State Street SPDR Portfolio Long Term Treasury ETF (NY:SPTL)

Headline News about State Street SPDR Portfolio Long Term Treasury ETF

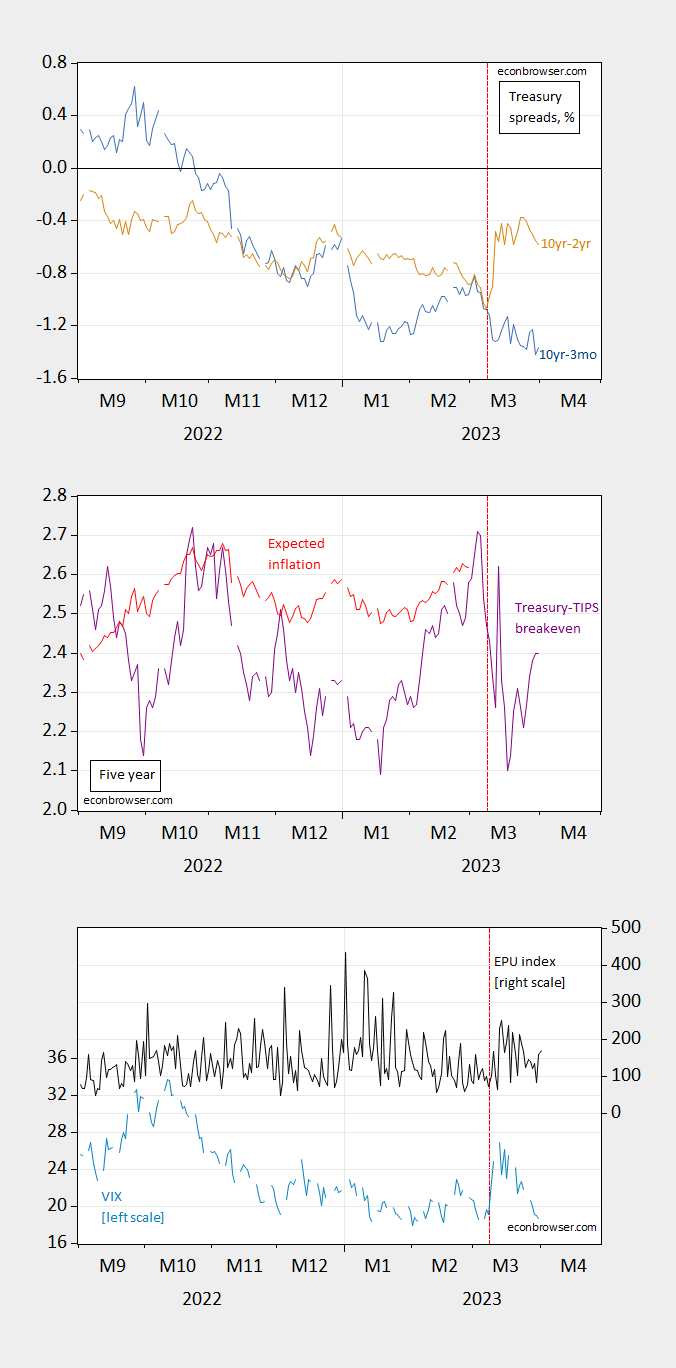

Yield Curve Shifts Offer Signals For Stockholders ↗

August 28, 2024

Via Talk Markets

Topics

Economy

Rates Spark: The 4.5% Line In The Sand Is Breached ↗

November 09, 2023

Via Talk Markets

Topics

Bonds

Via Talk Markets

Via Talk Markets

U.S. Labor Market Activity: Slowing, Not Weakening ↗

September 06, 2023

Via Talk Markets

Topics

Economy

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.