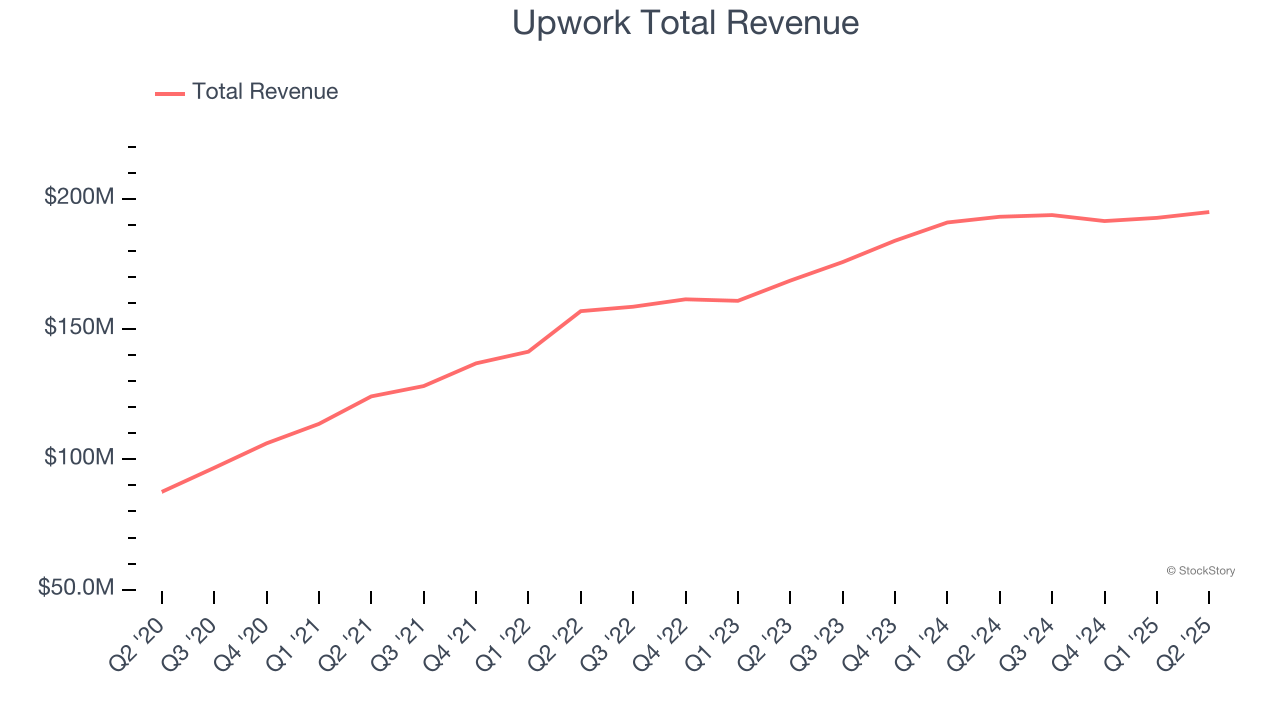

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ: UPWK) is an online platform where businesses and independent professionals connect to get work done.

Upwork reported revenues of $194.9 million, flat year on year. This print exceeded analysts’ expectations by 3.9%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

“Upwork delivered an exceptional second quarter, significantly outperforming across all key financial metrics. Our strong Marketplace performance was driven by AI features that delivered tremendous value to our full range of customers, from SMBs to large enterprises to talent,” said Hayden Brown, president and CEO, Upwork.

Upwork delivered the weakest full-year guidance update of the whole group. The company reported 796,000 active customers, down 8.3% year on year. Interestingly, the stock is up 43.3% since reporting and currently trades at $17.20.

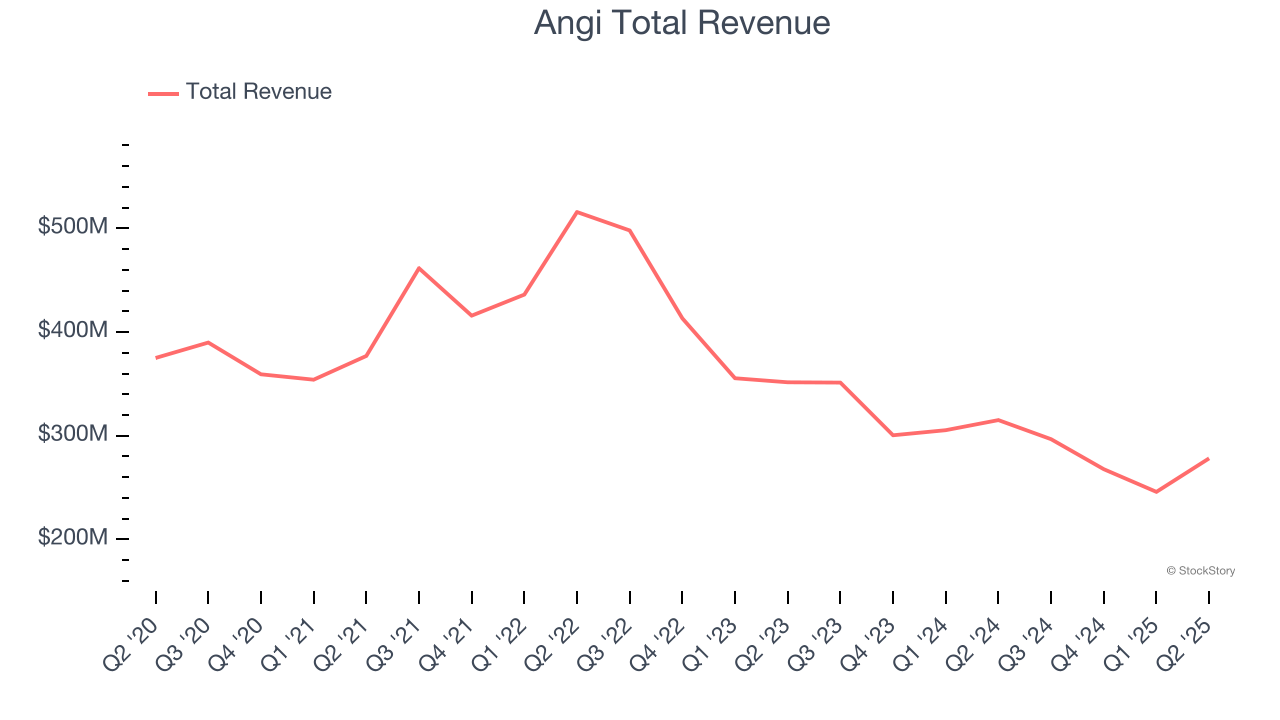

Best Q2: Angi (NASDAQ: ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $278.2 million, down 11.7% year on year, outperforming analysts’ expectations by 6.5%. The business had an exceptional quarter with a solid beat of analysts’ service requests and EBITDA estimates.

Angi scored the biggest analyst estimates beat among its peers. On a dimmer note, the company reported 4.56 million service requests, down 7.6% year on year. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.3% since reporting. It currently trades at $14.36.

Is now the time to buy Angi? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $108.6 million, up 14.8% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a softer quarter as it posted a decline in its buyers and a slight miss of analysts’ buyers estimates.

As expected, the stock is down 5.9% since the results and currently trades at $23.53.

Read our full analysis of Fiverr’s results here.

Uber (NYSE: UBER)

Notoriously funded with $7.7 billion from the Softbank Vision Fund, Uber (NYSE: UBER) operates a platform of on-demand services such as ride-hailing, food delivery, and freight.

Uber reported revenues of $12.65 billion, up 18.2% year on year. This number beat analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter as it also logged strong growth in its users.

The company reported 180 million users, up 15.4% year on year. The stock is up 9.4% since reporting and currently trades at $97.85.

Read our full, actionable report on Uber here, it’s free for active Edge members.

DoorDash (NASDAQ: DASH)

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE: DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $3.28 billion, up 24.9% year on year. This print surpassed analysts’ expectations by 3.8%. Overall, it was a strong quarter as it also put up strong growth in its requests and a decent beat of analysts’ revenue estimates.

DoorDash pulled off the fastest revenue growth among its peers. The company reported 761 million service requests, up 19.8% year on year. The stock is up 7.1% since reporting and currently trades at $276.48.

Read our full, actionable report on DoorDash here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.