Financial holding company Hilltop Holdings (NYSE: HTH) fell short of the market’s revenue expectations in Q2 CY2025 as sales only rose 1.9% year on year to $303.3 million. Its GAAP profit of $0.57 per share was 22.6% above analysts’ consensus estimates.

Is now the time to buy Hilltop Holdings? Find out by accessing our full research report, it’s free.

Hilltop Holdings (HTH) Q2 CY2025 Highlights:

- Net Interest Income: $110.7 million vs analyst estimates of $107.4 million (6.8% year-on-year growth, 3% beat)

- Net Interest Margin: 3% vs analyst estimates of 2.9% (9 basis point year-on-year increase, 15.7 bps beat)

- Revenue: $303.3 million vs analyst estimates of $307.5 million (1.9% year-on-year growth, 1.4% miss)

- Efficiency Ratio: 55.4% vs analyst estimates of 86% (30.6 percentage point beat)

- EPS (GAAP): $0.57 vs analyst estimates of $0.47 (22.6% beat)

- Market Capitalization: $2.01 billion

Jeremy B. Ford, Chairman, President and CEO of Hilltop, said, “During the second quarter of 2025, Hilltop delivered a 1% return on average assets and returned $47 million to stockholders through dividends and share repurchases. PlainsCapital Bank’s net interest margin expanded by 19 basis points as we continued to proactively manage deposit costs and benefited from a higher repricing of earning assets. HilltopSecurities produced a 5% year-over-year improvement in net revenue and a pre-tax margin of 5.8% in the face of a highly volatile quarter from long-term interest rates. PrimeLending had pre-tax income of $3.2 million on $2.4 billion of mortgage origination volume while operating in a persistently challenging home buying market. Notably, PrimeLending’s operating results include a one-time pre-tax benefit of $9.5 million associated with prior legal settlements. As we move into the second half of the year, we will continue to prioritize protecting our balance sheet and executing on our strategic priorities in order to create long-term stockholder value.”

Company Overview

Transformed from a residential communities business to a financial services powerhouse in 2007, Hilltop Holdings (NYSE: HTH) is a Texas-based financial holding company that provides banking, broker-dealer, and mortgage origination services.

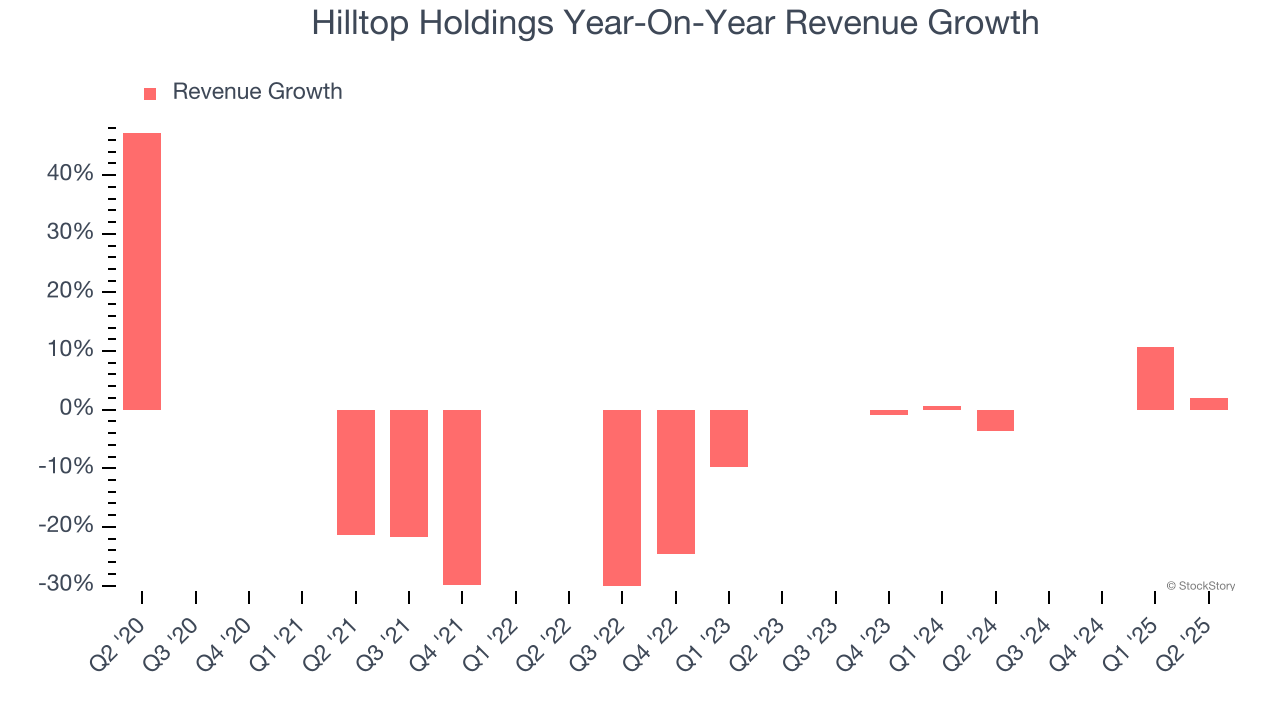

Sales Growth

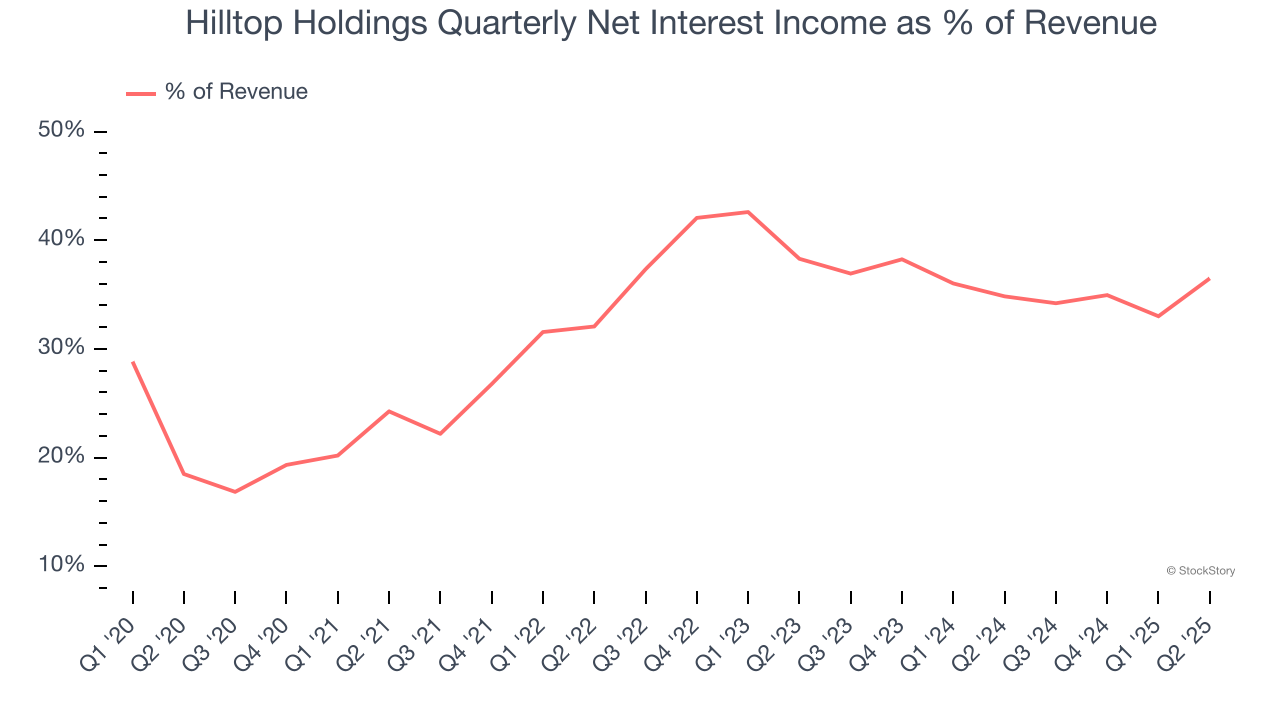

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Hilltop Holdings’s demand was weak over the last five years as its revenue fell at a 6.7% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Hilltop Holdings’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hilltop Holdings’s revenue grew by 1.9% year on year to $303.3 million, falling short of Wall Street’s estimates.

Net interest income made up 31.9% of the company’s total revenue during the last five years, meaning Hilltop Holdings is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

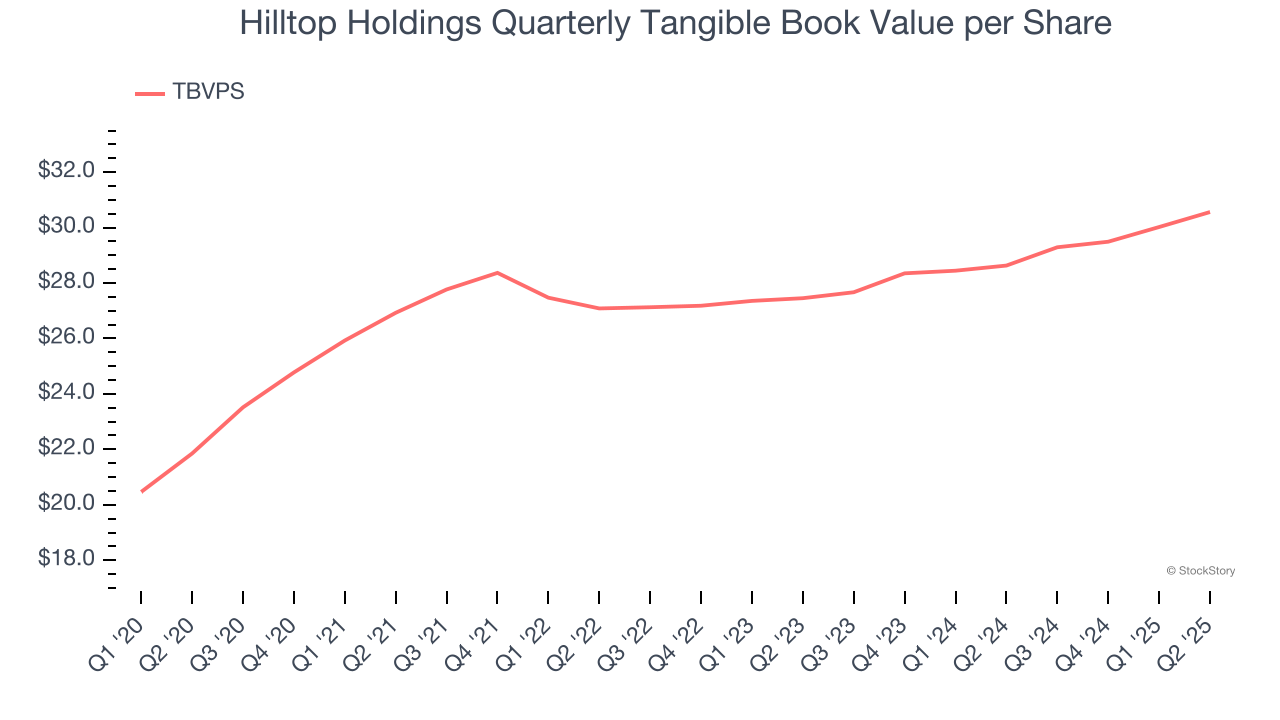

Tangible Book Value Per Share (TBVPS)

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

When analyzing banks, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value by removing intangible assets of debatable liquidation worth. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

Hilltop Holdings’s TBVPS grew at a solid 6.9% annual clip over the last five years. However, TBVPS growth has recently decelerated a bit to 5.5% annual growth over the last two years (from $27.45 to $30.56 per share).

Over the next 12 months, Consensus estimates call for Hilltop Holdings’s TBVPS to grow by 3.3% to $31.56, paltry growth rate.

Key Takeaways from Hilltop Holdings’s Q2 Results

We were impressed by how significantly Hilltop Holdings blew past analysts’ EPS expectations this quarter. We were also glad its net interest income outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $30.59 immediately after reporting.

So do we think Hilltop Holdings is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.