Over the past six months, Carter’s stock price fell to $50.45. Shareholders have lost 17.4% of their capital, which is disappointing considering the S&P 500 has climbed by 16.8%. This might have investors contemplating their next move.

Is there a buying opportunity in Carter's, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're cautious about Carter's. Here are three reasons why you should be careful with CRI and a stock we'd rather own.

Why Do We Think Carter's Will Underperform?

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE: CRI) is an American designer and marketer of children's apparel.

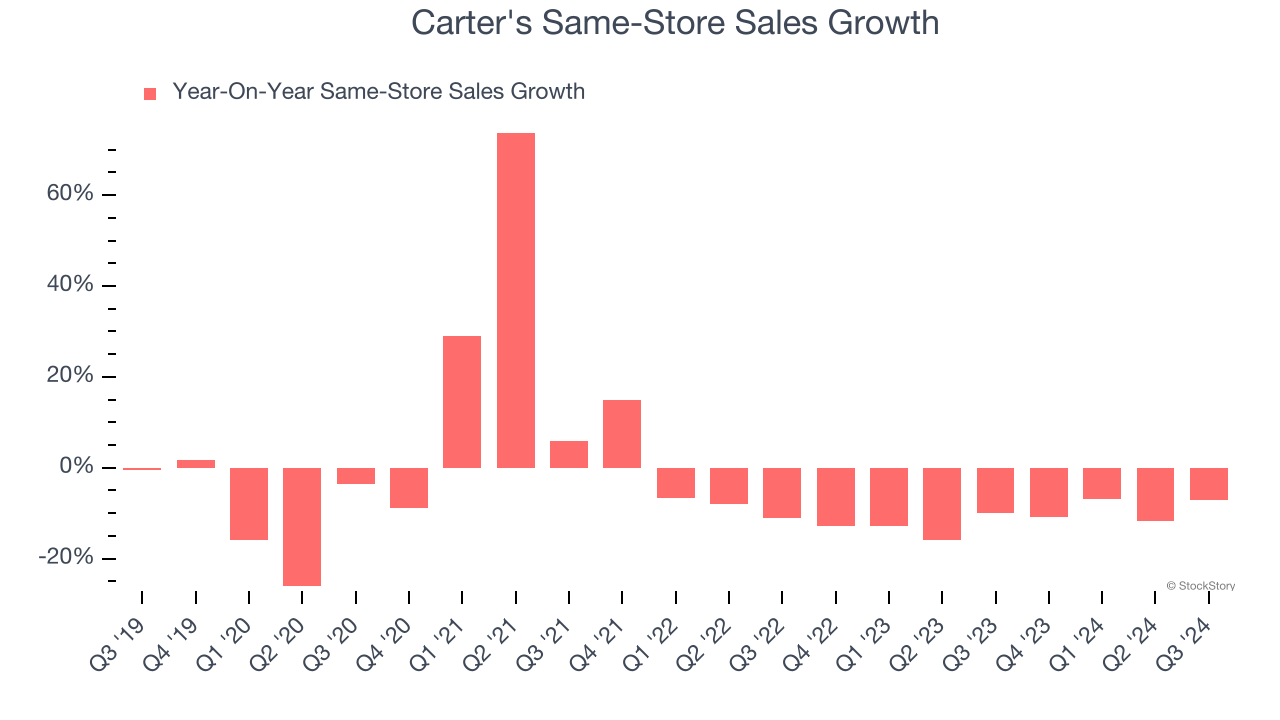

1. Shrinking Same-Store Sales Indicate Waning Demand

We can better understand Apparel and Accessories companies by analyzing their same-store sales. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Carter’s underlying demand characteristics.

Over the last two years, Carter’s same-store sales averaged 11% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Carter's might have to close some locations or change its strategy and pricing, which can disrupt operations.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Carter’s revenue to drop by 1.1%. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

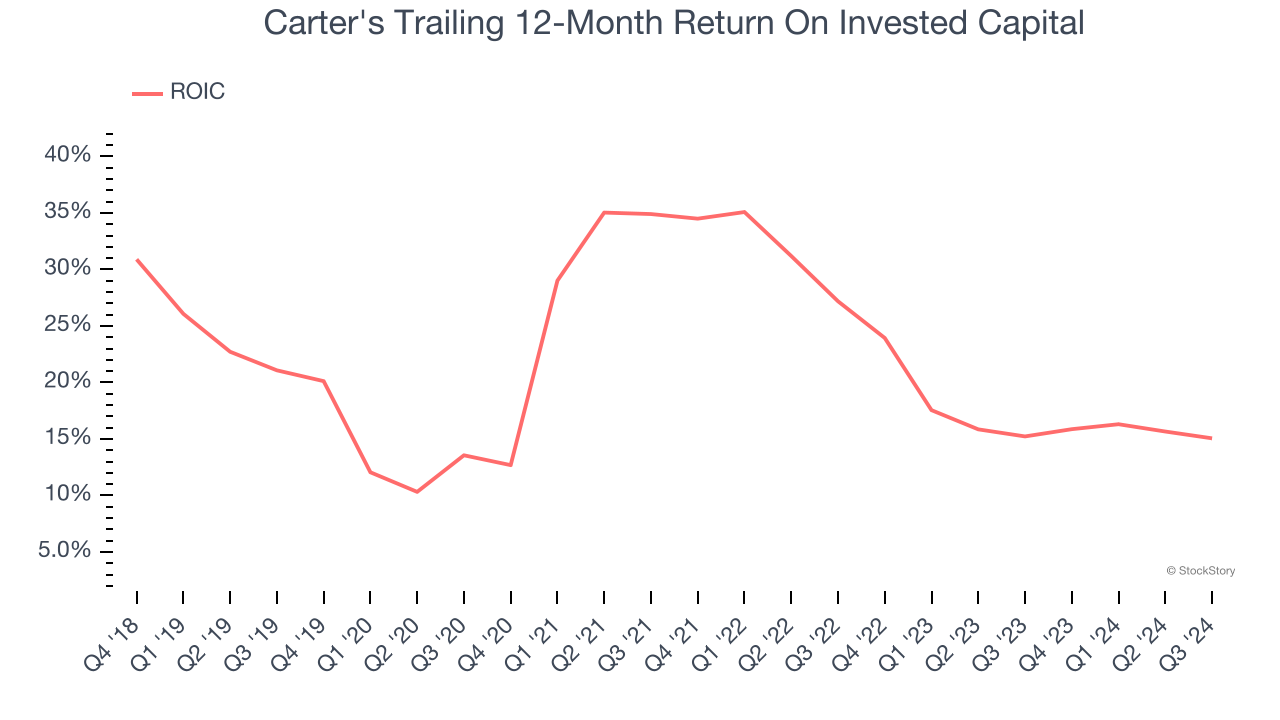

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Carter’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Carter's falls short of our quality standards. Following the recent decline, the stock trades at 10.1× forward price-to-earnings (or $50.45 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Carter's

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.