ANN ARBOR, MI / ACCESS Newswire / April 17, 2025 / University Bancorp, Inc. (OTCQB:UNIB), or ("UNIB") announced that it had audited net income of $11,818,099 in 2024, of which $10,467,383 was attributable to UNIB common stockholders, $2.02 per share on average shares outstanding of 5,169,518 for the year, versus audited net income of $6,799,619 in 2023, of which $5,426,558 was attributable to UNIB common stockholders, $1.07 per share on average shares outstanding of 4,936,751 for 2023.

For 2024, UNIB had a return on equity attributable to common stock shareholders of 12.5% on initial equity attributable to common stock shareholders of $83,970,376. Return on equity attributable to common stockholders in 2023 was 7.1% on initial equity of $76,283,525. Shareholders' equity attributable to UNIB common stock shareholders at December 31, 2024 was $93,590,773 (excluding minority interest of $11,961,541), or $18.10 per share, based on common shares outstanding at December 31, 2024 of 5,169,518, up from $16.24 per share at the end of 2023.

In late 2024, the board of UNIB instituted a new dividend policy and after paying a special $0.20 per share dividend on 12/30/2024, instituted a quarterly dividend of $0.10 per share payable 1/15/2025 and 4/15/2025. This dividend is intended to be paid 7/15/2025 and 10/15/2025, and quarterly going forward.

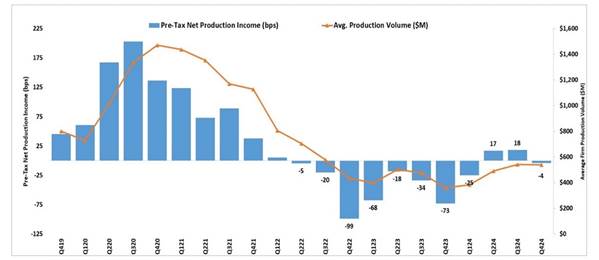

While UNIB's overall revenue grew 18.65% in 2024 versus the prior year, net income in 2024, 2023 and 2022 was negatively impacted by low profitability industrywide in the residential mortgage origination business, which impacted University Bank's mortgage origination units. The Mortgage Bankers Association reports that overall, the industry in the U.S. earned just 6 basis points on all residential mortgages originated in 2024.

Due to a shift in market opportunities, with the yields on mortgage loans rising sharply above the industry's cost of funds, the bank has retained more of its over a billion dollars of annual mortgage originations in recent years (the bank originated $1.1 billion of mortgage loans in 2024, $1.2 billion in 2023 and $1.5 billion in 2022), with portfolio loans held for investment at University Bank rising from $103.8 million at 12/31/2020 to $733.8 million at 12/31/2023 and $782.4 million at 12/31/2024. This has led to a rapid rise in the bank's net interest margin to more than $3 million per month from the previous level of under $1 million a month. In the short term, however, the bank did not earn upfront gains on sale from these $680 million in residential loans that went into portfolio and were not sold into the secondary market, and incurred all the expense of originating those mortgage loans, which was about $21.4 million, negatively impacting income (the industry average cost of originating a mortgage loan in 2023 according to the Mortgage Bankers Association was 3.66% of the loan balance, however our cost is a bit lower at 3.14%). The residential mortgages held in portfolio are with few exceptions adjustable-rate mortgages, either 1 st Mortgage Home Equity Lines of Credit that adjust at a spread over an index every six months, or 7/6 adjustable-rate mortgages that have a fixed rate for 7 years and then adjust every six months. The latter have been match funded with institutional deposits that mature in 4-5 years, and which cannot be withdrawn prior to maturity. Growth in portfolio loans moderated in 2024, as the management team chose to keep University Bank's total assets under $1 billion at 12/31/2024, to avoid incurring significant extra regulatory costs in 2025, as once a bank's assets rise above $1 billion as of a year-end, substantially additional regulations must be adhered to by a bank.

President Stephen Lange Ranzini noted, "Considering the 30-year low in mortgage origination units nationwide, our 2024 results were outstanding. We have put into place several key projects that should result in higher earnings in 2025 and future years. University Bank is now licensed to originate mortgage loans in all 50 states and the District of Columbia, and we have all the compliant document sets built for our whole suite of first mortgage origination products in every state nationwide, except for forward mortgages in Alaska and Hawaii, which we could easily build in a few weeks, and the remaining 7 states for 1 st Mortgage HELOCs, which we are working on rolling out, except for Texas, which has unique legal restrictions. The management team is also working on getting the bank licensed for second mortgages in all 50 states, and is developing a strategy to roll out a second mortgage suite of products for sale to the secondary market.

In 2023 UNIB opted to be designated as a Financial Holding Company, which gives us a greater range of investment and business development options. We used this authority in early 2023 to establish a Captive Insurance Company owned by UNIB, chartered in Washington DC, Crescent Assurance, PCC. This firm was profitable in its first two years of operation, having earned cumulative net income of $1.4 million on our original investment of $250,000. In 2024 we also completed the first part of a two-part strategy to launch a mortgage assets money management business, Hyrex, by shifting ownership of Hyrex Servicing, LLC from University Bank to UNIB.

University Bank also recently reached definitive agreements with 3 of the 7 other shareholders in Credit Union Trust to increase our ownership of that Trust Company from 12.5% to 50.0% for a total purchase price of $3.375 million, subject to a right of first refusal held by our remaining partners in that Trust Company. CU Trust passed the $100 million mark of Assets Under Management in 2024, and grew its AUM by $28.7 million in 2024, from $77.0 million to $105.7 million, and continues to grow towards the critical mass required to pass the break-even level, which is currently about $180 million.

Lastly, UIF, UNIB, University Bank and their subsidiaries and divisions have regulatory approval and are finalizing steps to launch additional products and product expansions in 2025.

In addition to the shift discussed above to holding more residential loans in portfolio instead of selling them on the secondary market, results in 2024 were negatively impacted by two items, partially offset by an unusual positive factor which had a net overall positive impact of $686,396, before income taxes:

Unusual expenses :

1. Management booked an allowance for credit losses of $674,635;

2. The value of the hedged mortgage origination pipeline fell $51,105 as the amount of locked loans at year-end 2024 fell versus the level at year-end 2023.

Unusual gains :

3. Management booked a valuation gain for our Mortgage Servicing Rights of $1,412,136;

Results in 2023 were negatively impacted by two items, partially offset by an unusual positive factor which had a net overall negative impact of $2,923,058, before income taxes:

Unusual expenses :

4. Management booked a valuation decline in our Mortgage Servicing Rights of $1,694,134;

5. The UNIB securities portfolio incurred a loss of $1,685,228.

Unusual gains :

6. The value of the hedged mortgage origination pipeline rose $456,304 as the amount of locked loans at year-end 2023 rose over the level at year-end 2022.

During late 2022 and early 2023, UNIB issued $28 million of subordinated debt. The subordinated debt was issued to facilitate the change in strategy to expand University Bank's balance sheet with additional portfolio loans. The subordinated debt, which matures 1/31/2033, has interest for the first five years fixed at 8.25% and floats at a variable rate of 4.87% over SOFR for the second five years, however UNIB entered into an interest rate swap agreement which effectively fixes the interest rate for the second five years of the term at 8.08%.

In October 2024, UNIB issued $15 million of senior unsecured debt. The senior unsecured debt, which matures 1/31/2030, has interest fixed at 9.25%

At 12/31/2024 cash & equity investment securities at UNIB, available to meet working capital needs and to support investment opportunities at University Bancorp were $28.3 million. UNIB also has a $10 million line of credit available with no balance currently drawn. This line of credit matures in October 2025, and bears interest at Prime Rate, capped at 6.25%.

A portion of UNIB's working capital has been invested in a portfolio of publicly traded investments. Towards the end of 2024 we sold most of our long positions.

Three of the remaining investments are large and the remainder are very small. The three largest investments at 12/31/2024 were:

Currency Exchange International (Symbol CURN), a company that specializes in foreign exchange, of which we now own 10.41% of the common stock;

Pulsar Helium (Symbol PSRHF), of which we now own 4.99% of the common stock, and is a company developing what appears to be North America's largest deposit of helium. We believe that the helium in their reserves probably has a value between $1 billion and $5 billion.

A portfolio of put options on the following indices: S&P500, KRE (S&P 500 Banks) & XLF (S&P 500 Banks, Shadow Banks, Insurance Companies & REITs) as well as on one large regional bank that we have strong concerns about, which if it fails will negatively impact our loan portfolio in Michigan. UNIB's put option portfolio was worth $1.75 million at 12/31/2024 and has since risen substantially in value with the recent stock market decline.

Due to a conservative credit culture, University Bank has had net recoveries on net loan charge-offs over the past 16 years. Over the past two economic cycles, the following loan provisions and charge-offs (in $'000s) were sustained by University Bank:

Year |

|

Provision Expense |

|

Net Charge-offs |

2008 |

|

$1.0 |

|

$0.8 |

2009 |

|

1.5 |

|

1.3 |

2010 |

|

0.9 |

|

0.5 |

2011 |

|

0.3 |

|

0.7 |

2012 |

|

1.4 |

|

1.5 |

2013 |

|

0.1 |

|

0.3 |

2014 |

|

-0.3 |

|

0.0 |

2015 |

|

-0.3 |

|

-0.1 |

2016 |

|

0.0 |

|

-0.0 |

2017 |

|

153.0 |

|

170.0 |

2018 |

|

-226.0 |

|

-207.0 |

2019 |

|

285.0 |

|

34.0 |

2020 |

|

3,951.00 |

|

-16.0 |

2021 |

|

-344.0 |

|

-21.0 |

2022 |

|

130.0 |

|

-21.0 |

2023 |

|

961.0 |

|

28.8 |

2024 |

|

713.7 |

|

21.9 |

Maximum Since Start of 2008 Financial Crisis |

|

|

|

$170.0 |

Cumulative Since Start of 2008 Financial Crisis |

|

$ |

|

$-5.3 |

University Bank has engaged an outside vendor to perform Stress Testing analysis and these tests assume a severely adverse (depressionary) national economic scenario worse than the most recent business depressions that we have experienced, in which we assume 10% unemployment, 12.5% drop in GNP, a 37.9% drop in residential real estate prices and a 40% drop in commercial real estate prices and that these prices never recover. Under this scenario we lose $16.1 million in total loan losses over the entire economic cycle, a fraction of our Tier 1 Capital, and under this scenario, with sharply falling interest rates, the bank is likely to see pre-tax earnings rise sharply. During the pandemic the bank was earning $1 million pre-tax per week due to high mortgage origination gain on sale margins and the record level of mortgage origination volumes. This credit risk is moderated by the existing allowance for loan losses of $5.1 million. Under this stressed depressionary economic scenario over the entire cycle the stress test projects that the bank's Tier 1 Capital will fall by $12.7 million, and the bank's Tier 1 Capital Ratio would drop to 8.86%. The stress test does not assume that UNIB injects additional capital into University Bank from UNIB's $28.3 million of cash and securities.

The Bank currently has $12.9 million of office building loans, of which a small amount, mostly medical offices, are leased to third parties. All of the Bank's commercial real estate loans have guarantors capable of carrying the loan if the building in future periods suffers from negative cash flow.

At 12/31/2024, we had the following with respect to delinquent loans (including both delinquent portfolio loans and delinquent loans held for sale):

Delinquent 30 Days to 59 Days, $4,387,114;

Delinquent 60 Days to 89 Days, $431,970;

Delinquent Over 90 Days & on Non-Accrual, $1,247,348.

There was no foreclosed other real estate owned at year-end.

The allowance for loan losses stood at $5,082,605 or 0.60% of the amount of portfolio loans, excluding loans held for sale. Substandard assets including loans held for sale rose by $1,367,000 during 2024 to $5,083,000, increasing to 5.1% of Tier 1 Capital at 12/31/2024 versus 4.2% of Tier 1 Capital at 12/31/2023.

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was $92,951,023 or $17.98 at 12/31/2024, up from $83,165,634 or $16.09 at 12/31/2023. Please note that we do not see this statistic as particularly useful or meaningful, as our assessment of the value of Midwest Loan Services and Ann Arbor Insurance Centre is far above book value plus the related goodwill and intangibles. For example, over the past 11 years, AAIC has increased its revenue by 12% compounded annually, to just under $2 million in 2024, and from our original investment of just $5,201 and following a small acquisition in January 2018, AAIC now has shareholders' equity of $1,468,363, and an estimated value of about $5.75 million using a standard industry multiple of EBITDA for small insurance agency valuations.

Unaudited net income was $2,553,410 for the three months ended December 31, 2024 or $0.49 per share on average shares outstanding of 5,169,518 for the period, versus unaudited net income of $1,644,673 or $0.33 on average shares outstanding of 4,935,518 for the same 2023 period.

Total Assets of University Bank at 12/31/2024 were $956,188,000 versus $971,251,000 at 9/30/2024, $996,681,000 at 6/30/2024, $940,473,000 at 3/31/2024, $931,631,250 at 12/31/2023, $865,578,686 at 9/30/2023, $833,497,000 at 6/30/2023, $776,141,240 at 3/31/2023, and $794,235,413 at 12/31/2022.

The Tier 1 Leverage Capital Ratio at 12/31/2024 was 10.40% on net average assets of $959.8 million, from 10.33% at 9/30/2024 on net average assets of $967.3 million, 10.18% at 6/30/2024 on net average assets of $945.1 million, 10.02% at 3/31/2024 on net average assets of $918.6 million, 10.06% at 12/31/2023 on net average assets of $882.5 million, 10.07% at 9/30/2023 on net average assets of $869.0 million, 10.27% at 6/30/2023 on net average assets of $833.5 million, 10.31% at 3/31/2023 on net average assets of $760.0 million, and 10.30% at 12/31/2022 on net average assets of $686.5 million.

Common Equity Tier 1 Capital at 12/31/2024 was $99,736,000, at 9/30/2024 was $99,903,000, at 6/30/2024 was $96,202,000, at 3/31/2024 was $92,013,000, at 12/31/2023 was $88,736,000, at 9/30/2023 was $87,540,000, at 6/30/2023 was $85,576,000, at 3/31/2023 was $78,339,000, and at 12/31/2022 was $70,672,000. Prior to dividend payments from University Bank to UNIB, the Tier 1 Capital and Shareholders Equity of University Bank exceeded $100 million as of month-end in several months in the second half of 2024, a major accomplishment and milestone.

Other key statistics as of 12/31/2024:

*Using 2024, 2023, 2022, 2021, 2020, 2019 and 2014 revenue which was $125,261,596,

$105,568,196, $94,077,751, $133,175,856, $136.991,511, $69,112,502 and $36,598,052, respectively.

# UNIB only current assets divided by 12-month projected cash expenses.

+ Calculated as: (non-interest expense/(net interest income + non-interest income))

x Based on last sale of $14.50 per share.

Treasury shares as of 12/31/2024 were 37,381.

The 2024 audited financial statements are available on UNIB's website at: www.university-bank.com/wp-content/uploads/2025/03/2024-University-Bancorp-Inc.-Audited-Financial-Statements-FINAL.pdf .

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/ . A detailed income statement, balance sheet and other financial information for UNIB and University Bank as of 12/30/2024 is available here: https://www.university-bank.com/wp-content/uploads/2025/03/4Q2024-UNIB-Financials-Preliminary-Unaudited.pdf .

About UNIB

Ann Arbor-based University Bancorp is a Federal Reserve regulated financial holding company that owns:

100% of University Bank, a bank based in Ann Arbor, Michigan;

100% of Crescent Assurance, PCC, a captive insurance company licensed in Washington DC; and

100% of Hyrex Servicing, a master mortgage servicing firm, based in Ann Arbor, Michigan.

University Bank together with its Michigan-based subsidiaries, holds and manages a total of over $36 billion in financial assets for over 183,000 customers, and our 528 employees make us the 5th largest bank based in Michigan. University Bank is an FDIC-insured, locally owned and managed community bank, and meets the financial needs of its community through its creative and innovative services. Founded in 1890, University Bank® is the 15th oldest bank headquartered in Michigan. We are proud to have been selected as the "Community Bankers of the Year" by American Banker magazine and as the recipient of the American Bankers Association's Community Bank Award. University Bank is a Member FDIC. The members of University Bank's corporate family, ranked by their size of revenues are:

UIF, a faith-based banking firm based in Southfield, MI;

University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor, MI.

Reverse Mortgage Lending, a reverse residential mortgage lender based in Southfield, MI; and

Mortgage Warehouse Lending, a mortgage warehouse lender based in Southfield, MI.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact: Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: ranzini@university-bank.com

SOURCE: University Bancorp, Inc.

View the original press release on ACCESS Newswire