Corcept currently trades at $58.76 and has been a dream stock for shareholders. It’s returned 434% since March 2020, blowing past the S&P 500’s 117% gain. The company has also beaten the index over the past six months as its stock price is up 35.8%.

Is there a buying opportunity in Corcept, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re glad investors have benefited from the price increase, but we're cautious about Corcept. Here are three reasons why you should be careful with CORT and a stock we'd rather own.

Why Is Corcept Not Exciting?

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $675 million in revenue over the past 12 months, Corcept is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

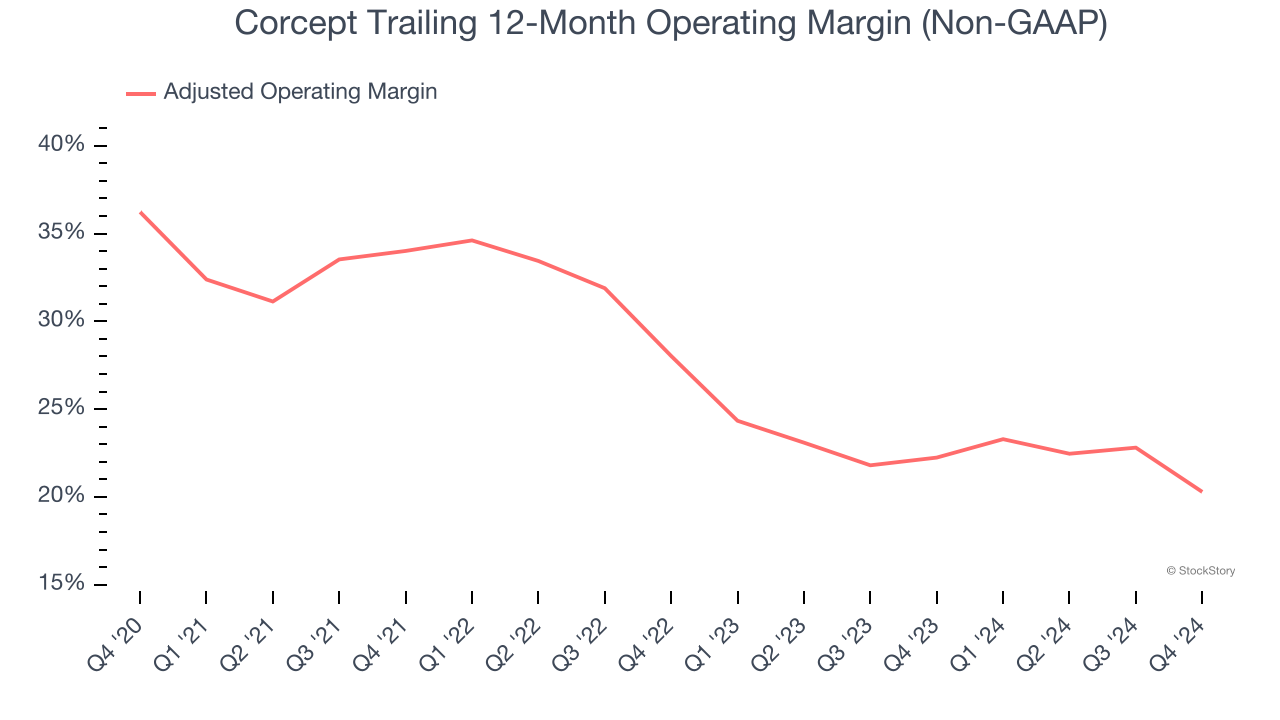

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, Corcept’s adjusted operating margin decreased by 15.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 20.3%.

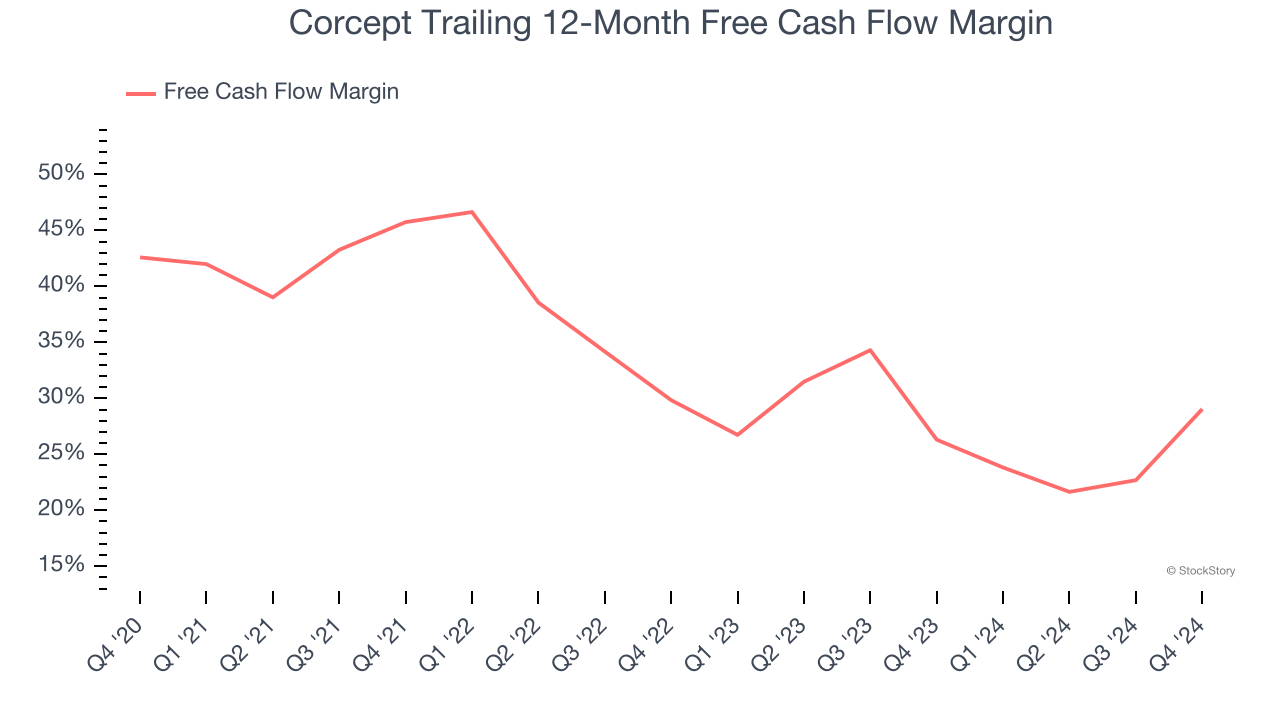

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Corcept’s margin dropped by 13.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle. Corcept’s free cash flow margin for the trailing 12 months was 29%.

Final Judgment

Corcept isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 26.6× forward price-to-earnings (or $58.76 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Corcept

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.