Alphabet has been treading water for the past six months, recording a small loss of 0.6% while holding steady at $168.13.

Is now the time to buy GOOGL? Find out in our full research report, it’s free.

Why Is Alphabet a Good Business?

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

1. Skyrocketing Revenue Shows Strong Momentum

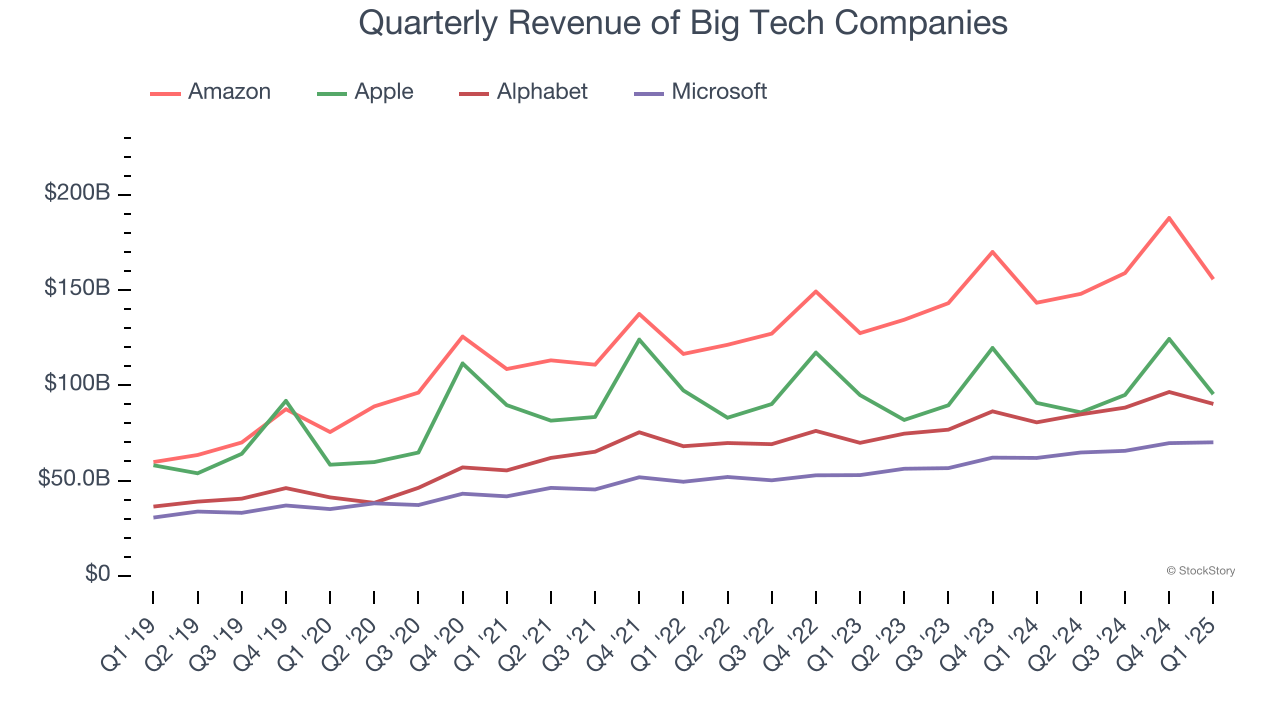

Alphabet proves that huge, scaled companies can still grow quickly. The company’s revenue base of $166.6 billion five years ago has more than doubled to $359.7 billion in the last year, translating into an incredible 16.6% annualized growth rate.

Over the same period, Alphabet’s big tech peers Amazon, Microsoft, and Apple put up annualized growth rates of 17%, 14.3%, and 8.4%, respectively.

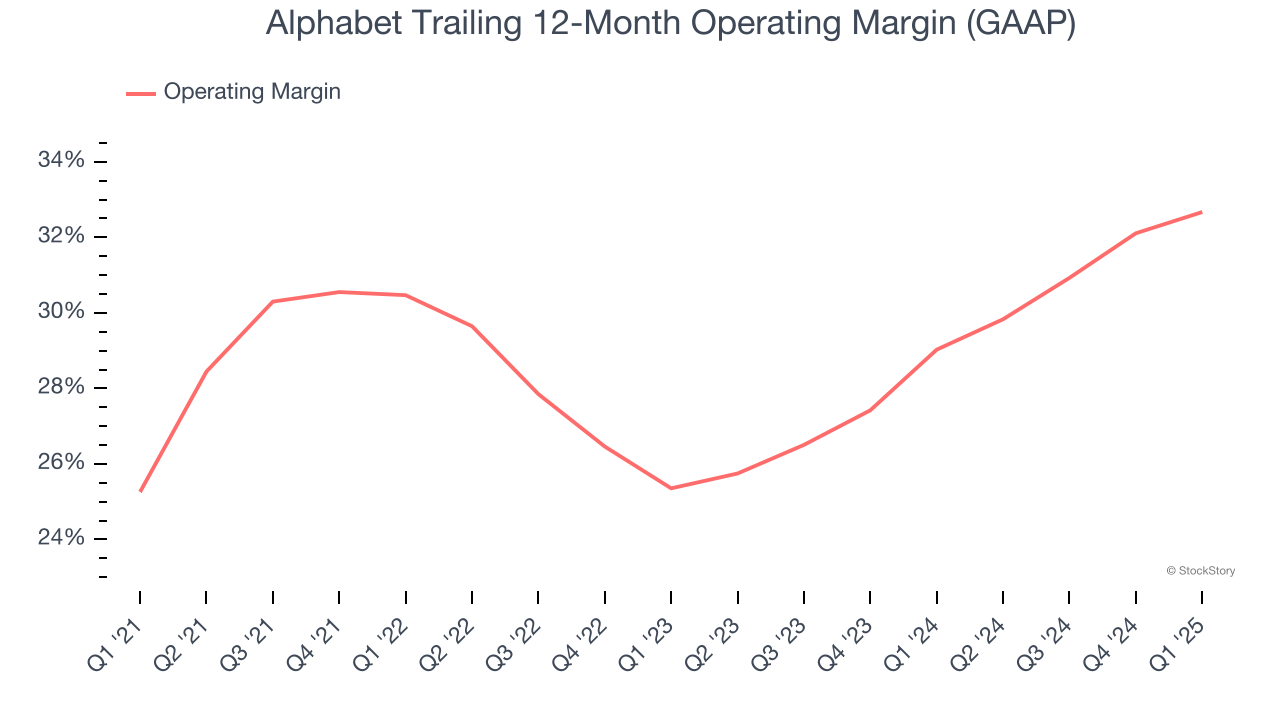

2. Operating Margin Reveals a Well-Run Organization

Operating margin is the key profitability measure for Alphabet. It’s the portion of revenue left after accounting for all operating expenses – everything from the IT infrastructure powering online searches to product development and administrative expenses.

Alphabet has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer internet business, boasting an average operating margin of 29%. A closer examination is required, however, because the company’s individual business lines have very different margin profiles.

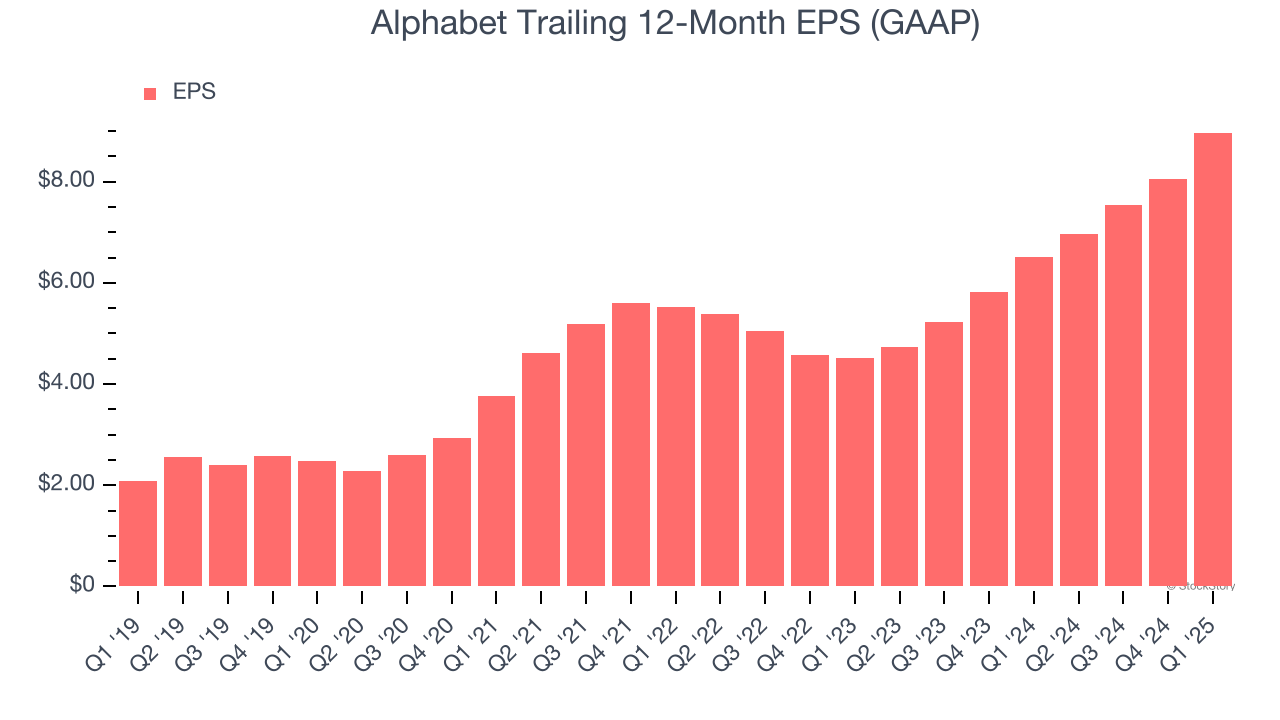

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it shows whether a company’s growth is profitable. It also explains how taxes and interest expenses affect the bottom line.

Alphabet’s EPS grew at an astounding 29.3% compounded annual growth rate over the last five years, higher than its 16.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Alphabet is a high-quality business, but at $168.13 per share (or 18.6× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.