Health Catalyst’s stock price has taken a beating over the past six months, shedding 27.2% of its value and falling to $4.10 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Health Catalyst, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Health Catalyst Not Exciting?

Even with the cheaper entry price, we're swiping left on Health Catalyst for now. Here are three reasons why we avoid HCAT and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

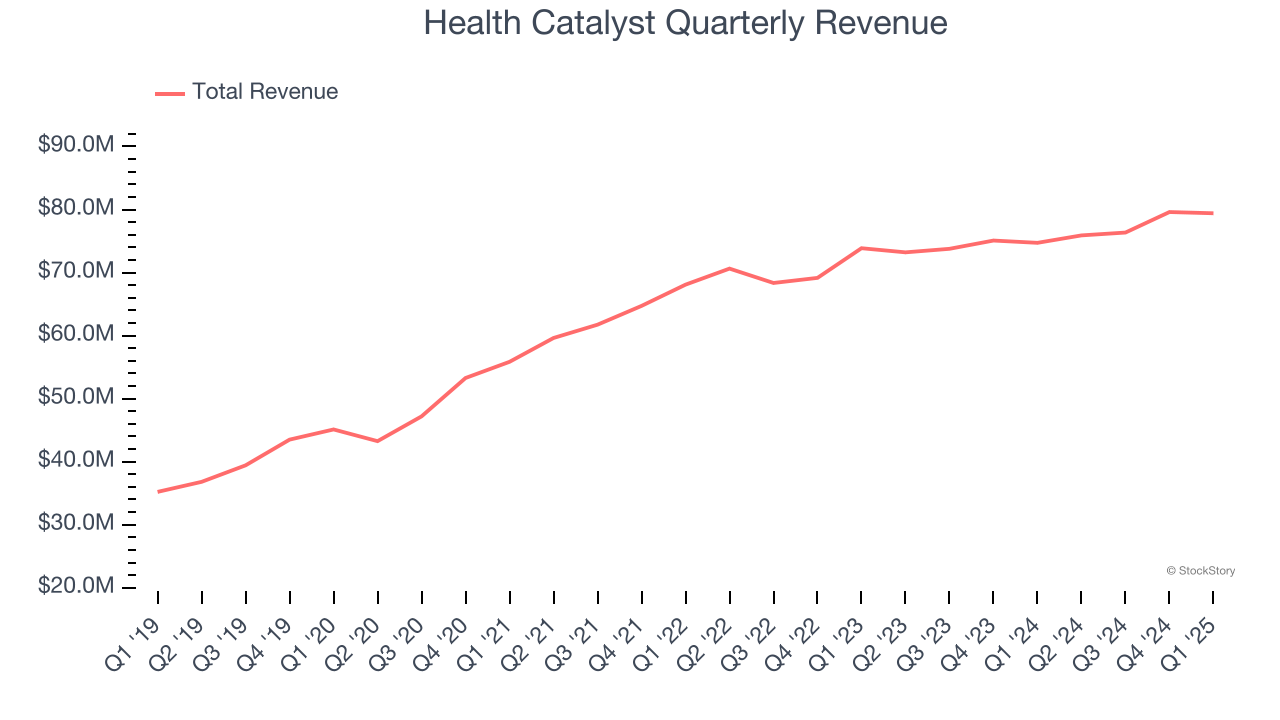

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Health Catalyst’s sales grew at a weak 7% compounded annual growth rate over the last three years. This fell short of our benchmark for the software sector.

2. Low Gross Margin Reveals Weak Structural Profitability

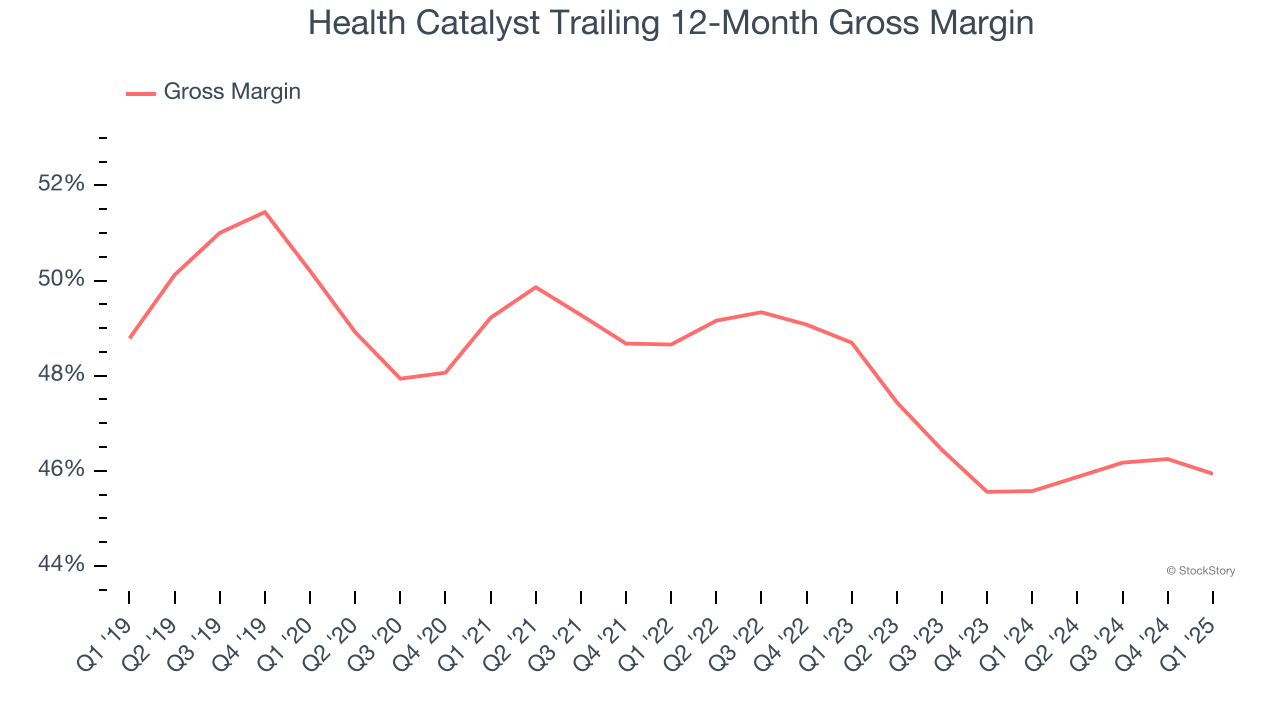

For software companies like Health Catalyst, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Health Catalyst’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 45.9% gross margin over the last year. That means Health Catalyst paid its providers a lot of money ($54.06 for every $100 in revenue) to run its business.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Health Catalyst’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Health Catalyst’s products and its peers.

Final Judgment

Health Catalyst isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 0.8× forward price-to-sales (or $4.10 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.