Cathie Wood’s trades often read like a quiet manifesto – what she buys signals confidence, what she trims hints at fading faith. In the week ended Dec. 19, that message was clear. ARK Investment Management leaned harder into AI-led biotechnology and crypto, while paring back exposure to consumer tech and electric-vehicle heavyweights.

At the center of that shift sat Recursion Pharmaceuticals (RXRX). ARK snapped up more than 2.8 million RXRX shares, worth about $13.4 million, spread across ARK Genomic Revolution ETF (ARKG) and flagship ARK Innovation ETF (ARKK). The additions lifted Recursion to the No. 27 holding in ARKK and a top-10 position in ARKG. The Utah-based biotech is betting on artificial intelligence (AI) to radically shorten drug discovery timelines, a thesis that neatly mirrors Wood’s long-held view of innovation reshaping healthcare.

The timing is intriguing. RXRX stock has remained deep in the red over the past year, yet sentiment has begun to thaw after encouraging clinical trial data from one of its pipeline candidates earlier this month. With confidence rising and Cathie Wood doubling down, should investors consider buying RXRX while it’s still trading more than half below its YTD peak?

About Recursion Pharmaceuticals Stock

Based in Salt Lake City, Recursion Pharmaceuticals is a clinical-stage biotechnology company that applies a unique combination of biological analysis, chemical expertise, advanced automation, data science acumen, and engineering innovations to industrialize the drug discovery process. With a market cap of $2.3 billion, Recursion is at the forefront of harnessing cutting-edge technology and massive datasets to spearhead advancements in medicine.

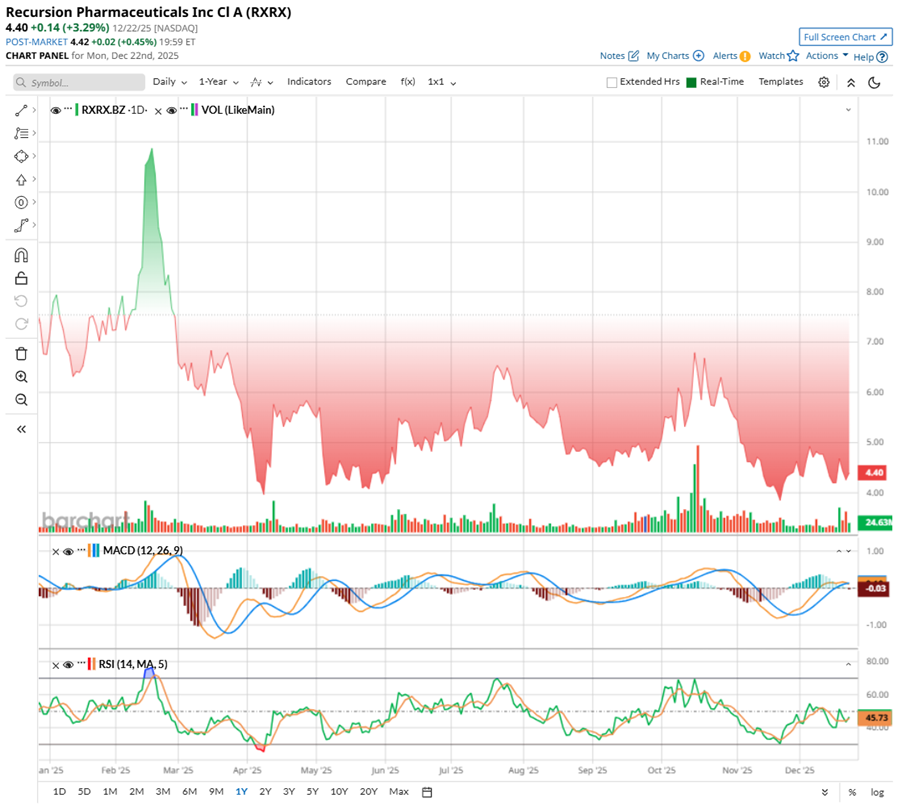

RXRX’s stock performance over the past year is like a long, grinding comedown rather than a sudden collapse. Over the past 52 weeks, the stock slipped 37.6%, sliding another 9.7% in the last six months, and sitting nearly 65% below its February peak of $12.36. Momentum has clearly cooled.

The 14-day RSI has drifted lower and now hovers near 46. The downward slope indicates a fading buying pressure rather than outright capitulation. Volume tells a similar story – sporadic spikes hint at trader interest. But there is no sustained accumulation yet, suggesting confidence remains tentative.

The MACD oscillator reinforces that caution. The yellow MACD line is tracking closely with the blue signal line, with the gap narrowing, signaling slowing downside momentum. The histogram remains negative, reflecting lingering bearish pressure. Together, these point to market indecision, where the selling force might be easing, but a bullish reversal has yet to assert itself.

In technical terms, RXRX looks less like a stock ready to sprint and more like one catching its breath, searching for a catalyst strong enough to shift sentiment from survival to resurgence.

RXRX currently trades at around 37.17 times forward sales, a premium to the broader biotech sector, yet still below its own historical norm, reflecting tempered optimism rather than outright exuberance.

Recursion Pharmaceuticals Reports Mixed Q3 Results

Recursion Pharmaceuticals’ third-quarter results, released on Nov. 5, generated revenue of $5.2 million, down sharply from $26.1 million a year earlier and missing Wall Street’s projections. The prior-year quarter benefited from a one-time $30 million milestone payment tied to the first phenomap delivered under its Roche and Genentech collaboration. A second $30 million milestone was achieved in October 2025, with a portion expected to be recognized in the fourth quarter.

Expenses, however, told a more forward-looking story. Research and development spending climbed to $121.1 million from $74.6 million, driven by the acquisition of full rights to REC-102, Recursion’s ENPP1 inhibitor, and the expanded scale following its November 2024 business combination with Exscientia. General and administrative expenses rose to $41.6 million, reflecting the same integration dynamics.

Net loss widened to $162.3 million from $95.8 million, though the per-share loss of $0.36 still came in below analyst forecasts. Operating cash outflows for the nine months ended Sept. 30, 2025, reached $325.7 million, up from $243.7 million a year earlier, partly due to Exscientia’s inclusion and $7.7 million in restructuring-related severance costs announced in June 2025.

Liquidity remains a stabilizing force. Cash and equivalents stood at $667.1 million as of Sept. 30, 2025, and $785 million as of Oct. 9, 2025, after $387.5 million in net ATM proceeds. With funding secured, Recursion projects its cash runway through the end of 2027.

Analysts tracking Recursion Pharmaceuticals anticipate revenue to be around $61.6 million for fiscal 2025, with losses expected to narrow 5.3% year over year to -$1.60 per share. For the next fiscal year, loss per share is projected to shrink by 32.5% annually to -$1.08.

What Do Analysts Expect for Recursion Pharmaceuticals Stock?

Wall Street just gave Recursion Pharmaceuticals a fresh vote of confidence. On Dec. 17, RXRX stock jumped 11.4%, standing out on an otherwise weak trading day, after J.P. Morgan's Priyanka Grover upgraded the stock. She lifted her rating to “Overweight” from a “Neutral” and nudged her price target to $11.

The shift hinges on strong clinical data from REC-4881, an experimental treatment for familial adenomatous polyposis. The Phase 1b/2 readout showed meaningful efficacy, prompting Grover to see real commercial promise. In her view, the drug carries blockbuster potential, with a realistic shot at topping $1 billion in annual sales. She assigns a 60% probability of successful commercialization, a notably confident stance for a clinical-stage biotech.

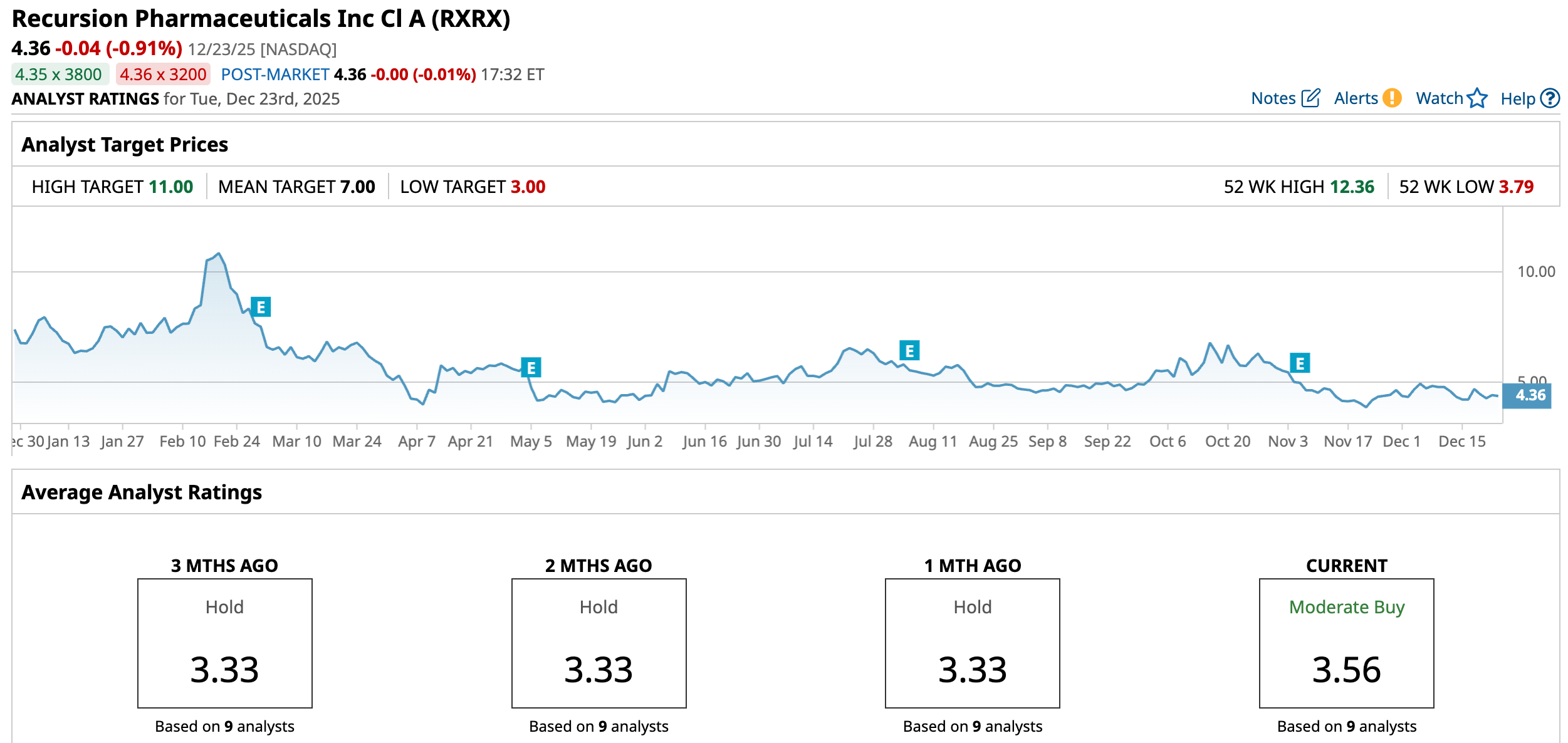

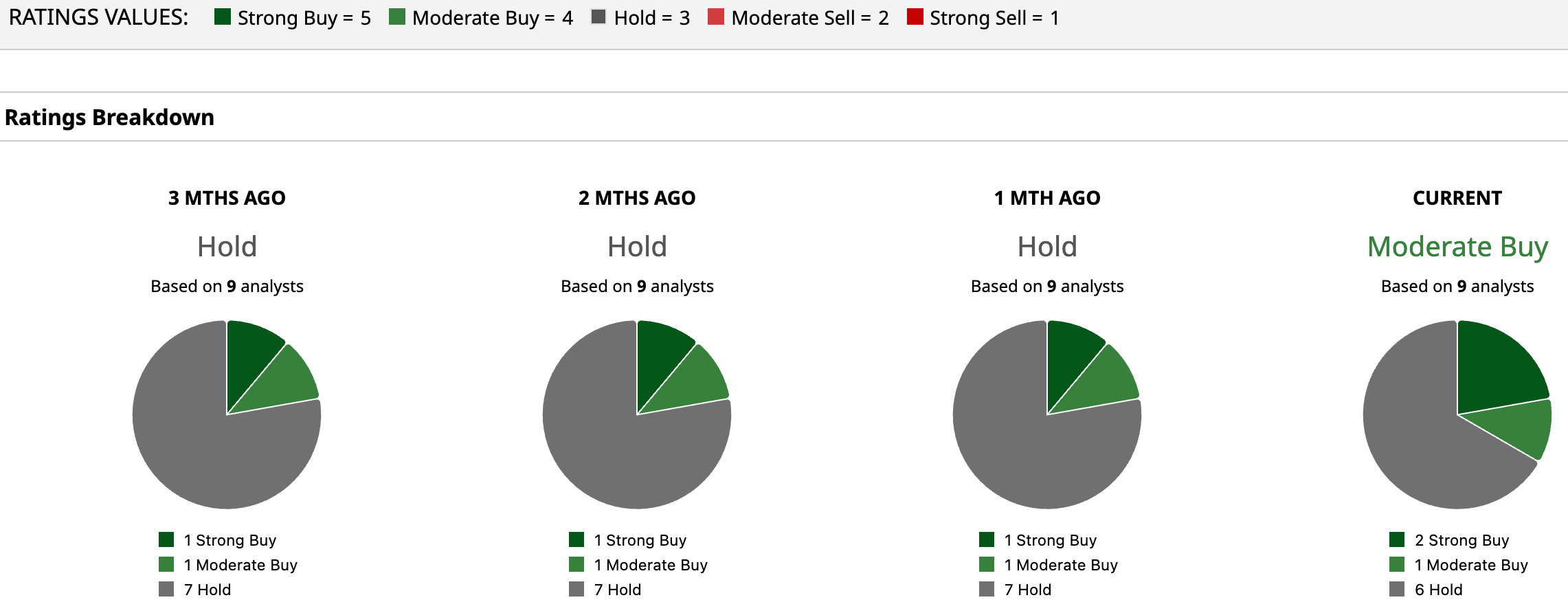

RXRX has a consensus “Moderate Buy” rating overall. Out of the nine analysts covering the stock, two recommend a “Strong Buy,” one suggests a “Moderate Buy,” and six rate it a “Hold.”

The average analyst price target for RXRX is $7, indicating a potential upside of 60.6%. However, the high price target of $11 suggests that the stock could rally as much as 152% from current levels.

The Bottom Line on RXRX Stock

Cathie Wood’s fresh buying brings renewed attention to RXRX, but the stock still sits at a crossroads. The AI-led drug discovery vision, improving clinical momentum, a solid cash cushion, and growing analyst support all strengthen the long-term narrative.

Still, soft technical signals, a premium valuation, and ongoing losses argue for restraint. RXRX does not appear to be a sprint-ready trade just yet. Instead, it reads as a patient, high-risk wager – one that may reward investors who can sit through uncertainty while waiting for technology, trials, and sentiment to align finally.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart