Heavy equipment distributor Custom Truck One Source (NYSE: CTOS) missed Wall Street’s revenue expectations in Q1 CY2025 as sales rose 2.7% year on year to $422.2 million. On the other hand, the company’s full-year revenue guidance of $2.02 billion at the midpoint came in 2.1% above analysts’ estimates. Its GAAP loss of $0.08 per share was 36% below analysts’ consensus estimates.

Is now the time to buy Custom Truck One Source? Find out by accessing our full research report, it’s free.

Custom Truck One Source (CTOS) Q1 CY2025 Highlights:

- Revenue: $422.2 million vs analyst estimates of $435.5 million (2.7% year-on-year growth, 3% miss)

- EPS (GAAP): -$0.08 vs analyst expectations of -$0.06 (36% miss)

- Adjusted EBITDA: $73.43 million vs analyst estimates of $78.2 million (17.4% margin, 6.1% miss)

- The company reconfirmed its revenue guidance for the full year of $2.02 billion at the midpoint

- EBITDA guidance for the full year is $380 million at the midpoint, above analyst estimates of $375.9 million

- Operating Margin: 2.9%, down from 4.5% in the same quarter last year

- Free Cash Flow was -$56.3 million compared to -$89.93 million in the same quarter last year

- Backlog: $420.1 million at quarter end

- Market Capitalization: $954.5 million

Company Overview

Inspired by a family gas station, Custom Truck One Source (NYSE: CTOS) is a distributor of trucks and heavy equipment.

Sales Growth

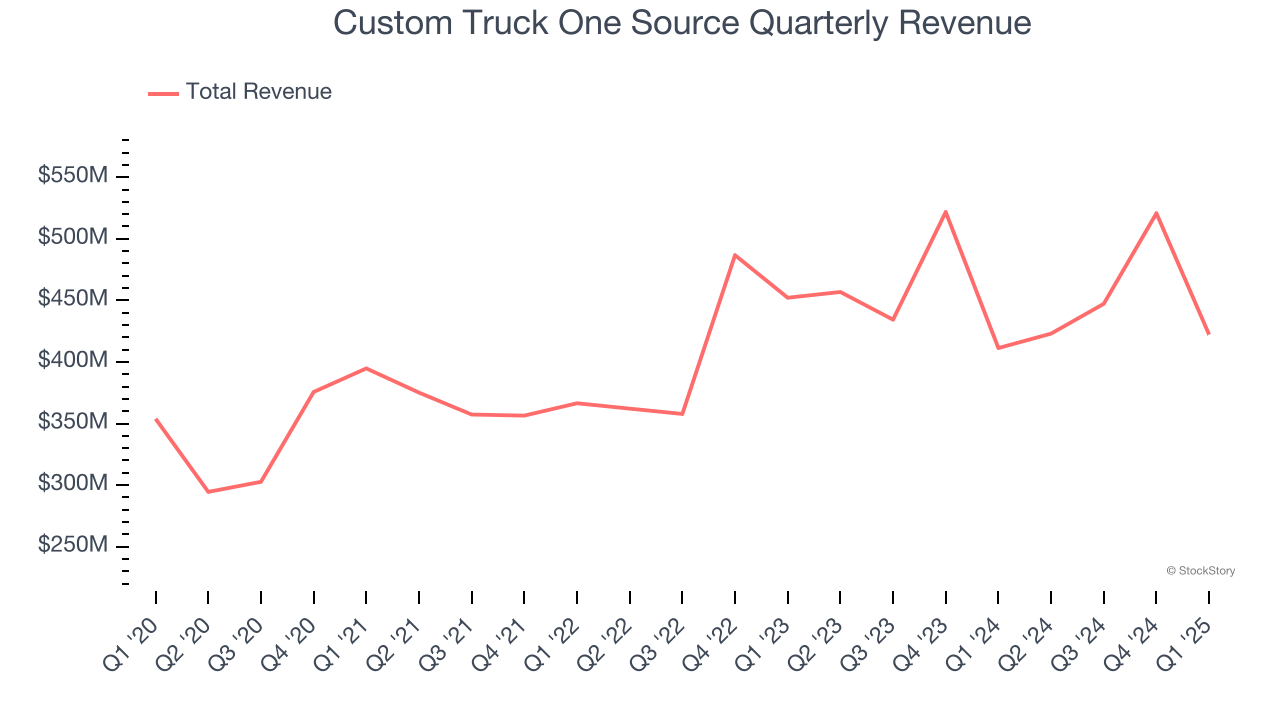

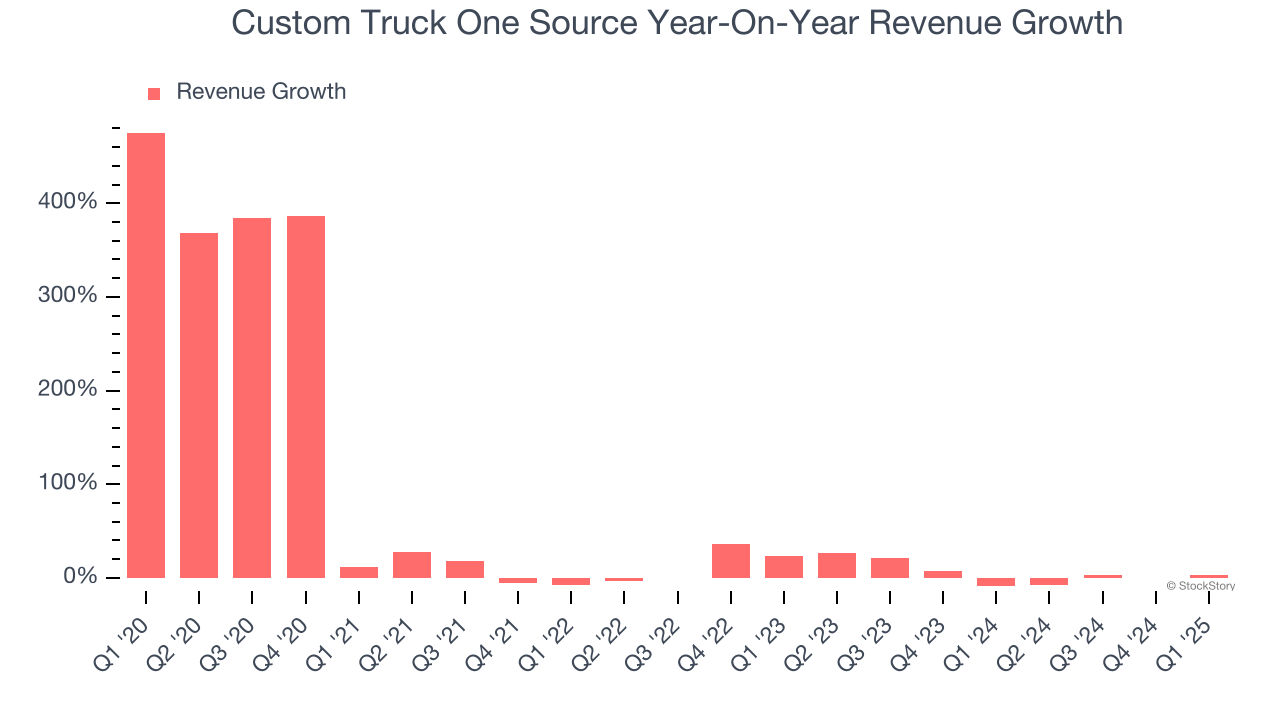

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Custom Truck One Source’s 26.7% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Custom Truck One Source’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.6% over the last two years was well below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Equipment Rental and Aftermarket Parts and Services, which are 36.6% and 8.4% of revenue. Over the last two years, Custom Truck One Source’s Equipment Rental revenue ( lifts, cranes, trucks) averaged 4.4% year-on-year declines. On the other hand, its Aftermarket Parts and Services revenue (maintenance and repair) averaged 1.4% growth.

This quarter, Custom Truck One Source’s revenue grew by 2.7% year on year to $422.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

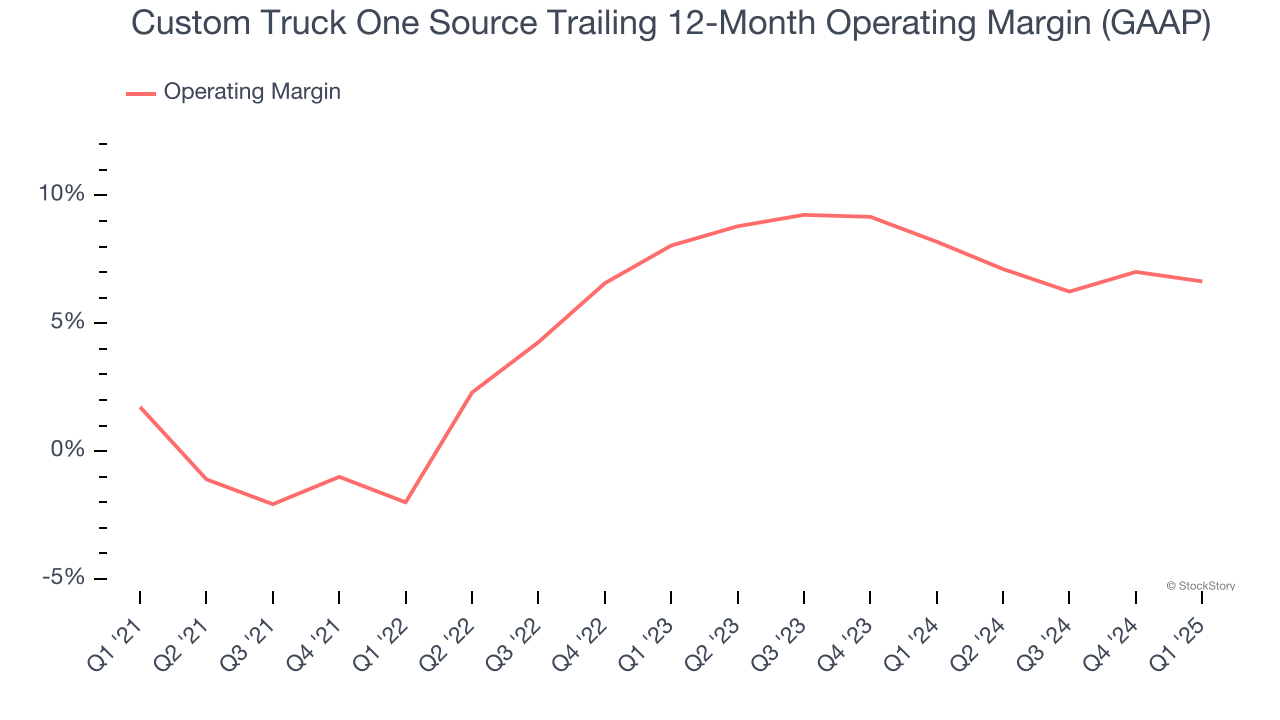

Custom Truck One Source was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.9% was weak for an industrials business.

On the plus side, Custom Truck One Source’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Custom Truck One Source generated an operating profit margin of 2.9%, down 1.5 percentage points year on year. Since Custom Truck One Source’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

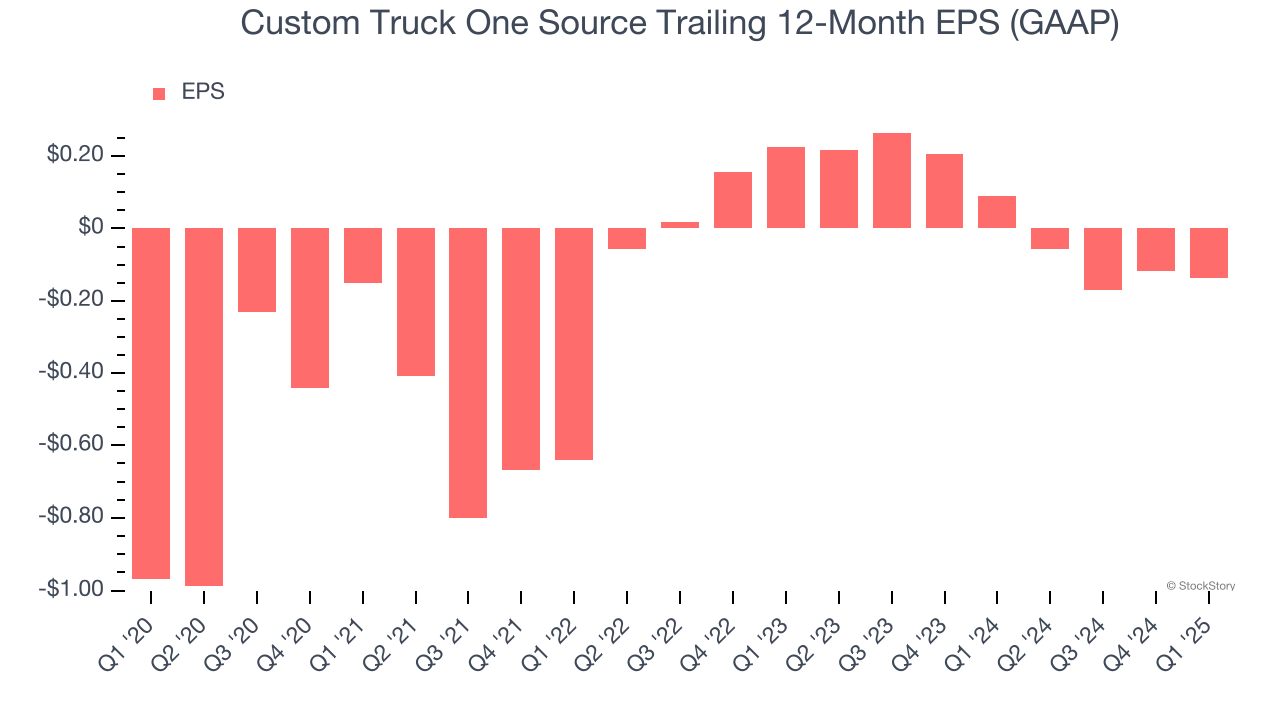

Although Custom Truck One Source’s full-year earnings are still negative, it reduced its losses and improved its EPS by 32.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Custom Truck One Source, its EPS declined by 61.6% annually over the last two years while its revenue grew by 4.6%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Custom Truck One Source’s earnings to better understand the drivers of its performance. Custom Truck One Source’s operating margin has declined by 5.9 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Custom Truck One Source reported EPS at negative $0.08, down from negative $0.06 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Custom Truck One Source’s full-year EPS of negative $0.14 will reach break even.

Key Takeaways from Custom Truck One Source’s Q1 Results

It was great to see Custom Truck One Source’s full-year revenue guidance top analysts’ expectations. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.5% to $3.83 immediately after reporting.

Custom Truck One Source’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.