Over the past six months, Kellanova has been a great trade, beating the S&P 500 by 23.2%. Its stock price has climbed to $80.74, representing a healthy 36.6% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Kellanova, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're cautious about Kellanova. Here are three reasons why there are better opportunities than K and a stock we'd rather own.

Why Is Kellanova Not Exciting?

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

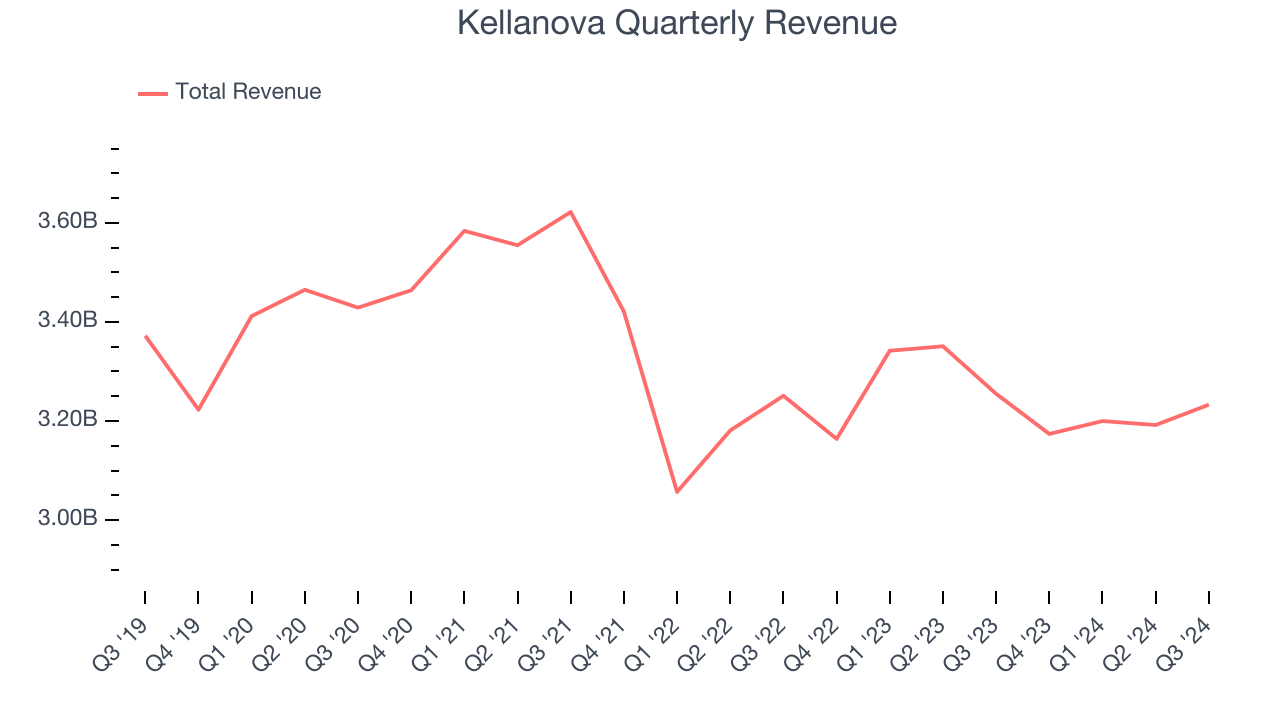

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Kellanova’s demand was weak over the last three years as its sales fell at a 3.5% annual rate. This was below our standards and signals it’s a lower quality business.

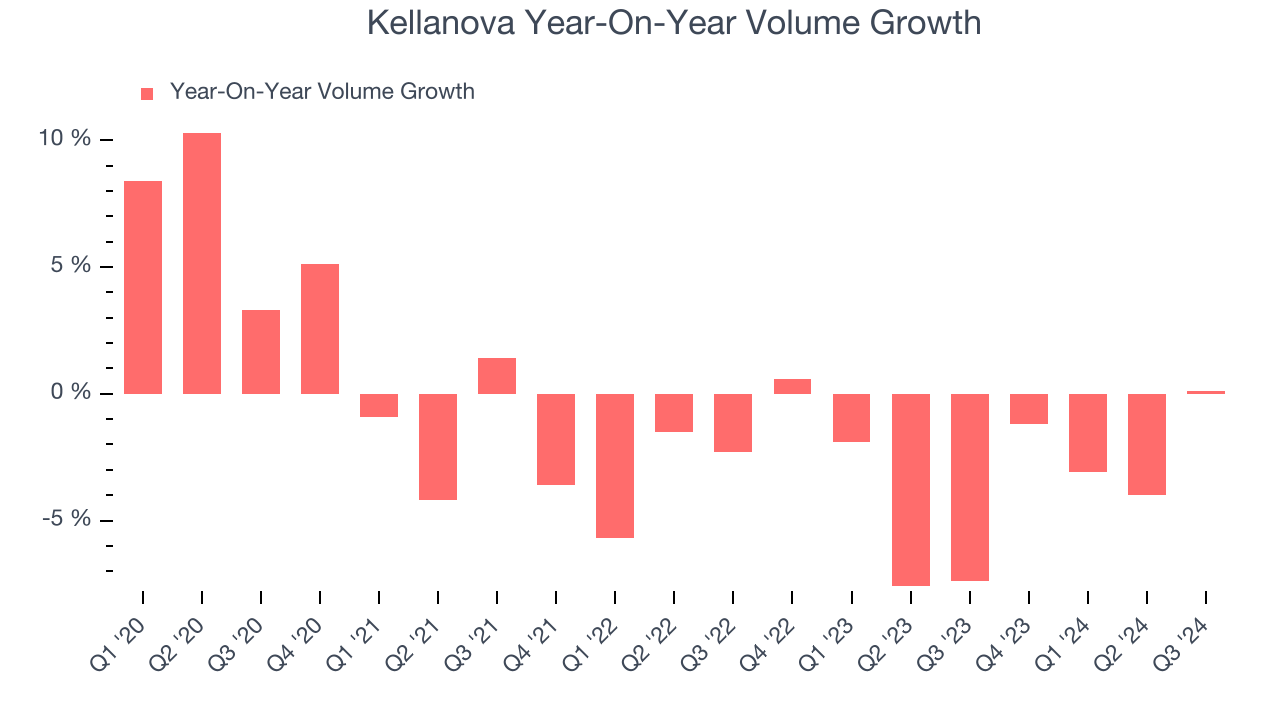

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Kellanova’s average quarterly sales volumes have shrunk by 3.1% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Kellanova’s revenue to stall. While this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

Final Judgment

Kellanova isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 21× forward price-to-earnings (or $80.74 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Kellanova

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.