Over the last six months, Graphic Packaging Holding’s shares have sunk to $22.07, producing a disappointing 15.7% loss - a stark contrast to the S&P 500’s 6.9% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Graphic Packaging Holding, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Graphic Packaging Holding Will Underperform?

Despite the more favorable entry price, we're cautious about Graphic Packaging Holding. Here are three reasons why we avoid GPK and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

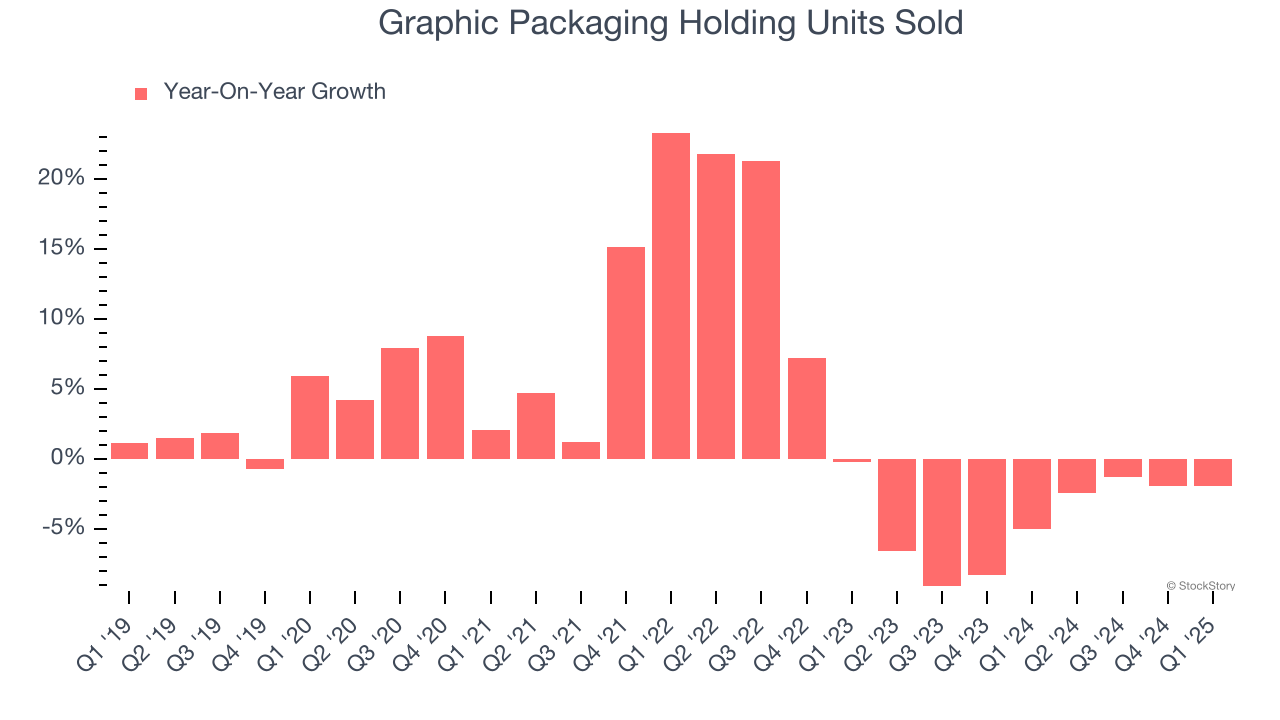

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Industrial Packaging company because there’s a ceiling to what customers will pay.

Over the last two years, Graphic Packaging Holding’s units sold averaged 4.6% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Graphic Packaging Holding might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. EPS Took a Dip Over the Last Two Years

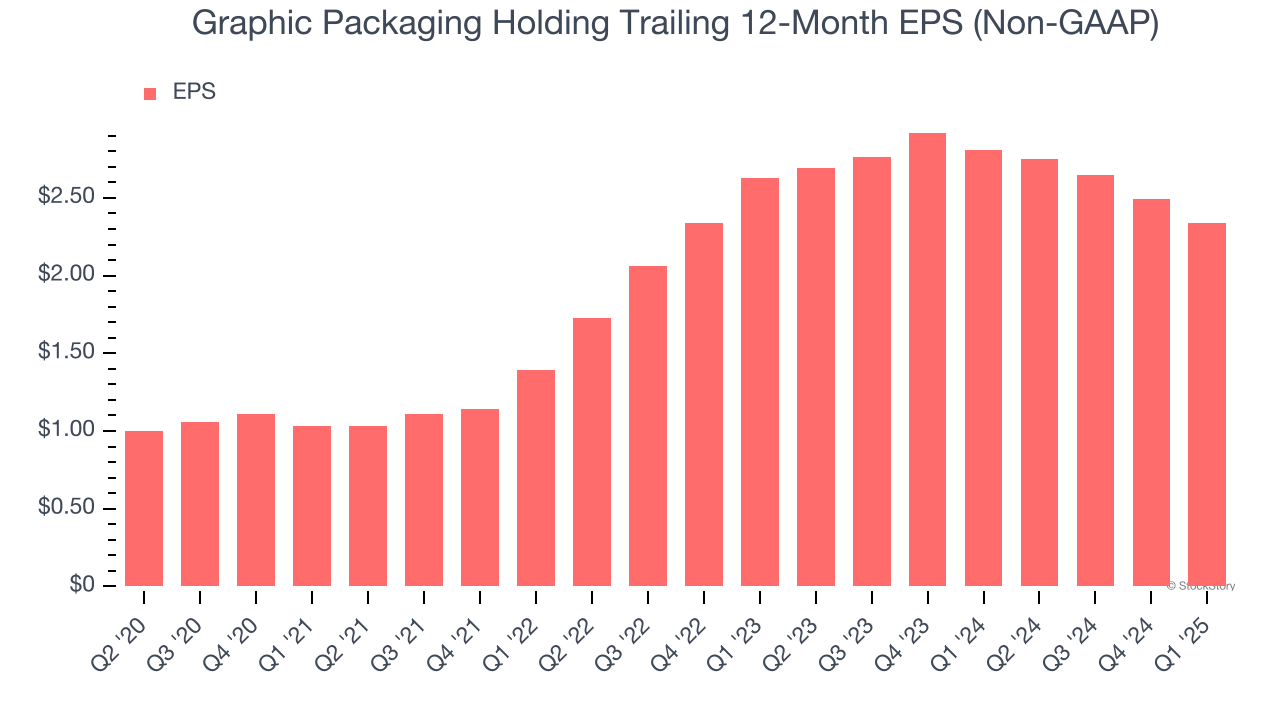

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Graphic Packaging Holding, its EPS and revenue declined by 5.7% and 5.1% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Graphic Packaging Holding’s low margin of safety could leave its stock price susceptible to large downswings.

3. Free Cash Flow Margin Dropping

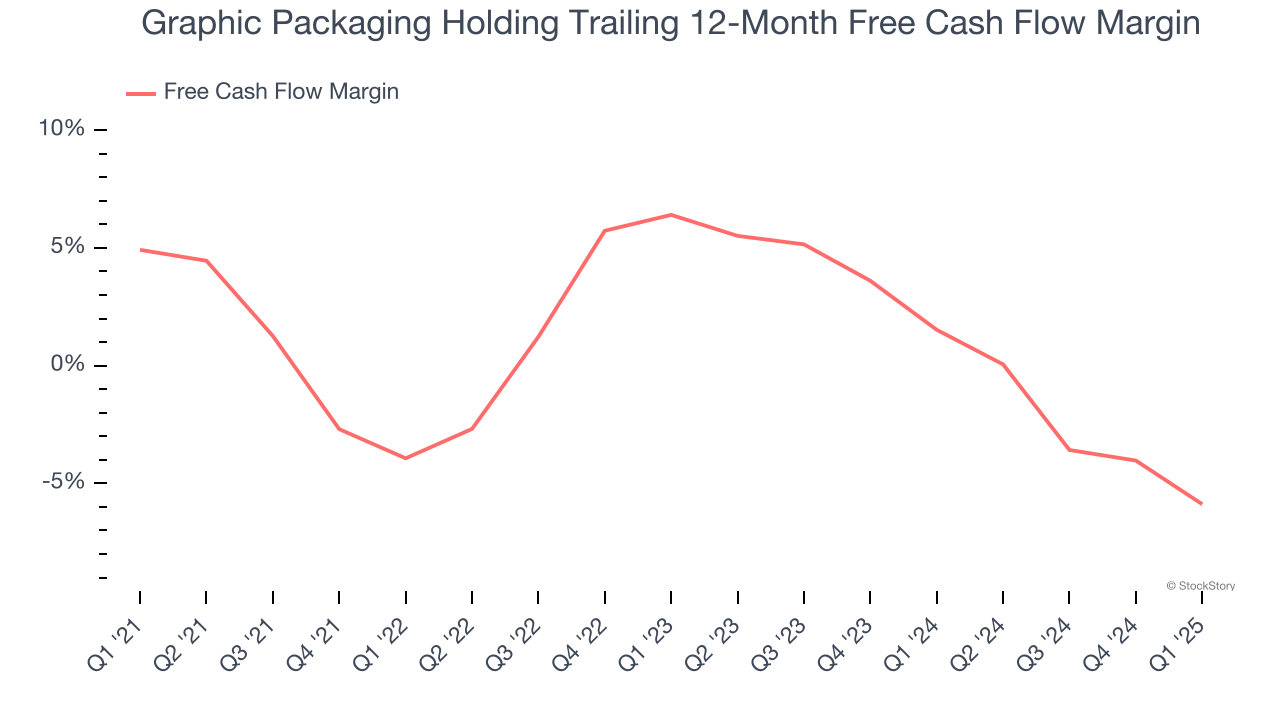

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Graphic Packaging Holding’s margin dropped by 10.8 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Graphic Packaging Holding’s free cash flow margin for the trailing 12 months was negative 5.9%.

Final Judgment

Graphic Packaging Holding doesn’t pass our quality test. After the recent drawdown, the stock trades at 9× forward P/E (or $22.07 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.