What a brutal six months it’s been for Scorpio Tankers. The stock has dropped 21.8% and now trades at $40.05, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy Scorpio Tankers, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Scorpio Tankers Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in Scorpio Tankers. Here are three reasons why we avoid STNG and a stock we'd rather own.

1. Decline in total vessels Points to Weak Demand

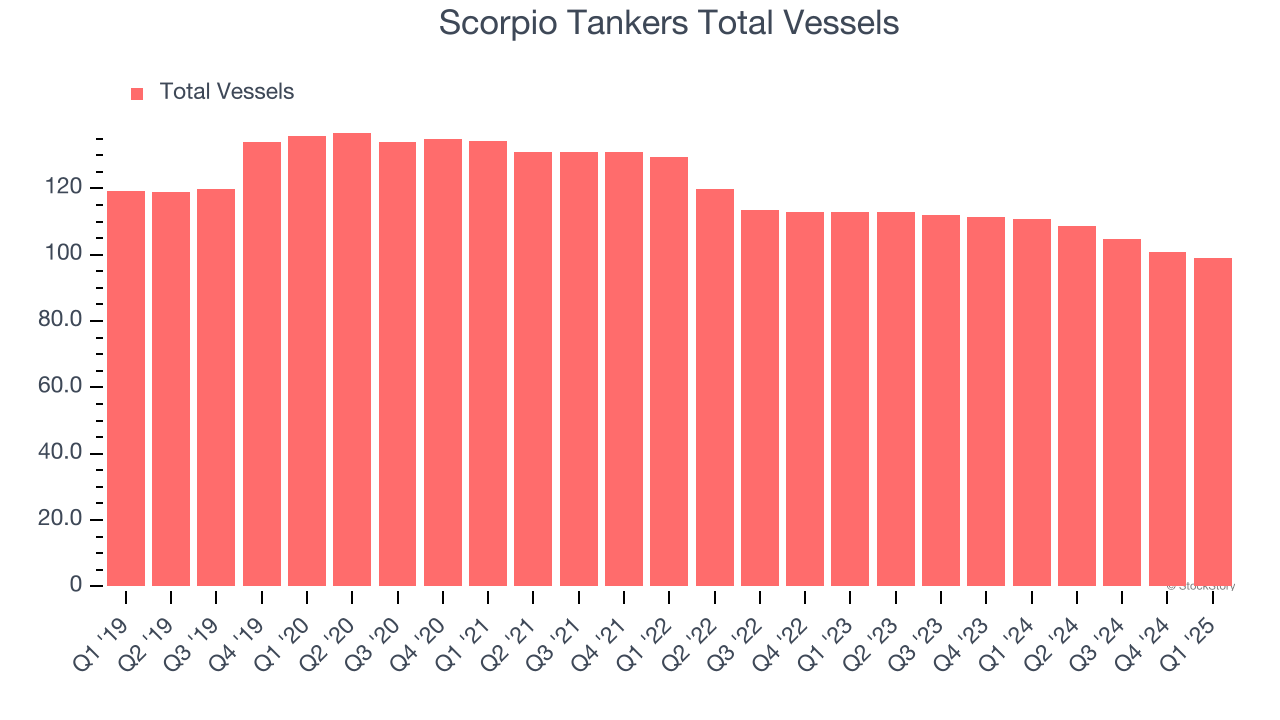

Revenue growth can be broken down into changes in price and volume (for companies like Scorpio Tankers, our preferred volume metric is total vessels). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Scorpio Tankers’s total vessels came in at 99 in the latest quarter, and over the last two years, averaged 5.1% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Scorpio Tankers might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Scorpio Tankers’s revenue to drop by 7.3%. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

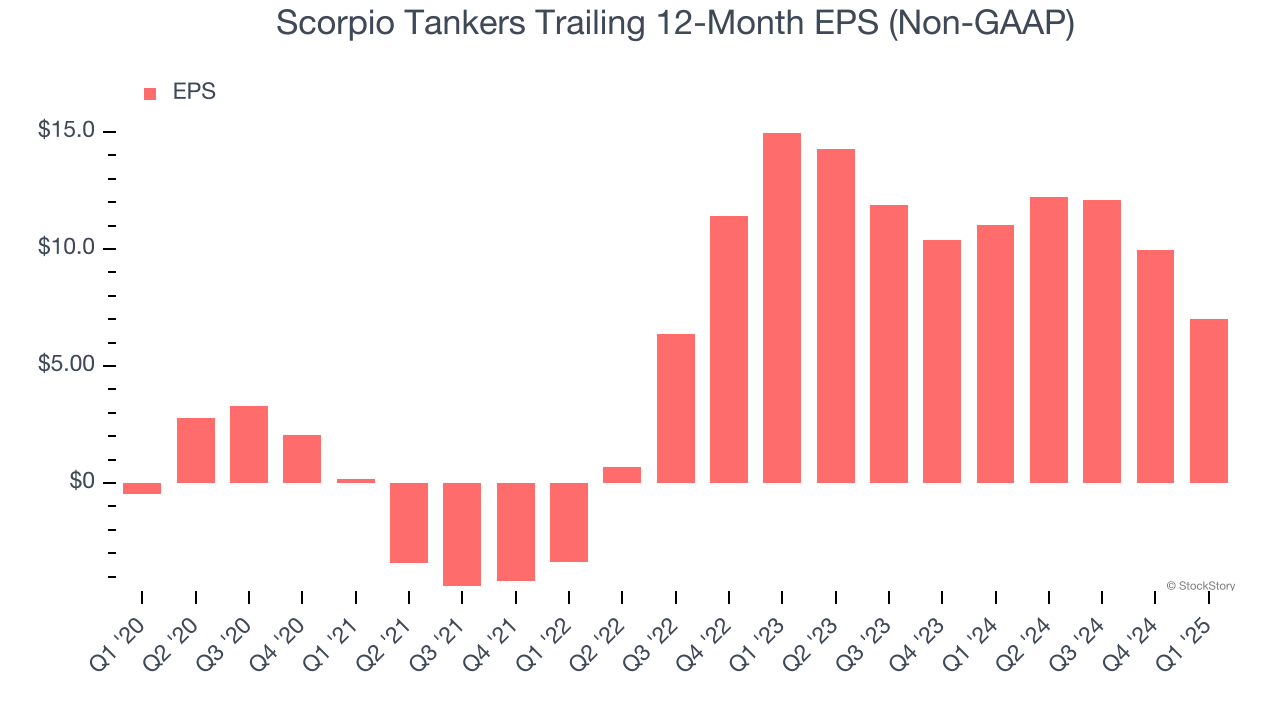

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Scorpio Tankers, its EPS declined by more than its revenue over the last two years, dropping 31.6%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Scorpio Tankers isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 6.3× forward P/E (or $40.05 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Scorpio Tankers

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.