Vishay Precision has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.8%. The stock now trades at $26.34, marking a 13.5% gain. This run-up might have investors contemplating their next move.

Is now the time to buy Vishay Precision, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Vishay Precision Will Underperform?

Despite the momentum, we're sitting this one out for now. Here are three reasons why VPG doesn't excite us and a stock we'd rather own.

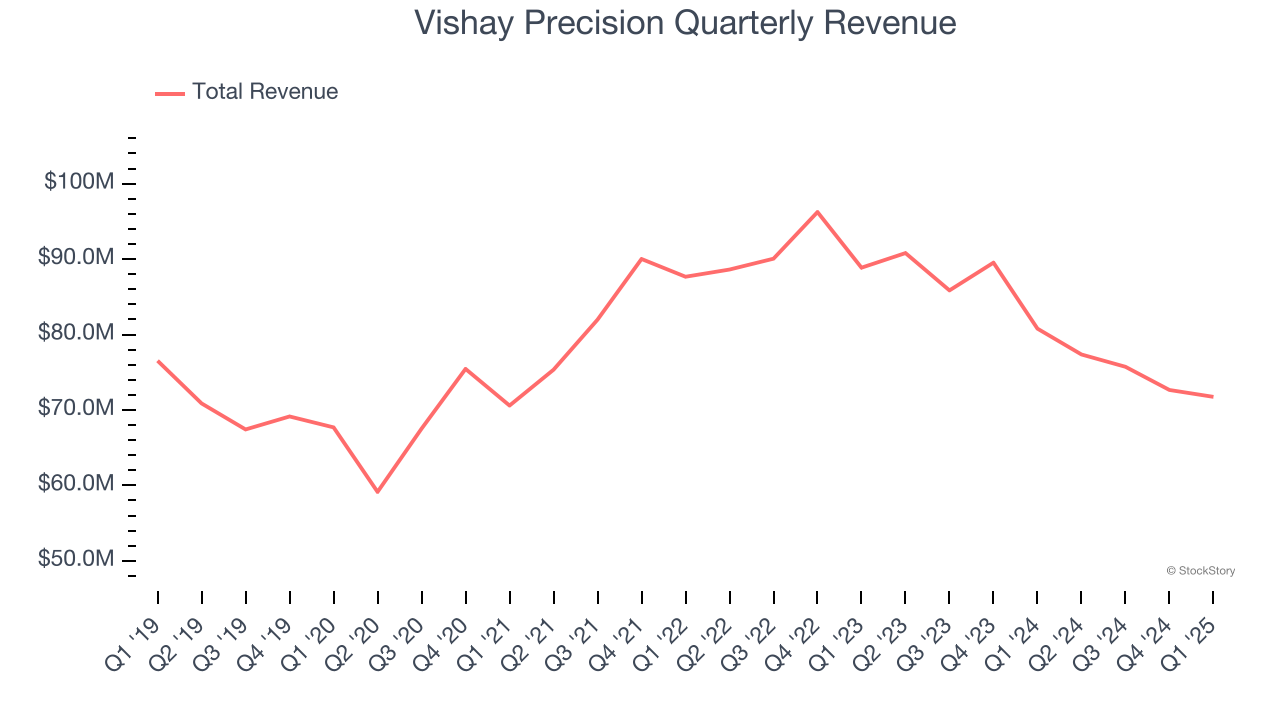

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Vishay Precision’s sales grew at a sluggish 1.6% compounded annual growth rate over the last five years. This fell short of our benchmarks.

2. Shrinking Operating Margin

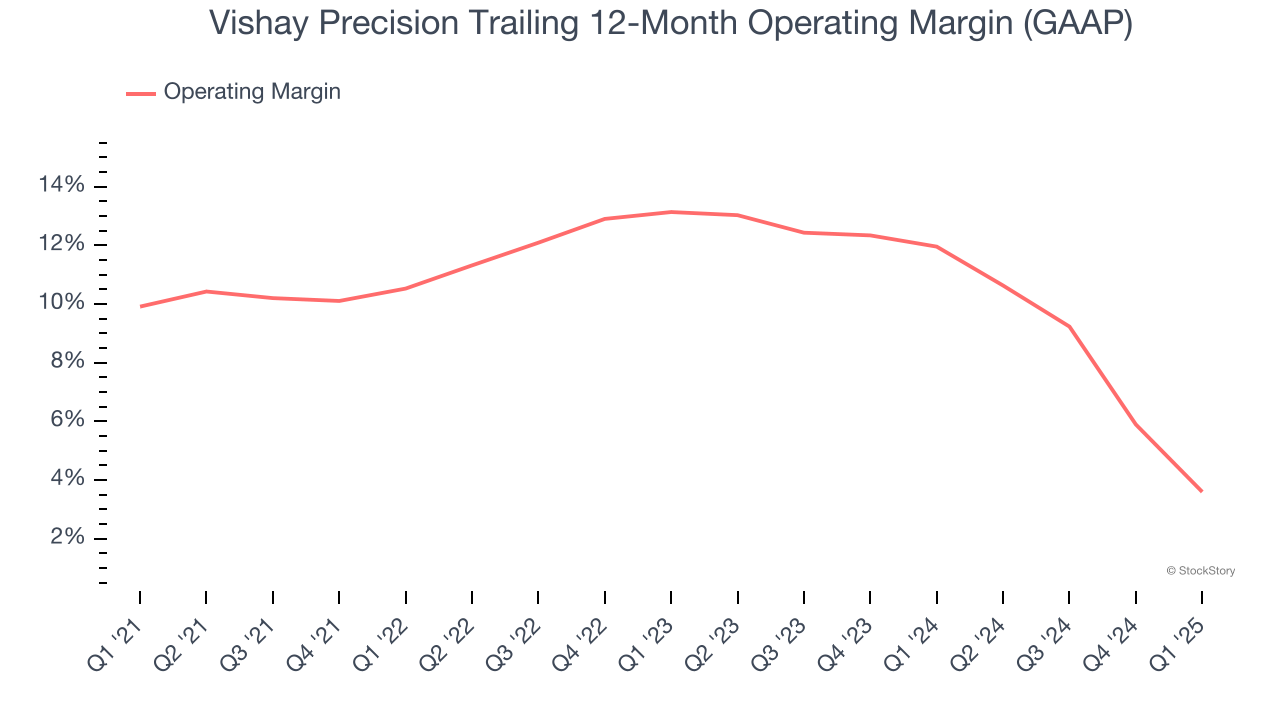

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Vishay Precision’s operating margin decreased by 6.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 3.6%.

3. EPS Trending Down

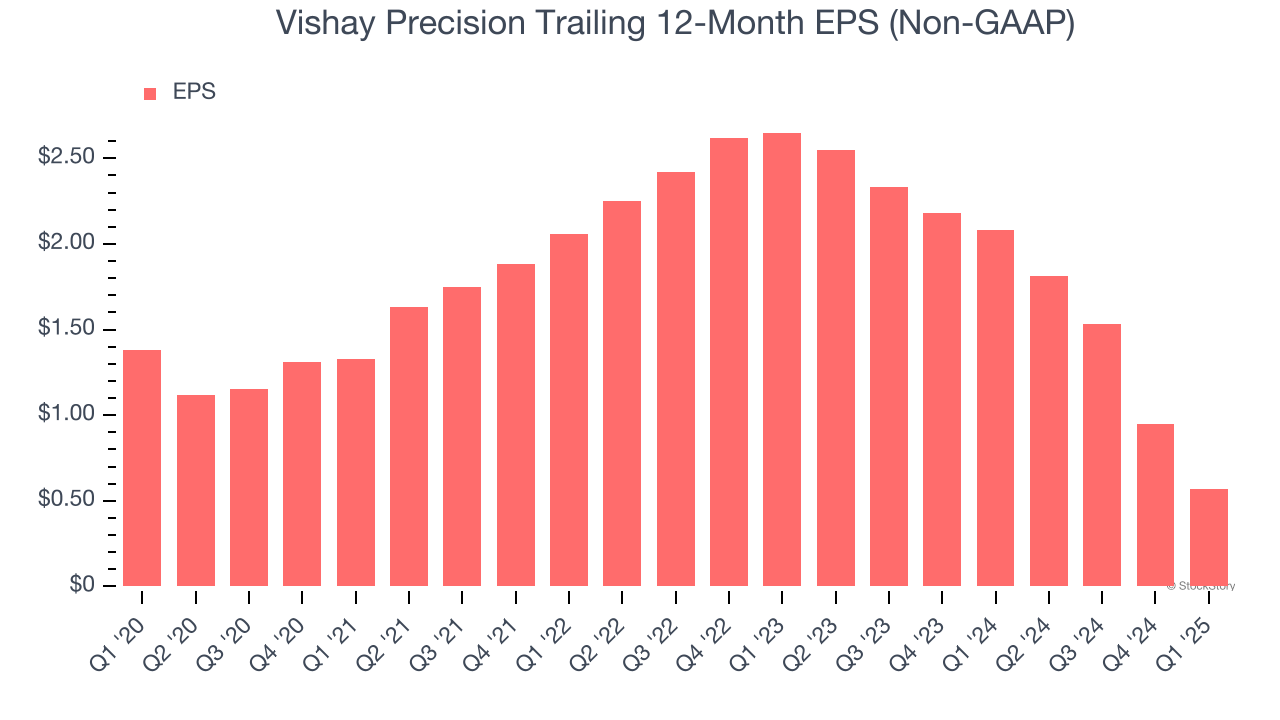

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Vishay Precision, its EPS declined by 16.2% annually over the last five years while its revenue grew by 1.6%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We see the value of companies helping their customers, but in the case of Vishay Precision, we’re out. With its shares topping the market in recent months, the stock trades at 21.3× forward P/E (or $26.34 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Vishay Precision

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.