Shareholders of Globus Medical would probably like to forget the past six months even happened. The stock dropped 28.9% and now trades at $58.14. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for GMED? Find out in our full research report, it’s free.

Why Does GMED Stock Spark Debate?

With operations spanning 64 countries and a portfolio of over 10 new products launched in 2023 alone, Globus Medical (NYSE: GMED) develops and sells implantable devices, surgical instruments, and technology solutions for spine, orthopedic, and neurosurgical procedures.

Two Positive Attributes:

1. Constant Currency Revenue Propels Growth

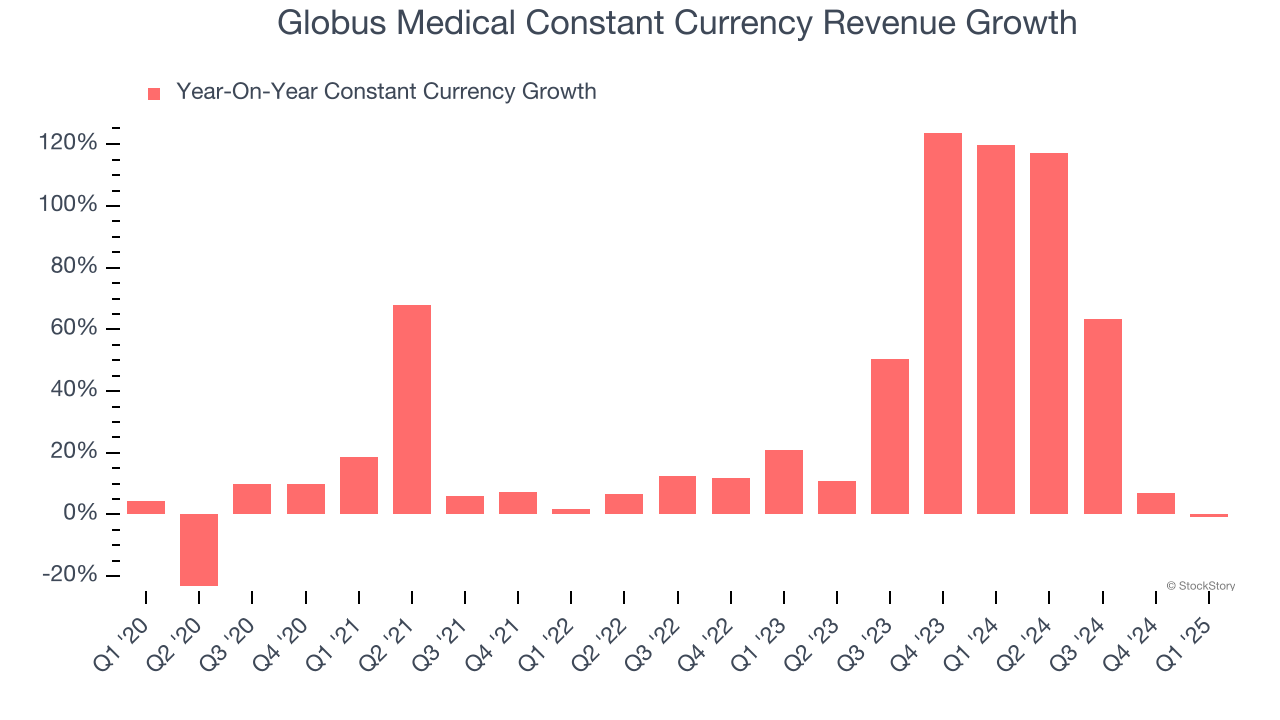

We can better understand Medical Devices & Supplies - Specialty companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Globus Medical’s control and are not indicative of underlying demand.

Over the last two years, Globus Medical’s constant currency revenue averaged 61.4% year-on-year growth. This performance was fantastic and shows it can expand quickly on a global scale regardless of the macroeconomic environment.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Globus Medical’s revenue to rise by 18.5%. While this projection is below its 53.3% annualized growth rate for the past two years, it is commendable and indicates the market is baking in success for its products and services.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

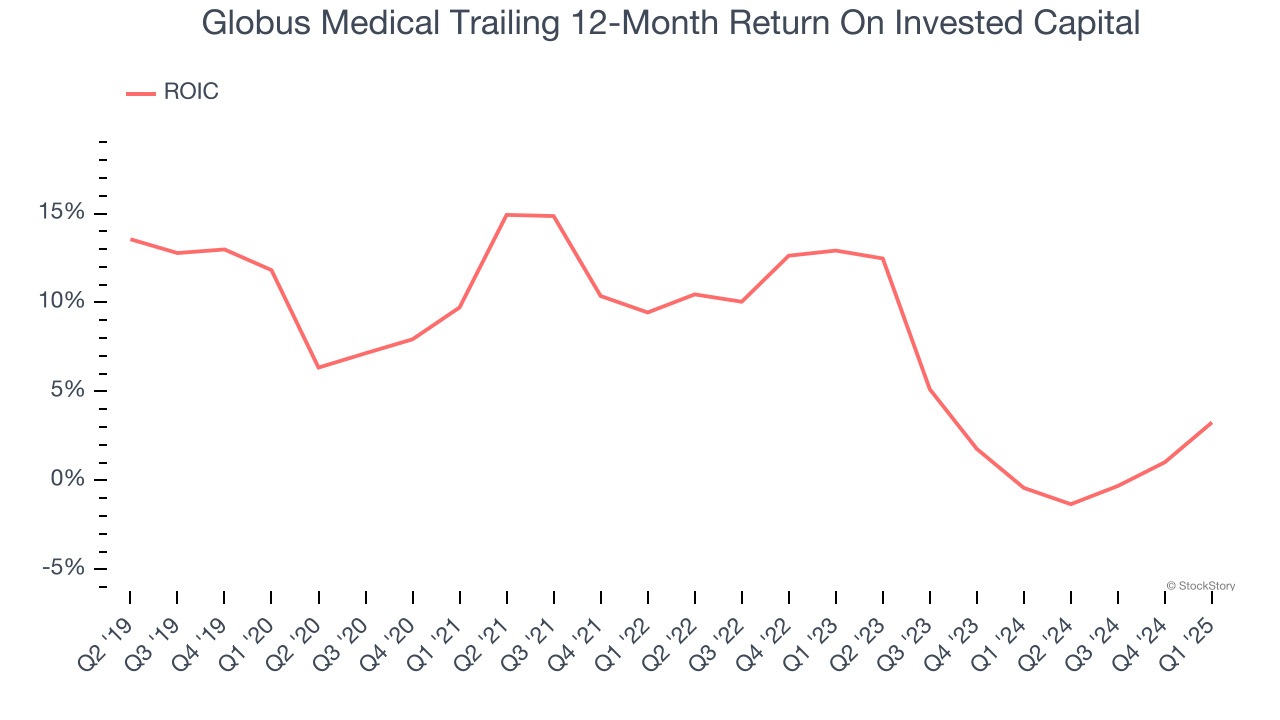

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Globus Medical’s ROIC has decreased over the last few years. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

Final Judgment

Globus Medical’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 16.4× forward P/E (or $58.14 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Globus Medical

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.