The year 2022 was a brutal one for companies in the tech sector. When tech stocks crash, investors perk up and look for reasons why. In this case, one cause sticks out above the rest — rising interest rates. Why do tech stocks go down when interest rates rise?

Rising interest rates can harm any stock, but tech companies tend to feel the burn more than others.

Overview of Rising Rates

In March 2023, the Federal Reserve raised the federal funds rate by 25 basis points, bringing the benchmark interest rate to 4.5%. The federal funds rate is known as the benchmark because it sets the standard for which banks lend to each other, and this benchmark rate heavily influences most other interest rates (i.e., mortgage rates).

Why does the Federal Reserve raise (and lower) interest rates? Because the Fed has what's known as a dual mandate: keep prices stable and encourage maximum sustainable employment. Price stability means keeping inflation at a moderate level, and the Fed's primary tool for dealing with inflation is setting interest rates. Inflation is a tricky beast, and the Fed aims for a 2% core inflation rate — low enough to keep the economy from overheating but high enough to encourage investment and prevent deflation.

Since the end of the Great Recession into the beginning of the COVID-19 pandemic, inflation has been at or below this 2% target. And with inflation low, the stock market benefitted, especially growth-focused tech stocks that feasted on easy money.

But the pandemic created a massive supply and demand imbalance as prices skyrocketed. In response, the Federal Reserve began raising rates in a hurry to cool demand and bring inflation back to a moderate level. And what cohort of stocks was hurt most by this action? Tech stocks, of course!

Overview of Tech Stocks

So why do interest rates affect tech stocks? Companies in the tech sector are innovators, but innovation doesn't often come cheap. While some tech stocks could be considered value stocks, most companies in the tech sector (especially those covered in financial media) are growth stocks. Companies looking for growth tend to spend lots of money to bring their products and services into the mainstream.

Tech stocks vary from small-cap startups to some of the world's largest and most successful companies. You've probably heard of some of the big ones like Apple Inc. (NASDAQ: AAPL), Microsoft Corp. (NASDAQ: MSFT) and Google, now Alphabet Inc. (NASDAQ: GOOG).

We still haven't answered the question, "why do tech stocks fall when interest rates rise?". While plenty of tech firms are large conglomerates, many more are small to mid-cap firms without endless access to cheap capital. Tech stocks focus heavily on research and development, so they often reinvest excess profits back into the firm and don't keep a lot of cash on hand (well, except Apple). Even large-cap companies launching new products or services must borrow money to finance their ventures.

When interest rates rise, the cost of borrowing capital also increases, which isn't felt evenly throughout the different sectors of the market. Banks like JPMorgan Chase and Co. (NYSE: JPM) or utility providers like Duke Energy Co. (NYSE: DUK) usually don't suffer as much when rates are rising since they don't need capital infusions the way tech stocks do.

Look at the two charts above; Google slumped as rates rose, but JPMorgan Chase was far less affected. Now these are just two examples in a market filled with thousands of different stocks, but tech stocks and rising rates have often been a sour mix.

Rising Rates and Tech Stocks

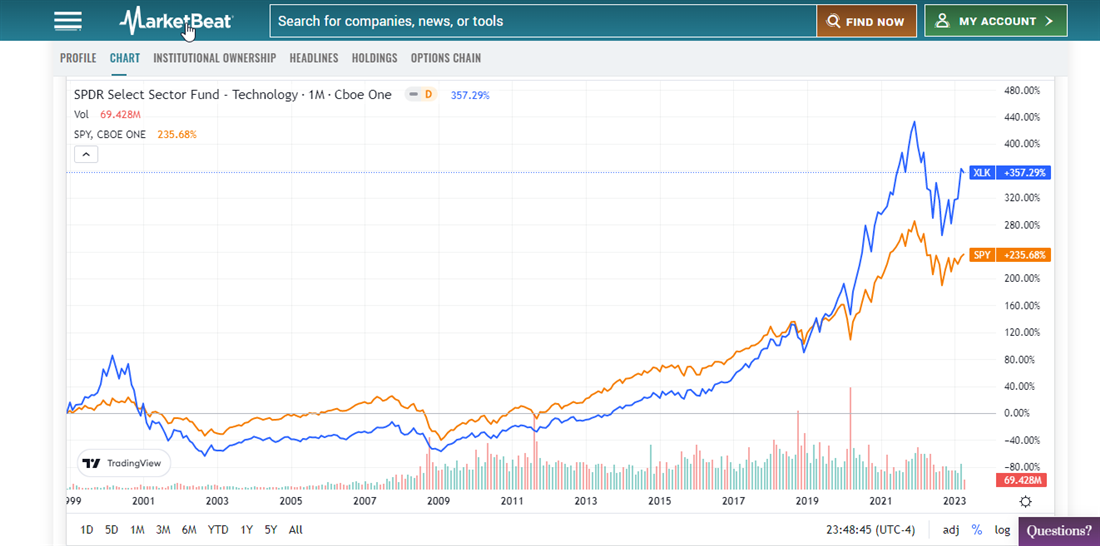

While tech stocks and high-interest rates don't usually get along, it's not a slam-dunk investment to buy tech when rates fall or sell tech when rates rise. The question of why interest rates affect tech stocks gets murkier when compared on a chart. Here's the Technology Select Sector SDPR Fund (NYSE: XLK), a broad-based tech ETF, compared to the S&P 500 over the last 20 years.

Rates plummeted following the dot-com bust in 2000, but it wasn't enough to save tech stocks from falling harder than the rest of the market. The federal funds rate stayed around 1% until 2004, then steadily rose to 5% in 2007 before the Great Recession. Despite rising rates, the tech sector didn't materially underperform the S&P 500 during that time frame. Following the Great Recession, rates stayed near zero until 2016. From 2016 to 2019, rates jumped over 2% from zero, but tech outperformed the S&P 500 during these three years.

When rates dropped to near zero during the COVID-19 pandemic, tech rapidly outperformed the overall market and stayed ahead of the pack until 2021. Even though the Federal Reserve signaled that rate hikes were coming, the tech bear market began when rates were still effectively zero. In 2022, tech stocks languished as rates rose rapidly but recovered in 2023 when the rate hikes began to slow.

The lesson here? If someone asks why tech stocks are down, the answer isn't automatically high rates. Based on yesterday's strategies, the market enjoys taking advantage of folks to invest, and the relationship between rates and tech stocks can be complicated. Theoretically, it's easy to understand why tech stocks are sensitive to interest rates, but results vary in practice.

Prospects for Tech Stocks in 2023

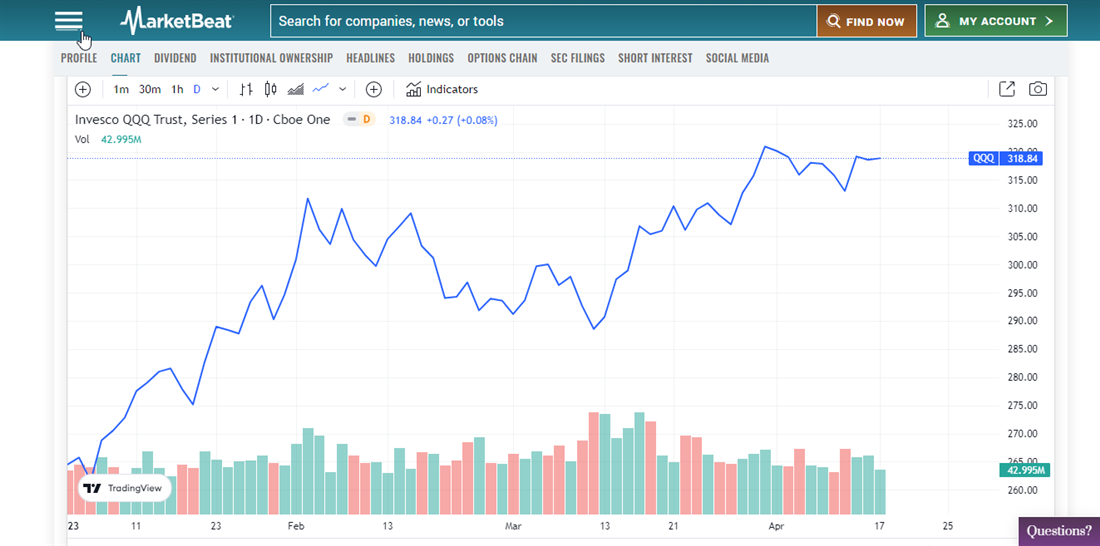

Despite the rough 2022, the start of 2023 has been promising for the tech sector. The highs of 2021 are still a ways off, but the Invesco QQQ Trust (NASDAQ: QQQ), the large-cap tech ETF, has gained nearly 20% in the first four months of 2023.

With inflation numbers dropping in line with expectations, the rate hike pace has slowed. Unlike 2022, few market prognosticators expect 75 basis point rate hikes in 2023. However, even if the Federal Reserve stops hiking rates this year, they've indicated that 4% to 5% rates will likely be here for some time. As shown in the examples above, (relatively) elevated interest rates are only sometimes a hindrance to tech stocks, but there are better environments for the cash-hungry sector.

Factors Influencing Technology Stocks

Interest rates aren't the only thing weighing on tech stocks. Here are three more factors to consider with tech stock investing.

Economic Uncertainty

Not only do recessions and bear markets hurt the tech sector, but so can macroeconomic and geopolitical events. For instance, the COVID-19 pandemic hampered many different supply chains, including the microprocessors and digital components needed by tech startups.

Inflation

Inflation can hurt any company without the power to raise prices, but tech stocks can be affected even more since inflation is usually followed by periods of rising interest rates. Additionally, smaller tech companies without meaningful profits may be unable to absorb price increases from their suppliers.

Corporate Earnings

Tech investors are looking for companies well positioned for growth, meaning earnings must keep pace with expectations. Tech stocks are often more about potential than profit initially, but eventually, investors will want to see the company grow sales as well as hype.

Future of Investing in Tech Stocks

Investing in tech has always been an exciting proposition. Not only do many of the market's biggest winners, like Apple and Microsoft reside in the sector, but these companies have produced some of the most game-changing innovations of the last 50 years. Think of products and services we depend on today that didn't even exist 20 years ago — smartphones, rideshare, streaming services and wearing medical devices. However, tech is a volatile sector, and many innovations will fail. Never invest in a tech stock without researching the company and ensuring you agree with its mission.

High Rates and Tech Stocks Are a Mixed Bag

High rates have rarely been well-received by the tech sector, but the performance of the stocks shows varied results, especially over the last 20 years. Declining rates didn't help the tech sector following the dot-com bubble, but the low rate environment following the Great Recession led to tech outperforming the S&P 500.

While rising rate environments should hurt tech, you can't use simple heuristics to make investment decisions since markets rarely play out as the crowd predicts.

FAQs

Will tech stocks bounce back? Here are a few common questions about rates and the tech sector.

Do higher interest rates hurt tech stocks?

Higher interest rates often hurt tech since those companies have high borrowing needs, but stock performance doesn't always match rate hikes.

Why do tech stocks fall with higher interest rates?

Tech companies need more frequent capital infusions, and capital gets expensive to acquire when rates are high.

Why does inflation cause tech stocks to drop?

Inflation can hurt tech stocks by increasing the costs of necessary products or services and bringing in higher rates. When inflation is high, the Federal Reserve seeks to limit the money supply through high rates to bring economic forces back into balance.