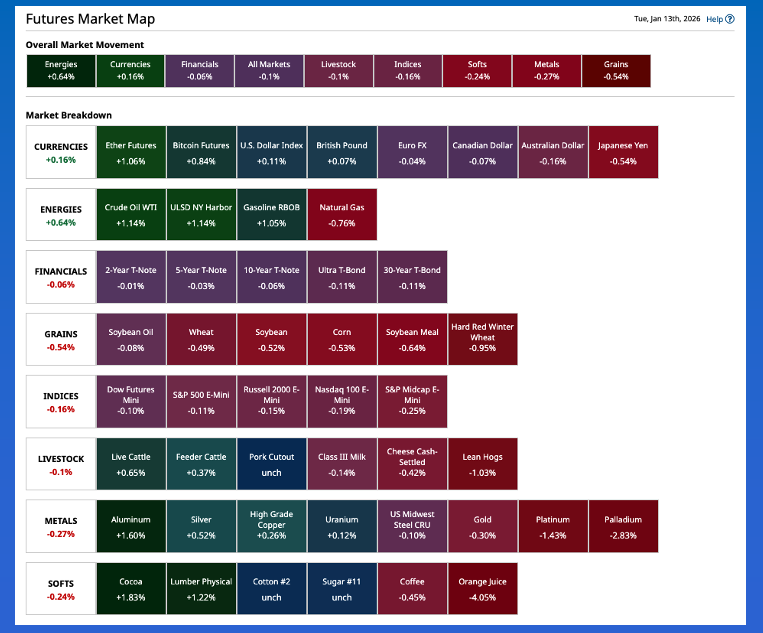

Tuesday morning's financial news was lacking a dramatic talking point, until the second segment of the program began.

Silver and gold continue to climb, but so to do US stock indexes challenging the debate over metals being used strictly as safe-haven markets.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.In the Grains sector, the latest social media post decreed 25% tariffs on any country doing business with Iran.

Morning Summary: As I watched financial news early Tuesday morning, there was something missing. Day after day there has been something dramatic attached to – well, you know who. But as the initial talking points were unveiled, it wasn’t there. The US hadn’t done anything (fill in the blank with your own word) overnight, which is unusual, turning the discussion to actual market goings on. The host (Steve Sedgewick of CNBC’s Squawk Box Europe) then talked about how gold and silver continue to skyrocket, the former posting its highest close on record Monday afternoon while the latter continues to climb to record highs nearly every day. (For the record, Feb gold closed Monday at $4,614.70 while March silver posted a high of $86.34 to open the week.) The common theme of talking heads is that this is safe-haven buying tied to the concern over the independence of the US Federal Reserve given this past weekend’s developments. Mr. Sedgewick then made the point that no other sector of the market is indicating concern as equity markets continue to hit new highs as well. Given this, it could be argued the Metals sector is wrong and Equities are right; Equities are right and Metals are wrong; or those saying the rally in Metals is nothing more than safe-haven buying are wrong. If we believe the idea “markets are never wrong”, the answer would be the last choice.

Corn: The corn market extended Monday’s meltdown overnight through early Tuesday morning. It’s interesting to note trade volume was elevated, likely due to follow-through selling from the fund side of the market. March dropped as much as 2.75 cents, dipping below $4.20, before recovering slightly, trimming its loss to 1.0 cent as of this writing while registering 43,000 contracts changing hands. How best to summarize the corn market after yesterday’s reset? The fundamentals of the market have not changed. Based on the Law of Supply and Demand, and tracking the National Corn Index ($CNCI), we know US supplies outdistanced demand throughout Q1 of the 2025-26 marketing year despite the strong pace of exports over the quarter and beyond. As of January 1, the pace projection, based on total export shipments, was roughly 4.5 billion bushels (bb), up about 64% from last marketing year’s reported shipments of 2.72 bb. The question is how long this pace can continue. The May-July futures spread covered 36% calculated full commercial carry at Monday’s close, as compared to the end of December’s 30% and the 2025 edition of the spread covering 6% this same week last year. In other words, the longer-term commercial outlook has been less bullish than a year ago.

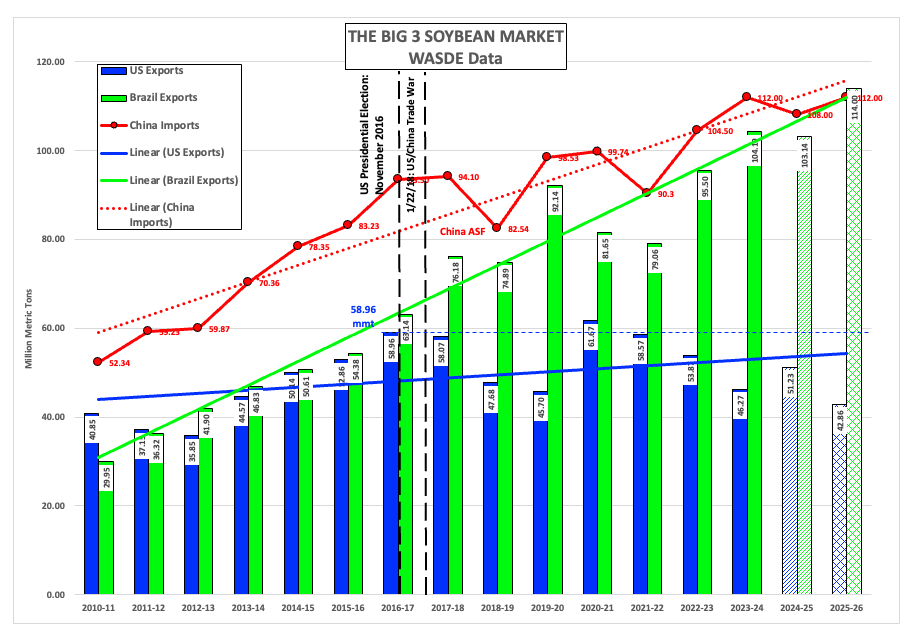

Soybeans: The soybean market was also in the red early Tuesday morning. As the financial news program unfolded, the second segment led with the latest social media post from the US president decreeing any country doing business with Iran will be subject to a 25% tariff. Guess who does business with Iran – that’s right, the world’s largest buyer of soybeans. The host of the program immediately followed with the key question: Does this mean tariffs on imports from China will see another 25% tariff? I’ll take this one step further: If the answer is yes, then how long until we see the cancelation of US soybean purchases China has on the books at this time. As of January 1, China reportedly held 5.7 mmt (as compared to 2.3 mmt the same week the previous year) while shipments to China were only 1.2 mmt (versus 16.7 mmt last year). A look back at USDA’s latest export demand guess of 1.575 bb (42.86 mmt) was down 60 mb (1.64 mmt) from last month but still 520 mb above the latest pace projection based on reported shipments through January 1. That is an issue the US market ($CNSI) will have to face over the coming weeks and months.

Wheat: After escaping much of Watson’s wrath post-report Monday, winter wheat markets moved lower overnight through early Tuesday morning. March HRW dropped as much as 5.5 cents on trade volume of 3,200 contracts and was sitting 3.5 cents lower at this writing. Recall it is here where funds recently moved to a net-long futures position of 1,630 contracts, according to the latest Commitments of Traders report, increasing the market’s vulnerability to a round of pressure from long liquidation. Why? The market remains fundamentally bearish, with its National Cash Index ($CRWI) continuing to run well below its previous 5-year end of January low price of $5.19 from last year. (For the record, the National HRW Index came in Monday night near $4.57.) At Monday’s close, the March HRW issue was down 3.5 cents for the day but still up 5.25 cents from last Tuesday’s settlement indicating Watson had added to its net-long futures position. We’ll see how much of this gain remains at today’s close. The March SRW issue was down 1.0 cent pre-dawn Tuesday, unchanged from last Tuesday’s settlement at $5.1050.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart