Industrial fluid and energy systems manufacturer Graham Corporation (NYSE: GHM) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 7.3% year on year to $47.04 million. The company’s full-year revenue guidance of $205 million at the midpoint came in 1.4% below analysts’ estimates. Its GAAP profit of $0.14 per share was 40% above analysts’ consensus estimates.

Is now the time to buy Graham Corporation? Find out by accessing our full research report, it’s free.

Graham Corporation (GHM) Q4 CY2024 Highlights:

- Revenue: $47.04 million vs analyst estimates of $49.5 million (7.3% year-on-year growth, 5% miss)

- EPS (GAAP): $0.14 vs analyst estimates of $0.10 (40% beat)

- Adjusted EBITDA: $4.03 million vs analyst estimates of $3.5 million (8.6% margin, relatively in line)

- The company reconfirmed its revenue guidance for the full year of $205 million at the midpoint

- EBITDA guidance for the full year is $19.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.7%, in line with the same quarter last year

- Free Cash Flow was -$2.11 million, down from $5.70 million in the same quarter last year

- Backlog: $385 million at quarter end

- Market Capitalization: $514.9 million

“Our strong performance through the first three quarters of our fiscal year reflects continually improving execution across our business. Customer demand for our diversified product portfolio is robust, driving margin expansion through improved product mix and operational efficiency. The progress we have shown to date, coupled with advancing discussions on both new programs and expansions with existing customers, reinforces our confidence in achieving our long-term growth targets,” said Daniel J. Thoren, Chief Executive Officer.

Company Overview

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE: GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

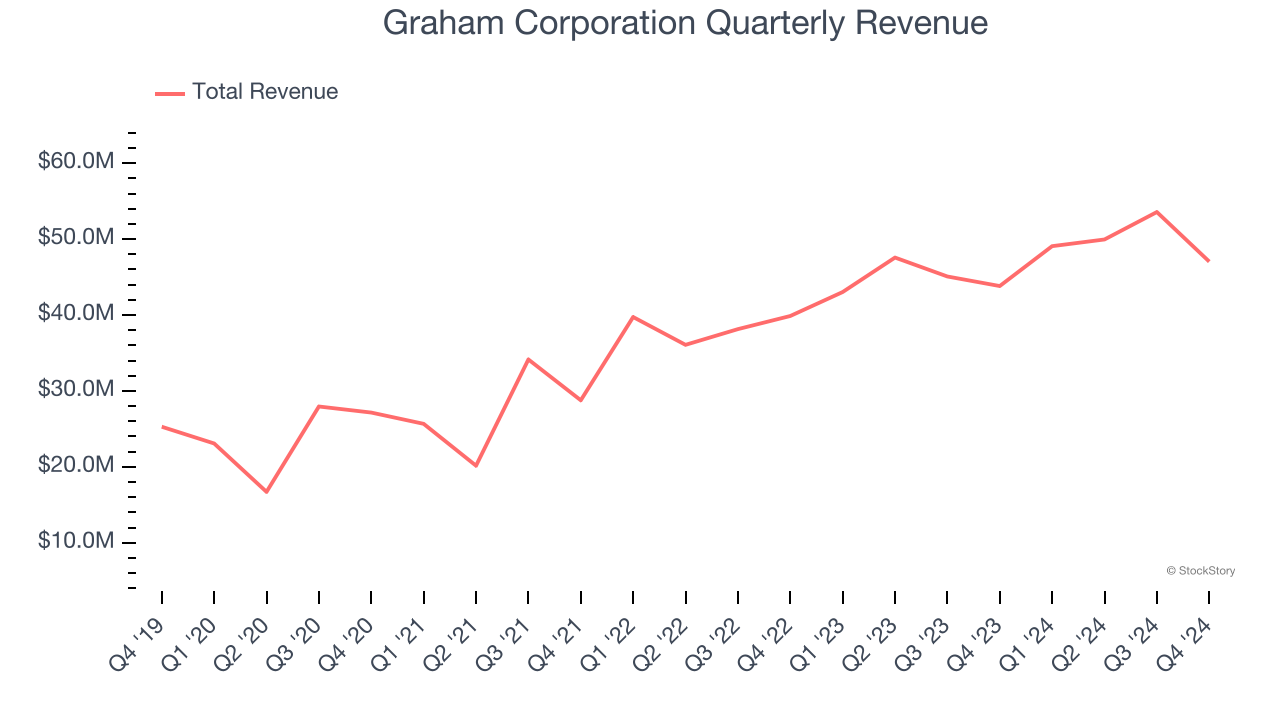

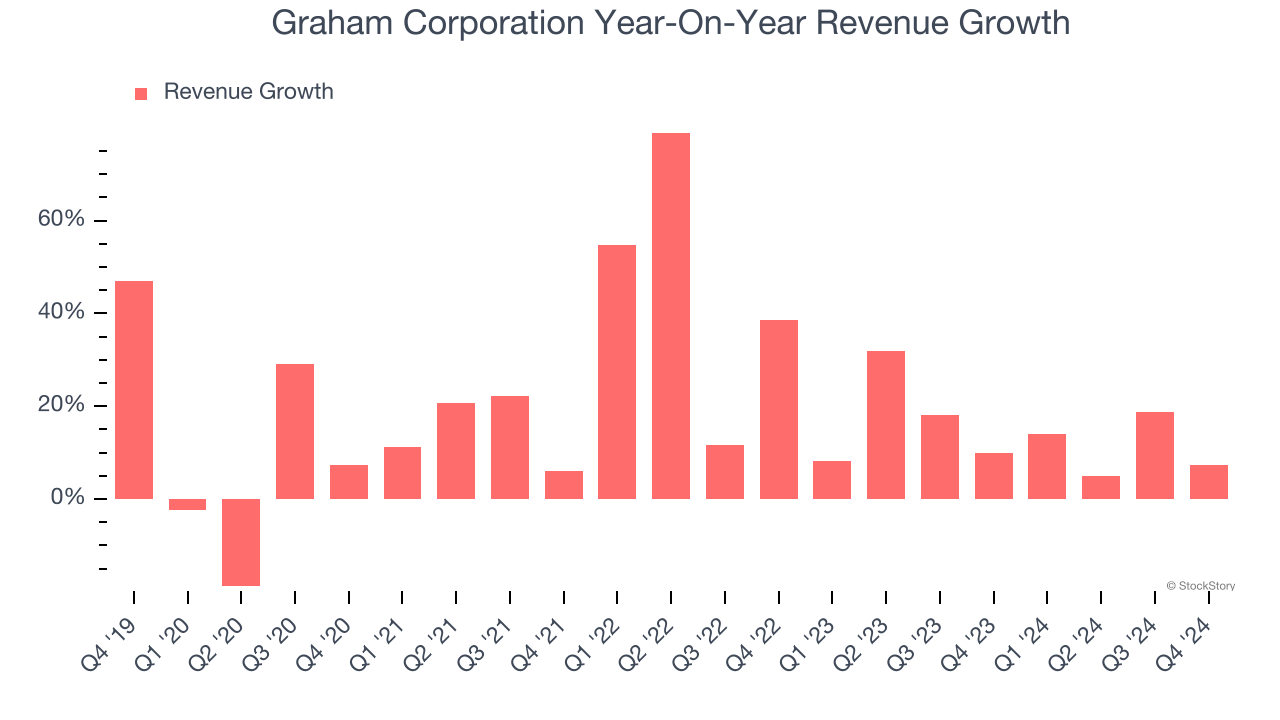

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Graham Corporation’s 17% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Graham Corporation’s annualized revenue growth of 13.9% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Graham Corporation’s revenue grew by 7.3% year on year to $47.04 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, similar to its two-year rate. Despite the slowdown, this projection is admirable and suggests the market is factoring in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

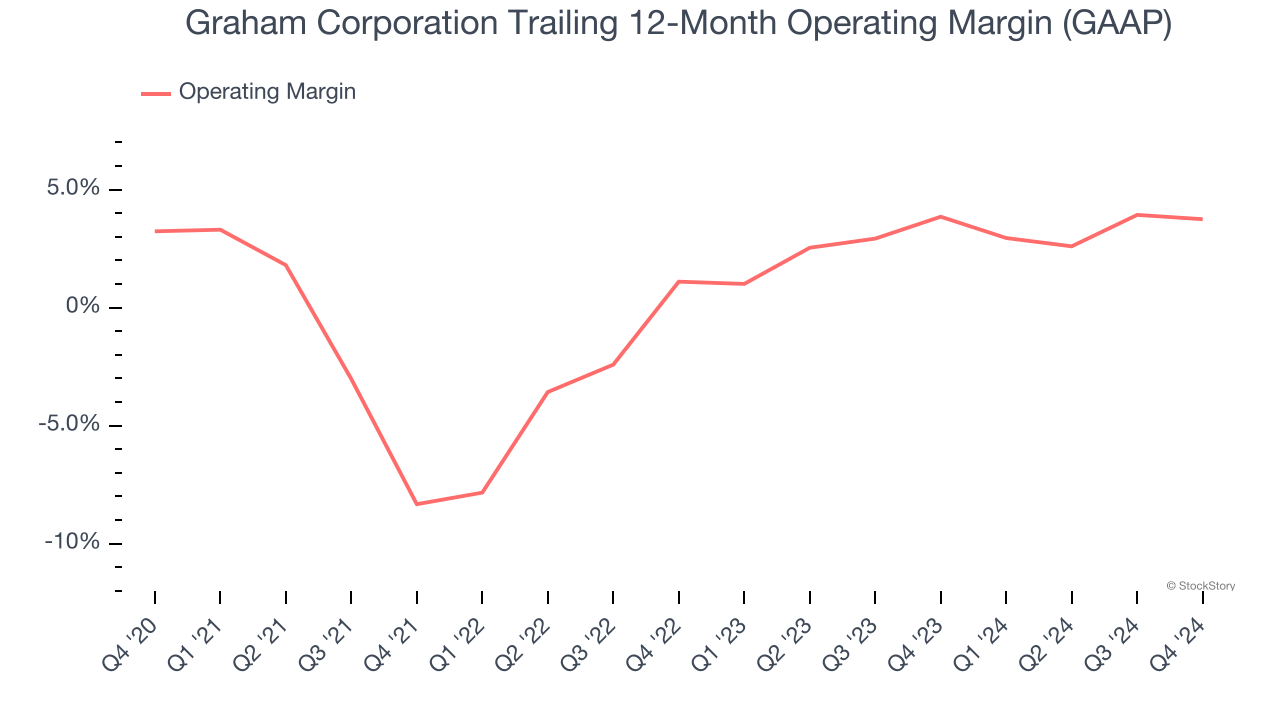

Operating Margin

Graham Corporation was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Graham Corporation’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, Graham Corporation generated an operating profit margin of 4.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

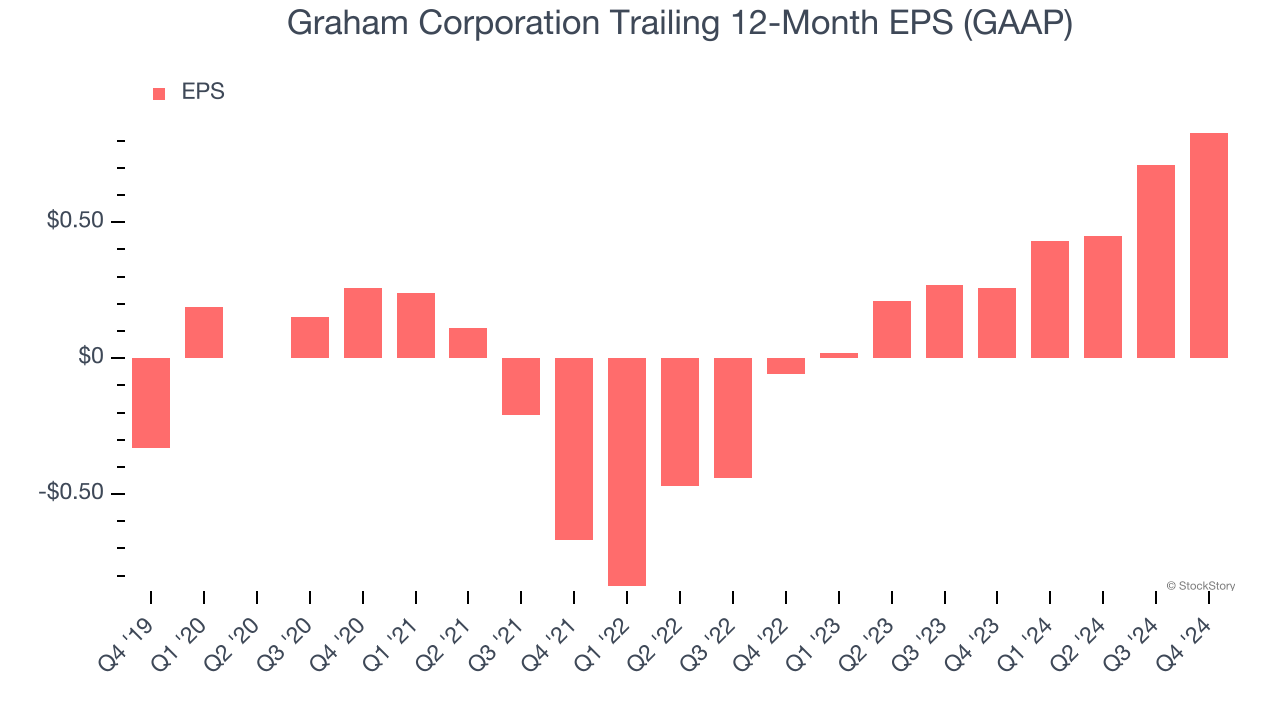

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Graham Corporation’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graham Corporation, its two-year annual EPS growth of 298% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Graham Corporation reported EPS at $0.14, up from $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Graham Corporation’s full-year EPS of $0.83 to grow 21.7%.

Key Takeaways from Graham Corporation’s Q4 Results

We liked how Graham Corporation beat analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. This is weighing on shares, and the stock traded down 2.6% to $45.88 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.