JPMorgan Chase trades at $334.38 per share and has stayed right on track with the overall market, gaining 14.5% over the last six months. At the same time, the S&P 500 has returned 10.1%.

Is now the time to buy JPMorgan Chase, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is JPMorgan Chase Not Exciting?

We're sitting this one out for now. Here are three reasons why JPM doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

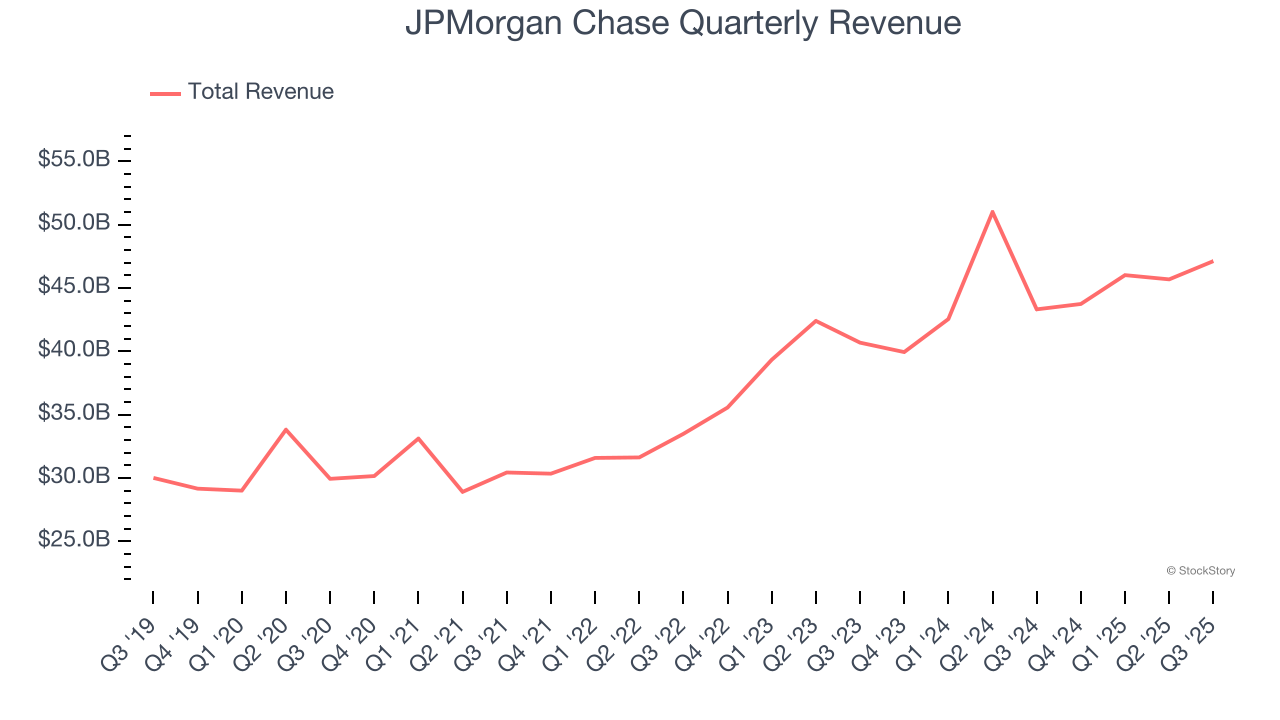

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Over the last five years, JPMorgan Chase grew its revenue at a mediocre 8.4% compounded annual growth rate. This was below our standard for the banking sector.

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

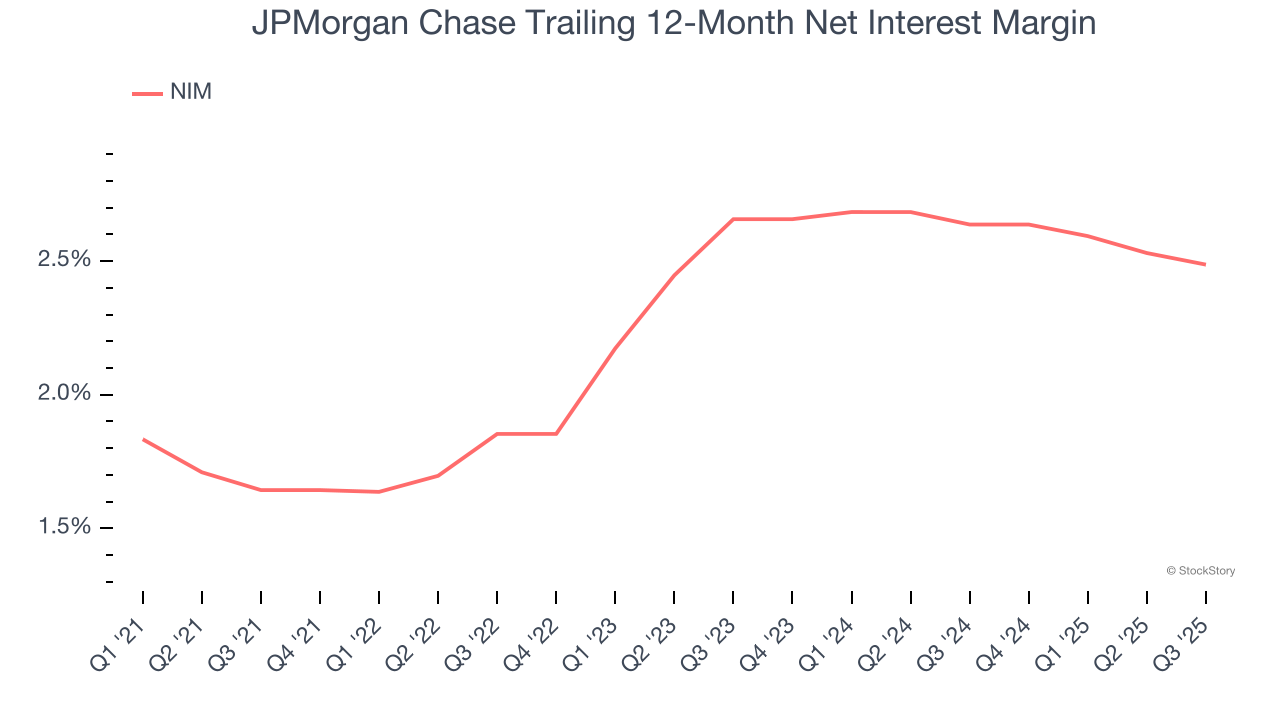

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, we can see that JPMorgan Chase’s net interest margin averaged a poor 2.6%, reflecting its high servicing and capital costs.

3. Projected TBVPS Growth Is Slim

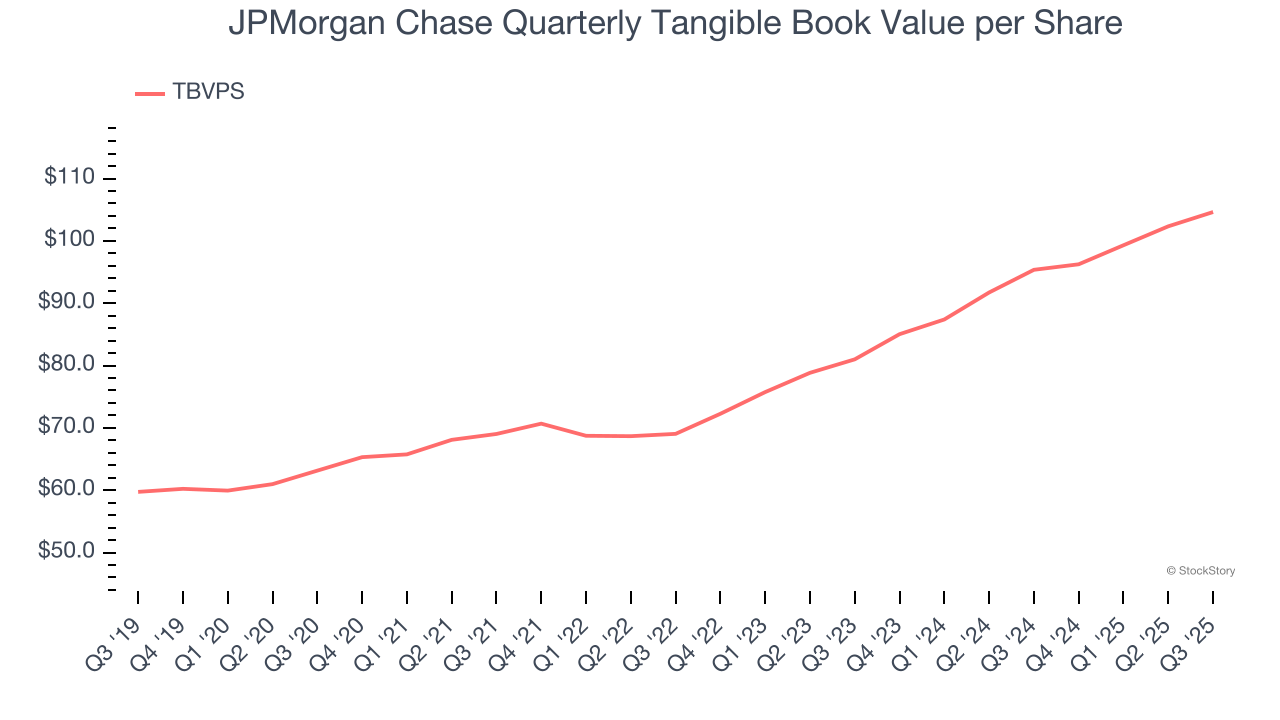

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for JPMorgan Chase’s TBVPS to grow by 7.1% to $112.10, lousy growth rate.

Final Judgment

JPMorgan Chase isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 2.6× forward P/B (or $334.38 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.