Over the past six months, Pangaea’s shares (currently trading at $5.34) have posted a disappointing 17.7% loss, well below the S&P 500’s 16.9% gain. This might have investors contemplating their next move.

Is now the time to buy Pangaea, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're cautious about Pangaea. Here are three reasons why we avoid PANL and a stock we'd rather own.

Why Do We Think Pangaea Will Underperform?

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

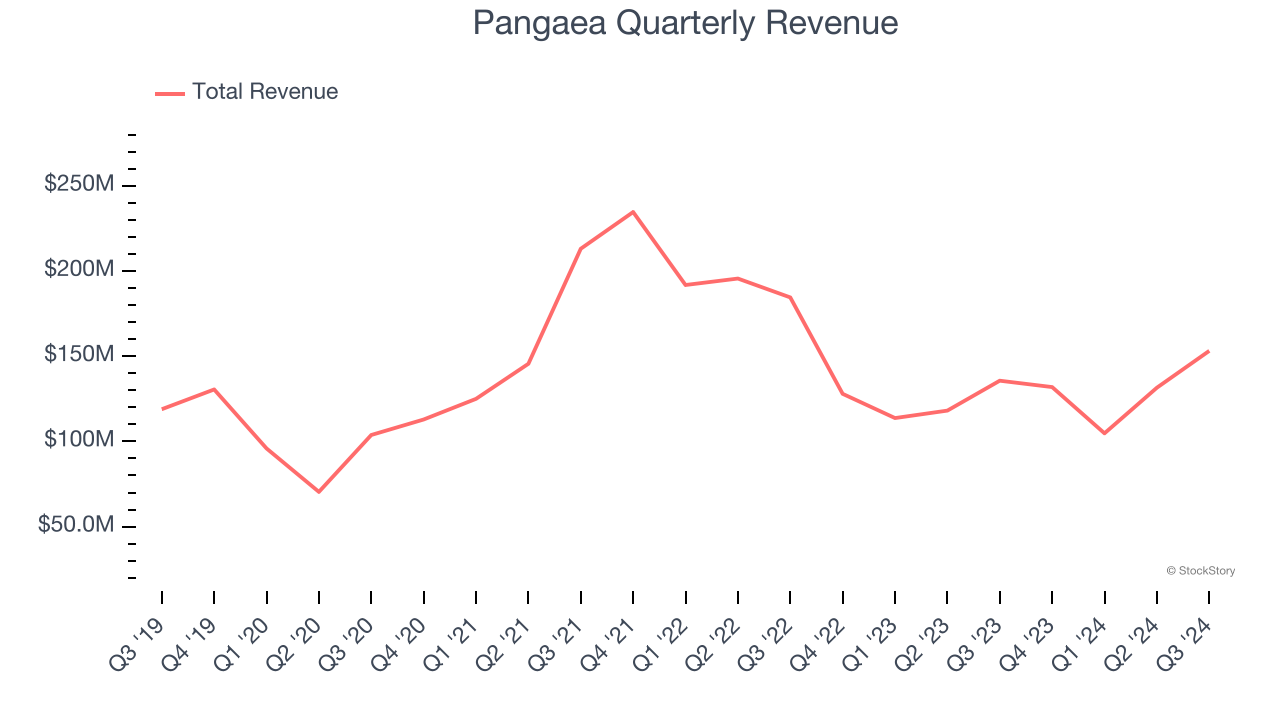

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Pangaea grew its sales at a mediocre 6.3% compounded annual growth rate. This was below our standard for the industrials sector.

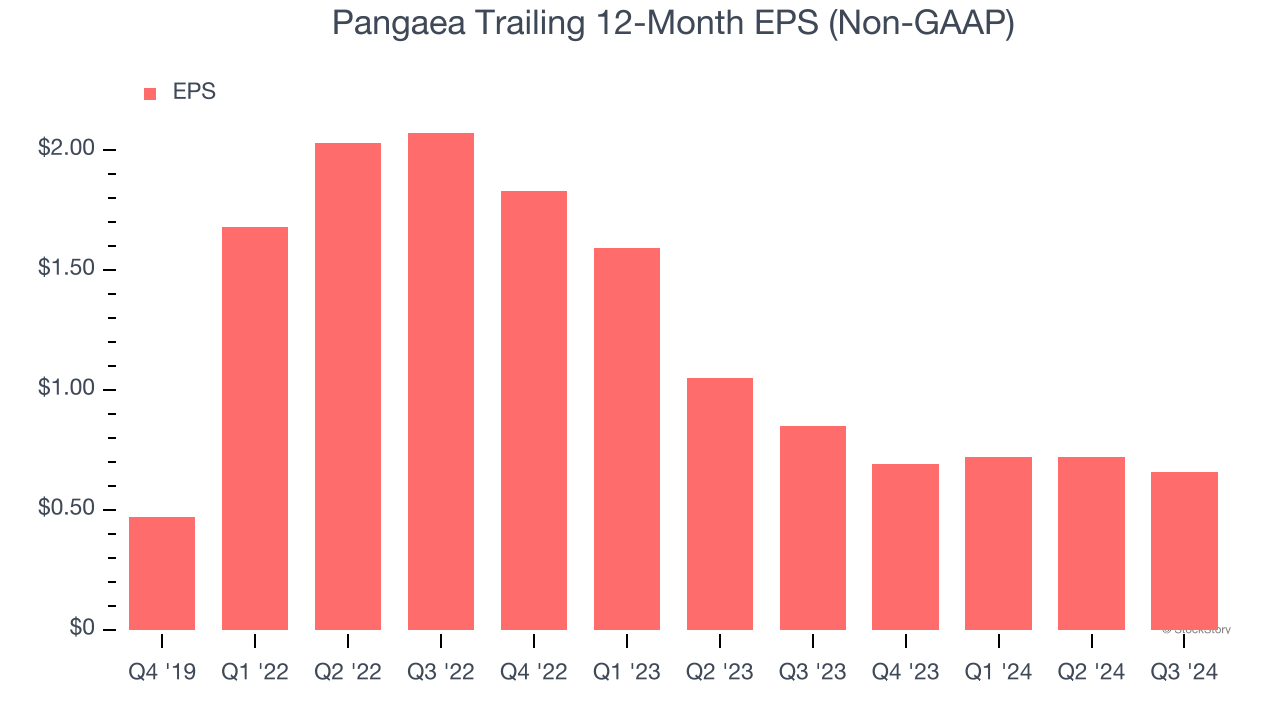

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Pangaea’s unimpressive 6% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

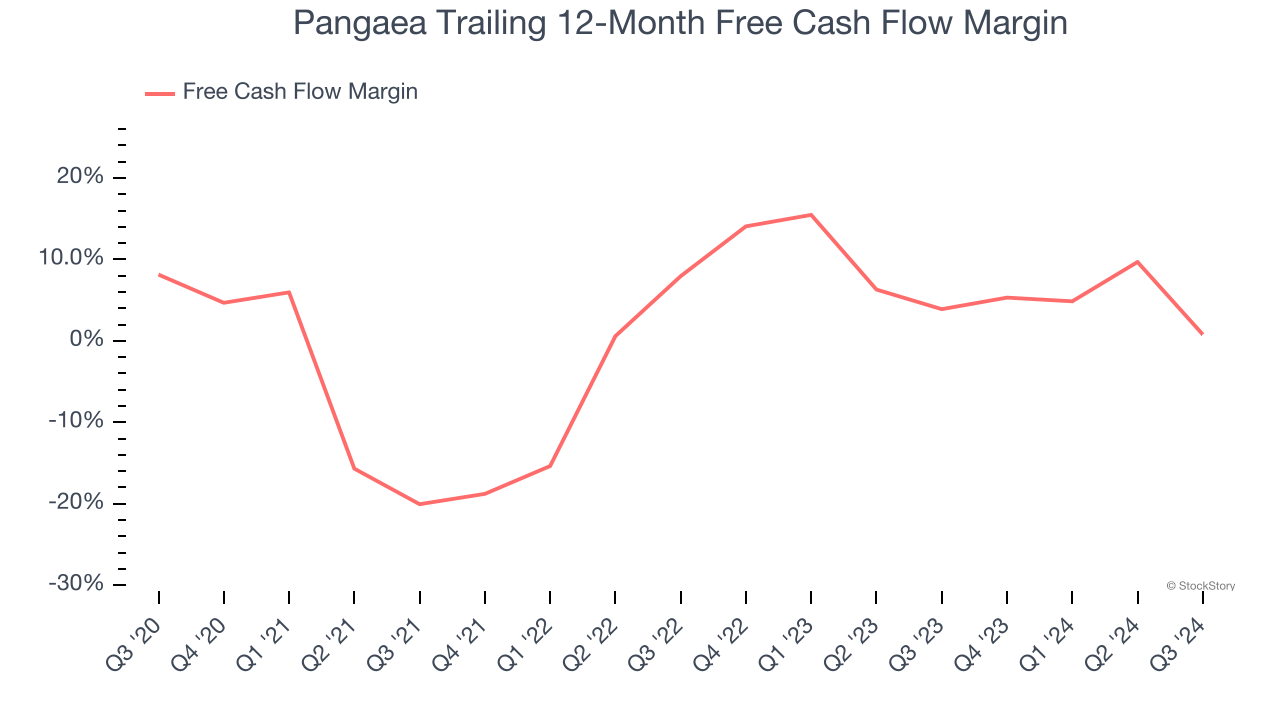

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Pangaea’s margin dropped by 7.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Pangaea’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Pangaea doesn’t pass our quality test. After the recent drawdown, the stock trades at 6× forward price-to-earnings (or $5.34 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Pangaea

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.