Bottom Line Up Front: Nvidia (NVDA) CEO Jensen Huang warns that the U.S. is losing its AI lead to China due to a "vilified" energy sector. Despite a larger economy, the U.S. has half the energy capacity of China, creating a 3-year bottleneck for AI data centers that China completes in weeks. Huang explicitly supports President Trump’s "onshoring" and energy deregulation as the only path to maintaining AI dominance.

The "Five-Layer Cake" of AI Supremacy

During a high-stakes CSIS fireside chat, Jensen Huang redefined the "AI Race" not as a software battle, but as a physical infrastructure challenge. He described artificial intelligence (AI) as a "five-layer cake," where the foundational layer (energy) is currently being vilified and ignored in the United States. Huang says it’s foundational to rapidly ramp up energy production regardless of source within the United States. Huang seemingly supports all sources of energy production, rather than taking the traditional approach and supporting certain types of energy production while opposing others.

Huang highlights this issue, while saying China is on the right track. "Energy, chips, infrastructure, models, and applications," Huang listed. "At the lowest level: energy. China has twice the amount of energy we have as a nation, and our economy is larger than theirs. It makes no sense to me."

The "3-Year Gap": Why China is Outbuilding the U.S.

Huang’s most damning critique focused on Velocity. While Nvidia remains "generations ahead" in chip design, those chips are useless without a place to plug them in. Huang gave a striking analogy, saying it takes 3 years from breaking ground to hosting an operational AI supercomputer in America. China’s velocity is completely unmatched because it’s capable of building an equivalent infrastructure, like a hospital, in a “weekend.”

Barchart has continued to cover this sector and others, keeping a key eye on this velocity factor. Not too long ago, AI-connected stocks like Nvidia, Oracle (ORCL), Alphabet, Meta (META), and others saw large intraday drops due to simple comments from Huang that America was losing the AI race. This signaled to investors to sell, rather than taking it how he intended: Let’s increase our velocity of building.

But energy isn’t the only time velocity was a market driver. America had its “DeepSeek” moment in early 2025, which saw markets drop on reports that DeepSeek created a comparable model to OpenAI at a fraction of the cost. Many AI giants thought they were comfortably in the lead, but DeepSeek became the modern-day “Sputnik” moment, showing investors not only that we’re not as far ahead as we think, but we might even be behind.

China’s unmatched velocity, both to build and to catch up, has continued to show that it’s a vital market metric.

Why Huang is "Cozying Up" to Trump’s Energy Policy

In a move that surprised some tech observers, Huang praised President Trump for "sticking his neck out" to reverse what he calls the "vilification of energy." Huang says it makes no sense that we vilify energy, although this goes for both sides. He doesn’t believe in the vilification of energy for coal, nuclear, solar, or other forms of energy production. Rather, America should be firing on all cylinders to ramp up production across every sector.

While this isn’t the Trump administration's policy per se, Huang did note that he has made it many multiples easier to build in America, ultimately backing his current plan for energy, AI, and infrastructure, highlighting:

- Reindustrialization: Huang revealed that Trump’s first words to him were, "We need to help America make things again."

- The Energy Surge: Huang is backing the administration's push for "all-of-the-above" energy, including natural gas and nuclear, to power "AI Factories."

- The "PhD Gap": Huang argued that bringing manufacturing back isn't just about tech, it's about creating prosperity for the 70% of Americans without a college degree, a sentiment central to Trump’s economic platform.

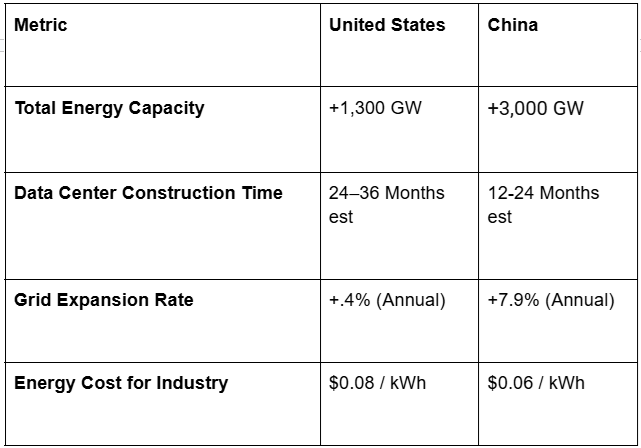

Industrial Comparison: U.S. vs. China (2026 Data)

To understand the scale of the challenge Huang is highlighting, look at the divergence in energy and infrastructure metrics:

As shown in the graph above, the difference is staggering. The U.S. is not only far behind in both construction and energy velocity, but it no longer has a lead in total production either. Given industry proponents' continued outspoken comments in this regard, it’s likely this velocity will start to speed up on the side of the U.S.

This can already be seen. Nuclear energy names like Oklo (OKLO) and NuScale (SMR) have seen meteoric rises in recent months due to expected demand. Their timelines, similarly, went from 5 to 10 years out to energy production within the next 1-3 years.

The Barchart Take: Energy is the New "Chip"

We’ve spent three years obsessing over GPU supply. Huang’s message is clear: The bottleneck has shifted. Investors should look past the "Model" companies (OpenAI, Google (GOOGL) (GOOG)) and toward the "Power" companies.

At Barchart, we are seeing a direct correlation between data center permitting announcements and regional utility surges. As Huang notes, "There are no new industries you can grow without energy." The U.S. is currently generations ahead in the "brain" (chips), but we are losing the "body" (infrastructure). Nvidia and AI infrastructure companies will still be good long-term holds, but their gains are more and more priced in, and there's a clear bottleneck to expansion. Look at who is supplying the data centers this power, where the data centers are being built, and how they are expanding.

Nuclear production is still years out, and coal is harder to scale and struggles with profitability and optics. But solar is largely buying land and putting solar panels on it. The technology is rapidly progressing, and the demand is endless right now. This gives clean energy names like NextEra Energy (NEE) and First Solar (FSLR), among similar industry names, a clear growth catalyst going into 2026 and beyond.

On the date of publication, Caleb Naysmith did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’

- Energy Commodities in Q4 and 2025- What are the Prospects for Q1 2026 and Beyond?

- Don’t Trade the Venezuela Headlines. Why We’re Skipping Oil Majors to Zero In on These Energy Stocks Instead.

- 3 of the Best Stocks to Buy for 2026 If You Believe That AI Will Keep Revolutionizing the World