Diabetes technology company Tandem Diabetes Care (NASDAQ: TNDM) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 22.3% year on year to $234.4 million. The company expects the full year’s revenue to be around $1 billion, close to analysts’ estimates. Its GAAP loss of $1.97 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Tandem Diabetes? Find out by accessing our full research report, it’s free.

Tandem Diabetes (TNDM) Q1 CY2025 Highlights:

- Revenue: $234.4 million vs analyst estimates of $219.4 million (22.3% year-on-year growth, 6.8% beat)

- EPS (GAAP): -$1.97 vs analyst estimates of -$0.59 (significant miss)

- Adjusted EBITDA: -$4.69 million vs analyst estimates of -$14.43 million (-2% margin, 67.5% beat)

- The company reconfirmed its revenue guidance for the full year of $1 billion at the midpoint

- Operating Margin: -51.6%, down from -21.7% in the same quarter last year

- Sales Volumes rose 13.3% year on year (-11.8% in the same quarter last year)

- Market Capitalization: $1.12 billion

Company Overview

With technology that automatically adjusts insulin delivery based on continuous glucose monitoring data, Tandem Diabetes Care (NASDAQ: TNDM) develops and manufactures automated insulin delivery systems that help people with diabetes manage their blood glucose levels.

Sales Growth

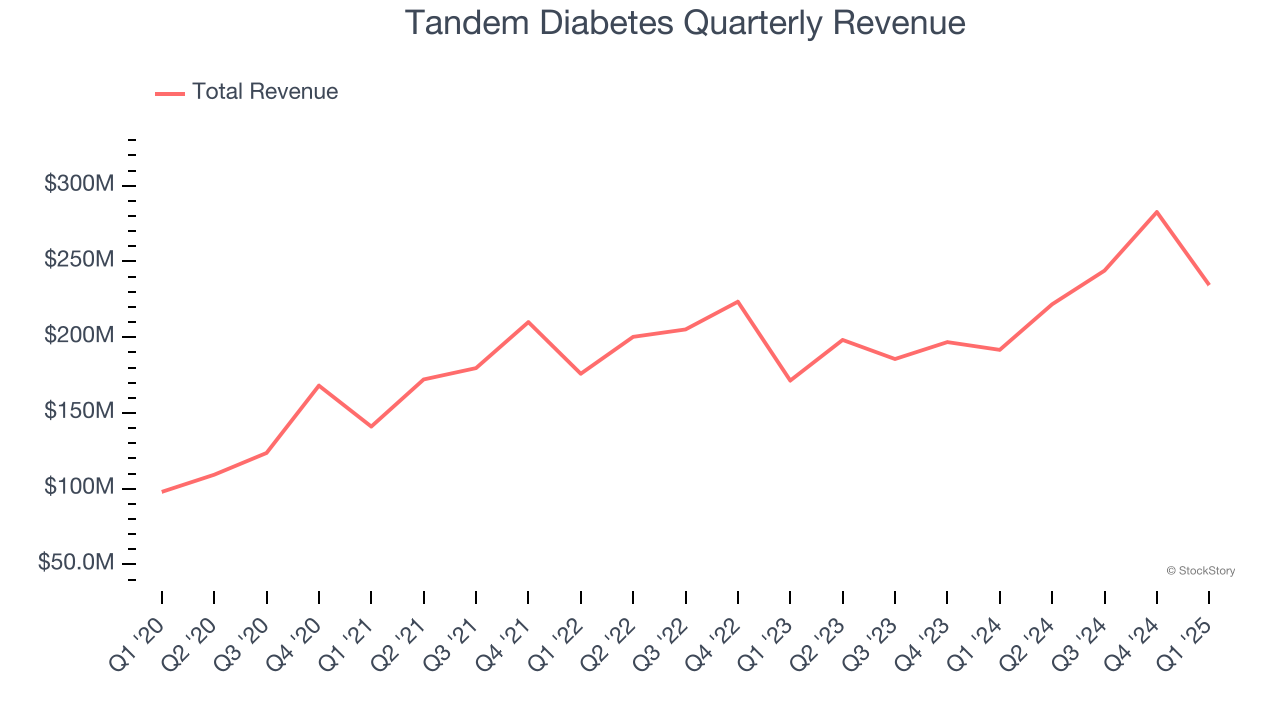

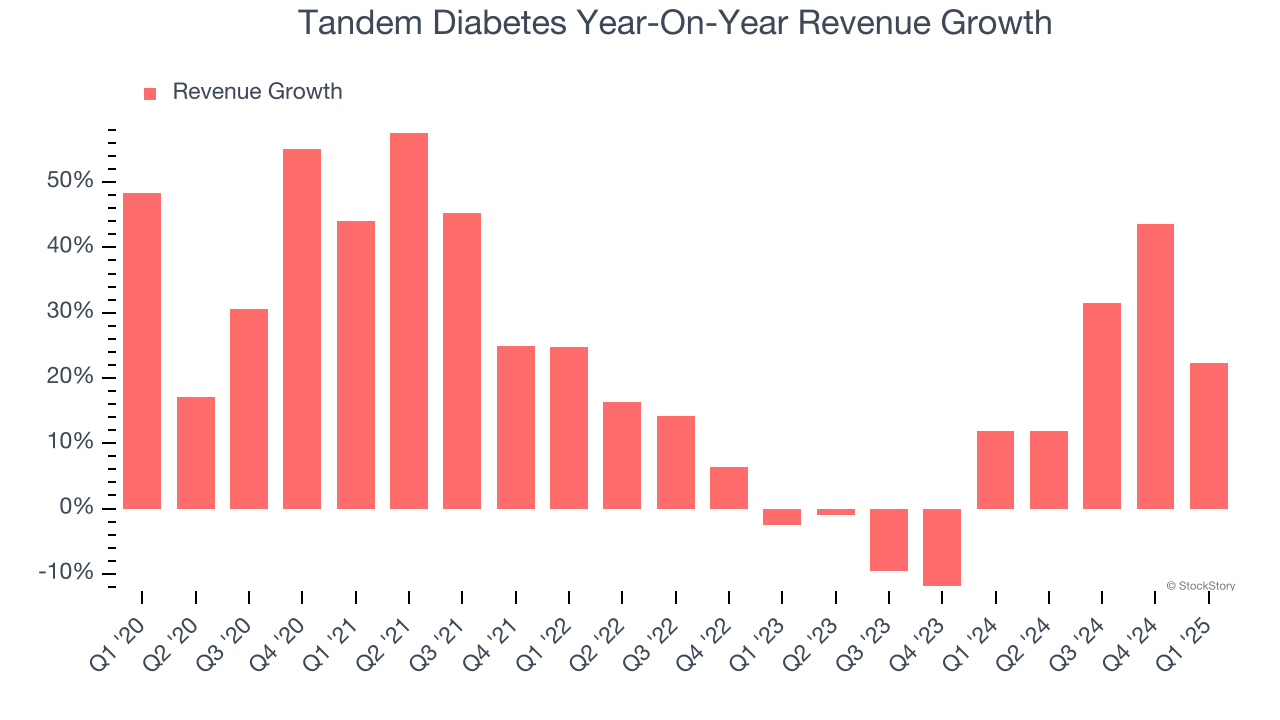

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Tandem Diabetes’s 20% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Tandem Diabetes’s annualized revenue growth of 10.8% over the last two years is below its five-year trend, but we still think the results were respectable.

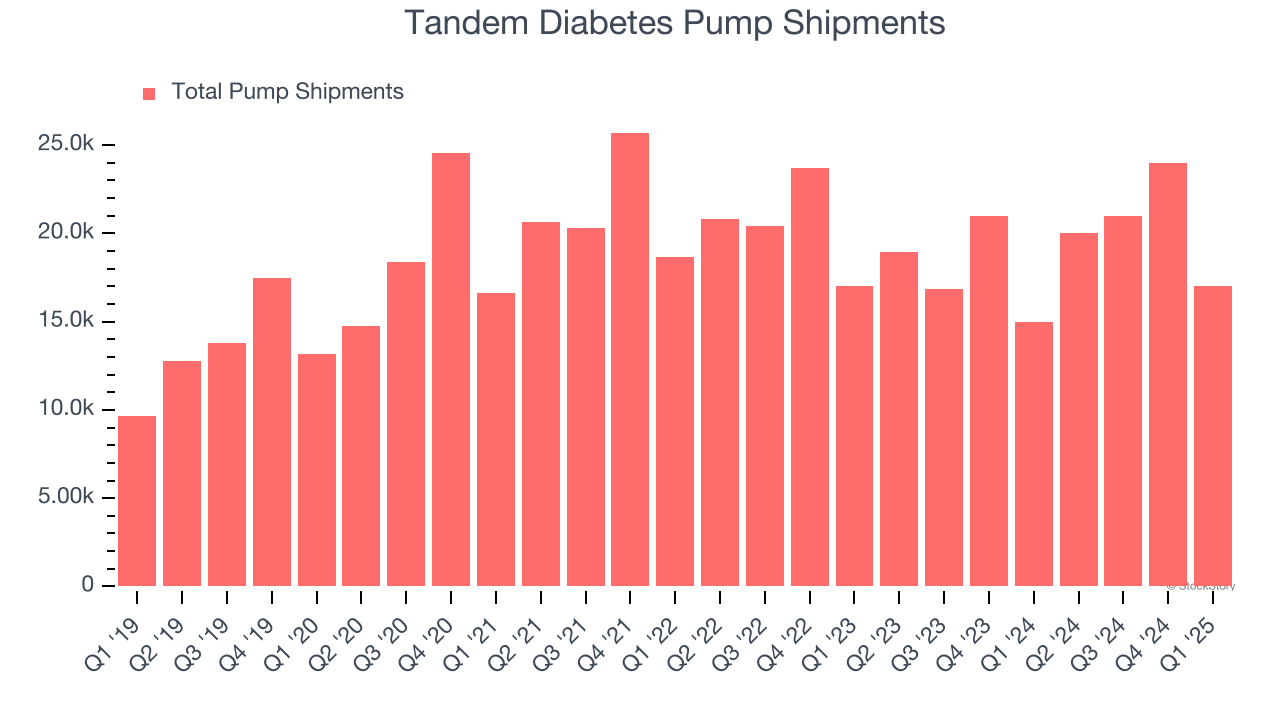

We can dig further into the company’s revenue dynamics by analyzing its number of pump shipments, which reached 17,000 in the latest quarter. Over the last two years, Tandem Diabetes’s pump shipments averaged 1% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Tandem Diabetes reported robust year-on-year revenue growth of 22.3%, and its $234.4 million of revenue topped Wall Street estimates by 6.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

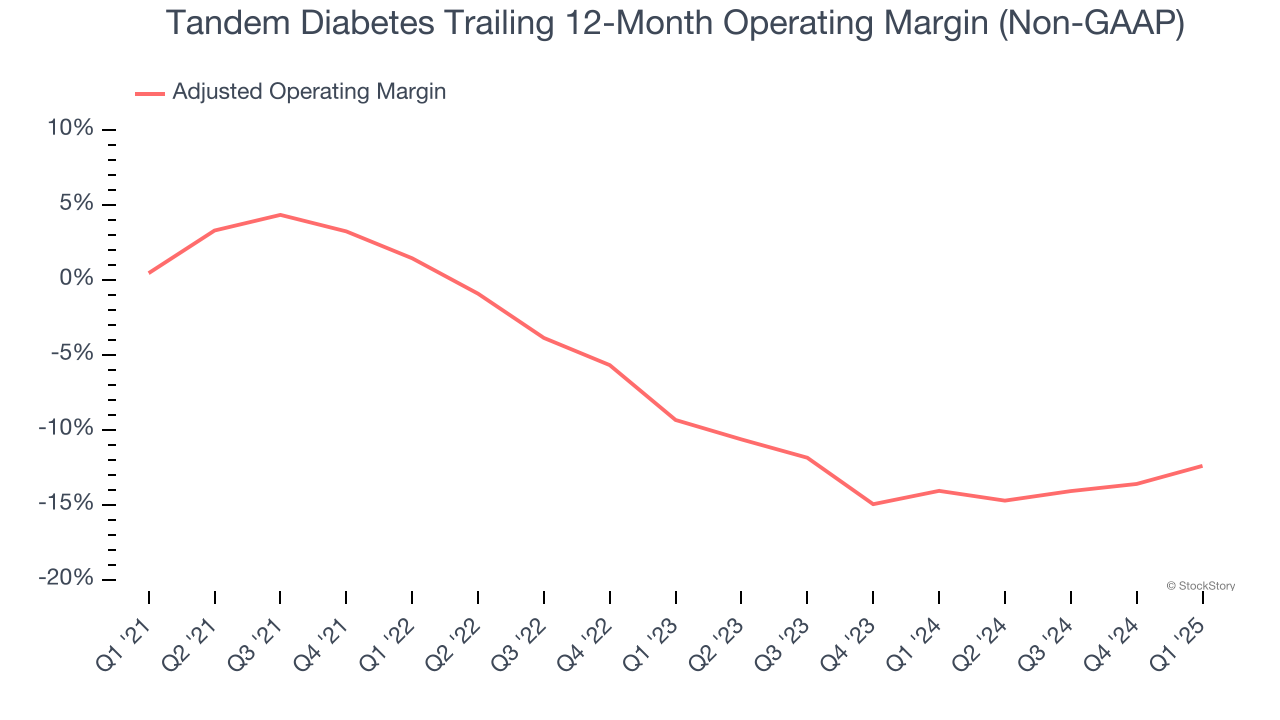

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Tandem Diabetes’s high expenses have contributed to an average adjusted operating margin of negative 7.6% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Tandem Diabetes’s adjusted operating margin decreased by 12.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Tandem Diabetes generated a negative 14.7% adjusted operating margin. The company's consistent lack of profits raise a flag.

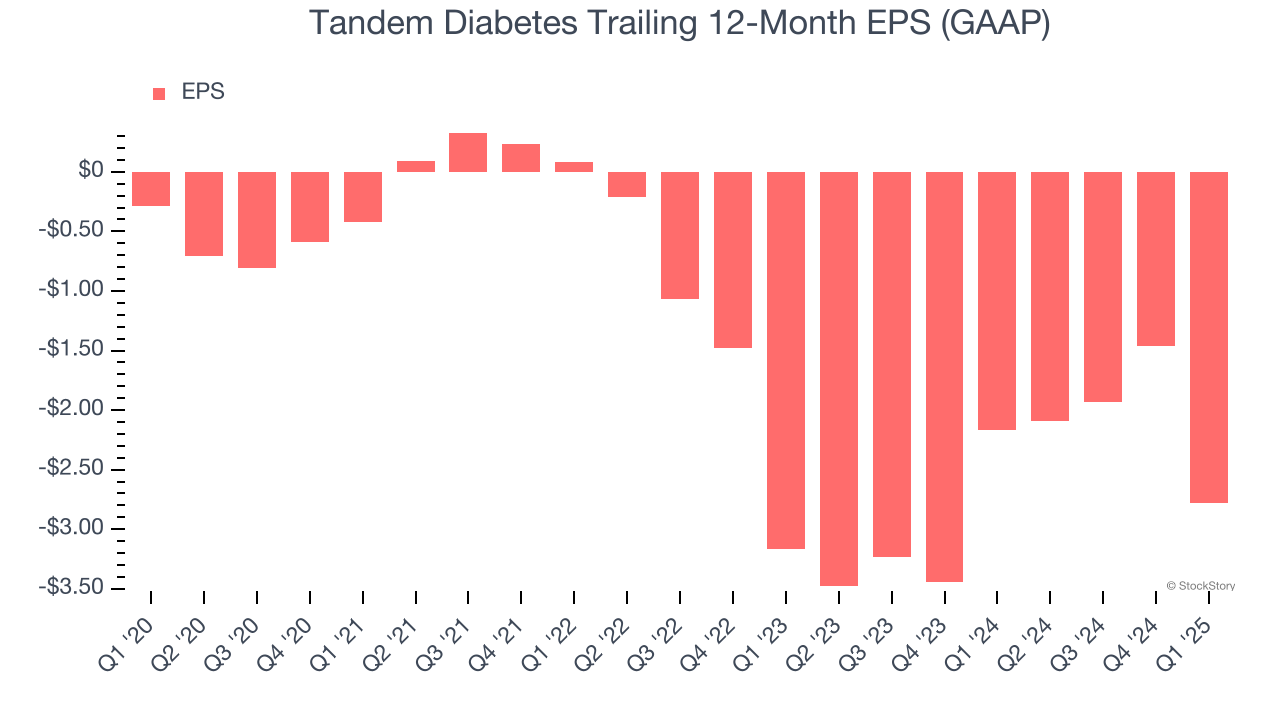

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Tandem Diabetes’s earnings losses deepened over the last five years as its EPS dropped 57.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Tandem Diabetes’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Tandem Diabetes reported EPS at negative $1.97, down from negative $0.65 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Tandem Diabetes to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.78 will advance to negative $1.04.

Key Takeaways from Tandem Diabetes’s Q1 Results

We were impressed by how significantly Tandem Diabetes blew past analysts’ revenue expectations this quarter. We were also happy its sales volume narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed significantly. Overall, this quarter had some key positives. The stock traded up 5.5% to $17.75 immediately following the results.

Big picture, is Tandem Diabetes a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.