ResMed trades at $254.11 per share and has stayed right on track with the overall market, gaining 8.9% over the last six months. At the same time, the S&P 500 has returned 5.4%.

Is RMD a buy right now? Find out in our full research report, it’s free.

Why Does ResMed Spark Debate?

Founded in 1989 to address the then-underdiagnosed condition of sleep apnea, ResMed (NYSE: RMD) develops cloud-connected medical devices and software solutions that treat sleep apnea, COPD, and other respiratory disorders for home and clinical use.

Two Positive Attributes:

1. Constant Currency Revenue Propels Growth

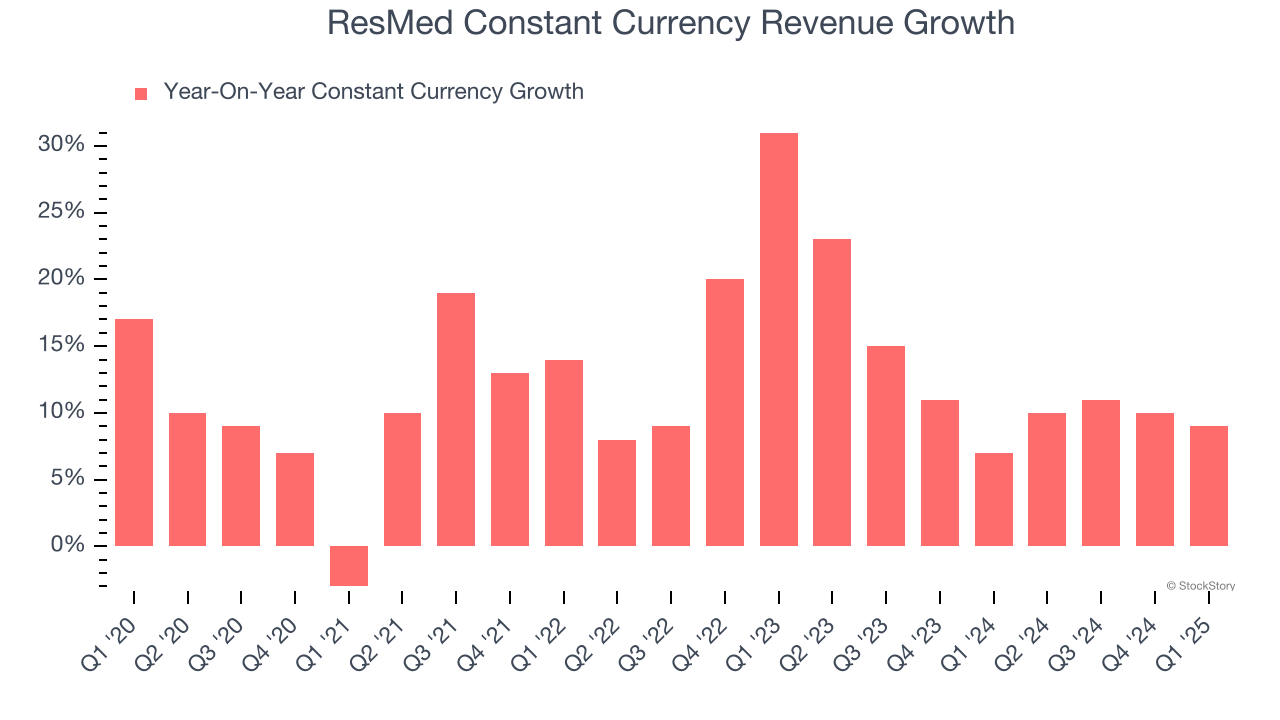

We can better understand Patient Monitoring companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of ResMed’s control and are not indicative of underlying demand.

Over the last two years, ResMed’s constant currency revenue averaged 12% year-on-year growth. This performance was impressive and shows it can expand quickly on a global scale regardless of the macroeconomic environment.

2. Increasing Free Cash Flow Margin Juices Financials

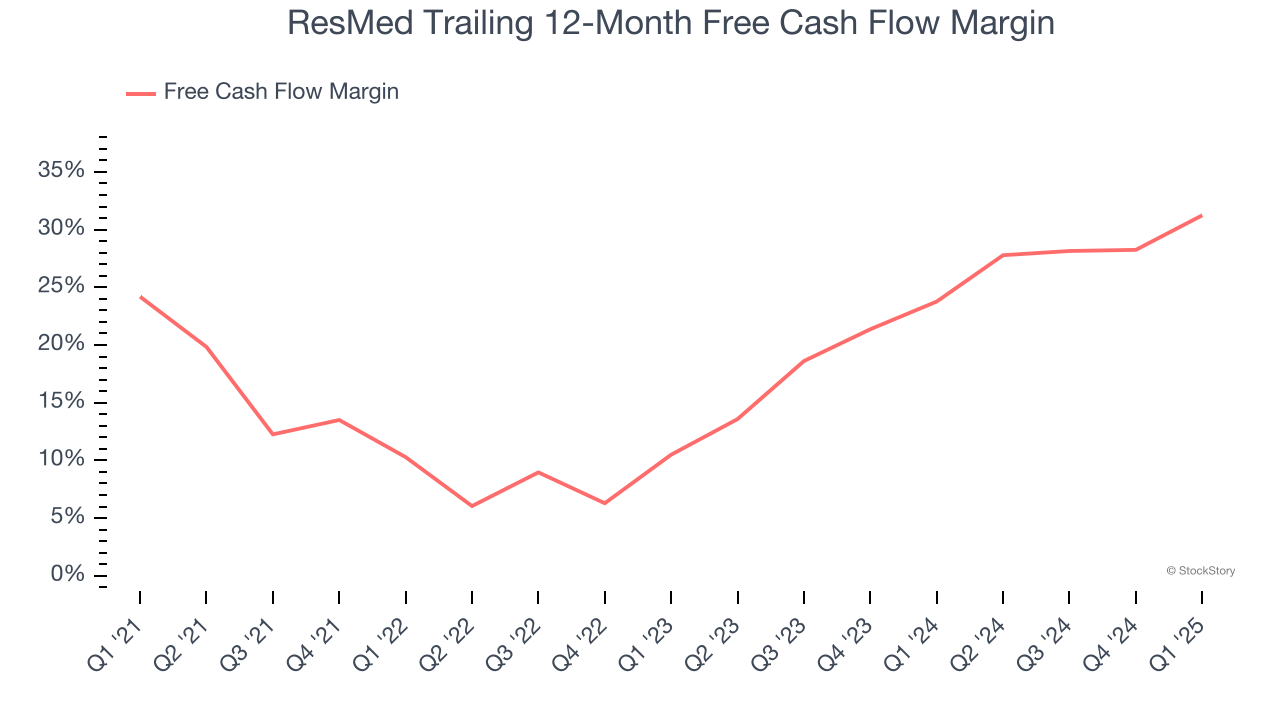

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, ResMed’s margin expanded by 7.1 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. ResMed’s free cash flow margin for the trailing 12 months was 31.2%.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

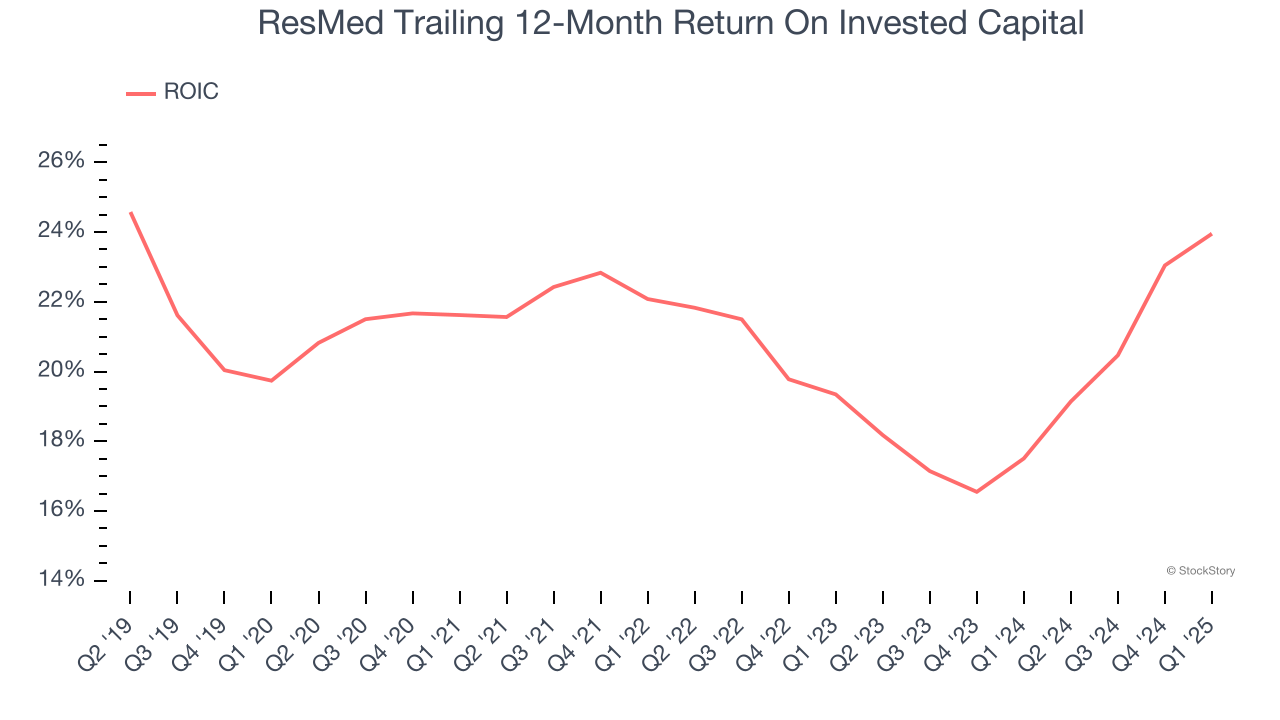

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, ResMed’s ROIC decreased by 1.1 percentage points annually over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

ResMed’s merits more than compensate for its flaws, but at $254.11 per share (or 25× forward P/E), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than ResMed

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.