Footwear conglomerate Wolverine Worldwide (NYSE: WWW) announced better-than-expected revenue in Q4 CY2024, with sales up 3% year on year to $494.7 million. On the other hand, the company’s full-year revenue guidance of $1.81 billion at the midpoint came in 2.2% below analysts’ estimates. Its non-GAAP profit of $0.42 per share was in line with analysts’ consensus estimates.

Is now the time to buy Wolverine Worldwide? Find out by accessing our full research report, it’s free.

Wolverine Worldwide (WWW) Q4 CY2024 Highlights:

- Revenue: $494.7 million vs analyst estimates of $486.5 million (3% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.42 (in line)

- Adjusted EBITDA: $46.4 million vs analyst estimates of $54 million (9.4% margin, 14.1% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.81 billion at the midpoint, missing analyst estimates by 2.2% and implying 3.4% growth (vs -11.7% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.13 at the midpoint, missing analyst estimates by 16%

- Operating Margin: 8%, up from -38.9% in the same quarter last year

- Free Cash Flow Margin: 15%, down from 24.7% in the same quarter last year

- Market Capitalization: $1.47 billion

“A year ago, we outlined an ambitious turnaround strategy composed of three chapters: stabilization, transformation, and inflection. We shared a plan to meaningfully strengthen the Company's balance sheet, expand profitability, and sequentially improve revenue trends – culminating with an inflection to growth in the final quarter of 2024,” said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide.

Company Overview

Founded in 1883, Wolverine Worldwide (NYSE: WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

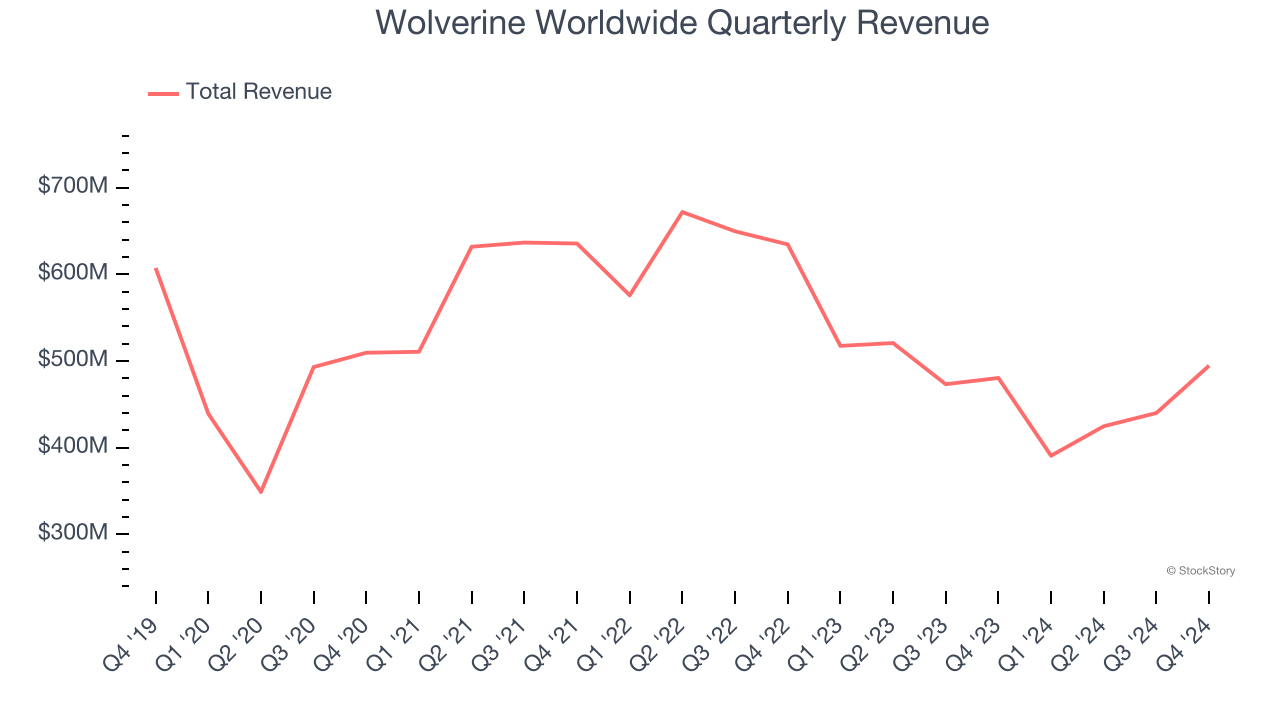

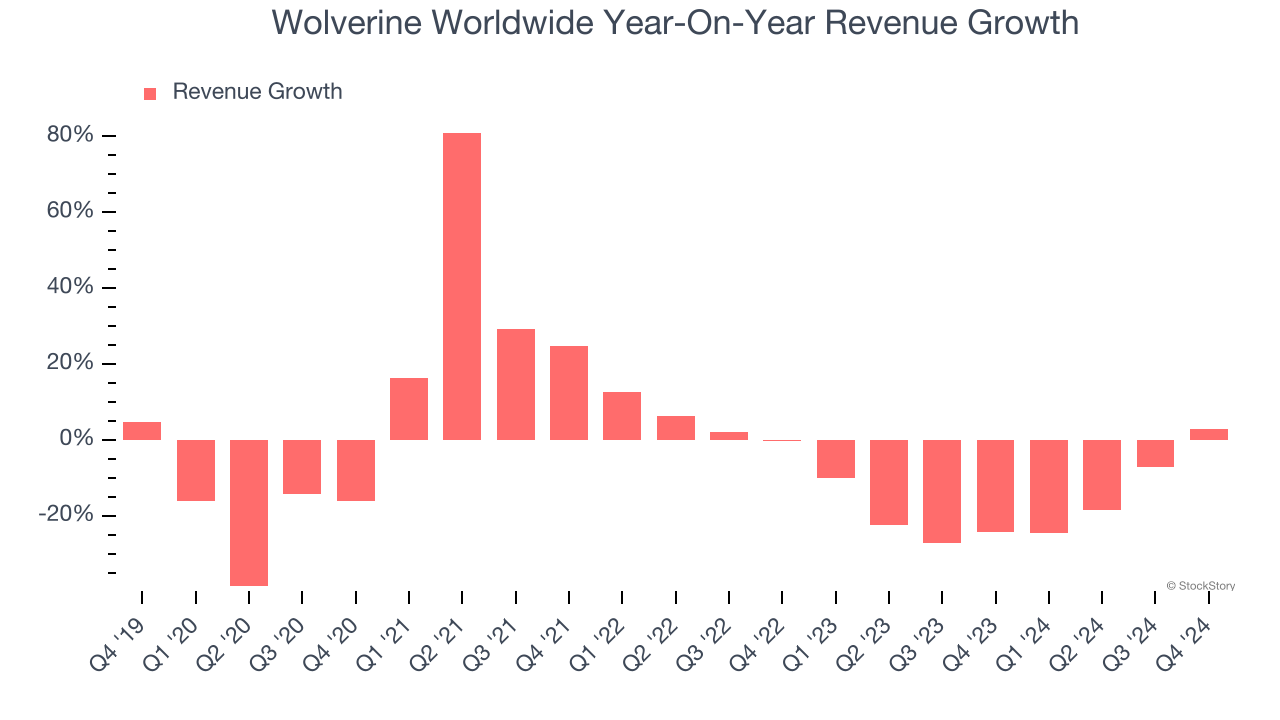

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Wolverine Worldwide’s demand was weak and its revenue declined by 5.1% per year. This was below our standards and signals it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Wolverine Worldwide’s recent history shows its demand has stayed suppressed as its revenue has declined by 16.9% annually over the last two years.

This quarter, Wolverine Worldwide reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

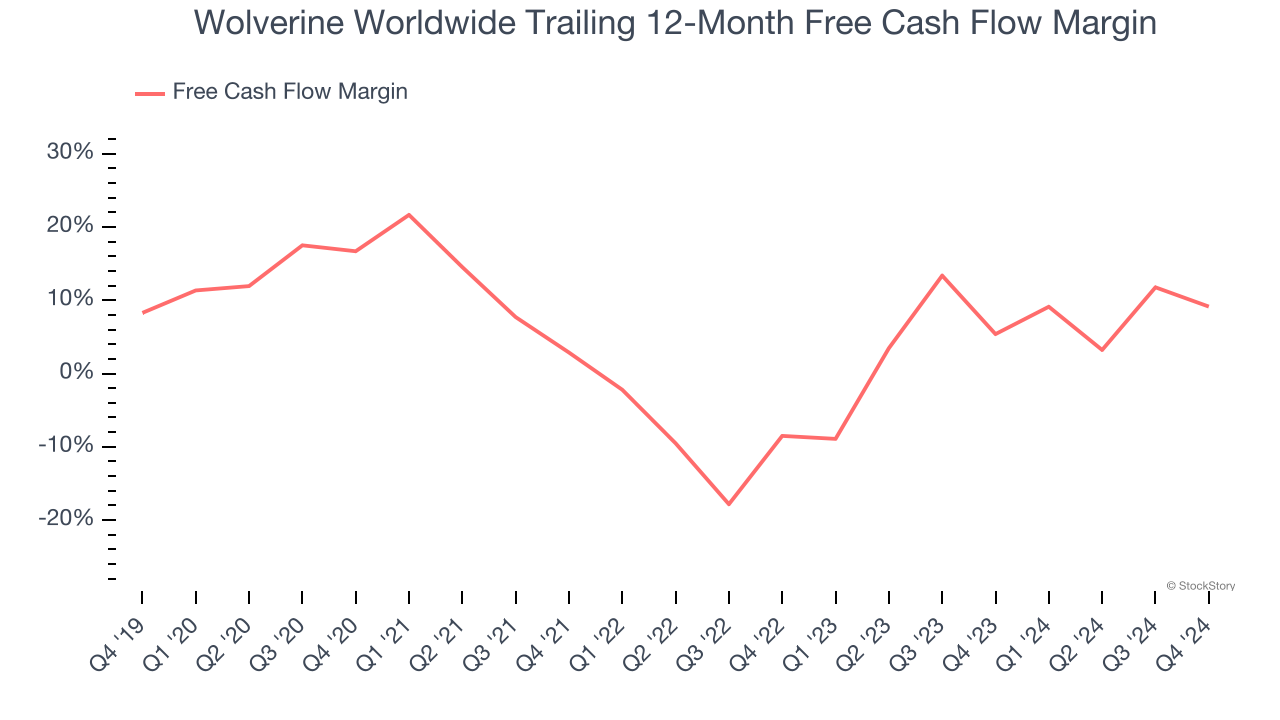

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Wolverine Worldwide has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.1%, subpar for a consumer discretionary business.

Wolverine Worldwide’s free cash flow clocked in at $74.4 million in Q4, equivalent to a 15% margin. The company’s cash profitability regressed as it was 9.7 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Wolverine Worldwide’s Q4 Results

It was encouraging to see Wolverine Worldwide return to top-line growth and beat analysts’ revenue expectations this quarter - the company's management team noted its turnaround strategy is working. On the other hand, its full-year revenue and EPS guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter, but the stock traded up 4.2% to $19.50 immediately following the results due to the upbeat tone.

Is Wolverine Worldwide an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.