Since February 2020, the S&P 500 has delivered a total return of 82.4%. But one standout stock has more than doubled the market - over the past five years, Intuitive Surgical has surged 205% to $588.60 per share. Its momentum hasn’t stopped as it’s also gained 31% in the last six months thanks to its solid quarterly results, beating the S&P by 14.2%.

Is now still a good time to buy ISRG? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Intuitive Surgical Spark Debate?

Founded in 1995 as a pioneer in its field, Intuitive Surgical (NASDAQ: ISRG) is a medical technology company best known for its da Vinci robotic surgical systems, which enable minimally invasive surgeries using automation.

Two Things to Like:

1. Rising Sales Volumes Show Elevated Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Surgical Equipment & Consumables - Specialty company because there’s a ceiling to what customers will pay.

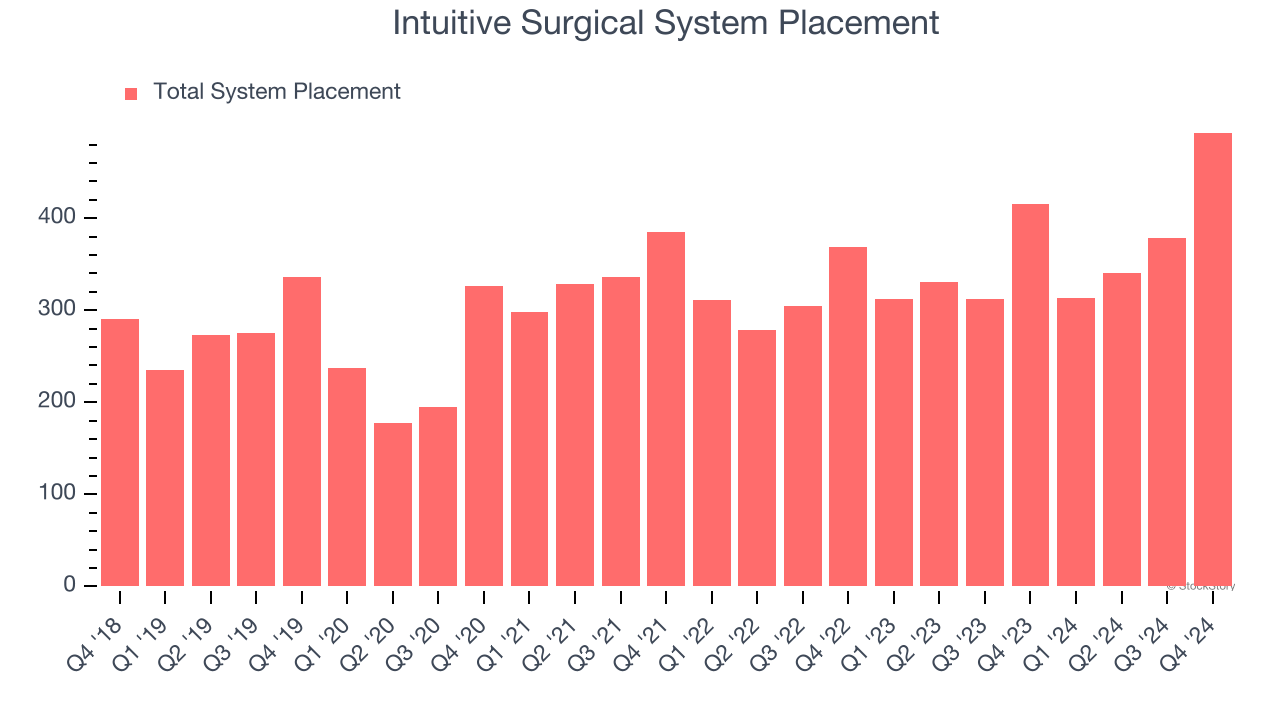

Intuitive Surgical’s system placement punched in at 493 in the latest quarter, and over the last two years, averaged 9.7% year-on-year growth. This performance was solid and shows there is something unique about its products.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Intuitive Surgical’s revenue to rise by 14.9%, close to its 15.9% annualized growth for the past two years. This projection is commendable and implies the market is factoring in success for its products and services.

One Reason to be Careful:

New Investments Aren’t Moving the Needle

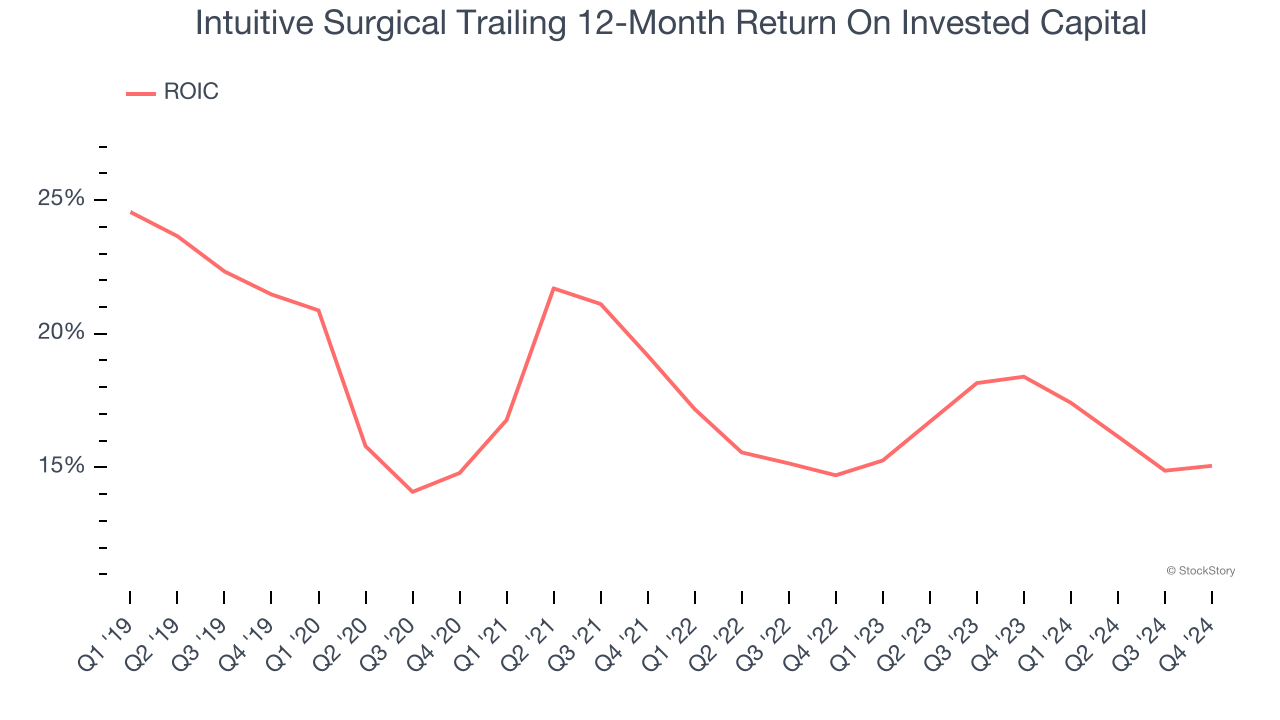

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Intuitive Surgical’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

Final Judgment

Intuitive Surgical has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 74.7× forward price-to-earnings (or $588.60 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Intuitive Surgical

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.