Freshpet’s stock price has taken a beating over the past six months, shedding 46.4% of its value and falling to $57.41 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Freshpet, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Freshpet Not Exciting?

Even though the stock has become cheaper, we're swiping left on Freshpet for now. Here are three reasons we avoid FRPT and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $1.04 billion in revenue over the past 12 months, Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Cash Burn Ignites Concerns

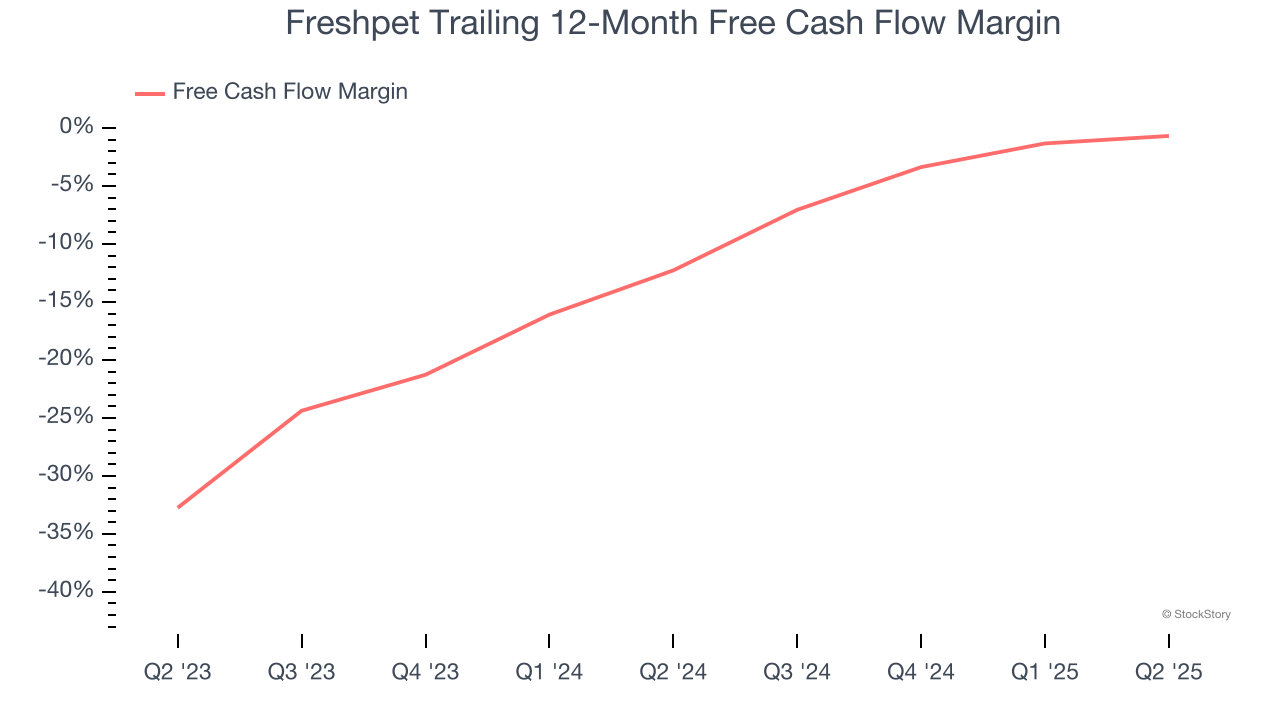

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Freshpet’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Freshpet’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 6%. This means it lit $5.96 of cash on fire for every $100 in revenue.

3. Previous Growth Initiatives Have Lost Money

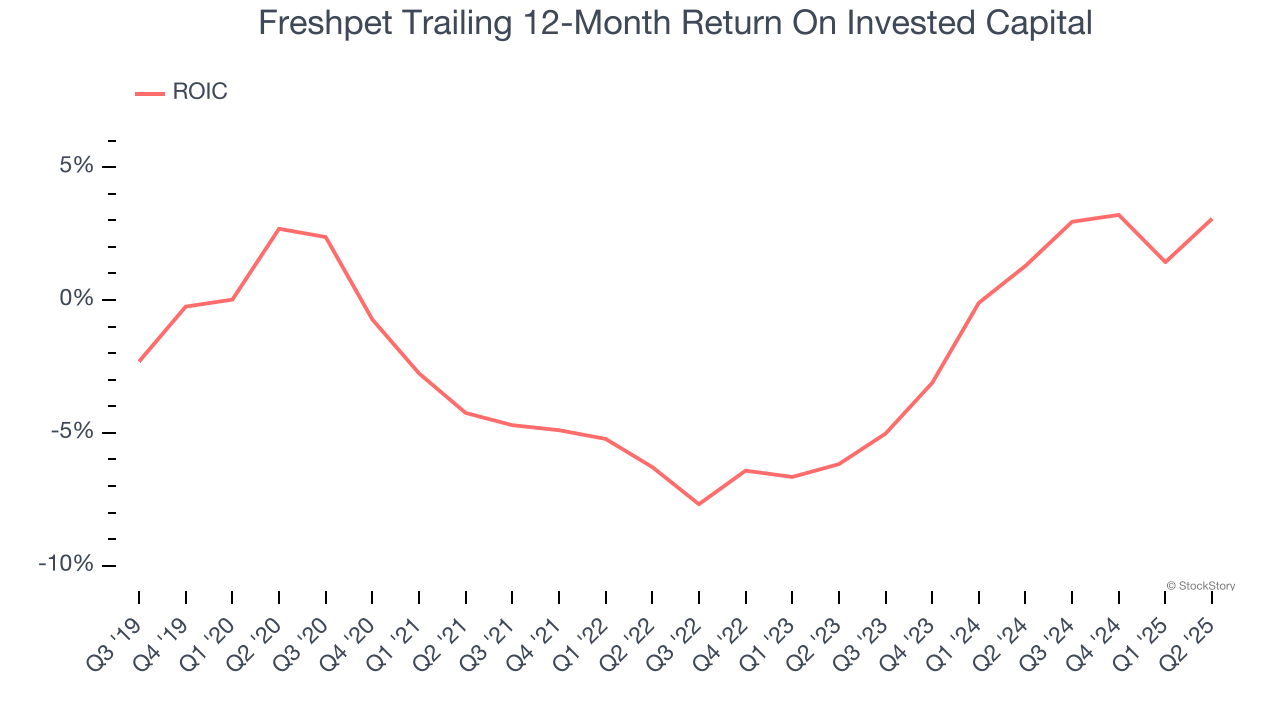

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Freshpet’s five-year average ROIC was negative 2.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

Freshpet isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 37.3× forward P/E (or $57.41 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Freshpet

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.