Since November 2024, Penguin Solutions has been in a holding pattern, posting a small loss of 3% while floating around $17.60.

Is there a buying opportunity in Penguin Solutions, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Penguin Solutions Will Underperform?

We're cautious about Penguin Solutions. Here are three reasons why there are better opportunities than PENG and a stock we'd rather own.

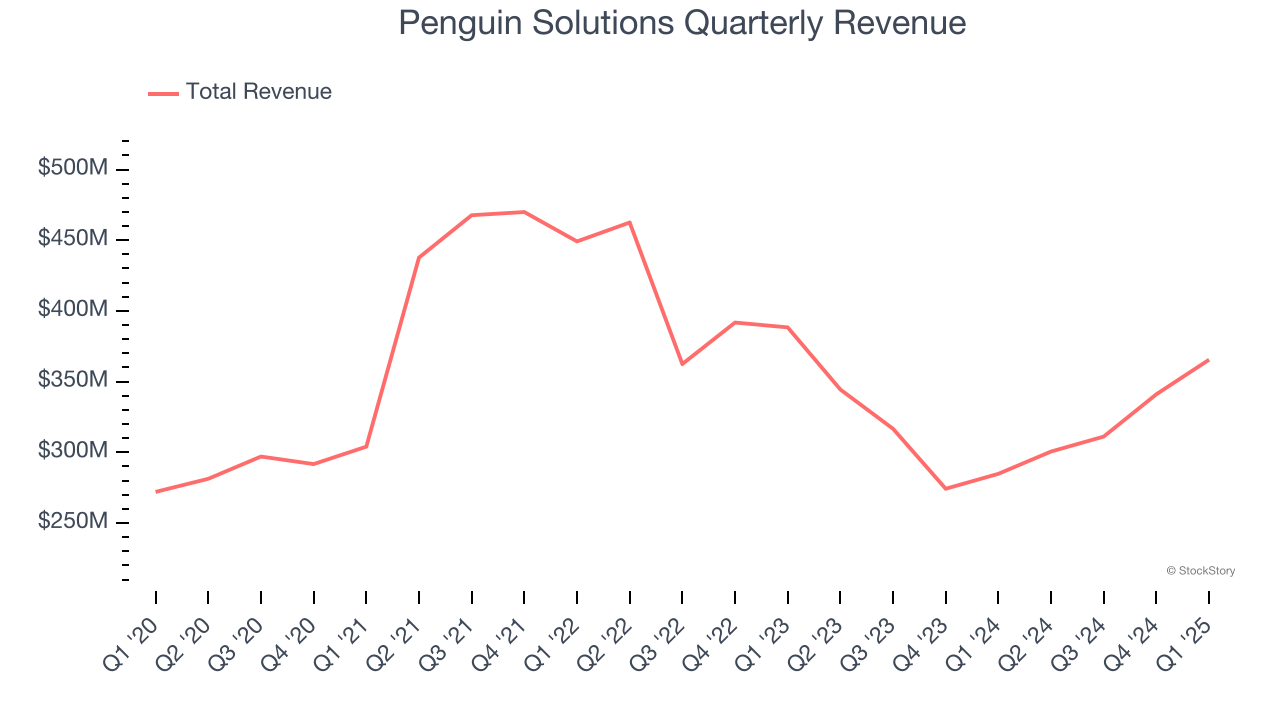

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Penguin Solutions’s sales grew at a sluggish 4.5% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

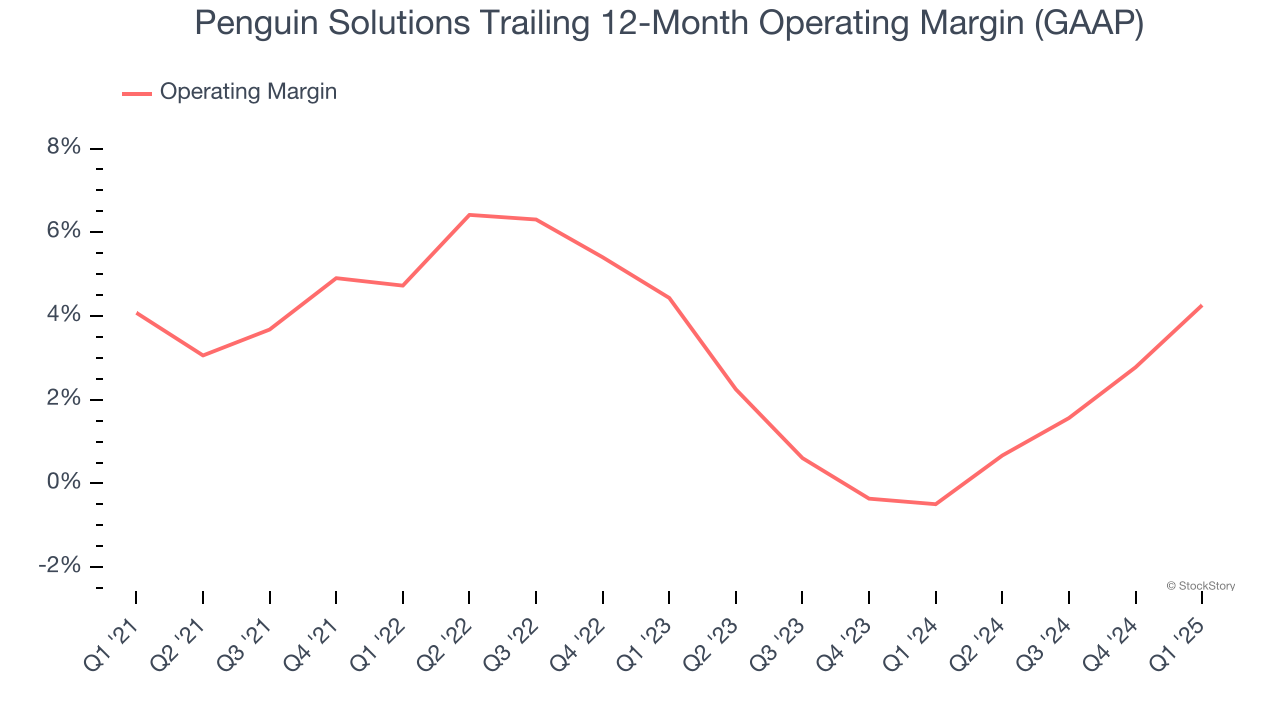

2. Weak Operating Margin Could Cause Trouble

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Penguin Solutions was profitable over the last two years but held back by its large cost base. Its average operating margin of 2% was among the worst in the semiconductor sector. This result isn’t too surprising given its low gross margin as a starting point.

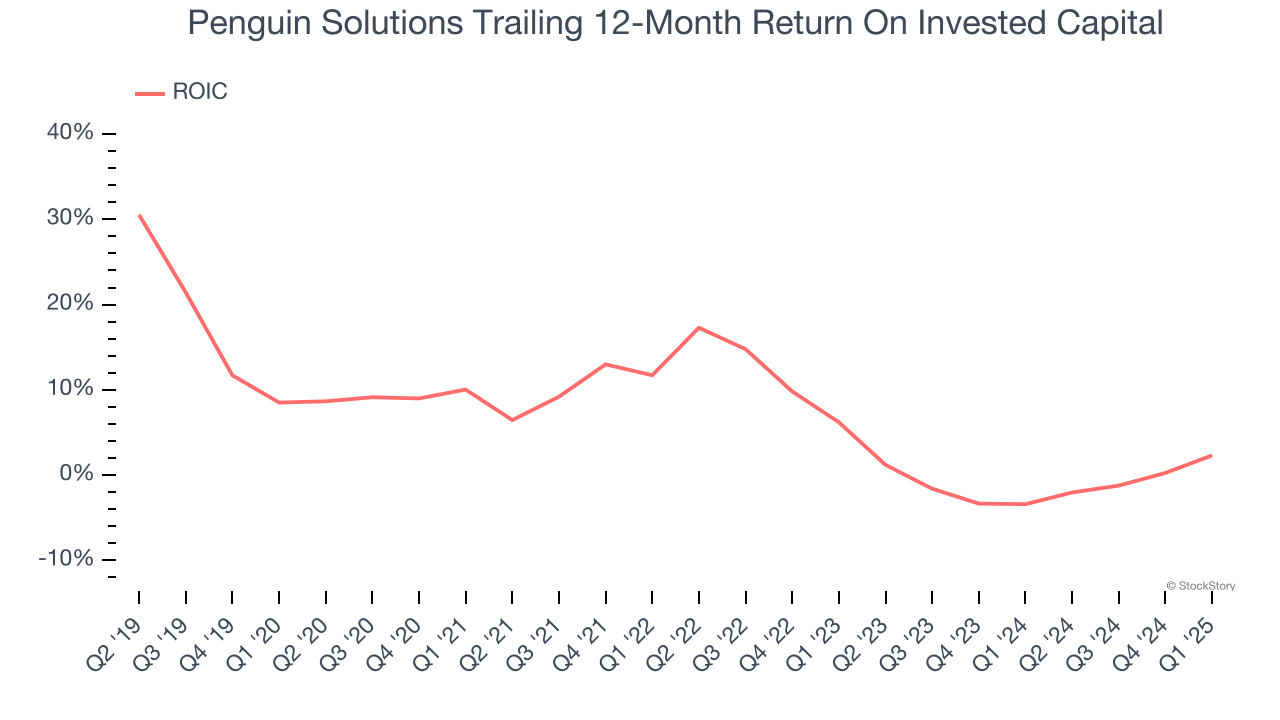

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Penguin Solutions historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Penguin Solutions, we’ll be cheering from the sidelines. That said, the stock currently trades at 11.3× forward P/E (or $17.60 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.