Over the past six months, Hillman’s stock price fell to $8.10. Shareholders have lost 19.6% of their capital, which is disappointing considering the S&P 500 has climbed by 5.8%. This may have investors wondering how to approach the situation.

Is now the time to buy Hillman, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Hillman Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why HLMN doesn't excite us and a stock we'd rather own.

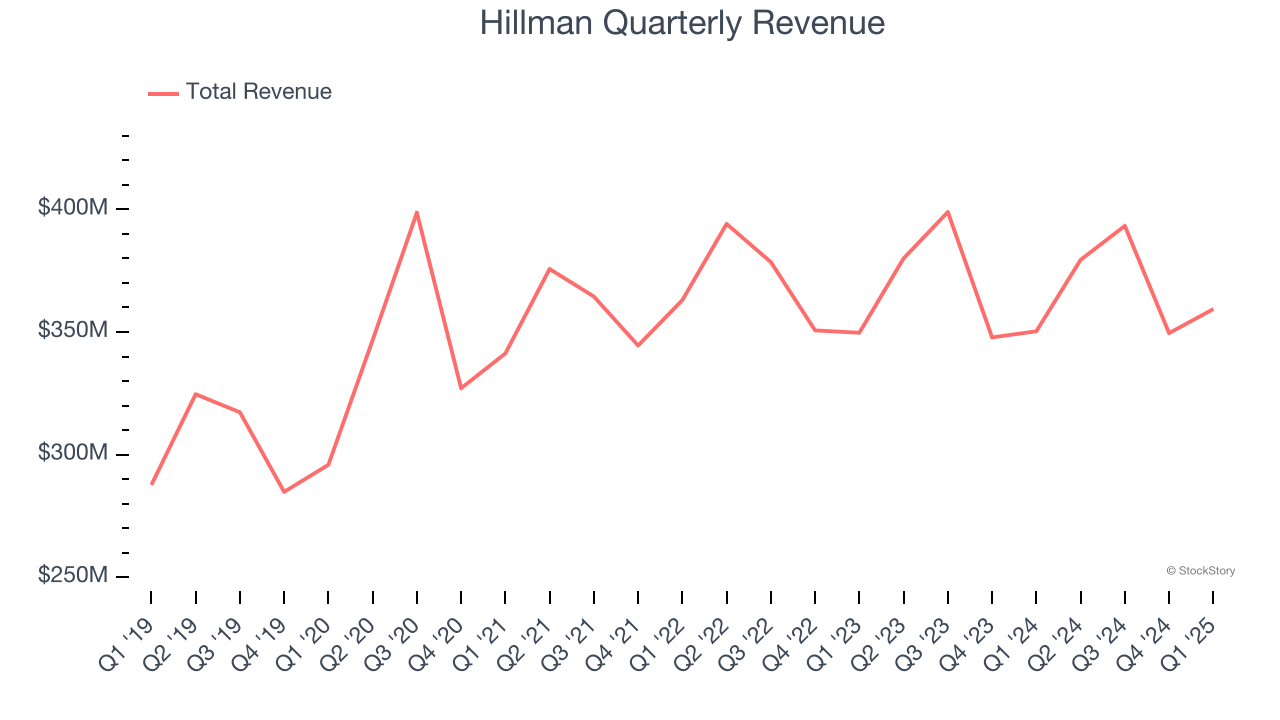

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Hillman’s sales grew at a sluggish 3.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

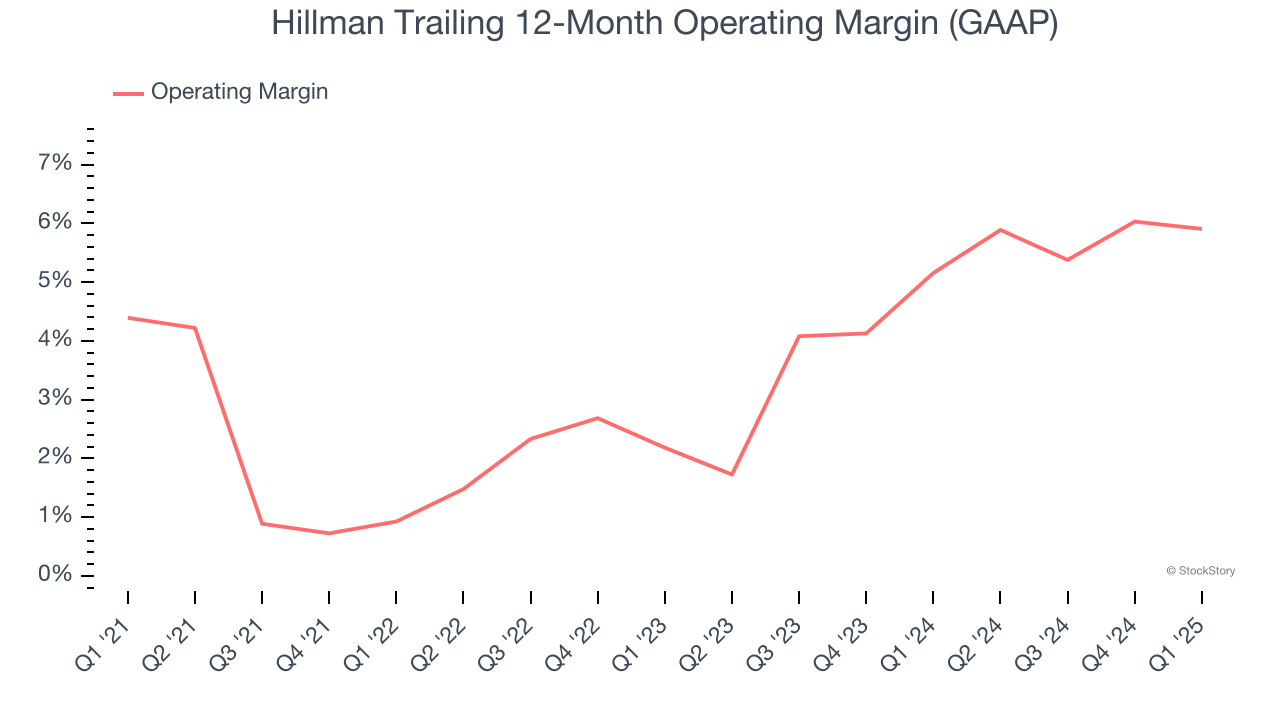

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hillman was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.7% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

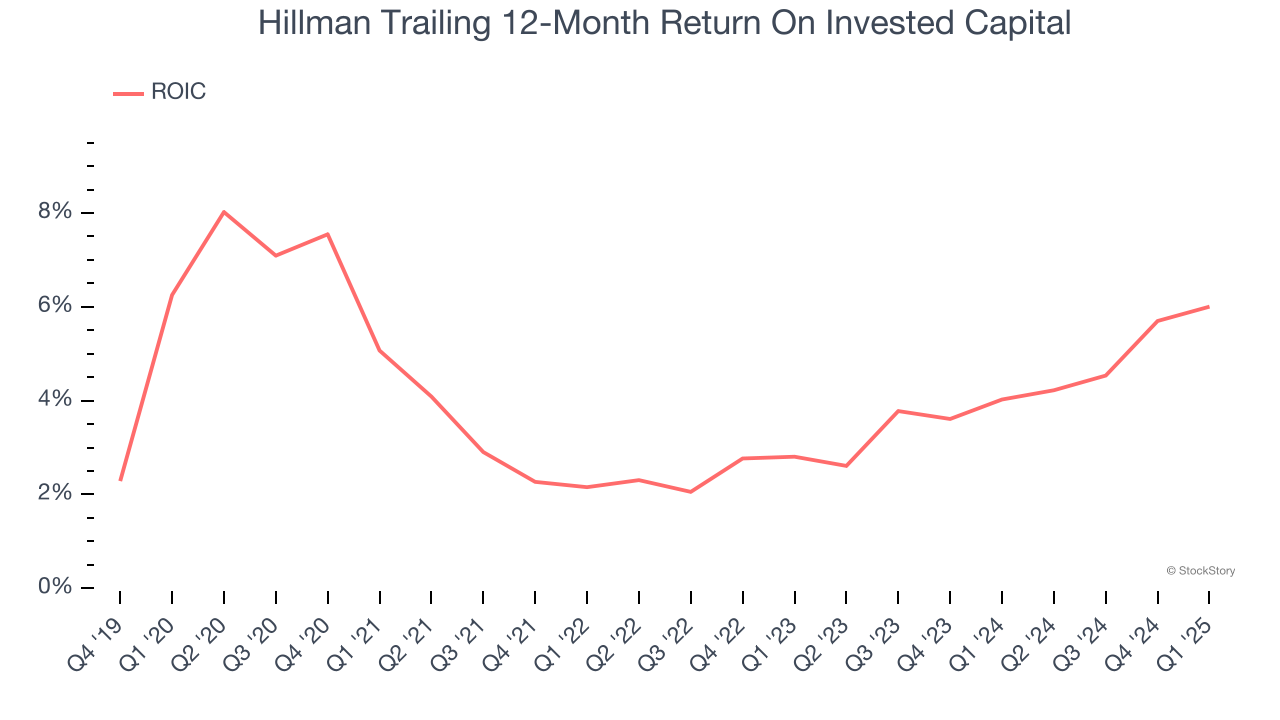

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hillman historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

Hillman isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 14.3× forward P/E (or $8.10 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.